Could Apple Buy A Third Of The World’s Gold?

Is there anything Apple can’t do?

Is there anything Apple can’t do?

First it revolutionized the personal computing business. Then, with the launch of the iPod in 2001, it forced the music industry to change its tune. Against initial market reservations, the company succeeded at making Star Trek-like tablets hip when it released the iPad in 2010. And in Q1 2015, a record 75 million units of its now-ubiquitous iPhone were sold around the globe. The smartphone’s operating system, iOS, currently controls a jaw-dropping 89-percent share of all systems worldwide, pushing the second-place OS, Google’s Android, down to 11 percent from 30 percent just a year ago.

As you might already know, the company that Steve Jobs built—which we own in our All American Equity Fund (GBTFX) and Holmes Macro Trends Fund (MEGAX)—is history’s largest by net capitalization. In its last quarterly report, Apple posted a record $75 billion in revenue and is now sitting pretty on a mind-boggling $180 billion in cash. Many analysts believe the company will reach a jaw-dropping $1 trillion in market cap.

So what’s Apple’s next trick?

How about moving the world’s gold market?

iGold

This April, Apple will be venturing into the latest wearable gadget market, the smartwatch, joining competitors such as Samsung, Garmin and Sony. All of the models in Apple’s stable of watches look sleek and beautifully designed—just what you’d expect from Apple—and will no doubt be capable of performing all sorts of high-tech functions such as receiving text messages, monitoring the wearer’s vitals and, of course, telling time.

This April, Apple will be venturing into the latest wearable gadget market, the smartwatch, joining competitors such as Samsung, Garmin and Sony. All of the models in Apple’s stable of watches look sleek and beautifully designed—just what you’d expect from Apple—and will no doubt be capable of performing all sorts of high-tech functions such as receiving text messages, monitoring the wearer’s vitals and, of course, telling time.

But the real story here is that the company’s high-end luxury model, referred to simply as the Apple Watch Edition, will come encased in 18-karat gold.

What should make this news even more exciting to gold investors is that the company expects to produce 1 million units of this particular model per month in the second quarter of 2015 alone, according to the Wall Street Journal.

That’s a lot of gold, if true. It also proves that the Love Trade is alive and well. Apple chose to use gold in its most expensive new model because the metal is revered for its beauty and rarity.

To produce such a great quantity of units, how much of the yellow metal might be needed?

For a ballpark estimate, I turn to Apple news forum TidBITS, which begins with the assumption that each Apple Watch Edition contains two troy ounces of gold. From there:

If Apple makes 1 million Apple Watch Edition units every month, that equals 24 million troy ounces of gold used per year, or roughly 746 metric tons [or tonnes].

That’s enough gold to make even a Bond villain blush, but just how much is it? About 2,500 metric tons of gold are mined per year. If Apple uses 746 metric tons every year, we’re talking about 30 percent of the world’s annual gold production.

To put things in perspective, the Sripuram Golden Temple in India, the world’s largest golden structure, is made from “only” 1.5 tons of the metal.

To put things in perspective, the Sripuram Golden Temple in India, the world’s largest golden structure, is made from “only” 1.5 tons of the metal.

TidBITS acknowledges that the amount of gold is speculative at this point. Two troy ounces does seem pretty hyperbolic. But even if each luxury watch contains only a quarter of that, it’s still an unfathomable—perhaps even unprecedented—amount of gold for a single company, even one so large as Apple, to consume.

Ralph Aldis, portfolio manager of our Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX), likens the idea of Apple buying a third of the world’s gold to China’s voracious consumption of the metal. As I mentioned last week, China is buying more gold right now than the total amount mined worldwide.

“If the estimates of how much gold each watch contains are close to reality, and if Apple’s able to sell as many units as it claims, it really ought to help gold prices move higher,” Ralph says.

But Can Expectations Be Met?

Here’s where this whole discussion could unravel. Although we don’t yet know what the Apple Watch Edition will retail at, it’s safe to predict that it will fall somewhere between $4,000 and $10,000, placing it in the same company as a low-end Rolex.

With that in mind, are Apple’s sales expectations too optimistic?

Possibly. But remember, this is Apple we’re talking about here. Over the years, it has sufficiently proven itself as a company that more-than-delivers on the “if you build it, they will come” philosophy. Steve Jobs aggressively cultivated a business environment that not only encourages but insists on “thinking different”—to use the company’s old slogan—risk-taking and developing must-have gadgets.

“Our whole role in life is to give you something you didn’t know you wanted,” says current Apple CEO Tim Cook. “And then once you get it, you can’t imagine your life without it.”

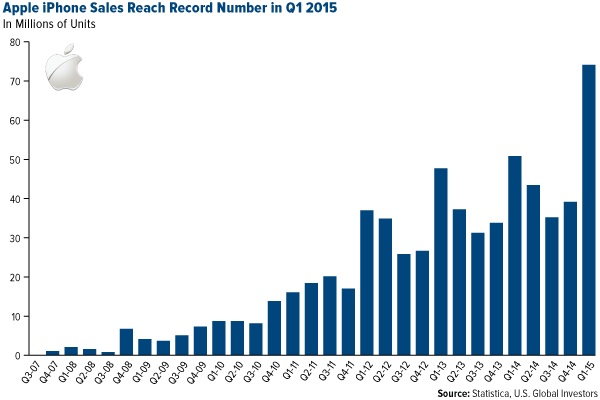

A perfect case study is the iPhone. When it launched in June 2007, the cell phone market was decidedly crowded. Consumers seemed content with the choices that were already available. Why did we need another phone?

Yet here we are more than eight years later, and as I pointed out earlier, 75 million iPhones were sold in the last quarter alone.

So it’s not entirely out of the realm of possibility for Apple to move 1 million $10,000 Apple Watch Editions per month.

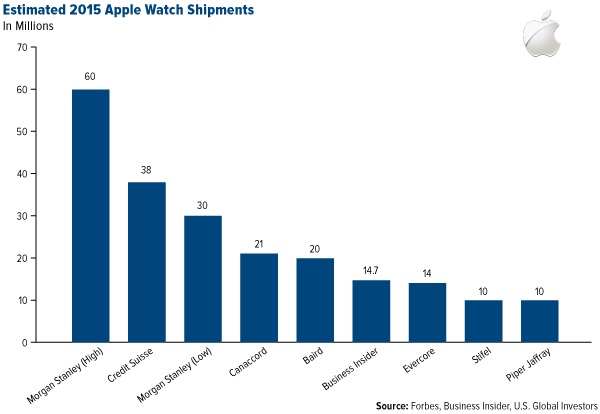

Early in January I shared the following chart, which shows various analysts’ Apple Watch shipment forecasts for 2015, ranging from 10 million to 60 million units. Of course, all models are included here, not just the luxury model.

Looking at it now, many of the predictions seem a little understated. After all, Apple hasn’t released a dud product in at least two decades (remember the Newton?). Come April, we’ll see for sure what the demand really is—for the Apple Watch as well as gold.

Global Metals & Mining Conference

The weekend before last, I attended the BMO Metals & Mining Conference in Hollywood, Florida, along with Ralph, Brian Hicks, a portfolio manager of our Global Resources Fund (PSPFX), and junior analyst Alex Blow.

“Generally speaking, companies have streamlined operations and are focused on shareholder returns,” Brian said.

Alex came away from the conference with renewed conviction that the global climate is conducive for gold, citing central bank easing policies and increasing volatility in world currencies, both of which support the yellow metal’s performance.

“It looks as though gold has technical support and that a bottom has been reached,” he said. “If the eurozone really picks up, gold demand should rise, which would also benefit China since its primary gold export destination is the eurozone.”

********

Mark Your iCalendar

I invite everyone to join us during our next webcast, to be held this Wednesday, March 4, at 4:30 PM ET/3:30 PM CT. The discussion will center on our Near-Term Tax Free Fund (NEARX), which has delivered 20 straight years of positive returns. We hope you can make it!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the All American Equity Fund, Holmes Macro Trends Fund, Gold and Precious Metals Fund, World Precious Minerals Fund, Global Resources Fund and Near-Term Tax Free Fund as a percentage of net assets as of 12/31/2014: Apple, Inc. (3.52% All American Equity Fund), (5.37% Holmes Macro Trends Fund); Google, Inc. 0.00%; Samsung Electronics Co. 0.00%; Garmin Ltd. 0.00%; Sony Corp. 0.00%.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of