The Dutch National Bank Is Bullish On Gold

Strengths

- The best performing metal this week was palladium, up 3.26 percent as its one-week lease rate reached the highest since January, indicating physical supplies are tight. Gold traders and analysts in the weekly Bloomberg survey were mostly neutral on the metal’s price outlook as the market awaits the upcoming Fed meeting. Gold did advance on Wednesday after an unexpected drop in U.S. retail sales. The metal also got a boost from increased trade war tensions. China threatened “strong countermeasures” if the U.S. enacts legislation supporting Hong Kong protesters.

- U.S. retail sales declined for the first time in seven months, suggesting that consumers are starting to become shaky, reports Bloomberg. The value of overall sales fell 0.3 percent last month, below estimates for a 0.3 percent advance. Slowing retail sales fueled economic worries, which can boost gold’s appeal as an asset class.

- The Dutch National Bank (DNB) released bullish statements on gold this week. “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again. Gold bolsters confidence in the stability of the central bank’s balance sheet and creates a sense of security,” said the DNB on its website. The Netherlands is the world’s tenth largest holder of gold with approximately 612.5 tonnes in its reserves.

Weaknesses

- The worst performing metal this week was platinum, down 0.66 percent as hedge fund managers cut net bullish positions to a seven-week low. Turkey’s gold reserves fell $181 million from the previous week, according to central bank data. The central bank’s holdings are now worth $25.8 billion, and are still up 44 percent year-over-year.

- China’s slowing growth is now spilling into gold jewelry demand. According to forecasts from Metals Focus, jewelry consumption is set to drop 4 percent in 2019. Investment demand is also forecast for a 20 percent decline. Higher metal prices are also hurting jewelers. Chow Tai Fook Jewellery fell as much as 4.6 percent after it announced it will record an unrealized loss of up to HK$1 billion.

- Jewelry demand has been muted in India too due to higher prices, but higher prices are good for investment demand, which had slowed in recent years. Investments in gold exchange-traded products (ETPs) in India has recovered this year, in part due to rising comfortability in making online purchases. Metals Focus said in its monthly note that recovery is expected to continue, but the size of fresh investment inflows may be limited by the attractiveness of equities. President Maduro of troubled, but gold-rich Venezuela said this week that he has decided “to approve a full functioning gold mine for each governor’s office.”

Opportunities

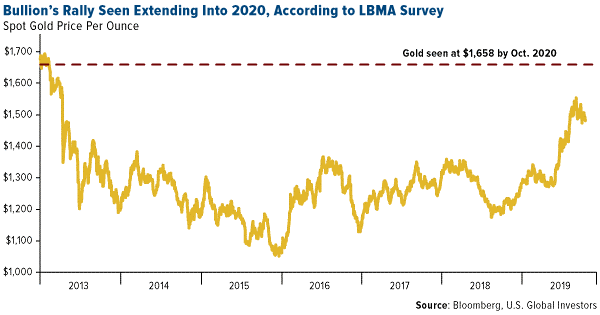

- According to delegates at the London Bullion Market Association (LBMA) annual conference, gold will rise to $1,658 an ounce by October 2020. Last years’ attendees “pretty much nailed” the metal’s rally in 2019, reports Bloomberg. The group also forecasts silver at $23 an ounce next year, rising 11 percent from today’s $17.60 level. Lastly, the attendees predict palladium will reach $1,924 an ounce by this time next year. Palladium is closing in on $1,800 an ounce as a supply deficit persists, according to Australia & New Zealand Banking Group.

- Suki Cooper, precious metals analyst at Standard Chartered Bank, says that the next push in gold prices will come from retail demand. In an interview with Bloomberg, Cooper said that “retail investors almost want confirmation of further rate cuts, some weakness in the equity markets before they move into good. The next leg higher in 2020 is going to be led by the retail side.” Speaking of more rate cuts, the Fed looks almost certain to cut rates for a third time later this month.

- Sprott CEO Peter Grosskopf is bargain hunting for stakes of mining firms that have taken a tumble, reports Bloomberg. Grosskopf said that if big producers don’t buy up their smaller rivals, then “the juniors will consolidate among themselves to create bigger companies.” Iamgold Corp is also bullish that more deals could emerge. “With so many companies chasing so few deposits, there’s certainly an opportunity for further consolidation in the industry,” says Iamgold chief financial officer Carol Banducci.

Threats

- Ray Dalio said that “big unique things are happening” in the global economy and that it’s “in a great sag.” The billionaire investor said impetus from measures such as rate cuts and tax cuts is fading and that a lot of long-term debt maturities are coming such as pensions and health care that are a burden. Dalio says one of the reasons for slower growth is a large wealth gap, which is a disparity that also leads to an education gap.

- In another credit warning, S&P Global Ratings says that the number of weakest links grew to 263 in September from 243 in August and are near a ten-year high. Weakest links are issuers rated B- or lower by S&P Global Ratings with negative outlooks. Twenty percent of the weakest credits are in the consumer products sector which has seen 52 downgrades this year versus only 5 credit upgrades.

Bloomberg’s Lisa Lee reports that leveraged loan investors are “getting increasingly angsty, and their fear may be a harbinger of more pain coming in credit markets.” Leveraged loans are performing worse than junk bonds, which is surprising since they have been considered a lower-risk way to invest in junk-rated companies. Lee adds that “the loans have grown into a $1.2 trillion market” and that “safeguards and protections for investors have weakened.” While most economists rightly argue you can’t have a recession without a credit blow up, the green brown shoots are beginning to show their color.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of