Gold SWOT: Silver Reached a Record High Last Week

Strengths

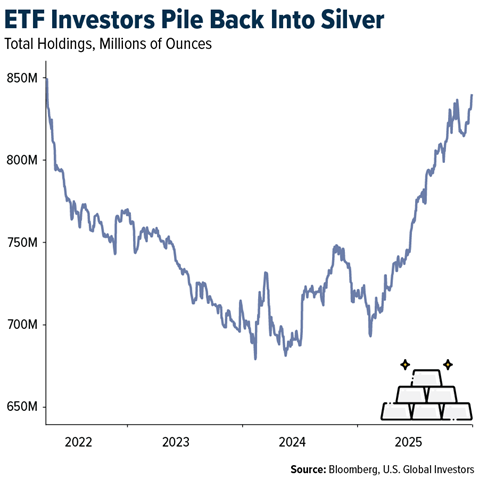

- The best performing precious metal for the week was silver, up about 3.6%. Silver reached a record high on Monday, retreated for three days and set another record on Friday. The metal has gained nearly 22% in the past month, previously hitting $50 an ounce in 1980 and 2011.

- Gold holdings in exchange-traded funds (ETFs) hit 3,932 tons at November's end, marking six months of growth. This reflects continued investor interest, with gold set for its strongest year since 1979 as investors shift from bonds and currencies to alternative assets.

- Sibanye Stillwater reached a three-year wage agreement with the representative unions at its South African gold operations, with the estimated average three-year basic wage increase for the total bargaining-unit wage bill, including all benefits, at approximately 5.4% per annum, according to a statement.

Weaknesses

- The worst performing precious metal for the week was platinum, down about 1.3% , perhaps on factor activity shrinking in the U.S. by the most in four months as reported this week. The Bank of Thailand intends to enforce more rigorous reporting rules for gold transactions. Officials have noticed that approximately 10% to 20% of these transactions are related to fluctuations in the baht. They plan to further investigate how this impacts the currency's volatility and consider possible solutions.

- According to UBS, streaming companies have not performed as well as expected despite rising gold prices in 2025. This is because new deals are getting more costly and competitive, and miners are delivering stronger results, which makes the streaming and royalty model less appealing.

- Bank of America notes that, in the past year, gold's rally has shown a lower correlation with other asset classes than it did throughout the entire post-COVID period. Its connection to Treasuries has also decreased. Additionally, although commodities typically gain when the dollar weakens, this trend has diminished in the current year. For example, crude oil prices have dropped year-to-date, mainly due to decisions by OPEC and geopolitical factors.

Opportunities

- Mithril Silver and Gold Ltd. has secured a Purchase Option for the La Dura gold-silver property near its Copalquin site in Durango, Mexico. La Dura includes several historic mines, notably a four-level gold-silver mine with a 60-tonne-per-day facility and holds extensive mining data from the 1990s to 2018. The mine last operated in 2013. Mithril has an exclusive four-year option to buy 100% of the concessions for US$4 million.

- RBC reports that Barrick has announced its intention to evaluate an initial public offering (IPO) for its North American portfolio assets, including Nevada Gold Mines, Pueblo Viejo and Fourmile. RBC notes that this proposed spin-out could potentially generate significant value for Barrick shareholders, estimating an additional relative upside of 15–20% compared to the company’s current share price.

- Perseus Mining Ltd. has made a bid to acquire Predictive Discovery Ltd., outbidding a Canadian competitor, Robex Resources Inc., for gold assets in Africa. The offer values Predictive at A$2.1 billion ($1.4 billion), with Perseus proposing A$0.778 per share—a 24.5% premium over Predictive Discovery’s Dec. 2 closing price.

Threats

- Caledonia Mining Corp. said a proposal by Zimbabwe’s government to double the royalty on gold producers would curb its profits. “If implemented, it would be expected to result in a lower level of profitability and cash generation relative to current market expectations,” the company said Monday in an emailed statement.

- First Majestic is offering $300 million in unsecured convertible senior notes due 2031, with an option for initial purchasers to buy up to an additional $45 million in notes. The company plans to use proceeds to repurchase a portion of an existing 2027 convertible notes and for general corporate purposes, according to Bloomberg.

- Italy was urged by the European Central Bank to rethink a push to declare its gold reserves the property of its people, a move critics say could open the door to the government selling off bullion.In a legal opinion dated Tuesday, the Governing Council asked Premier Giorgia Meloni’s government to review the proposal following a request from Rome for officials in Frankfurt to study the matter, according to Bloomberg.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of