Coronavirus, Powell And Gold

The number of cases and deaths by the new coronavirus have escalated quickly. However, the fears subsided and the stock market rebounded. How did gold perform, and what can we expect from the king of metals next?

Should We Stop Worrying about the Coronavirus?

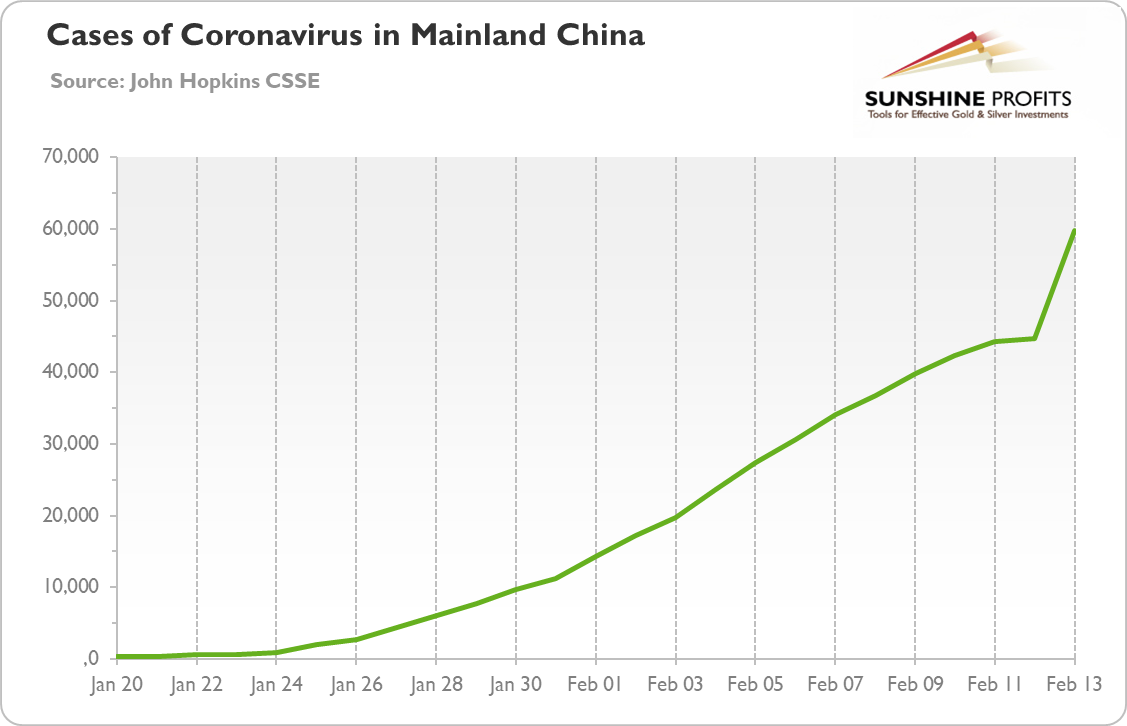

Well, that was a quick escalation. On February 2, when we wrote the first Fundamental Gold Report about the coronavirus, there were 14,557 confirmed cases and 305 deaths. Yesterday, the World Health Organization reported almost 45,171 cases and 1115 deaths. So, the number of infections and death toll of coronavirus have surged in recent days. Moreover, China has changed today its diagnosis methodology (to include “clinically diagnosed” cases), confirming 15,152 new cases and 254 additional deaths. Hence, as the chart below shows, the total number of cases in China has reached 59,800, while the global number has already surpassed 60,000.

Chart 1: Cases of Coronavirus in Mainland China

Meanwhile, the US stock market reached record closing highs yesterday as the chart below shows. Are investors blind? Are they irresponsible optimists? Well, it’s true that the Fed’s cheap money enables traders to have fun while the world is burning.

Chart 2: S&P 500 (green line, left axis) and gold (yellow line, right axis, in $) in 2020

But there is also a true ray of hope. Not counting today’s spike in new cases in China caused probably by the change in the methodology, the number of new cases reported daily there has been on a downward trend since February 4. It means that transmissions are still occurring but at a slower rate, which gives hope that the outbreak may be approaching its peak.

However, it’s far too premature to say that the containment is working – the case may be simply unconfirmed. And the virus may still spread outside China. Moreover, investors should remember that the economic impact of the new coronavirus is likely to be greater than in case of the SARS outbreak nearly 20 years ago. This is because: 1) it already killed more people than SARS did; 2) China’s government has taken more drastic measures – for example, many Chinese factors have been shut – to contain the epidemic; 3) China’s economy is now about four times greater than two decades ago. Some analysts slashed their forecast for China’s growth in 2020 to as low as 5 percent. When the virus is contained and the factories reopen, there will be a rebound, but there is no doubt that we will see a serious slowdown in Chinese growth in the first quarter and in global growth in the next few months.

Powell Remains Optimistic

Federal Reserve chairman Jerome Powell testified before the Congress this week. He reiterated his confidence in the sustainability of the record-long US economic expansion, saying that “there’s no reason why the current situation of low unemployment, rising wages, high job creation – there’s no reason why it can’t go on”. Powell admitted that the outbreak of the new coronavirus will impact China and that there will “very likely be some effects on the United States.” But he argued that it was too early to determine what those effects would be and would they lead to a material reassessment of the outlook.

However, Powell opened the door to increase asset purchases aggressively if needed. He said that the Fed has, aside the interest rates, two tools to fight the recession: forward guidance and quantitative easing. And that “we will use those tools — I believe we will use them aggressively should the need arise to do so.” That would be music to the gold bulls’ ears!

Implications for Gold

What does it all mean for the gold market? Well, the coronavirus has not made gold rally. Investors probably are aware that the current uncertainty is temporary and once the coronavirus is contained, global growth will resume. What is important is that the central banks will remain very accommodative until there is some resolution on the coronavirus. The fresh liquidity will support the risky assets. It seems to be negative for safe-haven such as gold , but the yellow metal often moves in tandem with the stock market in times of monetary accommodation. The chart above clearly shows that although gold has not rallied like crazy due to the coronavirus, it has been resilient when the fears subsided a bit.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.

*******