Five Reasons to Consider Investing During This Summer Travel Season

The busy summer travel season is here yet again, and according to forecasts, this year could set a number of new records for airlines and highways. Thanks to a steadily improving economy, rising gross domestic product (GDP), strong consumer confidence and affordable airfare and fuel costs, more people than ever before are expected to fly on U.S. airlines and drive on the nation’s highways this summer.

Below are five reasons why this summer travel season could be a favorable one for investors.

1.Millions Leaving on a Jet Plane

Airlines for America (A4A), the main airline industry trade group, projects a record 234.1 million people flying worldwide on U.S. carriers between June 1 and August 31. That figure’s up a healthy 4 percent from last summer.

To accommodate the 2.54 million expected daily passengers—100,000 more than normal—airlines will need to add an extra 123,000 seats a day.

2.Consumer Confidence and Satisfaction Up

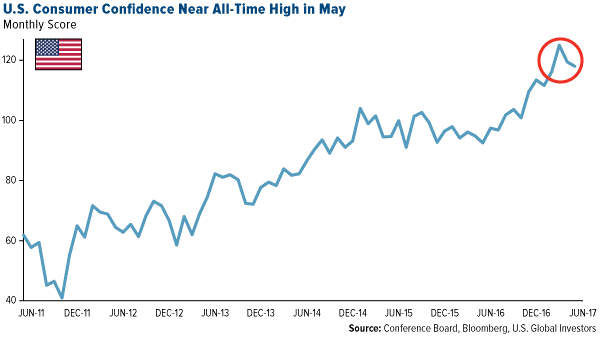

The surge in air travel demand is a reflection of an improving domestic economy. Consumers are happy to spend their money right now, with the Consumer Confidence Index posting a 117.9 in May. Even though this is a couple of points below the April reading, optimism still stands at a historically high level.

It doesn’t hurt that airfare is relatively affordable at the moment. According to big data firm Hopper, airfare to Europe should be a huge bargain this summer, down an expected 18 percent from last year on average.

Glowing customer satisfaction is another contributing factor to increased demand. The just-released J.D. Power 2017 North America Airline Satisfaction Study shows that passengers are more satisfied with their service than at any other time in the study’s 10-year history. Despite the regretful United Airlines incident in April, when a man was dragged from a Chicago flight bound for Louisville, overall satisfactory rose for a fifth consecutive year, reaching its highest level ever. For the 10th straight year, Alaska Airlines was ranked first among traditional carriers. Delta Air Lines, which we own in our All American Equity Fund (GBTFX), came in a close second.

3.Rockin’ Down the Highway

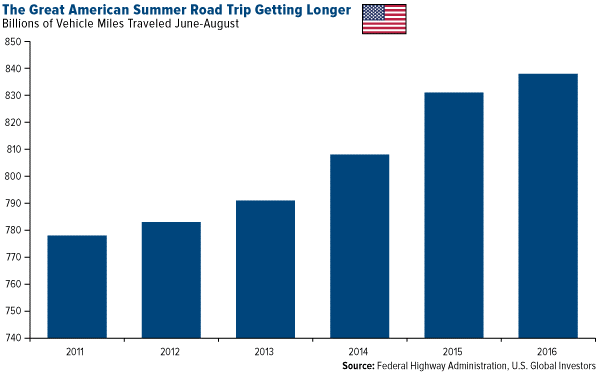

Airline passengers won’t be the only ones enjoying an improved economy and low fuel costs this summer. More motorists than ever before are expected to make use of U.S. roads and highways, with 56 percent of Americans saying they plan on traveling more than 500 miles round trip, a 10 percent increase over last summer, according to GasBuddy.

Also pushing up travel expectations is what GasBuddy calls “a feat never before seen.” For the first time in recent memory, the price of gasoline at the beginning of the summer is nearly the same as it was at the beginning of the year. We normally see gas rise about 50 cents during the first five months of the year, but in 2017 it’s risen only 1.5 cents ($2.28 per gallon in January versus $2.30 in May). This should help encourage more Americans to splurge on a longer summer road trip.

4.Appetite for Production

As a result, we expect to see another new high in gasoline consumption. During the summer months of 2016, gas consumption in the U.S. reached an average of 9.62 million barrels a day, surpassing the previous record of 9.57 million barrels a day set in the summer of 2007. With even more motorists taking longer road trips this year compared to last summer, we could see the amount edge closer to 10 million barrels a day.

This bodes well for oil and gas companies such as Phillips 66, Exxon Mobil and Valero, all held in our All American Equity Fund (GBTFX).

5.Vacation Had to Get Away

These airline and highway projections become even more likely to happen when we factor in that Americans are reportedly using more of their vacation time. According to Project: Time Off, an advocacy research initiative run by the U.S. Travel Association, American workers took an average 16.8 days off in 2016, up slightly from 16.2 days the previous year. Though the difference seems marginal, the additional 0.6 days added an extra $37 billion to the U.S. economy in 2016, creating an estimated 278,000 jobs.

So whether you plan on traveling by road or air this summer, you can probably expect to be accompanied by more people than in years past. This might lead to congestion and packed airports, but ultimately it’s a good opportunity for investors.

Seeking investment opportunities in domestic travel and consumer spending? Explore the All American Equity Fund (GBTFX) today!

********

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the All American Equity Fund (GBTFX) as a percentage of net assets as of 3/31/2017: United Continental Holdings Inc. 0.00%, Delta Air Lines Inc. 1.40%, Phillips 66 1.75%, Exxon Mobil Corp. 2.17%, Valero Energy Corp. 2.23%.

Administered by the Conference Board, the Consumer Confidence Index (CCI) measures how optimistic or pessimistic consumers are with respect to the economy in the near future. The idea behind the Index is that if consumers are optimistic, they tend to purchase more goods and services.

The J.D. Power 2017 North America Airline Satisfaction Study measures passenger satisfaction among both business and leisure travelers, and is based on responses from 11,015 passengers who flew on a major North American airline between March 2016 and March 2017. The study was fielded between April 2016 and March 2017.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of