Gold Stock Sentiment Closed At 2-Year High

Strengths

-

The best performing precious metal for the week was palladium, up 2.43 percent on hedge funds, boosting their net bullish position this past week. Gold surged on Friday as the dollar and equities dropped after former national security advisor Michael Flynn prepared to testify that President Donald Trump directed him to contact Russia, reports Bloomberg. In Bloomberg’s weekly poll, almost half of respondents were neutral on gold’s outlook as of Thursday afternoon.

-

The World Gold Council announced a resurgence of gold demand in China driven by millennials and online sales. China was also the biggest contributor to global gold demand during the past quarter, according to China Daily. The yellow metal is also becoming popular in Germany as gold trading stores are now in every major city. There are over 100 in the nation, up from just a handful ten years ago. The BCA Research continues its recommendation to keep gold exposure limited to 5 percent in portfolios.

-

Early in the week, gold futures briefly climbed above $1,300 an ounce for the first time in six weeks, writes Susanne Barton of Bloomberg. The weakness of the dollar has been a positive driver of gold.

Weaknesses

-

The worst performing precious metal for the week was silver, down 3.71 percent. Silver is now trading the cheapest relative to gold since April 2016. This month, gold traded in its tightest monthly range and narrowest volatility in 12 years despite recent pullback in the yellow metal, which could lead to trading elsewhere with a lack of volatility and into the highly volatile digital currency space. CME Group Inc. and CBOE Global Markets Inc. are poised to offer bitcoin futures contracts, which would make it easier for investors to bet on digital currencies. This could potentially take away interest from gold.

-

U.S. GDP rose to a three-year high and the Federal Reserve Chair Janet Yellen described a brightening picture for the economy. Uncertainty arises around investing in gold amid speculation that economic growth will lead to the Federal Reserve raising interest rates has kept generalist away from gold.

-

Trouble continues for Barrick Gold as they were downgraded to sell from buy by Citi this week. As reported on IKN, an investigation into their Argentinian mine waste spillage incident appears to show Argentine officials deliberately prevented the area surrounding the mine from being included in a national consensus in 2010 to protect glaciers. It is unclear whether the issue would lead to the Barrick having to shutter the mine.

Opportunities

-

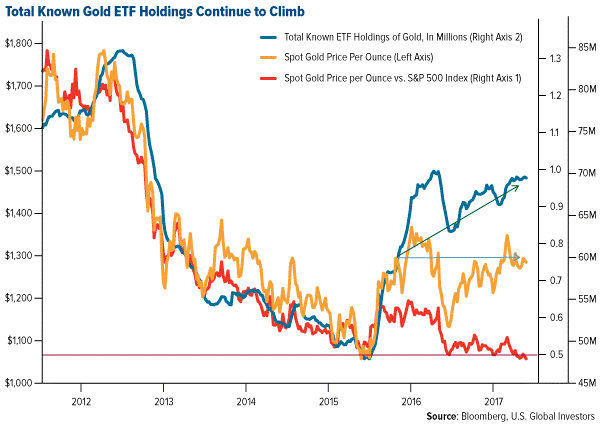

Gold open interest, a tally of outstanding futures contracts, dropped to its lowest since August as risk assets prevail. This is an interesting contrast to the fact that total gold holdings ETFs have racked up their third straight quarterly rise in assets, its longest stretch since 2009, showing that bulls haven’t given up on gold yet.

-

INK Research on gold stock sentiment closed this week at a two-year high of 361 percent despite the growing popularity of bitcoin and digital currencies. The research shows insiders of gold mining companies are buying the gold stock dip, betting that gold can compete with cryptocurrencies as a form of insurance against unforeseen, negative market-moving events. Insiders buying stock in their own company generally is seen as a good sign to investors to also buy the stock.

-

Total known gold-ETF holdings continue to rise up to 17 percent this year. Ironically, the pace of accumulation is exceeding the rise in the gold price which is up 11 percent. In addition, the ratio of the S&P 500 relative to gold shows that gold is trading at a ratio of 0.50 on this price to value ratio. According to Bloomberg the implication is that stocks, with record valuation levels, are expensive relative to gold and that already investors seem to be quietly moving money out of stocks and into gold, hedging a market correction.

Threats

Goldman Sachs warns of an eventual bear market as the current prolonged bull market has left a measure of average valuation at the highest since 1900, reports Christopher Anstey of Bloomberg. Goldman Sachs International strategists wrote “all good things must come to an end” and that the average valuation across equity, bonds and credit in the U.S. is currently at an all-time high of 90 percent.

Bitcoin faced major hurdles this week as hedge-fund platforms Brooklands Fund Management, Mirabella Advisers and Privium Fund Management all said they turned down requests to take on bitcoin based investors as a client, citing concerns over its place as a legitimate asset. Additionally bitcoin prices plummeted nearly 20 percent in less than 90 minutes after being interrupted by a market outage on Thursday before recovering about half the slippage from the FOMO crowd (“Fear Of Missing Out”).

The latest update from the New York trial of a Turkish banker accused of laundering Iranian oil money is that a Turkish-Iranian testified that he paid tens of millions of dollars in bribes to the head of a Turkish bank to evade the U.S. sanctions against Iran. Turkish Prime Minister Binali Yildirim responded saying he hopes that the gold trader will “turn back from his mistake” in cooperating with U.S. prosecutors, furthering Binali’s stance that the trial is politically motivated, according to Reuters.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of