Gold Beams Back To Long; Silver Screams So Strong!

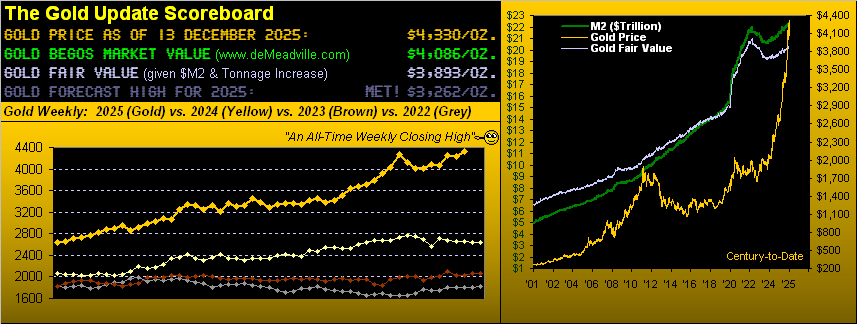

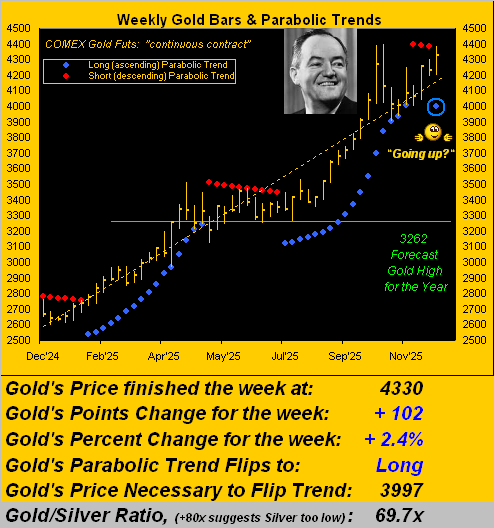

We are “pleased as punch” –[Hubert H. Humphrey, circa ’60s] to proclaim that Gold just completed yet another “failed” weekly parabolic Short trend of but three weeks, settling higher yesterday (Friday) at an All-Time Weekly Closing High of 4330. We’ll further expound upon that, but first:

Direct from our “‘Don’t Forget the Silver!’ Dept.” — the white metal soaring well-above 60 this past week (as posted Tuesday on “X” via @deMeadvillePro) — we present the following table, remindful of that herein stated ad nauseam throughout this year, (indeed across recent years prior):

Indeed, Sweet Sister Silver, few took notice of you until just recent weeks. And yet, what an incredible year you’ve had! Like Gold, your settle yesterday at 62.09 is an All-Time Weekly Closing High, which per the above table places you +112% year-to-date, let alone your having also en route achieved an All-Time Intraday High to 65.09, at which price you momentarily were +122% in 2025.

Moreover: as herein a week ago graphically portrayed would be inevitable, the Gold/Silver ratio fully reverted to its evolving mean (69.4x century-to-date), penetrating it to 66.7x during Thursday; (it settled the week at 69.7x).

And for the “johnny-come-lately” FinMedia came the usual “having just figured it out” hype. “Oh Silver is going to 100!” they say; “Oh Silver is gonna hit 200!!” they say; “Oh Silver will get to 300!!!” they say. (Yes, we’ve seen all three prognosticative “reports”).

But we “say” let’s instead do the math, ok? For what reasonably is Silver’s Fair Value today?

Again, ’tis a simple calculation as we’ve previously presented. Per the opening Gold Scoreboard, the Fair Value for the yellow metal is presently 3893. Divide that by the mean of the Gold/Silver ratio (69.4x) et voilà the Fair Value of the white metal is now 56.08. Thus currently priced at 62.09, we may “say” that Silver is +11% overvalued. Too, by her “textbook technicals” (our cocktail of Relative Strength, Stochastics and John Bollinger’s Bands), Silver is now 22 consecutive trading days “overbought”; (by comparison, Gold and Copper both are 11 days “overbought”) … all that just in case you’re scoring at home.

But: at least Silver finally has achieved an area of rational market valuation. “Brava Brava, Sista Silva!!”

As for good old precious Gold, on its way to making this fresh All-Time Weekly Closing High, the weekly parabolic Short trend again met a “short-lived” end. Since February 2024, there have been five such parabolic Short trends of 3, 3, 10, 10 & 3 weeks; but those Long have been 17, 16, 17, 16 & 17 weeks. Indeed, the similarity of the Long trends’ durations is striking:  “Uh oh, it’s magic”

“Uh oh, it’s magic” –[The Cars, ’84]. And now a new one has begun, (technically come Monday’s open),

–[The Cars, ’84]. And now a new one has begun, (technically come Monday’s open),

However, ’tis actually not magic; rather ’tis math that makes the next graphic’s newly-encircled blue dot appear. And today priced at 4330, Gold in 2025 is +64%, with the All-Time Intraday High from 20 October still in place at 4398. As for the just “failed” Short trend of only three red-dotted weeks, it opened on Monday 24 November at 4069 and was snuffed out yesterday at 4330. (Reminder: “Shorting Gold is a bad idea”). Rather, we’re “pleased as punch” indeed, HHH:

“But ‘HHH’ was more pro-fiat than precious metals, mmb…”

Hardly a Gold bug he was, Squire, and whilst in his second stint as Senator, did not criticize oppositional Nixon’s nixing of the Gold Standard (15 August ’71). However, post-mortem, HHH was presented a Congressional Gold Medal.

Meanwhile, as to the mortality of the Economic Barometer, one must consider the “s“-word: “stagflation“. For an “unintended inference” was right in the opening paragraph from last Wednesday’s Federal Open Market Committee’s Policy Statement:

- “Inflation has moved up since earlier in the year and remains somewhat elevated.”

-

So clearly pre-vote, the FOMC had reviewed our September Inflation Summary Table from last week’s missive in which nearly every datapoint was “above target”. However, the Committee instead gave deference to the slowing (and by ADP’s data “shrinking”) stance of the job market. Nine of the voters favoured the FedFunds -0.25% rate cut to the now 3.50%-3.75% target range; one even voted for -0.50%.

But a tip of the cap to both Kansas City FedPrez Jeffrey Schmid and Chicago FedPrez Austan “The Gools” Goolsbee by more intelligently voting for no change. For the reason to actually raise (stubborn inflation) + the reason to cut (accretive unemployment) ought = no change. ‘Course combined, they’ll lead to stagflation. ‘Tis a very tricky time for the Fed. And with all due respect to Chairman Powell, given his term ends come May, perhaps ’tis best to let the next Federal Reserve leader worry about it all.

So as we turn to the Econ Baro (with 43 “shutdown” metrics still missing), ’tis taken a bit of a dip:

Speaking of dips, how did that of yesterday in the S&P 500 work out for ya? The 60-minute period from 15:00-16:00 GMT sported the seventh-worst single hour drop by points (-62) since mid-year. One can feel the fragility of the S&P making itself more manifest with each notably negative news event. And as we oft update, the dividend yield for the all-to-risk S&P today (1.146%) is less than one-third that of the annualized three-month U.S. risk-free (in theory) Treasury Bill (3.525%). Further, the “live” price/earnings ratio of the S&P settled the week at 56.0x. Still, the good news is that as this Investing Age of Stoopid sallies forth, neither yield nor earnings have relevance, (nor does your portfolio theory education).

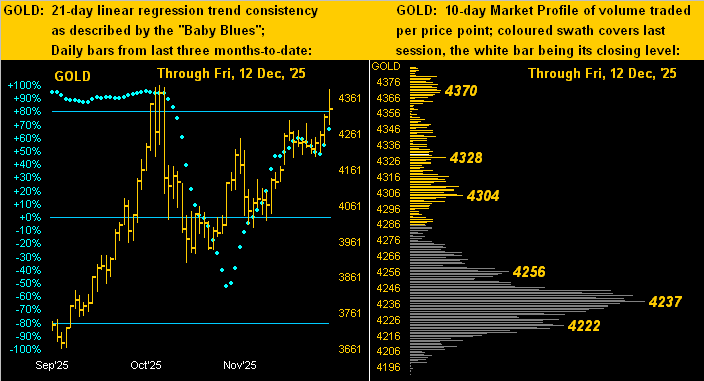

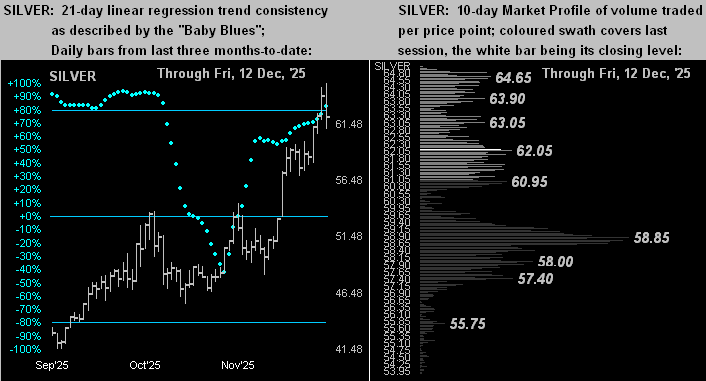

‘Course, just as Gold had relevance for the Egyptians ’round 3000 BC, so does it today. And as we go to the yellow metal’s two-panel graphic featuring the daily bars from three months-ago-date on the left and 10-day Market Profile on the right, ’tis quite the healthy picture. The baby blue dots of regression trend consistency after a wee stumble are renewing their upside push, whilst the Profile shows heavily-dominant volume support at the labeled 4237 apex:

Too for the white metal, her resemblance to Gold is sufficiently positive, with both the rising “Baby Blues” (below left), and Profile (below right) sporting support at 58.85:

Thus year-to-date for the precious metals ’tis been great, albeit arguably quite extended given both Gold and Silver presently +11% above Fair Value. In fact by rounding out the Metals Triumvirate, Copper also is having a fine year +33%, its sixth-best this century. That, too, has brought some bounce to Sister Silver from her industrial metal aspect, although we can also credit Copper as being money, certainly so from the Bronze Age (2000 BC).

Regardless, per our title, Gold has beamed back to Long with Silver screaming so strong! Which reminds us that upon blending in your Osterizer precious Gold with industrial Copper and pressing “puree”, you of course get Silver! (Metallurgists, please hold your email):

Either way, collect all three today!!!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

*******