Gold Achieves Fair Value

If for some inexcusably unconscionable reason you missed Tuesday’s Prescient Commentary and/or our entry on “X” (@deMeadvillePro ), we herein repeat same for you stragglers: “Gold at 00:05 GMT this morning reached its Dollar debasement value of 3865”.

Indeed en route to settling out the week yesterday (Friday) at 3912, Gold traded to yet another All-Time High at 3923 on Thursday. As for Sweet Sister Silver, she traded up to her own 14-year high at 48.33 toward closing the week at 47.97, +63.8% net year-to-date and well-outpacing Gold’s nonetheless splendid net gain of +48.2% thus far in 2025.

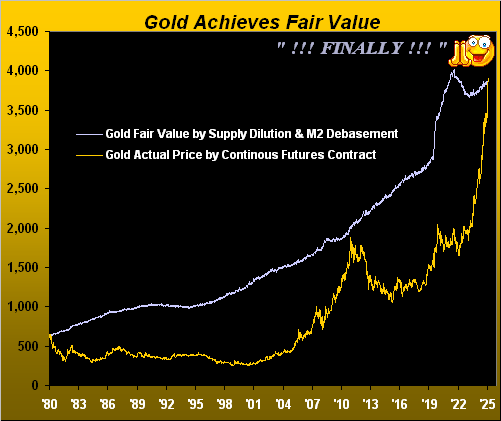

But the Big Gold Story is — for the first time arithmetically since the week ending on Halloween, 31 October 1980 (price then 642) — Gold has now eclipsed our quintessential valuation of 3867. ‘Tis thus “fair” to say Gold has finally achieved its Fair Value.

“Which is slightly different than the above Scoreboard’s right-hand graphic, correct mmb?”

Spot-on as ever you are, dear Squire. The Gold Scoreboard — the long-standing opening hallmark of The Gold Update — depicts that graphic on a dual scale: one for the StateSide Money Supply (“M2” basis) and one for the price of Gold. The key point therein is to directionally correlate Gold in concert with M2. However, let’s now look at Gold relative to its actual Fair Value.

“The difference being, mmb?”

Squire already well knows the difference, but he loves to infuse the occasional dramatic pause. Price itself (which we measure vis-à-vis its “continuous futures contract” as ’tis far and away the most liquid medium for trading Gold) is simply that: the price of Gold (plus an essentially immaterial amount of eroding premium, currently +0.7% basis December’s expiry).

The Fair Value of Gold however, is a different, more salient and leading measure as to where price “ought be”. The calculation from the M2 starting point as just noted (31 October ’80, thank you Federal Reserve Bank of St. Louis), is then routinely revised to account for the increase in M2 (basically the de facto liquid measure of the world’s reserve currency) as further adjusted for the increase in the supply of Gold itself. For the more there is of something, the less ’tis worth. And Gold tonnage since back in 1980 has increased by some 2.3x effectively detracting from value.

Regardless of the increasing supply of the yellow metal, M2 today is +1,293% of what ’twas back in 1980 and thus is the primary debasing driver of Gold. So putting it all together, we same-scale chart both Gold and its Fair Value — et voilà — we’re finally there! ‘Tis a crossing sight to behold:

‘Course as shown in the graphic, the last time Gold nearly achieved Fair Value was back in September of 2011, price then embarking on a worse than -47% slide into December 2015. (You long-time readers may recall our writing of Gold as having “gotten ahead of itself”). And no, this time ’round we don’t perceive a repeat of such decline.

In fact, present Gold hype abounds! (One wonders where “they” have been for so many of these past years). Moreover, it suddenly seems that everyone’s become a Gold expert. “Oh, it’s the debt!” they say. “Oh, it’s Trump!” they say. “Oh, it’s global conflict!” they say. Far be it from us to stand in the way of what “they” say. But at the end of the day, ’tis currency erosion by which Gold makes hay.

Further, Gold being a very liquid market — which as do all liquid markets — trends upward, downward and sideways. Too, from the “It Takes Two to Tango Dept.”, every form of Gold bought is sold to that buyer by the seller at the agreed-upon price. And price can become quite excessively extended to the upside as is Gold’s current case, irrespective of what “they” say. For example, by deMeadville’s “textbook technicals” (a cocktail of John Bollinger’s Bands, Relative Strength and Stochastics), Gold is now 25 consecutive trading days “overbought.”

“Well, mmb, that probably won’t be on CNBS…”

Squire, likely neither on Bloomy nor FoxyB. Certainly our next proprietary graphic is not FinMedia made for all to see:

From the website, the smooth line in the above upper panel is our near-term valuation for Gold (3621) based on price’s movement relative to those that comprise the primary BEGOS Markets (Bond / Euro / Gold / Oil / S&P 500). And as we always remind, price inevitably reverts to its smooth valuation line, even as it too rises and falls. The present difference per the lower panel oscillator shows price as +291 points “high” above valuation.

As well, you may have sensed the edginess on Gold’s sellside. This past Tuesday within a four-hour period, Gold fell -79 points, only to regain it all and then some; but again on Thursday within three hours came a drop of -81 points. The hysteria may be (as it continues to be for the S&P) that Gold is poised to go (using technical terminology) “rip-snort, el gonzo, upside nutz”. Not that it shan’t, but there’s a lot of attractive Gold trading profit for the taking these days. As certainly so there is for the S&P 500 as we go to the Economic Barometer:

The Baro was due to take in 13 metrics this past week … but just six (privately-generated) made the trip whilst the publicly-generated balance of seven offered zip. Of those six reports, August’s Pending Home Sales and September’s Institute for Supply Management Index improved period-over-period; but worse were ADP’s negative Employment data, the ISM Services Index, the Chicago Purchasing Manager’s Index and the Conference Board’s Consumer Confidence, all for September.

So: are you confident? As has been bandied about Wall Street over the years, when the government is out of the way, the markets positively play. Thus far for the three trading days of “no-budget” October, the S&P has risen by as much as +0.9%, indeed closing for the first time above 6700 on Wednesday, and again so on both Thursday and Friday. Cue  “Do the Wall Street shuffle…”

“Do the Wall Street shuffle…” –[10cc, ’74].

–[10cc, ’74].

‘Course, not so much shuffling upward as streaking higher has been Gold. Here next we’ve the yellow metal’s two-panel graphic of daily bars from three months ago-to-date on the left and 10-day Market Profile on the right. Achieving Fair Value is a beautiful thAng:

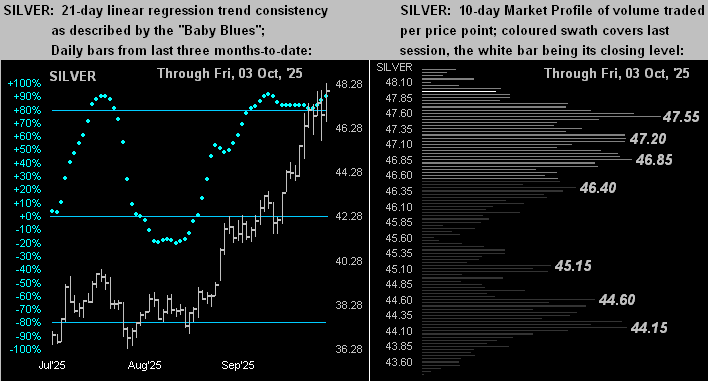

The white metal’s like graphic says it all: Silver these past three months (below left) has been comprehensively adorned in her precious metal pinstripes (as opposed to her industrial metal jacket). But by her Profile (below right), the 46.40-45.15 swath is quite light on volume, such that should Gold begin to correct as we expect, Silver swiftly would fall back through that zone with an eye to then trying to hold 44.15 as labeled:

To close, we were reminded this past week of a conservation away back in the days of AvidTrader, wherein by completely mindless (let alone official) observations, ’twas determined that the mighty Goldman Sachs was correct on its various outlooks a double-digit percentage of the time … that being 50%.

Now more than two decades later, we similarly query: “Is Goldman Sachs capable of making up its mind?” To wit, this courtesy of “The Right Hand Doesn’t Know What the Left Hand Is Doing Dept.”

- Hat-tip Bloomy from this past Monday: “Goldman Strategists Turn Bullish on Stocks as Recession Risk Low”

- Hat-tip CNBC(S) from Friday: “Goldman Boss David Solomon warns investors of a stock market drawdown”

Some things never change. Yet we think ’tis The Boss who’s wiser. Especially given the S&P 500’s price/earnings ratio having just settled the week at an inane 48.6x. “Have we crashed yet?”

Either way, don’t forget who truly is the boss: Gold!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********