Will The Bursting Of Auto Loan Bubble Affect Gold?

It seems that the auto loan bubble has already peaked. What does it mean for the U.S. economy and the gold market?

It seems that the auto loan bubble has already peaked. What does it mean for the U.S. economy and the gold market?

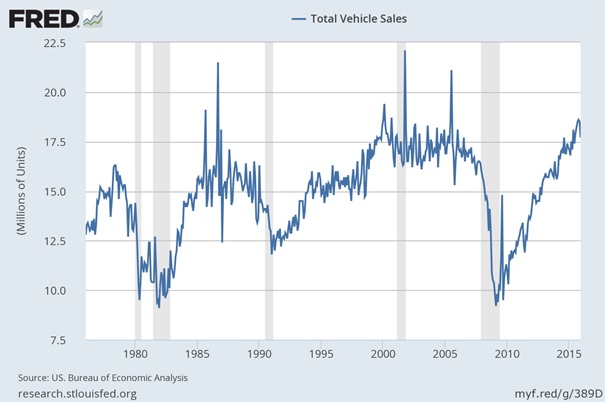

In 2015, over 17 million new vehicles were sold in the U.S., the highest number in history.

However, on a monthly basis, sales peaked in October. Seasonally-adjusted sales in December dropped by nearly 1 million (see the chart below). Production has also been declining since October.

Chart 1: Total vehicle sales from 1976 to 2015 (in millions of units).

As we have already explained, the auto loan bubble is a replay of the housing bubble. The Fed’s easy-money policy and lax credit have enticed people to buy more (luxurious) vehicles. Low interest rates have also prompted investors to seek a yield and engage in more risky investments, such as bonds backed by subprime auto loans. In consequence, the volume of auto loans has increased (as well as their duration). In the third quarter of 2015, auto originations reached a ten-year high, with a notable share of subprime loans.

Assuming that November and December were not temporary swings, what does the automotive bust imply for the U.S. economy and the gold market? We all know the consequences of the burst of the housing bubble. The mechanism may be similar now: falling prices, surge in delinquencies on car loans and foreclosures. However, it does not necessarily mean that the automotive bust will push the U.S. into the next Great Recession.

The borrowers will feel the pain from an imploding subprime auto loan market, and there will be pressure on securities backed by subprime auto loans, this is sure. However, the effects for the broader economy should be softer than in the case of the housing bubble. Why? First, the size of the subprime auto loan market is a tiny fraction of what the subprime mortgage market was at its peak. Second, cars are much cheaper and easier to recover and resell in case of default than real estate. Third, the worth and the duration of car loans are lower than mortgages.

To sum up, it seems that the auto loan bubble has already peaked. The implosion of the subprime auto loan market should be positive for the price of gold, as the bursting of the housing bubble was. However, the negative effects for the broader economy – and for the gold market – would appear gradually and would be less significant than in 2007-2009.

If you enjoyed the above analysis, we invite you to check out our other services dedicated to the precious metals investors. We invite you to join our gold newsletter today – you’ll also gain 7-day trial of our premium Gold& Silver Trading Alerts. It’s free and if you don’t like it, you can easily unsubscribe.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor