BlackRock & Fidelity In Collusion With the UK Government?

The Western World is Already In Recession

Subtract budget deficits from national GDPs, and private sector GDPs are shrinking. While government spending is creating more debt, the tax base to pay interest costs is contracting.

Some analysts are pointing out that private sector debt is declining and they conclude that lending risk is lower than commonly thought. An article in the UK’s Daily Telegraph (Wednesday, 16 July) by veteran journalist Ambrose Evans-Pritchard was headed, “British debt is a screaming buy and Blackrock, Fidelity, and Schroders agree”.

As Evens-Pritchard points out, these financial megaliths are at odds with the sentiment in the gilt market, which must also be the case in other economies with a significant government borrowing requirement. It begs the question as to whether this story is planted in cooperation with the UK government, aware of a funding problem.

Conspiracy theory, maybe, but government disinformation is remarkably common. We must proceed with what we know in answering the question raised: Do you buy or sell government debt?

GDP tells a different story

To answer it, we must deconstruct GDP, changing our focus to the US economy, which is the one that really matters. The US budget deficit last year was 6.4% of nominal GDP. But nominal GDP growth was only 5.0%, meaning that the private sector must have contracted by 1.4%. In Q1 2025, nominal GDP increased at an annualised rate of 3.25%, yet the budget deficit is still over 6% and rising. Therefore, the private sector is contracting at an increased rate. In fact, adjusted for price inflation, real GDP actually contracted 0.5% on revised official estimates.

Obviously, nominal GDP is only growing due to the federal government’s excess spending over revenues. And because GDP is no more than a credit figure, credit deployed by the private sector is actually contracting. It reflects not only overall economic activity in the private sector but is a net figure encompassing changes in savings rates, bank credit, business start-ups and closures, and debt write-offs. The FRED chart below illustrates the reduction of bank credit for non-financial private sector lending as a proportion of the total economy.

The US savings rate has declined to less than 1% of total consumption, while debt write-offs have risen. But the big change is in banks redeploying their balance sheets away from the non-financial private sector, in a trend which dates back to the Lehman crisis and particularly Q1 of 2021.

The situation of the UK economy differs in its particulars but in their aggregate the situation is similar. Other major economies with government budget deficits piling on more debt sustaining the illusion of private sector growth include the entire G7.

So far, I have described the situation represented by official statistics, which only look backwards with questionable reliability. Looking ahead, we can be certain that President Trump’s tariff policies are creating uncertainty, and when they are finally fixed, they will impact global business activity negatively. Not only is this logical, but it is confirmed by the evidence that followed the Smoot-Hawley Tariff Act of 1930, which, coupled with contracting private sector credit following the roaring twenties, collapsed the US economy and spread the slump globally.

Does that combination ring any alarm bells yet?

It is a racing certainty that Trump’s tariffs will have the same consequences as the Smoot-Hawley Act, the degree to which will be revealed in the coming months. Furthermore, with US and global credit fuelling stock prices, 2025 is looking increasingly like 1929, also confirmed by the level of lending for speculative purposes recorded by FINRA.

Private sector economies already in recession will almost certainly descend further into slump territory. The consequences for government revenues are bound to be catastrophic. Debt-to-GDP metrics for all G7 nations will go through the roof as both borrowing soars and their GDPs decline.

This brings us back to the question posed at the beginning of this article: Do you buy or sell government debt?

From our analysis of the outlook, by the end of this year, the volume of G7 government debt issuance will be rising sharply. But worse than that, the theoretical underpinnings of tax receipts are already going into reverse, meaning that government debt and its interest cost are rising at an accelerating pace while the tax revenues to fund them are contracting. It is the classic definition of debt traps.

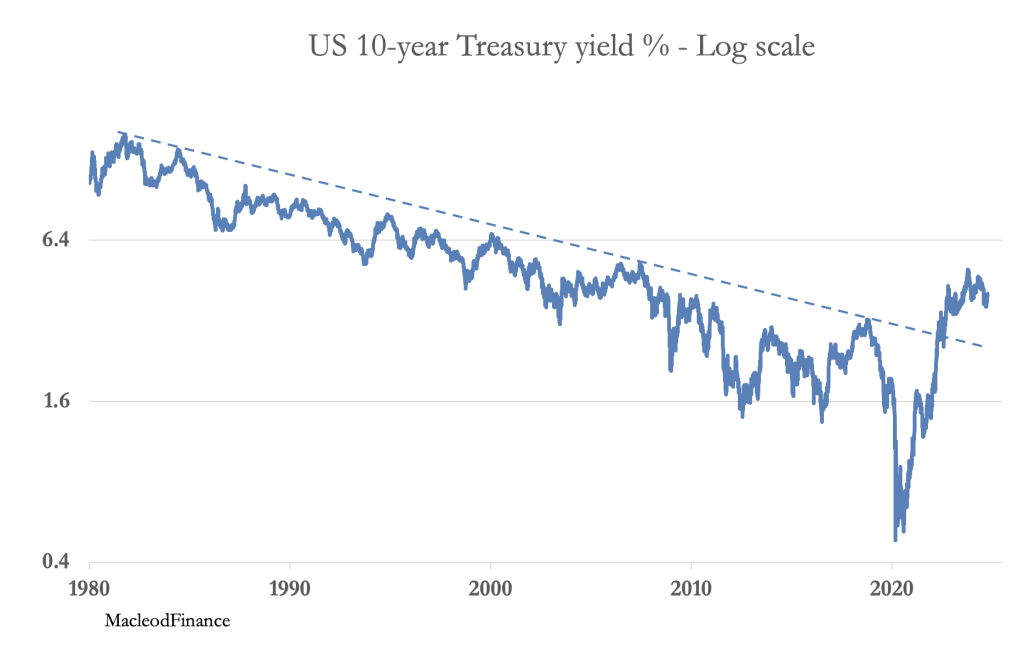

It is small wonder that government bond yields have risen, breaking a long-term trend going back to the 1980s, the implications of which must not be ignored:

Macroeconomic analysis gets it wrong

Neo-Keynesians and monetarists believe that in a recession, prices decline as a result of falling demand. For some goods and services this may be true, but it ignores the fact that supply contracts as well. Nevertheless, these macro-economists believe that inflation will fall in these recessionary times, so that the outlook is for lower interest rates. This is an egregious error, as current inflation trends avow.

The problem is in government debt traps. Nowhere is the problem more acute than for the US and its dollars. Already, there are funding problems evident for issues with distant maturities. The Fed is planning to reduce the level of capital the large banks have to reserve in the form of the supplementary leverage ratio, so that they can expand their credit in favour of treasury bills. This is desperate stuff.

Clearly, it is perceptions of currency risk which are driving government bond yields, not assumptions that central banks continue to control interest rates and bond yields. Initially, it is a concern for foreign holders of dollars and underlying financial instruments and investments totalling some $40 trillion, one-third more than US GDP.

Those perceptions are bound to spread from foreign investors to domestic institutions, who will realise that if the Fed is forced to reduce interest rates in the event of a domestic financial and economic crisis, then the dollar will fall in its purchasing power. Central banks, predominantly in Asia, already see this probability and have been adjusting their reserves by selling fiat currencies for the safe haven of gold.

Above all, this is the end game for fiat currencies. It is not so much gold rising, but the prospects for the dollar and the entire fiat currency system deteriorating at an accelerating pace.

And as for Blackrock, Fidelity, and Schroders saying gilts are a screaming buy, I can only conclude that they are deliberately misleading us or are Keynesian fools.

Courtesy of VonGreyerz.gold

*********