Gold And The Political Theater: Is The Tail Wagging The Dog?

As the old saying goes, politics is a show business for ugly people. Fair enough, but what does it have to do with gold? Let’s jump right in and find out!

There Is No Trade War

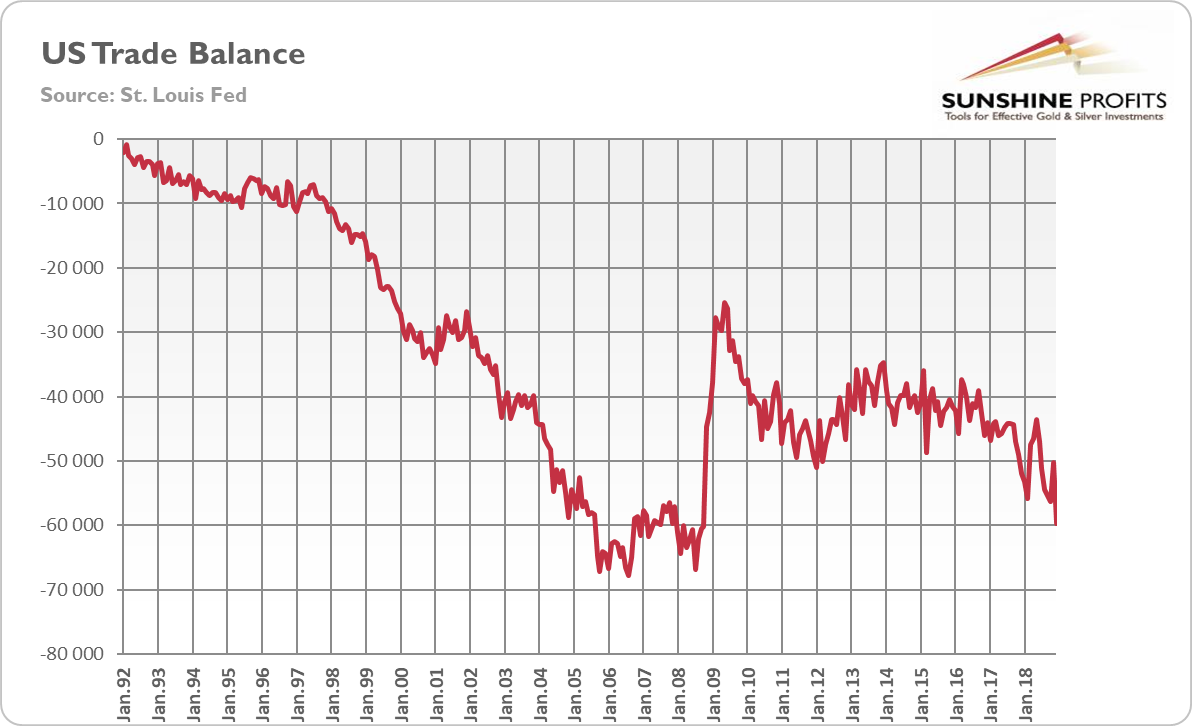

Economic reports are rarely fun. But when we read the latest US trade report, we could not help but laugh. It turns out that the US goods and services deficit was $59.8 billion in December, up $9.5 billion, or almost 19 percent, from $50.3 billion in November. For 2018, the goods and services deficit was $621.0 billion, an increase of $68.8 billion or 12.5 percent, from 2017. In other words, despite Trump’s “America First” policies and trade wars, including tariffs aimed at shrinking the trade deficit, the US trade gap has widened. Actually, it surged to a 10-year high last year, as one can see in the chart below. As if that was not enough, the shortfall with China hit a record peak! Isn’t that funny?

Chart 1: US Trade Balance from January 1992 to December 2018

Well, it’s a laugh through tears. We have two options here. The first is that Trump’s administration is economically illiterate. As students of economics learn, a trade deficit simply reflects that a country chooses to consume more than it produces. So, it must import the difference from the rest of the world. A trade deal will not help here. If the Chinese buy more US goods, the bilateral trade with China will shrink. But the US total trade deficit will not decline unless Americans reduce total demand by saving more.

Let’s reiterate to make it crystal clear. The real reason why the US has massive trade deficit is not the foreign import barriers, but the fact that Americans are spending more than they produce. They can do that because foreigners lend them money to finance their net purchases, and because the US dollar is an international reserve currency eagerly accepted by and sought after other countries both to finance their international trade needs and to maintain their reserve positions in. So, please note another funny thing: the US households benefit as a whole from trade deficits. After all, they can consume more than they produce. They get real stuff in exchange for their greenbacks. Despite blaming China, its government actually subsidizes American consumers.

But there is also the second option, more probable. There is no trade war at all. Yes, you heard it well. It’s just a smokescreen, or a political theater. The whole US-China dispute is not about trade deficits, but about the dominance in supply chains. Uncle Sam does not care about its trade imbalance (after all, the tax cuts boosted consumer spending, while the increased federl deficit exacerbates the deficit of savings) – the aim of tariffs was rather to induce China to end stealing US technology. So, gold investors should not focus on trade deficits and the whole buzz around them – it’s just a show for the public.

Interest Rates Are Not at ‘Neutral’

The US monetary policy is another great spectacle. Yesterday, John Williams, the New York Fed President, said that the Feeral Funds Rate is neither accommodative nor contractionary, so there is no hurry in hiking interest rates. In a speech at the Economic Club of New York, he said:

My current estimate for r-star is 0.5 percent, so when you adjust for inflation that’s near 2 percent, the current federal funds rate of 2.4 percent puts us right at neutral.

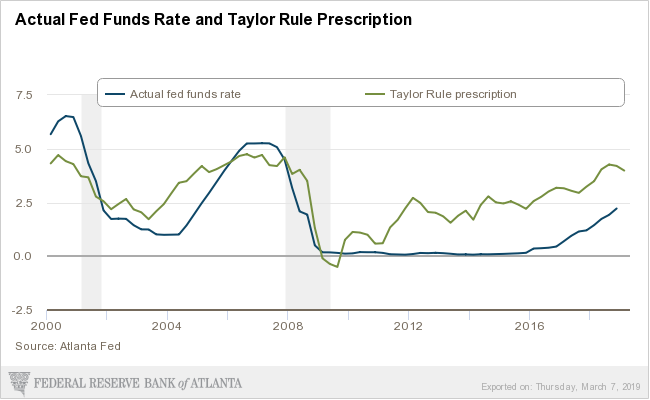

Well, we do not know how Mr. Williams calculates the neutral rate, but he definitely does not use the Atlanta Fed’s estimations of a Taylor Rule. As you can see in the chart below, the prescription is much higher, indicating that the federal funds rate should be around 4 percent to be neutral.

Chart 2: Actual federal funds rate (blue line) and Taylor Rule’s prescription (green line) from 2000 to 2019

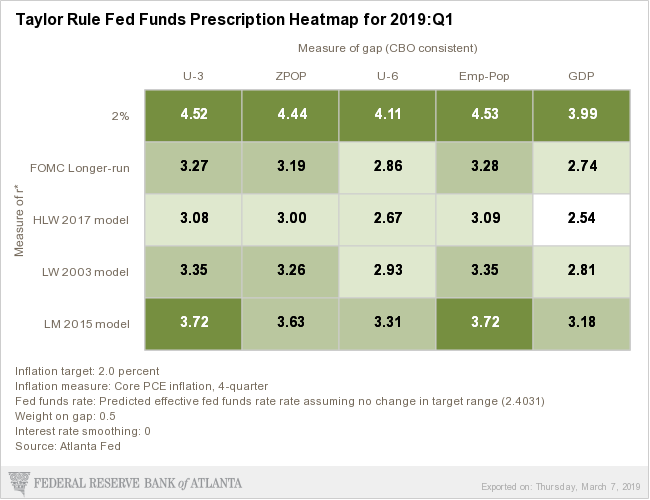

We are of course aware that there are many Taylor Rule prescriptions, but virtually all of them suggest that the Fed’s monetary policy is still accommodative, as one can see in the table below. Despite different inputs used in calculations, all methods indicate that the federal funds rate should be higher.

Table 1: Atlanta’s Fed Heatmap for Taylor rule for Q1 2019

So, does Williams not know Taylor’s rule? Is he economically illiterate? We doubt it. What he is saying is just a theater. The Fed does not want to raise interest rates further because of the $5.7 trillion corporate borrowing binge. This is what Robert Kaplan, Dallas Fed President, admitted on Tuesday:

It’s something that I’m aware of, which sort of reinforces for me why I feel we should be taking no action for some period of time.

The US central bank is simply afraid of bursting the bubbles it previously created maintaining the interest rates too low for too long. The cautious stance is worse for gold than aggressive hiking, as it postpones the day of reckoning. On the other hand, more dovish Fed and lower interest rates are supportive for the yellow metal as an alternative for the yield-bearing assets.

Implications for Gold

The implication for gold is clear. Politics is a theater, or show business for ugly people, as the old saying goes. Hence, do not take what policymakers say at face value. Look at data. Our gold analyses are always data-based.

And one more thing. People love spectacles, so the political factors may often dominate the markets. But all shows eventually end. When the curtain falls, the fundamental factors of the precious metalsmarket should come to the fore. Don’t focus on the buzz, but look deeper. Then, your gold investments will shine.

And remember: today the ECB holds its regular monetary policy meeting. It is expected to loosen its stance, so we could some volatility in the gold market. We will cover its monetary policy decisions next week. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

* * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.