Gold And Rocketing Chinese Growth

Chinese economic growth is probably the main driver of both physical gold demand and the global bull market in stocks.

I’m invested in China through ETFs, bank stocks, and… gold!

With the possible exception of HSBC, most analysts in the West appear to be underestimating the resilience of a billion Chinese citizens working maniacally in the private sector.

I’ll go even further than HSBC and predict that Chinese GDP growth could re-touch the 7% area if a trade deal is announced.

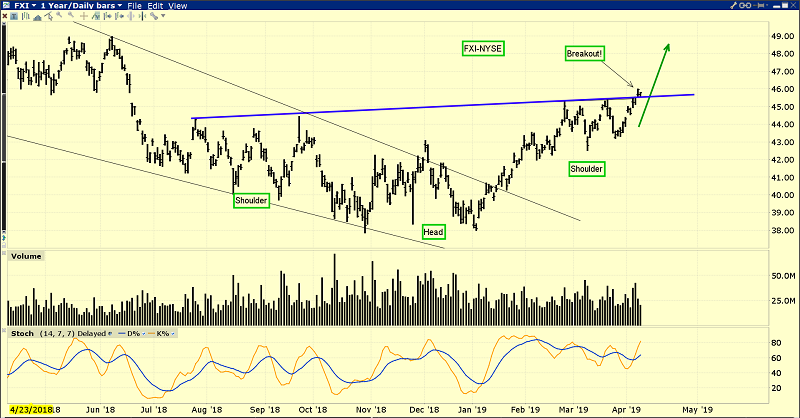

The FXI-NYSE Chinese stock market ETF is breaking out of a powerful inverse H&S bottom pattern. The technical action fits with the growing GDP fundamentals, and key Chinese gold jewellery stocks are racing to fresh highs for the year.

My www.guswinger.com leveraged ETF swing trade service focuses on YINN-NYSE for Chinese stock market action. YINN is a triple-leveraged ETF. Its price should soar if even a fraction of the positive Chinese growth scenario laid out by HSBC and myself comes to pass.

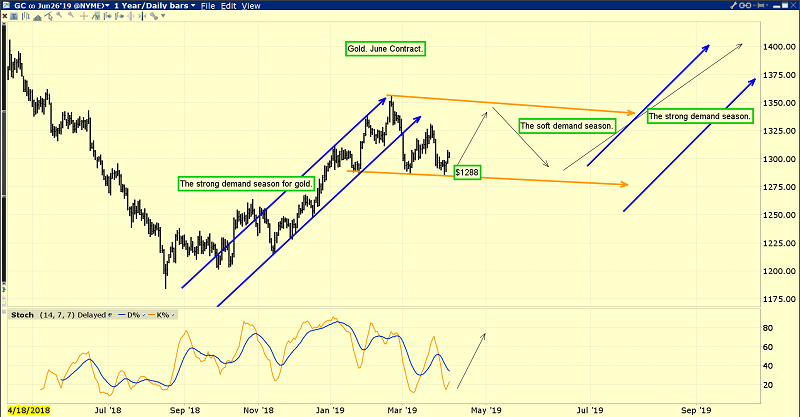

While gold is doing extremely well so far in the weak demand season, a trade deal and/or a Chinese GDP surge could end this weak season earlier than usual.

Most big bank analysts see gold at $1400 or higher within 12 months. That $1400 price would turn many gold miners into gargantuan cash cows.

Mining stock dividends would soar and make global money managers embrace the sector in a much more consistent way than they have in the past.

If Chinese growth can reach the 7% area, Indian growth should reach 8%. India’s central bank has started its own gold buy program and all the silly government attacks on the Indian gold sector have ended.

Most gold analysts look for signs of a weakening global economy to propel gold higher. In contrast, I look for signs of strength in the private sector and signs of weakness in the US government sector. Both are present now.

The US government is a walking tombstone. Its debt cannot be paid. It’s a gargantuan glutton that is clearly out of control. The government and its central bank recklessly smash savers by demanding ultra-low rates and QE. It does so because its own grotesque appetite for borrowed money is insatiable.

Interestingly, Trump has just nominated gold standard enthusiast Herman Cain as a potential Fed governor. Trump says that Herman “gets it”.

Does Trump mean Herman understands that only a gold standard can end the insane growth of the US government?

I think so. The current bottom line for gold is that all Chindian growth lights are green and all US government debt lights are red. This is the perfect environment for creating rallies in the gold price that are sustained.

The price action of the TLT-NYSE bond market ETF supports my theme of strength in global stock markets and gold, and weakness in bonds.

Sometimes gold rallies when interest rates decline and sometimes it rallies when they rise. If there’s enough fear in either scenario, gold will rally strongly.

Gold soared in 2009 after rates were dramatically lowered with QE and fear of system collapse was rampant.

Gold soared in 1979 as rates went ballistic and fear of hyperinflation was rampant.

Libertarians are obviously eager to watch the US government incinerate in a rocketing rates bond market fireball, but I think the coming swoon in bond prices will be more mundane.

Simply put, the US government debt fireball lies ahead, but in the medium-term gold is likely to rally to $1400 mostly because of the fundamentals of strong Chinese growth.

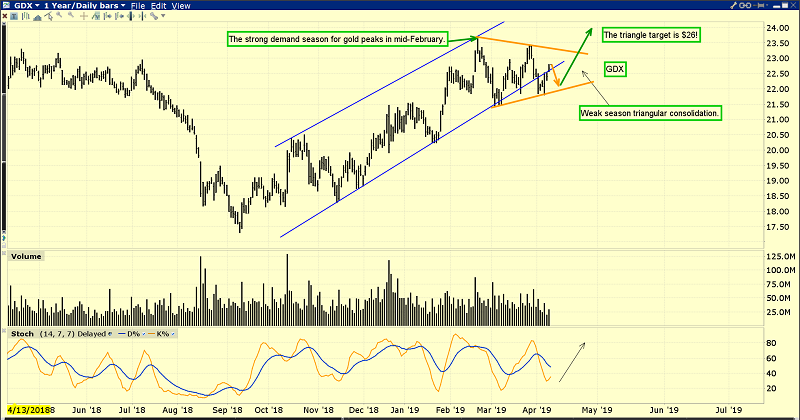

This is the solid-looking GDX chart.

I’ve been adamant that the weak season sideways action for GDX and associated miners won’t end until there’s a Friday close of $23 or better.

Will this be the week that it happens? Well, it feels imminent and the good news for investors is that the symmetrical triangle now in play for GDX has an upside price target of about $26!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “The Golden Surge!” report. I highlight eight key gold and silver miners with similar technical patterns to GDX that can stage much bigger rallies as GDX breaks out to upside!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: