Double Whammy: Fed Policy And The US-China Trade War

Markets were decisively in “risk-off” mode last week. Following weak manufacturing news last Thursday, the yield on the 10-year Treasury sunk to its lowest level since October 2017. The spread between the 10-year yield and three-month yield, in fact, inverted once again, with the shorter-term bond yield higher by 6 basis points. As such, the “boring” yet mostly reliable utilities sector rotated to the top.

I’m not going to use the R-word here. All I’m going to say is that it might be time for investors to brace for a significant correction—especially with debt at record levels and the Federal Reserve left with very little firepower to combat a full-blown crisis.

Let’s take a look at what the smart money is doing.

Many successful, ultra high-net-wealth individuals (UHNWIs) favor municipal bonds, not only because they’re tax-free at the federal and often state and local levels, but also because they’ve managed to perform well even during equity bear markets. According to the first-quarter asset allocation report for Tiger 21, a peer-to-peer network for UHNWIs, members had an average weighting of 9 percent in fixed income, which includes muni bonds.

The U.S. economy looks rock-solid with a strong jobs market, but there are some worrisome signs lurking under the surface.

Could U.S. Manufacturers Contract in 2019?

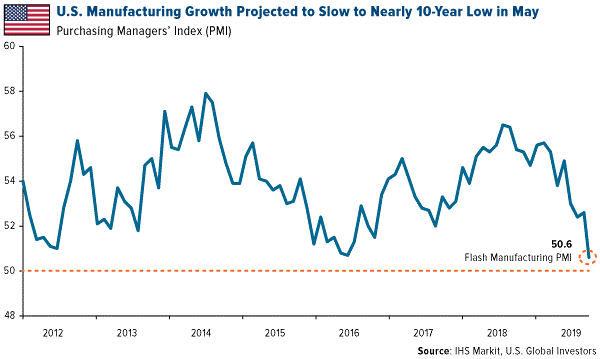

Case in point: May’s “flash” index of U.S. manufacturers registered a sharp decline to 50.6, down from 52.6 in April. This is only a preliminary reading, but if it turns out to be accurate—we’ll know early next month—it would mark the slowest growth in the domestic manufacturing industry since September 2009, according to IHS Markit. Then again, it could fall below 50.0, which would indicate contraction.

Nearly all of the underlying economic data weakened from the previous month, including output, employment and inventories. New orders actually fell in May for the first time since August 2009, meaning U.S. manufacturers had a net negative number of orders. Business expectations sunk to a seven-year low.

As I’ve explained many times before, we see the manufacturing PMI as a leading indicator of future demand for energy and raw materials. But it also has obvious implications for earnings per share (EPS) growth and gross domestic product (GDP) growth.

IHS Markit’s report doesn’t comment on why manufacturers are in this position right now, but two big culprits jump to mind: the Federal Reserve and the U.S.-China trade war.

The Historical Fallout of Tightening Credit

Earlier in the month I shared a chart with you showing that every major slowdown in the U.S. manufacturing industry going back to the 1950s was preceded by a Fed tightening cycle. The way things are headed, this cycle looks to be no different. Fed Chair Jerome Powell has hinted that there will be no more interest rate hikes in 2019, but the “damage” has already been done, so to speak.

In a recent report, analysts at research firm Cornerstone Macro wrote that they believe the U.S. manufacturing index “will eventually break below 50.0 in 2019 as it HAS AFTER EVERY FED TIGHTENING CYCLE.”

This is significant because it’s one of the final things to happen in nearly every business cycle of the past several decades. After the index dips below 50.0, we start to see employment weaken. (We’re already starting to see some of this. Ford alone has cut some 7,000 positions, with many more expected.) Around 92 percent of the time, an EPS recession followed manufacturing pullbacks, according to Cornerstone. After that, a GDP recession has occurred three quarters of the time.

China Digging In for the Long Haul

And then there’s the U.S.-China trade war, an end to which might still be some time away. Last week Chinese president Xi Jinping told crowds that the country was “now embarking on a new Long March,” interpreted as a sign that he could be preparing for a protracted engagement.

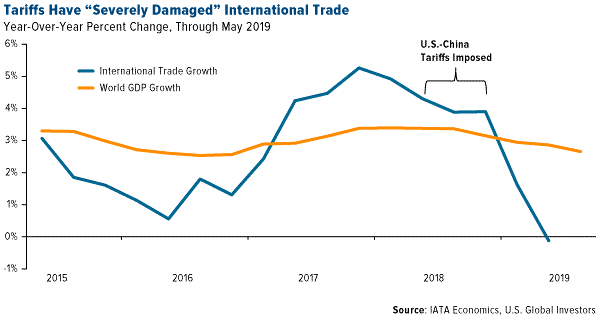

The skirmish has already “severely damaged” international trade volumes, according to the International Air Transport Association (IATA). Air cargo was down 2 percent in the first quarter of 2019 compared to the same period a year ago, while air freight rates between Hong Kong and North America have spiked.

Tariffs are also hurting the competitiveness of American companies operating in China, a survey conducted earlier this month has found. Responding to the American Chamber of Commerce in the People’s Republic of China (AmCham), as much as 75 percent of China-based U.S. firms, and 81.5 percent of U.S. manufacturers, said that tariffs were having a negative impact on their business. More than 40 percent indicated they planned on relocating outside of China to avoid tariffs, but of those, only 6 percent said they were considering returning to the U.S.

But conditions here in the U.S. can be just as constricting for some companies, thanks to higher tariffs. In a report last week, UBS estimated that as many as 12,000 U.S. stores could close this year because of tariffs, putting some $40 billion of sales at risk. The U.S. is already “over-stored,” according to the report, but so many store closures in a single year would be a major squeeze on the broader economy with mass job losses.

Goldman Sachs: Inflation Will Surge

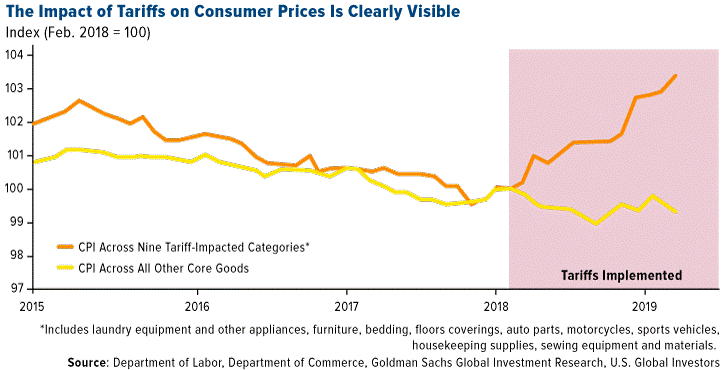

What I have my eye on most, though, is inflation. Tariffs and other trade restrictions are naturally inflationary.

In a recent note to investors, analysts at Goldman Sachs revised up their estimates of the impact tariffs might have on U.S. inflation. Look at the chart below. Although prices for total consumer goods—as measured by the consumer price index (CPI)—have declined over the past few years, prices for as many as nine separate categories hardest hit by tariffs have surged since the U.S.-China trade war began in early 2018.

Earlier this month, Trump raised tariffs from 10 percent to 25 percent on $200 billion worth of Chinese imports. If tariffs were imposed on an additional $300 billion, which Trump has threatened to do, inflation would rise “noticeably” above 2 percent next year, Goldman says. This would “slightly increase the likelihood” that the Fed would hike interest rates.

It should be pointed out that such tariffs are not generally paid by Chinese exporters. Instead, they are paid by U.S.-based importers, which often pass the extra expense on to the end consumer.

Cornerstone Macro weighed in on the subject in a note dated May 21, writing that tariffs are just one part of the inflation story right now—the other being rising fuel costs.

“Tariffs, coupled with rising gasoline prices, represent a double whammy for U.S. consumers,” the firm writes. It projects prices for gas and consumer goods to be up some 5 percent year-over-year in the second half of 2019.

Higher Inflation Has Historically Meant Higher Gold Prices

The good news in all this is that higher inflation has historically been supportive of the price of gold. In the years when inflation was 3 percent or higher, annual gold returns were 15 percent on average, according to the World Gold Council (WGC).

When gold hit its all-time high of $1,900 an ounce in August 2011, consumer prices were up nearly 4 percent from the same time the previous year. The two-year Treasury yield, meanwhile, averaged only 0.21 percent, meaning the T-note was delivering a negative real yield and investors were paying the U.S. government to hang on to their money. This created a favorable climate for gold, as investors sought a safe haven asset that would at least beat inflation. Go gold!

Missed my interview with Chris Powell of the Gold Anti-Trust Action Committee (GATA)? Click here to read it now!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a period of time, often annually. A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2019.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of