Becoming Battered Billionaires

A few readers may think this editorial analysis is far-fetched and possibly unlikely. Nonetheless, it is about FIVE well-known billionaires, who have become FILTHY RICH during the recent secular bull market in US stocks. However, when those few skeptical viewers become aware of Bear Market history (i.e. 2000-2002 and 2007-2008)…and the current hyperbolically levitated level of irrational exuberance blinding all common sense today, everyone will appreciate that a horrific Bear Market in stocks looms imminently in Wall Street.

A few readers may think this editorial analysis is far-fetched and possibly unlikely. Nonetheless, it is about FIVE well-known billionaires, who have become FILTHY RICH during the recent secular bull market in US stocks. However, when those few skeptical viewers become aware of Bear Market history (i.e. 2000-2002 and 2007-2008)…and the current hyperbolically levitated level of irrational exuberance blinding all common sense today, everyone will appreciate that a horrific Bear Market in stocks looms imminently in Wall Street.

History Is The Forerunner or Prologue To The Future

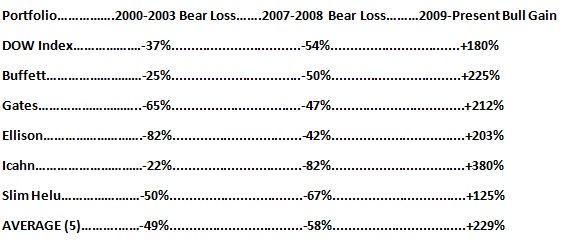

- 2000-2002 Bear Market Bubble saw the DOW Index fall -37%

- 2007-2008 Bear Market Bubble saw the DOW Index plummet -54%

Fast-forward to the 2009-Present Bull Market fueled by unbridled GREED and irresistible COMPLACENCY. The strong words of “greed” and “complacency” are used here for the following reasons.

- The DOW Index has relentlessly soared more than +180% since early 2009…this is a modern day record.

- NYSE Margin Debt is at an all-time high…higher than it was in 2000 and 2007 just prior to the stock market crash (http://tinyurl.com/mf6mn9h )

- Many company insiders are dumping stocks at these ludicrously high price levels.

- Warren Buffett recently sold his $3.7 billion stake in Exxon.

- All US Stock Indices are at or near all-time peak levels (DOW, S&P500 and NASDAQ).

- Record company stock buybacks with a view to artificially increasing Earnings Per Share (EPS).

- Utilities Index has already begun a Bear Market trend, which historically is a leading bearish indicator to all asset classes.

- The US T-Bond market gives all indications of having topped out…thus ending a 32-year Bull Market.

- China’s Shanghai Index has plummeted nearly -30% in the past three weeks, thus heralding a Bear Market in Asia.

Since the year 2000, many investors made fabulous fortunes. In fact FIVE prominent well-known billionaires copiously added to their billions. They are Warren Buffett, Bill Gates, Larry Ellison, Karl Icahn and Mexican Carlos Slim Helu. However, it was not without grievous financial suffering along the way…the Fabulous Five lost many, Many, MANY billions in the two previous Bear Markets. Moreover, As of July 24, 2015…the price of the Flagship stocks of the above five billionaires are all below their respective 200-dma. Indubitably, this will galvanize the attention of Technical Analysts worldwide, because it is a telltale sign of a fourth-coming Bear Market.

To be sure all market cycles are immutable, only magnitude and duration vary. Here below are charts showing how much each billionaire’s wealth was mercilessly hammered down in the Bear Markets of 2000-2003 and again in 2007-2008.

Specifically, these charts show the horrific magnitude of lost price during the Bear Markets of 2000-2003 and 2007-2008. But these charts also illustrate how much each Billionaire’s wealth has subsequently sky-rocked in the secular Bull Market of 2009-Present.

Warren Buffett’s Berkshire Hathaway (BRK/A)

During the 2001-2002 Bear Market BRK/A lost approximately -25%.

During the 2007-2008 Bear Market BRK/A lost approximately -50%.

Since early 2009 to the present BRK/A has soared about +225%

Bill Gates’ Microsoft (MSFT)

During the 2000-2001 Bear Market MSFT lost approximately -65%.

During the 2007-2008 Bear Market MSFT lost approximately -47%.

Since early 2009 to the present MSFT has soared about +212%.

Larry Ellison’s ORACLE

During the 2000-2002 Bear Market ORCL lost approximately -82%.

During the 2007-2008 Bear Market ORCL lost approximately -42%.

Since early 2009 to the present ORCL has soared about +203%.

Carl Icahn’s Enterprises (IEP)

During the 2000-2002 Bear Market IEP lost approximately -22%.

During the 2007-2008 Bear Market IEP lost approximately -82%.

Since early 2009 to the present IEP has soared about +380%.

Carlos Slim Helu’s America Movil SA (AMX)

During the 2001-2002 Bear Market AMX lost approximately -50%.

During the 2007-2008 Bear Market AMX lost approximately -67%.

Since early 2009 to the present AMX has soared about +125%.

Indubitably, putting all the above data into perspective will galvanize the attention of global investors from Boston to Beijing to Beirut to Berlin to Buenos Aires. And here is the summary. Indeed, history is testament that nearly vertical levitation in stock prices is often followed by near vertical free-fall crashing stock values…as greed virally mutates into fear and panic. Consequently, it is indeed not too far-fetched to forecast that the Famous FIVE billionaires will lose many billions in market value of their aforementioned flagship companies.

Based upon the above data, it is conceivable the flagship stocks of these Billionaires may lose up to 50% of their respective current value in the looming Bear Market in Wall Street.

……………

This author has the greatest admiration and profound respect for the above Fabulous FIVE market seers…in fact they should be role models for all aspiring financial investors and entrepreneurs who seek the ultimate pinnacle of success. Yes, they might lose quite a few billions…in the forth-coming Bear Market. But one must remember that a Multi-Billionaire’s life-style is not diminished if he loses $20-35 Billion in a market correction…Besides in time all market cycles will again reverse.

Related Articles

The Mother Of All Bubbles Will Burst In Late 2015

Shanghai Stocks Sink: Déjà vu 2001 & 2007…All Over Again

How Much Will The DOW Index Correct In The Developing 2015-2016 Bear Market?

China’s Stock Market Crash Likely Headed West