The 5 Arcs & 7 Cracks of Systemic Collapse

For centuries, philosophers have compared the great questions (and mysteries) of life to a circle.

That is: To fully understand the circle, you must also recognize its arcs, and to fully understand the arcs, you must see the circle.

The fancy lads call this paradoxical “tying together of all things” hermeneutics.

But we don’t need fancy phrases to call out a global financial system losing all credibility, options and happy endings.

When it comes to the “circle” of an increasingly apparent economic collapse, the systemic, mathematical and historical “arcs” of this dying economic/financial/social sphere are becoming easier for all of us to both feel and see.

A Circle of Systemic Implosion

But to make this real (rather than philosophical), let’s put these evidentiary “arcs” in their proper place so that we can all objectively recognize the circle of systemic implosion knocking on our doors.

ARC 1: Debt

As we’ve been writing for years, the patient-zero from which all the ripple effects of systemic implosion emanate is tragically simple and historically confirmed, namely: Debt.

When nations cross the Rubicon of 100% debt to GDP, growth slows by a third.

As that ratio increases, growth becomes a fantasy. In short, and as David Hume warned centuries ago: Debt destroys nations.

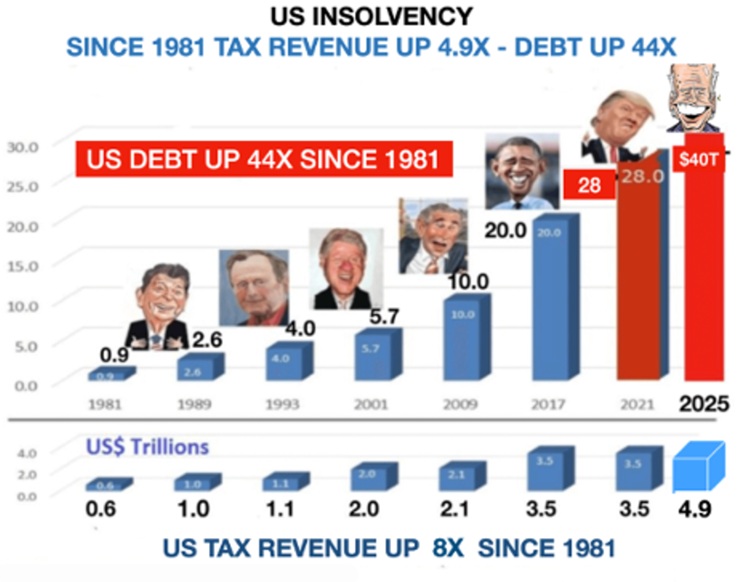

Debt in the US is at historical, unprecedented and also unsustainable levels.

If Hume was right, then Uncle Sam faces serious problems now and ahead.

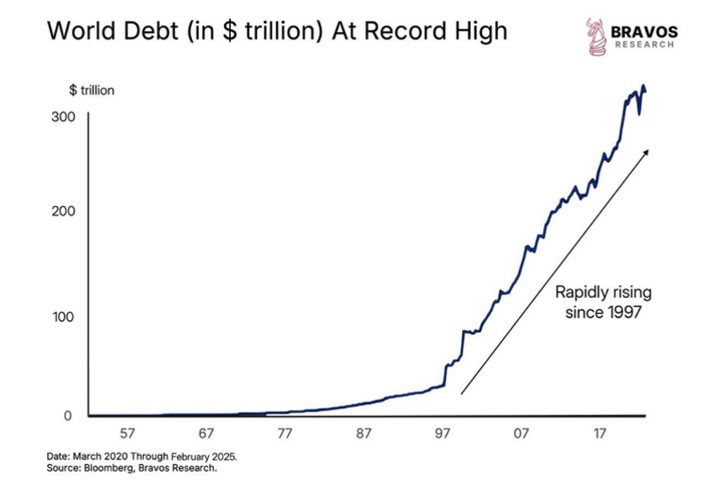

But what’s even scarier about debt destruction today is that the problem is not just American, it’s global.

Total global debt stands well above $300T, and total global GDP is only 1/3 that cancerous figure.

In short, debt is on a rampage, and it is leaving a swath of destruction (and evidence) in its wake.

ARC 2: The Causes (and Criminals) of Debt

If debt is a crime, then our policymakers are the criminals.

The smoking gun for the currently imploding debt cycle was August 15, 1971, when the home of the World Reserve Currency decoupled from its constitutionally forewarned gold chaperone.

Why the decoupling from sound money?

The answer is simple: Politicians of all stripes (who harbor a “will to power” that would make Nietzsche blush) prefer the short-term votes, power and prestige that come from unlimited spending, which is only possible when a currency is decoupled from a golden chaperone.

This was true long before Trump, and the sins are both red and blue.

Short-term self-interest rather than long-term national interest is the philosophical (human, all too human) modus operandi of all pathologically unwise politicos…

ARC 3: Currency Debasement

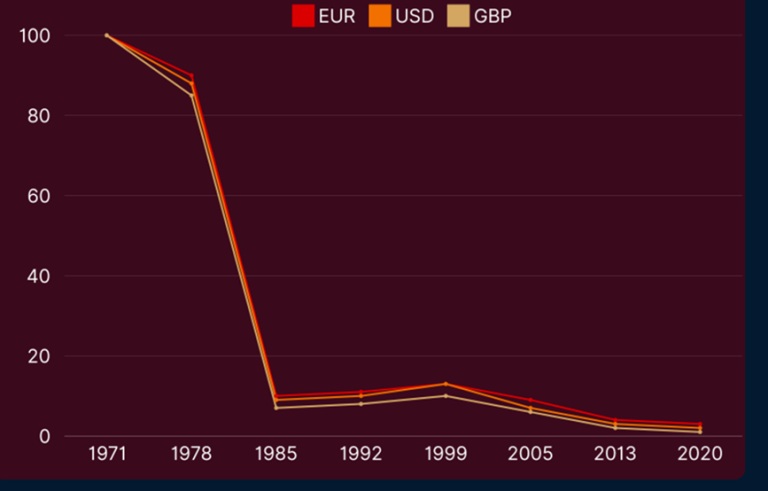

Once a currency is free of its golden anchor, it can be printed, mouse-clicked and credit-expanded to infinity and beyond to pay for (“monetize”) the promises, policies and egos of leaders who know little of history and almost nothing of money.

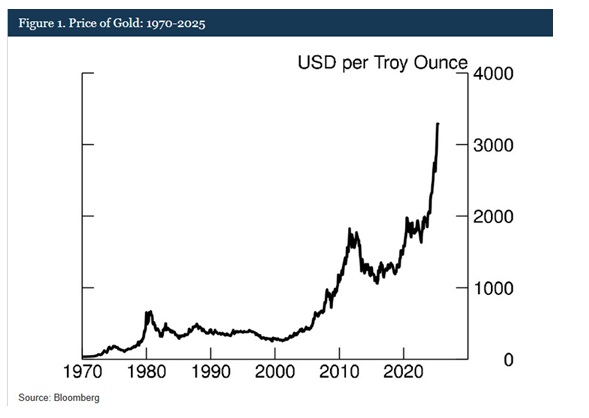

Such credit (and hence currency) expansion leads directly to currency debasement as nations inflate away their ever-expanding bar-tabs with ever-debased currencies (measured against real money: Gold).

This pattern and cycle of debt to currency debasement is as familiar as history itself—at least for those who bother to understand history…

ARC 4: Dishonesty

The next phase of policy makers with their backs against a debt wall is equally clever and equally inevitable, namely: Lying.

One obvious great lie came on day 1, when Nixon promised us in 1971 that our dollar would be just as strong tomorrow as today, and that the decoupling from gold would be “temporary.”

Even prior to that infamous decoupling in 71, the lying was already in full swing.

The Fed Chairman and Treasury Secretary of that time were telling Congress that such a decoupling would, in fact, strengthen the dollar and weaken gold.

Fifty-four years later, your dollar has lost 99% when measured against gold.

And as for that “pet rock,” well…rather than “weaken,” it has risen by 8000% since those experts told us it would tank.

Just saying…

But the lying just continued, of course.

Our PhD economists at the FOMC and beyond, for example, gave us Modern Monetary Theory (MMT), which promised us we could print trillions to monetize our sovereign debt without creating inflation.

MMT, which is neither “modern,” nor “monetary” nor even a “theory”, has been tried (and failed) from Ancient Rome, the 1720 John Law Era and the collapse of the 1789 French economy to the fiasco of Weimar Germany or the implosion of Yugoslavia in the 1990’s.

In short, one big, history-confirmed lie.

More recently, the lies keep piling up, from the CPI scale/lie we use to downplay actual inflation to a redefinition of a recession for a nation already in recession.

ARC 5: Desperation

From dishonesty follows desperation, when policy makers, otherwise allergic to taking responsibility or speaking bluntly of a crisis, begin looking for fantasy policies to “save us.”

We’ve been tracking and objectively calling out the hidden impotence behind the so-called miracle measures, which are currently making the headlines.

The list is long yet not very distinguished.

But for simplicity, let’s list the most notable fantasies which both history and math (for those willing to look deeply) already confirm as doomed (rigged) to fail.

More to the point:

- Tariffs won’t save us from a debt implosion.

- Stablecoins won’t save us from a discredited dollar and ever-increasing centralization.

- DOGE and USAID cuts won’t save us from a $37T public debt clock whose numbers are rising exponentially rather than “carefully.”

- AI won’t save us from inherently deflationary technology whose near-term buzz hides a longer-term cancer of massive unemployment and recessionary (market-imploding needles) on the AI horizon.

The Jig is Up –And the Evidence/Cracks are Everywhere

As for evidence that all of the foregoing “arcs” are now manifesting as historically unprecedented “cracks” in the global financial system, all one has to do is look around…

Crack 1: The USD

The most obvious indicator of a US in decline is the no-longer-ignorable decline in trust (and demand) for its overly-indebted and stupidly weaponized USD.

As more and more nations trade outside the USD, the BRICS+ headline of de-dollarization is not a “conspiracy theory” but an historical tipping point for the much-debated but otherwise discredited USD.

Crack 2: A Ticking S&P Timebomb

An S&P 500 of which 40% of its market cap is narrowly led by 7 mega-cap (and AI-top heavy) enterprises is not a stock market but rather a market of a few monopoly stocks in which the top 10% enjoy 90% of its wealth.

This narrow market is over-valued by every metric and is entirely Pavlovian in its rises and falls, going up with a dovish Fed or down with a hawkish Fed.

The net result is a Fed-centralized equity market (in the backdrop dying capitalism and rising feudalism) whose inflationary rise is entirely correlated to the Fed’s inflationary monetary policies.

When, not if, the natural forces of the bond market (i.e. spiking yields) replace the Fed’s un-natural monetary forces, this bubble will do what all bubbles do: pop.

Crack 3: An Unloved UST

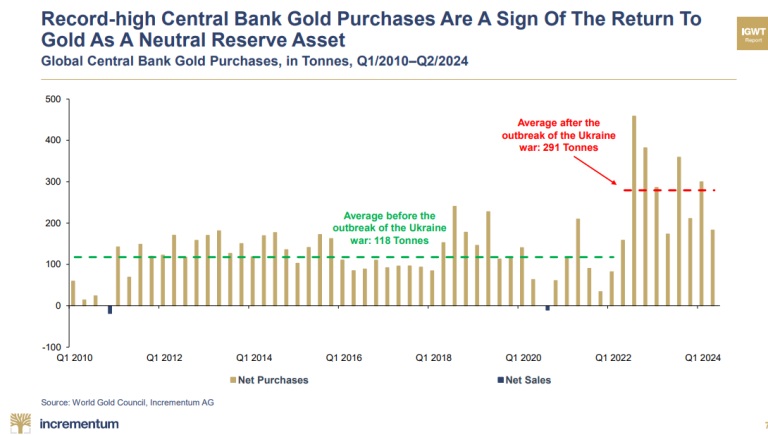

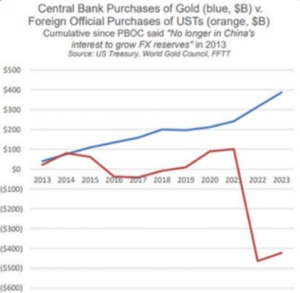

Since 2014, the world’s central banks have been net-selling USTs and net-stacking physical gold.

This embarrassing trend, driven entirely by distrust for Uncle Sam’s ever-increasing debt-trap, only accelerated when Uncle Sam weaponized that UST and USD in 2022.

Less trust, demand and buyers for US IOUs means more pressure on the Fed’s money-printers to buy its own debt and keep bond prices up and hence bond yields (the true cost of credit) compressed.

Such a bond “accommodation” means currency debasement, pure and simple.

Crack 4: Panic on the COMEX

Once the setting for legalized price fixing of the gold and silver price via uber-levered futures contract shorts, the COMEX is seeing headline-ignored inflows and outflows in which the metals needed to continue the price fix on precious metals is simply no longer there.

Why?

Because counterparties on the COMEX now want physical gold within their own hands, rather than price fixing between London and New York.

Why this sudden need for the real gold rather than paper contracts?

It’s simple: The world, like the BIS, IMF and BRICS+ nations, trusts physical gold as an objectively superior strategic reserve asset than the once sacred 10Y UST, which debt alone has now fully discredited.

Crack 5: Central Bank Gold Stacking

From the moment the US made the fatal mistake of weaponizing the world reserve currency in 2022, central bank gold stacking has tripled.

Why?

Again: For the simple reason that the world is losing love, trust and demand for a weaponized and over-indebted USD whose prior monopoly powers are now devolving in plain sight.

The world sees what history has always shown us: Once a nation debases its currency to monetize its debt sins, gold becomes real money…

and paper money, becomes, well, just paper…

Crack 6: Waning Petrodollar

When the dollar ditched its gold chaperone in 1971, the clever minds led by Kissinger in DC understood an immediate need to create global demand for the USD.

The OPEC arrangements, which followed, forced the world to buy oil in USD, and for decades, this energy “sponge” created needed demand for an otherwise debased USD.

Since 2022, however, oil is increasingly being bought and sold outside the USD at levels once thought unthinkable before that broken dollar was weaponized.

This is yet another sign of a world moving away from the USD’s declining hegemony due entirely to the USA’s rising debt sickness.

Crack 7: Discord on the Rise

Internal social, cultural and political polarizations within and outside of the US, whether based on race, sexual orientation, immigration dynamics or just plain poor citizens suffering under the visible rage of invisible (i.e., misreported) inflation are clear signs that the natives are getting restless.

Trust in government is at an all-time low within the US and throughout the G-7.

Such social chasms, as well as the worst foreign relations since 1949 and the greatest risk of nuclear war since the Cuban Missile Crisis (with proxy and direct wars nearly everywhere), are classic symptoms in the template of systemic implosions following sovereign debt crises and currency debasement.

As Hemingway warned, the “temporary prosperity” of debt-driven good times is always followed by the “permanent ruin” of currency debasement and war…

Look around you: What do you see?

Currency debasement and war…

No Easy Way Out

Dying nations, dying currencies, and dying financial systems, like dying armies, don’t give up easily, even after it’s clear they are experiencing their Waterloo or Gettysburg moment.

Like the stages of grief, denial is the first emotion for policymakers who can’t admit failure or accountability.

The debt, which is eating away at nations, currencies and citizens, is now too big to grow out of or wean away from with smarter spending habits.

As von Mises warned, there will need to be “constructive destruction” in the form of recessions, market mean reversions, and currency collapses (and hence skyrocketing gold) before the anger stage is surpassed by the acceptance stage.

The IMF talks of resets (and gold-backed CBDC). Bessent and Trump are flirting with gold revaluation.

These are just two of many possibilities, including a Bretton Woods or Plaza Accords 2.0 to re-arrange the deck chairs on a Titanic level of global debt.

Whatever comes next, it will not be smooth, easy or painless.

Paper money will continue its historical and inflationary slide south as gold, that intentionally ignored and downplayed asset, will continue to reach higher all-time-highs as sovereign credibility—from banking and currencies to trust and wisdom—continues to reach all-time-lows.

*******