Down, Down, and Down again. The Precious Metals Slide Re-starts

As the concern with geopolitics peaked, so did gold price. Silver and mining follow. Are you prepared for the likely outcome?

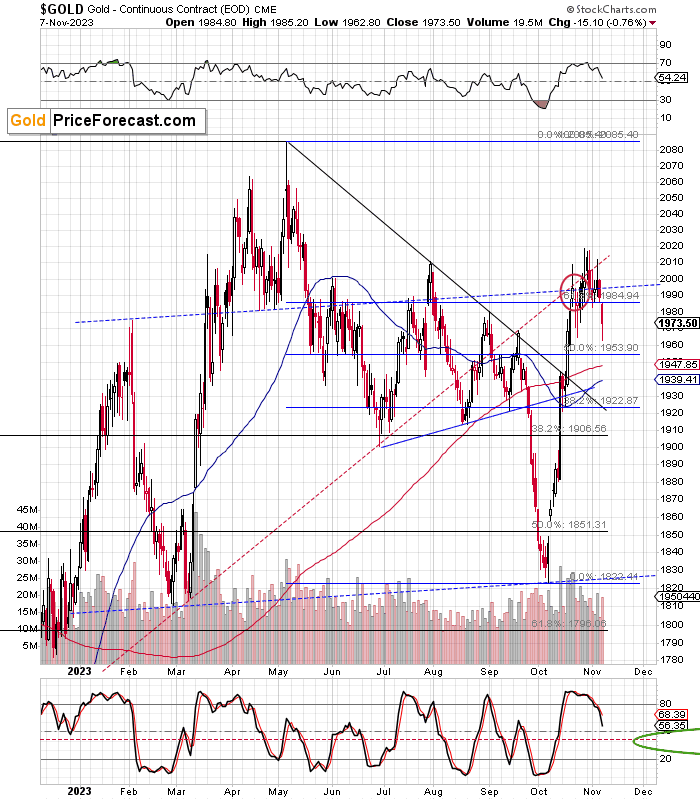

Gold Peaks and Slides

In my yesterday’s analysis, I wrote the following about gold:

Gold made a few attempts to move above the all-important $2,000 level and the rising resistance lines, and it failed all of them. The strong short-term momentum is gone, just as the fear of the unknown regarding the situation on the Middle East. To clarify – the situation remains unclear and critical, but the fear / concern already peaked (based on Google Trends data).

I previously wrote that gold was likely to peak up to two weeks after the concern peaked, and that period is over. Gold did indeed move slightly higher after the concern peaked – just like what we saw in 2022 after the analogous fear/concern regarding the Russian invasion also peaked. The history is very likely to rhyme, and this rhyme implies much lower gold prices in the following weeks. The fact the momentum is gone confirms the above.

The fact that the gold price moved lower during yesterday’s session simply confirmed that this is indeed what’s going on right now. The upward concern-based momentum is gone, and the price can now get back to its medium-term trend, which is down. Some gold analysts might argue that the trend in gold is not down but that it’s horizontal, and there’s some truth to it – while looking at gold price alone. However, adding silver and mining stocks to the mix and looking at the situation in the entire precious metals market reveals that the trend is actually down.

It’s the same kind of situation that we saw last year in early March after the Russian invasion started and the concern peaked. Gold then declined over $400 from its top in the following months.

Remember when gold soared due to Greenspan-induced extremely low interest rates? Now, it’s the opposite – rates are high (also real rates), and the gold price is likely to finally reflect that.

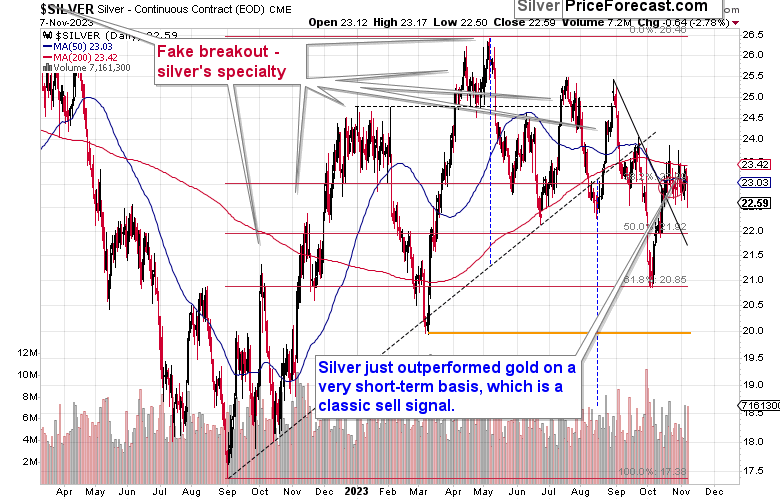

Silver price declined, too, confirming the direction of gold’s move. The same goes for mining stocks.

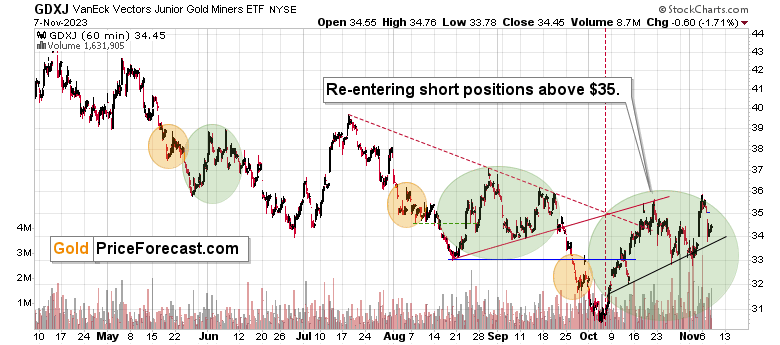

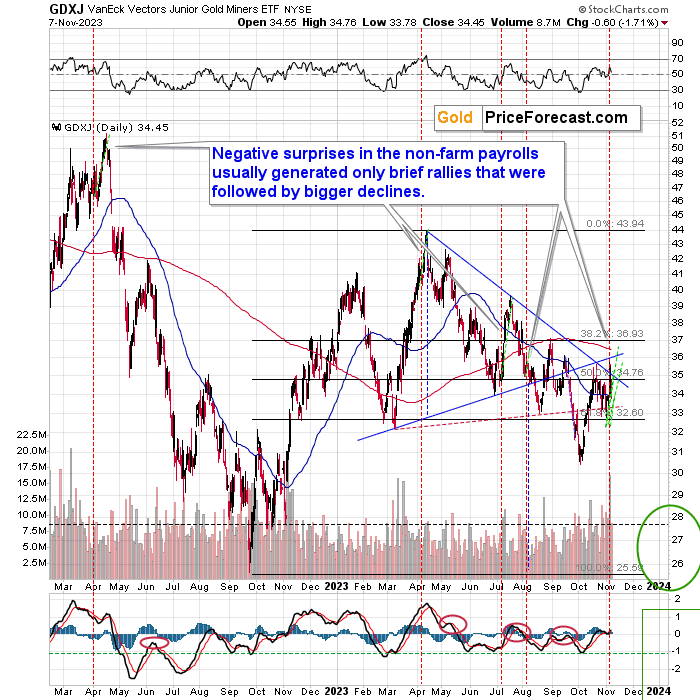

The above 1-hour GDXJ ETF chart shows just that the tiny breakout above the October highs was quickly invalidated, which on its own served as a sell signal.

This chart additionally shows how similar this double-top is to what we saw in the recent past – in early June and in mid-September. Re-tests of previous highs are not uncommon for junior miners, and the fact that we saw it once again is – simply put – normal. That’s not a bullish game-changer, it’s a regular topping pattern.

Whether it’s triggered by “real traders” or algorithmic trading tools doesn’t really matter – the latter increased the importance of the very short-term price moves in recent years, but overall, the patterns remain intact – double tops are often followed by bigger declines, regardless of what caused them to form.

Miners Show Signs of Decline

Interestingly, junior miners declined yesterday even though the general stock market moved higher.

This is important because on Friday, miners soared along with stocks. They no longer want to follow stocks’ lead, which means that whether stocks are topping here or not doesn’t matter that much. Miners are likely to decline, anyway.

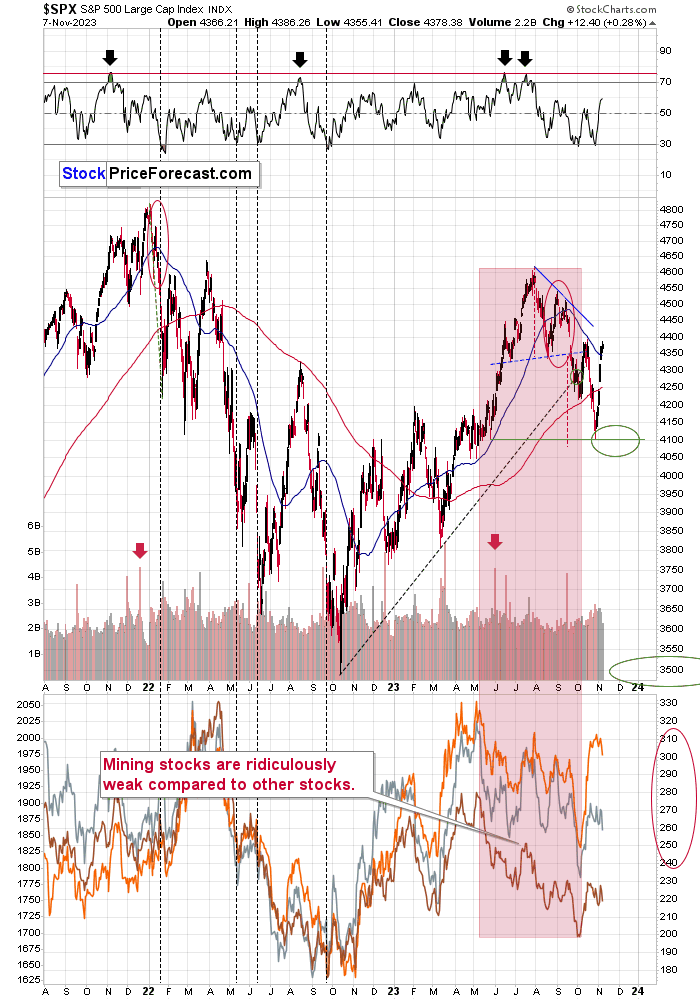

And… Are stocks topping here? That’s quite possible, as they already corrected visibly after reaching my previous downside target, and RSI moved visibly above 50, which was when those corrective upswings oftentimes ended in the past.

Besides, it was not only junior miners that declined despite stocks’ strength.

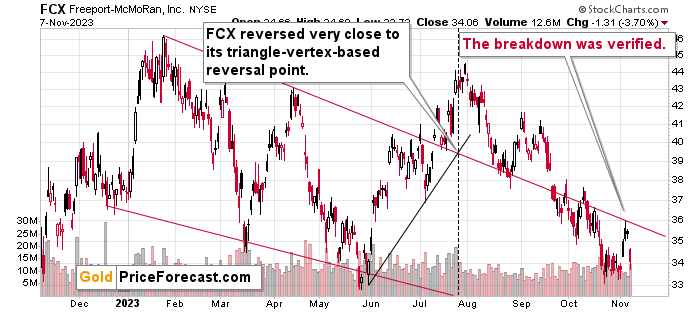

FCX, one of the biggest gold and copper producers, also declined heavily after (once again) verifying the breakdown below the declining resistance line.

This is a bearish signal for the stock market as declines in commodities and commodity stocks herald weaker demand in the future. The profits on our short positions in FCX and GDXJ increased yesterday, and they are likely to increase further.

Consequently, mining stocks are likely to slide due to both declining gold values and declining stock prices.

On a final note, please keep in mind that Friday’s rally was triggered by below-expected nonfarm payroll statistics.

I marked the previous analogous surprises with vertical orange lines and I marked the follow-up rallies with green. Copying them to the current situation revealed that what was likely to happen based on this surprise has probably already happened, and the medium-term downtrend can now resume. In fact, it appears to have already resumed.

********

Przemyslaw Radomski,

Przemyslaw Radomski,