Gold And Commodity Cycles

We have so far analyzed the current situation in the oil market, suggesting that falling oil prices can indicate another recession in the not so distant future. So the obvious question arises: would it be positive or negative for the gold market? The answer depends on whether gold is pro-cyclical or not. Some economists believe that gold, as oil, rises in a boom and falls during the bust. We consider that opinion too simplified. However, there are indeed strong arguments that commodity prices are strongly affected by the monetary policy responsible for the business cycle. Let’s analyze some data.

We have so far analyzed the current situation in the oil market, suggesting that falling oil prices can indicate another recession in the not so distant future. So the obvious question arises: would it be positive or negative for the gold market? The answer depends on whether gold is pro-cyclical or not. Some economists believe that gold, as oil, rises in a boom and falls during the bust. We consider that opinion too simplified. However, there are indeed strong arguments that commodity prices are strongly affected by the monetary policy responsible for the business cycle. Let’s analyze some data.

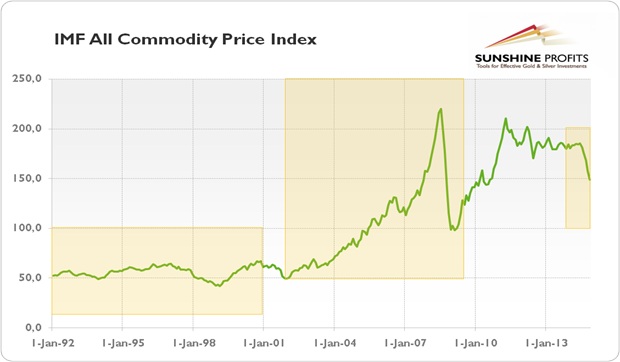

Usually commodity prices were booming during inflationary times: in the first years of 1920s, 1970s and 2000s. On the other hand, commodity prices were not performing well after the contraction of the money supply 1929-1933 and in the 1980s and 1990s due to the significant tightening of monetary policy implemented by Volcker (see chart 2). Commodity prices also fell significantly after Lehman’s collapse in 2008. Similarly, it seems that the recent drop in commodities prices means a popping of another inflationary bubble because of real or (just) perceived Fed’s monetary tightening. Although the U.S. interest rates did not really rise in 2014, investors are thinking ahead and shifting out of commodities today in anticipation of future higher interest rates in the next year.

IMF All Commodity Price Index from 1992 to 2014

Why do we think that the bull market in commodities is over? Undoubtedly variability of commodity prices is not an unusual thing; however a recent supercycle was rather unique in terms of length and scope. Usually high prices do not last too long, because they encourage larger production. High prices are the only cure for high prices, the adage says. And usually the prices of commodities do not surge together. Why would we have supply shortages across the full range of commodities?

According to the popular theories, the rapid development of emerging markets, mainly China and India, was the real cause behind the commodities boom. Surely, this economic growth should not be neglected. However many analysts consider easy-money policy as a much more important factor explaining rising commodities prices. For example, according to this paper, growth of commodities was caused mainly by excess liquidity and not by demand from emerging economies.

So, how did it all start? The commodity boom began in late 2001, just as the Fed cut interest rates to counteract the recession after the bursting of the high-tech bubble. Lower interest rates encouraged banks to expand their lending. In turn, cheap funds induced entrepreneurs to extend their operations and investments, which stimulated demand for raw materials. Moreover, new and easy money entered commodities as the new “hot” investment destination for money managers. They were in a bear market since the early 1980s, but the growing demand from emerging markets called investors’ attention to this asset class.

Investors should also note that commodities were negatively correlated with the falling stock market at that time and low interest rates decreased the opportunity cost of investing in commodities. Professor Frenkel points out that the Federal Reserve cut real interest rates sharply in 2001-2004, and again in 2008-2011, which lowered the cost of holding inventories thereby contributing to an increase in demand. According to him, low real interest rates also increase the price of storable commodities by increasing the incentive for extraction tomorrow rather than today.

It is still not the full story. In that time the government deregulated pension funds, which started to diversify their portfolios by investing in commodities. Also, first commodity ETFs facilitated investments in that asset class. Professor Randal Wray calls this process the financialization of the commodities market and considers it as the main reason behind the commodity super cycle. Similarly, according to Yanagisawa, the speculative money inflows were one of the main factors explaining the rapid rise in oil prices. Now, if you add bubbles in emerging markets (alongside the real growth), the falling of the U.S. dollar and rising expectations of inflation stimulated by QE programs (in the second phase of the commodities bubble), you get a full picture of why and how a commodity boom was created.

We have talked so far about commodities in general. But what about gold? Does this all apply also to the yellow metal? For sure, gold in many ways behaves like all other commodities. The inverse relationship with U.S. dollar is the most important feature in common with other commodities. However, gold is not only the commodity; it also behaves like a currency. This is why the gold is so unique. Among the commodities considered in the above-mentioned analysis, only gold was not affected very significantly by the severe liquidity squeeze in 2007 and 2008, “implying that gold acted as a safe haven during the period of international financial dysfunction”. Therefore, although commodities in general are to a large extent pro-cyclical, gold breaks out of this simple scheme.

********

Courtesy of Sunshine Profits‘ Market Overview Editor