Gold SWOT: Andean Precious Metals Delivered Another Standout Quarter

Strengths

- Platinum was the best-performing precious metal this past week, up just 0.54%, and the only one to post a gain. It continues to show relative strength, reclaiming key retracement levels even as miners lag.

- Gold’s sharp drop may present a buying opportunity for those expecting gains in the second half. Rising holdings in bullion-backed ETFs suggest many investors see it as a worthwhile bet. Monday’s decline followed confirmation from President Trump that U.S. bullion imports won’t face tariffs, ending recent market uncertainty, according to Bloomberg.

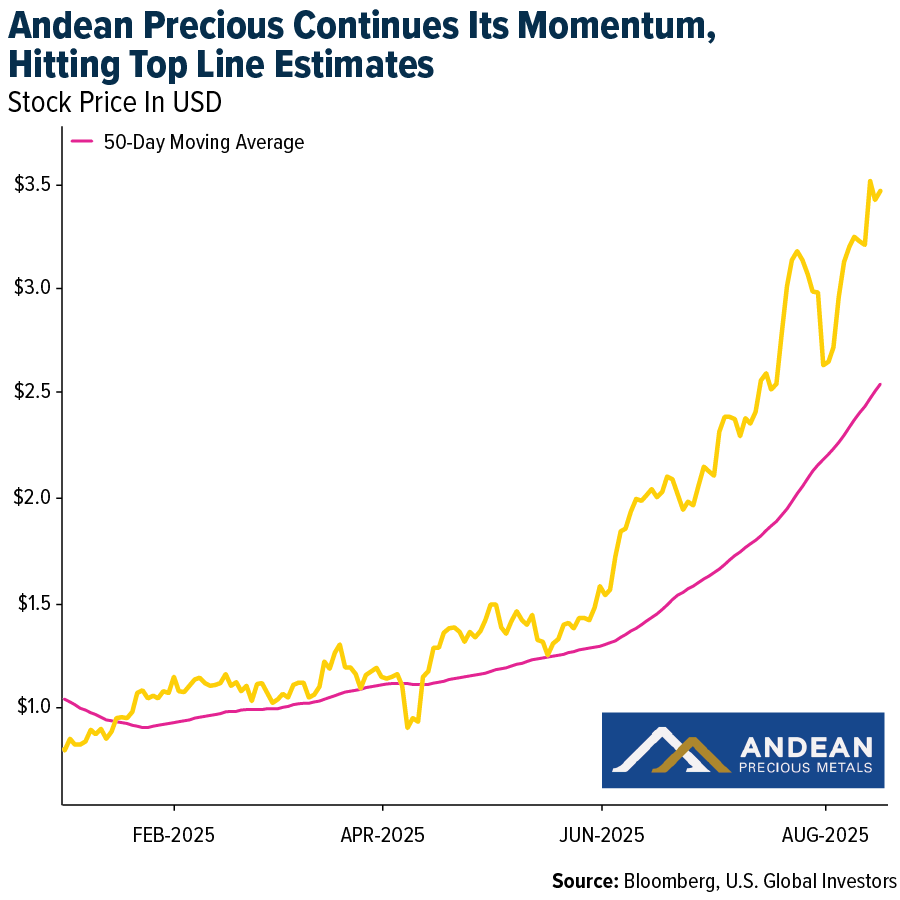

- Andean Precious Metals delivered another standout quarter, with revenue climbing to $73.7M and free cash flow surging 50% year-over-year as both San Bartolome and Golden Queen advanced toward peak output. Bolstered by $87.3M in liquid assets and production momentum building into H2, the company is proving it can grow top-line performance while maintaining a fortress balance sheet.

Weaknesses

- The worst-performing precious metal for the past week was gold, down 3.08%. Gold is on track for a weekly loss as stronger-than-expected U.S. inflation pushed bond yields and the dollar higher, reducing demand for the non-interest-bearing metal. Traders also scaled back expectations for imminent Fed rate cuts, removing a key near-term support for bullion prices.

- Barrick Mining Corp. slumped in pre-market trading after the Canadian miner posted a $1.04 billion net charge related to the seizure of its Loulo-Gounkoto gold complex by Mali’s military junta. The loss was due to “the deconsolidation of Loulo-Gounkoto following the change of control,” the company said in its second-quarter earnings report on Monday.

- Evolution Mining Ltd.’s midpoint FY26 gold production guidance at North Parkes is forecast to decline by 54% to 20–25K ounces. While this aligns directionally with previous signals, the magnitude of the decline is larger than expected. RBC estimates the guidance could lead to Triple Flag production and cash flow per share downside of 2% in 2025 and 6% in 2026.

Opportunities

- Agnico plans to deepen the current shaft at Malartic by 70 meters to 1,870 meters and add a second loading station to improve operational flexibility. Plans for a second shaft are also advancing. A second shaft could potentially handle 10,000 tons per day, bringing total underground production to 30,000 tons per day and yielding 750,000–800,000 ounces per year, according to Canaccord.

- Kinross Gold is set to increase its stake in Asante Gold. The two companies agreed to amend a 2022 share purchase agreement in a transaction that includes $55 million in cash payments. Under the terms, Asante will issue 36,927,650 shares priced at C$1.45 each.

- The accelerated permitting review timeline for Castle Mountain (10% of NAV), under the U.S. Federal Government’s Fast-41 Program, could de-risk and advance the project’s expected annual production of 200,000 ounces. This would further strengthen Equinox’s future production profile, with Greenstone and Valentine ramping up this year, according to RBC.

Threats

- Sharp outperformance of gold equities when gold prices are flat or declining is rare. RBC notes that historical periods of gold equity outperformance versus gold have often been followed by underperformance, which may warrant some caution. They also highlight that large-cap gold equity valuations were exceptionally attractive in mid-June, trading at a trough 0.9x NAV and never-before-seen free cash flow yields of over 8%.

- So far this year, Michael Saylor’s Strategy Inc. has raised around $6 billion through the sale of perpetual preferred offerings to buy Bitcoin, much of which has been placed with retail investors. The latest issuance, called “Stretch,” is a $2.5 billion offering with no voting rights that pays a variable dividend—which can also be omitted. Over the past month, Strategy’s stock is down more than 17%, while Bitcoin has remained essentially flat. A more prudent strategy might just be to buy some gold.

- Swatch Group AG CEO Nick Hayek said the Swiss government should retaliate against the 39% tariffs imposed by President Donald Trump by introducing a levy on gold shipments to the U.S. Swiss companies, including Swatch, are still reeling from the U.S. president’s decision to impose the highest import tariffs of any developed nation, according to Bloomberg.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of