Gold: The Cost Of Production Is Near

Gold is no longer vulnerable. It has entered a nice buying area.

The $1225 - $1200 price zone is both technically and fundamentally important. Here’s why:

The average cost of producing gold is now approximately $1210. Fundamentally oriented money managers of size are almost always buyers when gold dips into the cost of production zone.

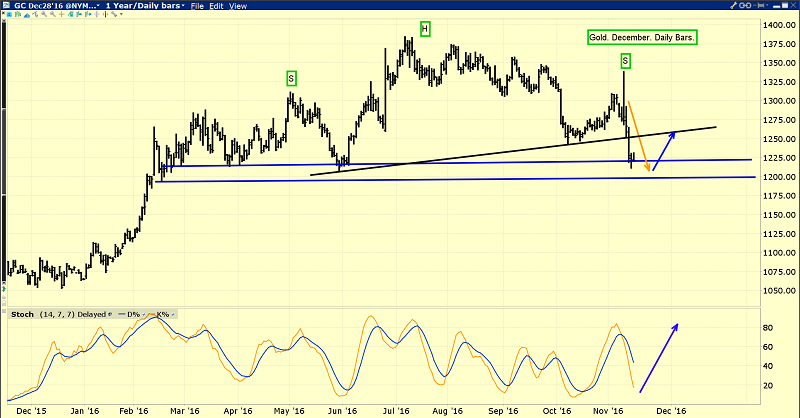

A look at the technical action.

The $1225 - $1200 zone is decent support. It’s not huge support, but it’s decent. I was a modest buyer in the $1220 area this week, after being a seller at $1305 - $1320 last week.

I think a lot of people believed that the election of Trump would send gold skyrocketing, but I called gold “vulnerable” going into election night.

The bottom line is that Trump is “supportive” for gold. His economic plan will increase the size of an already out of control US government debt. His infrastructure spending plans are inflationary.

It’s impossible for America to grow its way out of the unfunded liabilities nightmare it faces.

The debt problem can’t be fixed with more taxes. It can’t be fixed with less taxes. It can’t be fixed with more growth. It certainly can’t be fixed with more debt.

America’s epic debt problem can’t be fixed at all. Debt needs to be paid, and it isn’t going to get paid. That’s why investors need to own gold. Simply put, in the big picture, Trump’s election is good news for gold, but in the short term, $1305 -$1320 is significant sell-side resistance.

As gold surged in the first half of 2016, miners engaged in significant hedging on the COMEX. With the price now near the cost of production again, they appear to be pulling off those hedges. That’s very good news.

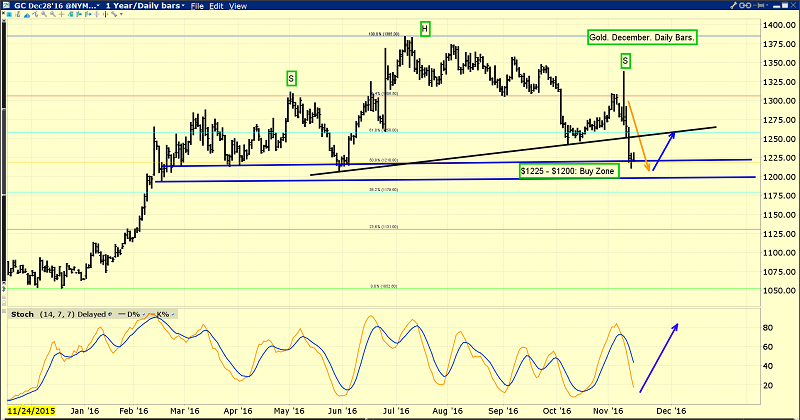

That’s another look at the daily gold chart.

The $1218 area is a key 50% Fibonacci retracement. When the price of an asset pulls back to an important Fibonacci line, investors are not guaranteed “free money” if they buy, but if important fundamental news is at hand, it is a key buying area.

Given that gold is at/near the cost of production for mining companies, this particular Fibonacci retracement zone is quite important.

After staging a mini crash after the US election, the T-bond looks set to rally.

That’s more good news for gold; gold can rally if the T-bond falls against the dollar, but only if real interest rates fall (nominal rates minus the rate of inflation).

The violence of the T-bond’s post election price decline far exceeded the rise in inflationary expectations, and so gold was hit hard against the dollar.

Gold should rally from the $1225 - $1200 area, and it likely will do that. If there is no rally, the next reasonably important buying area is at modest support in the $1180 - $1160 zone.

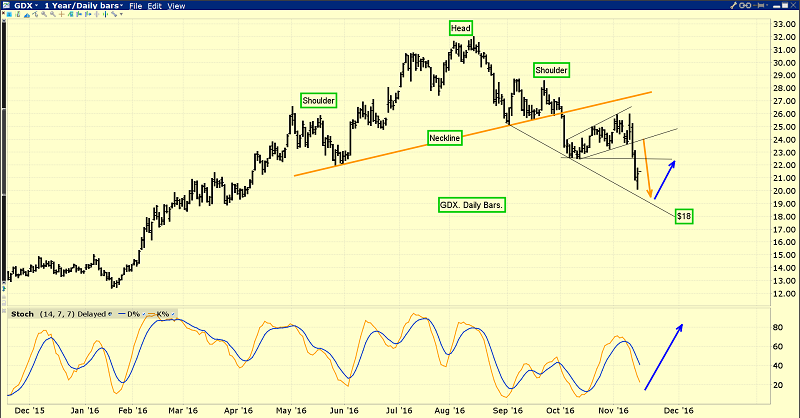

- The Stochastics indicator at the bottom of this GDX daily chart. It’s almost oversold.

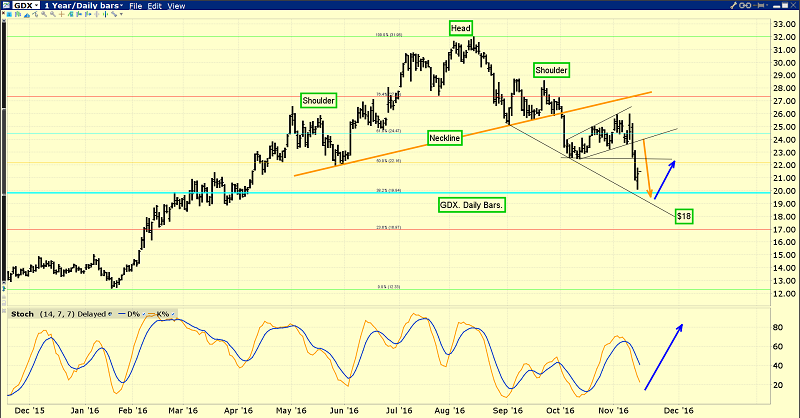

That’s a second look at the GDX daily chart. The 38% Fibonacci retracement zone is now in play, in the $20 area for GDX. Light buying is recommended, mainly because gold is at the mining industry’s average cost of production.

I’ve laid out a “playbook” for the transition from deflation to inflation, and for the transition from America as leading empire to the rise of Chindia. In that transition, gold stocks serve as the canary in the inflationary coal mine. They sang loudly in the first half of this year.

To actually create that inflation, higher interest rates are required. Those higher rates incentivize banks to move money out of the government bond market and into the fractional reserve banking system. As the money is loaned out, money velocity reverses, and inflation is created.

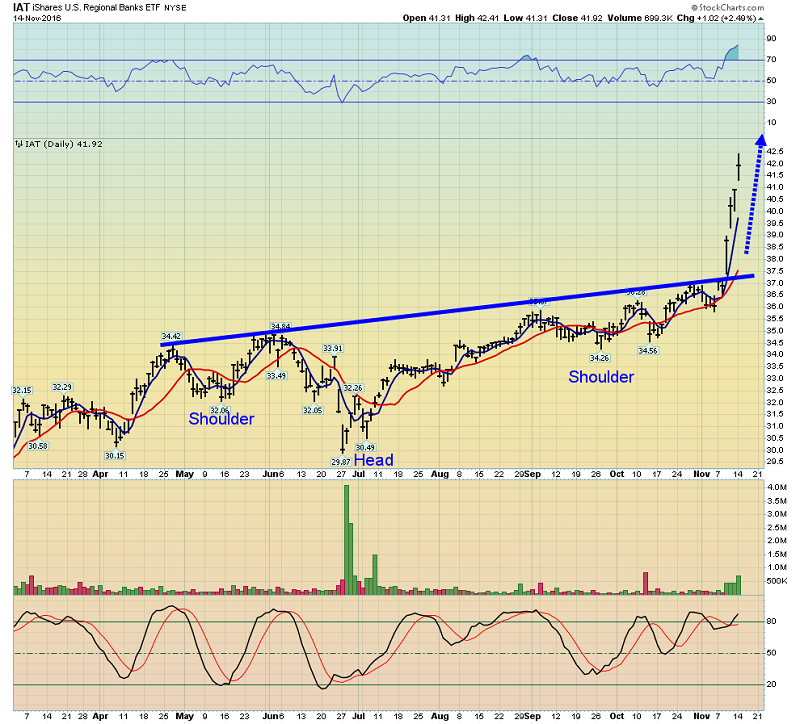

This regional bank stock ETF shows where America is, in that transition. Bank stocks are surging, driven by the prospect of higher bank loan profits. Trump’s promised deregulation of the banking sector is adding rocket fuel to the rally.

Western gold community investors need to have a wee bit of patience. Here’s why: Bank stocks are the main theme at this point in the transition to an inflationary world. Once bank profits rise, money velocity will reverse. From there, gold stocks will begin a vastly bigger rally than the one that occurred in the first half of this year, and this one will be sustained!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Seniors Golden Six Pack!” report. I cover six top senior gold mining companies, as well as a “sleeper” intermediate producer that has a mine producing gold at $100 an ounce! I include key buy & sell zones for all seven stocks.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced - and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: