Gold, Stock Market And Crypto: Key Tactics Now

The great USA nation appears to have devolved into the “United Socialists of America”. What happened?

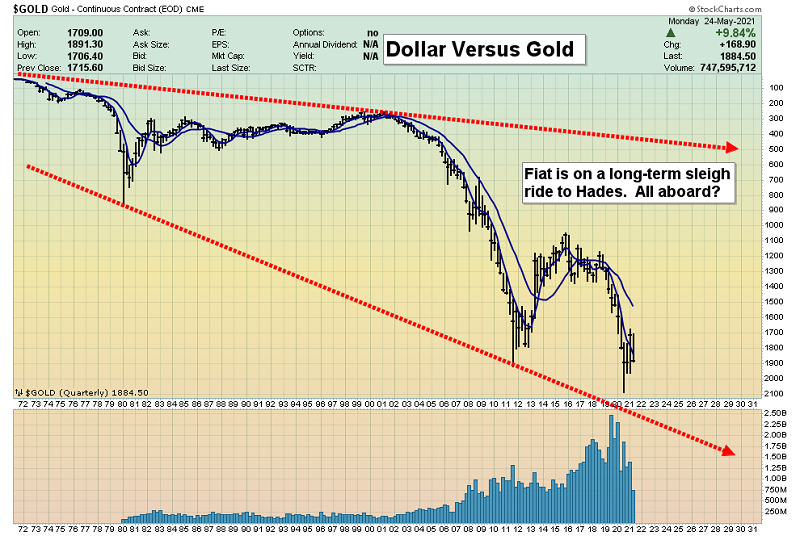

The “disturbing yet comical” long-term chart of the US fiat dollar versus gold.

History shows that once a nation embraces unlimited supply paper money and abandons gold, it embarks on what is best termed a “financial sleigh ride to Hades”. It happens regardless of which political party tries to play skipper with the fiat ship.

Citizens are now getting paid more “stimulus” payments to stay home than to go to work. They are urged to invest these universal basic welfare payments into the financial markets… and to buy houses with enormous leverage.

The Nasdaq ETF chart. As the printed welfare money flows into the stock, bond, and real estate markets, the US central bank “juices” the socialist theme, by buying bonds and mortgages with even more electronically issued fiat.

While these welfare payments make the markets look good in the medium-term, I’ll dare to suggest that the Nadaq, Dow, and SP500 are in the final throes of an ominous “Elliott Super Wave Five”.

Fundamentally, America appears to be at a time point that is a hybrid of 1928 and 1966. As the current “growflation” theme transitions into stagflation, US money managers are likely to embrace a 10%-20% allocation to gold… which is the norm in Asia.

The average citizen in the West will also begin to embrace gold as a sensible asset class to invest a portion of their fiat money. They need to do this before their fiat gets ravaged by the insidious inflation genie that is rising out of the bottle.

The spectacular long-term gold chart. I’ve been outlining the likely formation of a gargantuan inverse H&S bull continuation pattern since 2012. Now it looks like a sculpture carved by Michelangelo!

Note the bullish technical action in the right shoulder; the moving average crosses are crisp and clean, and the shoulder takes the shape of a drifting rectangle/bull flag.

This type of technical action is expected when a momentum-style move is getting underway. That certainly appears to be the case now, from both a fundamental and technical perspective.

The bottom line is that fiat money is a vile part of socialism. The socialists are likely to pay a heavy price, as gold blasts over the neckline and begins a wondrous journey towards my $3000 target zone!

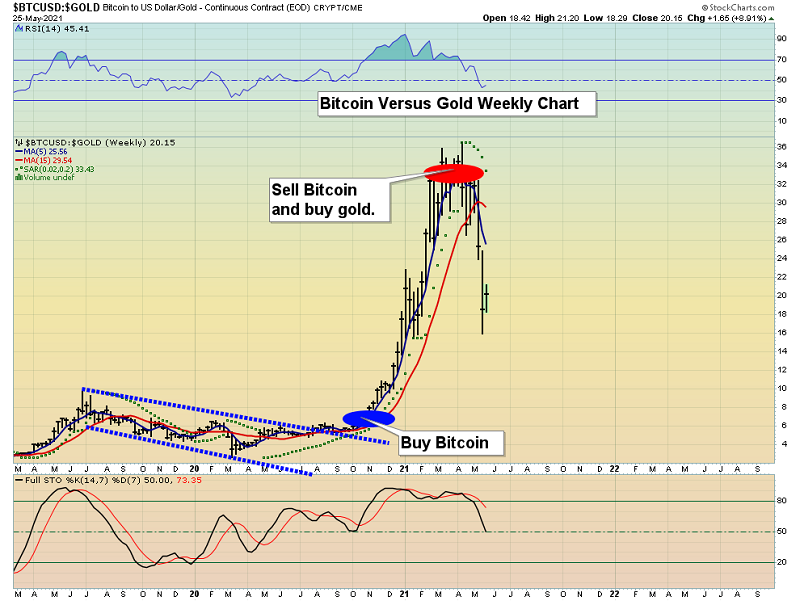

The money-making bitcoin versus gold chart. While my call to sell bitcoin and buy gold has obviously been a major winner, investors are wondering if it is now time to sell gold and rebuy bitcoin.

The simple answer is…no!

Bitcoin can be bought now, but only with disgraced fiat, or with proceeds from the late-stage stock market.

Sell high and buy low. It is a simple adage… and it works. In fiat terms, the US stock market is high, so my plan is to book a lot of profit between now and August.

I call the Sept-Oct time frame “Global stock market crash season”. Clearly, the smart time to sell is ahead of a potential crash, not after it happened. For the US stock market… that time is from now to August.

While some stock market proceeds can go to bitcoin and key coins I cover in my crypto newsletter, more can go to the gold and silver miners.

The GDXJ daily chart. Not only is a key trendline breakout in play, but it’s happening while a bull flag appears to form!

My GDXJ buy zone basis gold $1778 was a big winner as I urged investors to sell into gold $1996, and it’s happened again with $1671 and $1850.

Having said that, it is now time to hold core positions with an iron hand. An argument can be made that a gargantuan momentum-style move is coming, and it will be inflation-oriented.

Gold did well during the 2000-2020 deflation cycle. The miners did “so-so” but…

This inflation cycle will likely last for 15-20 years and the miners are likely to outperform anything and everything.

The GOAU chart. All the gold stock ETFs look technically awesome, and GOAU may be the best of the bunch. While light trading position profits can be booked and some further “shoulderization” of the chart pattern is possible, all eyes should be on what I call the neckline of champions… for a major breakout to the upside!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Hot For An Inflationary Trot!’ report. I highlight key GOAU and GDXJ component stocks in momentum mode, with buy and sell tactics for each mighty miner!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

*********

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: