Gold Forecast That’s Bullish, Bearish…And A Must-Read

The title of this analysis may seem perplexing, but it’s really isn’t. Gold can rally up and down. In fact, any market can. They just can’t do it at the same time. Gold and silver bottomed several days ago and they are now moving higher and their rally is likely to continue for some time. This “some time” is not likely to extend beyond what is generally known as the “short-term” meaning no longer than the next few weeks.

There are quite a few reasons for it and in today’s analysis, we would like to more closely examine one of them - the situation in the USD Index and its relationship with gold.

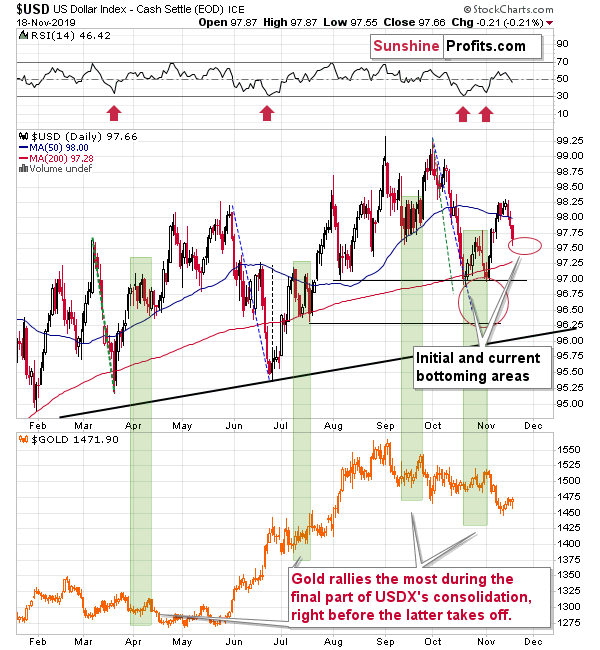

We previously commented on the above USD Index chart in the following way:

The breakdown below the very short-term rising wedge pattern resulted in a major decline. “Major” from the very short-term point of view as the following daily downswing has been the biggest daily decline that we saw this month. After the initial decline, the move lower continued and the USDX closed the week below its 50-day moving average. The 50-day MA has been providing support quite reliably in the previous months. It was not always strong support, but often meaningful enough to make it useful as a trading tool. While it stopped the decline on Thursday, the USDX broke below it overall.

The above breakdown opened the way to even lower USDX values.

The green and blue dashed lines represent declines that are similar to the October decline. The rallies that followed them were quite sharp, but they too had smaller pauses within them. Both: March-April, and July rallies consolidated after the USDX moved above its 50-day moving average.

The short-term decline that we saw so far doesn’t compare to what we saw in early April and in mid-June. Consequently, the odds are that the USD Index will decline some more before soaring to new highs.

This means that gold is likely to move higher before plunging. Consequently, the odds are that reports of gold turning bearish for the short run are premature.

Now, since the USD Index already moved to our target area, the question arises, if this is likely to translate into a top in gold or not. Our answer is that it indicates that the top is relatively close, but not necessarily yet in.

You see, the link between gold and the USD Index is not as straightforward at it may appear at the first sight. People will usually expect gold to move higher on the same day when the USD Index moves lower and vice-versa. And quite often happens in this way. However, the strength of reaction varies. In fact, it could vary so much that moves in the USDX are going to be mostly ignored once the day-to-day price noise is filtered out.

In today’s gold prediction article, we will focus on the very specific part of the gold-USD dynamics – on gold’s behavior during USD’s consolidations. And more precisely, what happens if the USD Index continues to move sideways for a while and soars only after some time.

After all, that’s exactly what could happen right now. The USD Index has already moved to our target area, but it doesn’t automatically mean that the next upswing has to start immediately. In fact, pauses before rallies were quite common in the previous months. We marked those cases with green rectangles.

There were four similar cases this year. In two cases, the USDX consolidated after rallying and in two cases it consolidated after declining. And yet, as far as the consolidation itself is concerned, we see the same kind of reaction in gold in all four of them.

Gold rallied most visibly when the consolidation in the USD Index was ending.

This is profound, because it means that the USD Index doesn’t have to slide from here for gold to move higher in the next several days. The USD Index might move back and forth (perhaps slightly higher or slightly lower) and gold could form the final short-term pop-up just like it did in mid-April, mid-July, late-September, and late-October. In other words, our USD Index analysis doesn’t invalidate our gold analysis.

Of course, if the USD Index declines some more, gold would likely rally anyway.

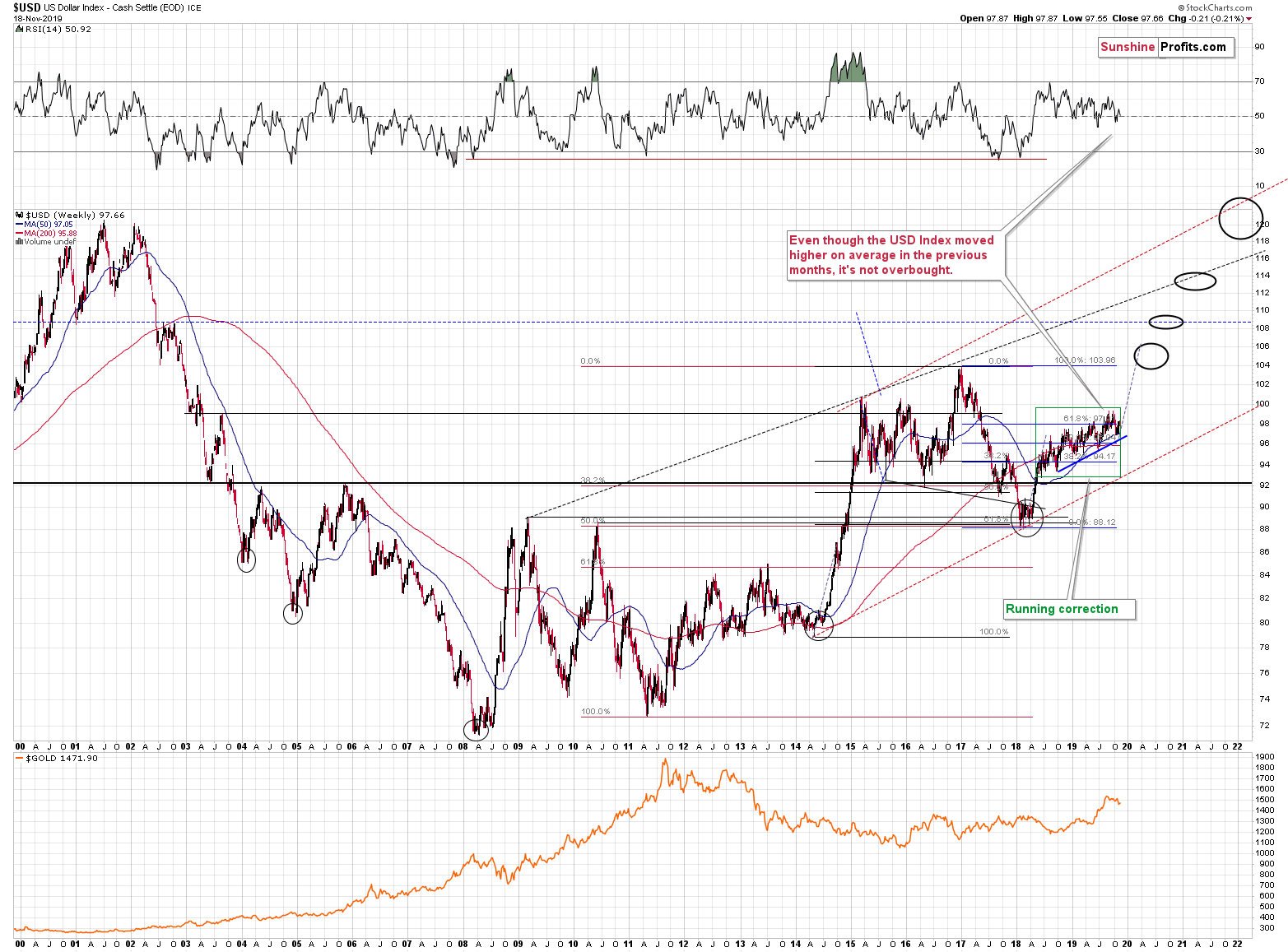

That’s the outlook for the short term and the short term only. After it’s all said and done and the dust settles, the USDX is likely to resume it’s medium- and long-term trends.

And that’s where the golden picture becomes gloomy.

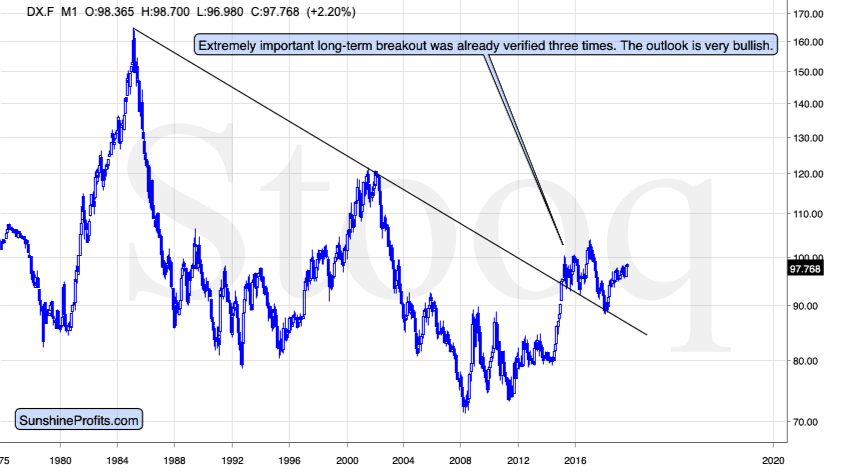

The USD Index is after a massive long-term breakout and its verification. This makes a medium- or long-term rally very likely. The previous similar rallies resulted in big drops in the value of gold (like in the early 80s and in the second half of the 90s).

Based on the above chart it’s easy to imagine how the USDX can rally to the 120 level or so. As we zoom in and the proper context disappears, it starts to look “unreasonable”.

The 120 level seems very high – like something almost unachievable. And no wonder – the USD Index has been trading below 100 for almost 18 years (with a few relatively brief exceptions). Yet, the confirmed breakout from the previous chart is an undeniable fact, and both: USD Index and the precious metals market are likely to be affected by it.

Looking at the last 1.5 years of USDX performance from the short-term point of view make it seem like nothing really happened – it looks like a horizontal back-and-forth action. The above chart, however, clearly shows that it’s actually a running correction – a pause after a strong rally during which the USD Index moves on average higher anyway. The “correction” here means that the pace at which USD rallied simply declined.

The outlook for the following months – and quite likely years – is bullish for the USD Index. To be clear, the above doesn’t mean that gold has to continue declining as long as the USD Index rallies. Just as the USD Index bottomed (2008) well before gold topped (2011), we are likely to see something opposite in the following months. At some point gold is likely to stop reacting to USD’s rally and start to move higher on its own. We are likely months away from this situation, though.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold news newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,