Gold Forecast: 72-Day Cycle Peaked?

Recap of Last Week

Recap of Last Week

Last week's action saw gold forming its low in Monday's session, here doing so with the tag of the 1785.80 figure. From there, a gradual push higher was seen into later in the week, with the metal hitting a Friday peak of 1815.80 - before backing off the same into the daily/weekly close.

Gold Market, Short-Term

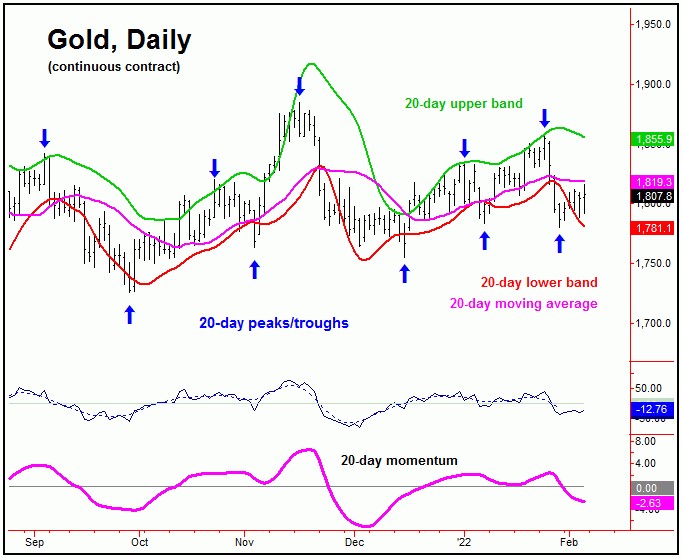

As noted last weekend, the last short-term peak - and correction - came as the result of the 20-day cycle, which is shown again on the chart below:

From last weekend: "our 20-day cycle is now some 15 trading days along, and with that the next short-term bottom is expected to come from this component. Once this low is complete, a quick rally back to the 20-day moving average or better should be seen in the days to follow, before the another swing high forms."

With the action seen into last week, our 20-day cycle trough is confirmed to have been the 1780.60 swing low, which puts this wave at some 5 trading days along into a new upward phase. In terms of price, as mentioned, the probabilities favored a minimum rally back to the 20-day moving average for Gold, which has nearly been met with the rally into late last week.

Gold's 3-5 Week Picture

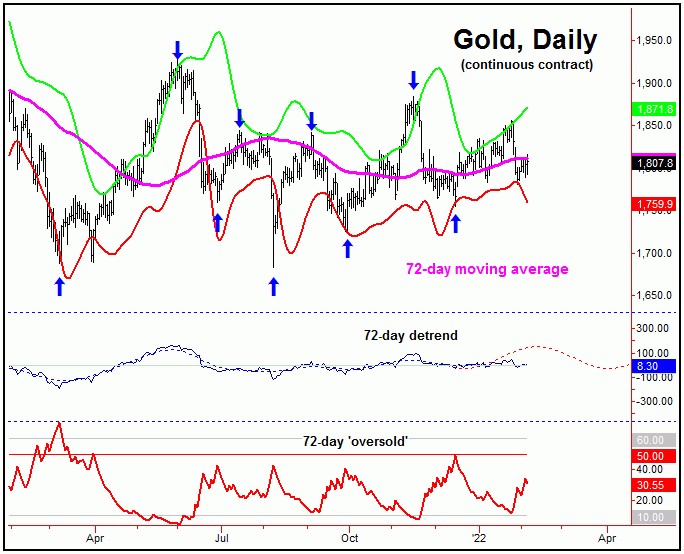

From the comments made in past articles, the last larger rally phase came as a result of the 72-day cycle, which is shown again on the next chart:

In terms of time, the upward phase of this 72-day wave was originally projected higher into this mid-January to mid-February region, which we have obviously seen playing out - with the metal forming its highest high so far with the January 25th tag of the 1856.50 figure (April, 2022 contract).

With the above said and noted, either our 72-day cycle has already topped, or else has a higher high to go before peaking. Most of the momentum indications suggest this wave to have already peaked, though this has yet to actually be confirmed - by a number which are watching closely in our Gold Wave Trader report.

The alternate to the above is that a push back to higher highs (above 1856.50) could be seen in the next week or two, before actually topping this 72-day cycle. Stepping back, the next trough for this particular wave - if made on schedule - is due around the early-April timeframe, plus or minus.

Mid-Term Outlook

The next trough for this 72-day cycle should also end up as the bottom for the larger 154-day wave, which is shown below:

As mentioned, the next mid-term low should come from the combination of the 72 and 154-day waves, with some suggestions that the larger 310-day cycle could already be pushing back to the upside, off a contracted low made back in August of 2021. If correct, an April bottom with the 72 and 154-day cycles would be favored to end up as a countertrend affair, against that August, 2021 bottom.

Regardless of the precise positioning of the 310-day cycle, a Spring, 2022 bottom with the 72 and 154-day cycles would be expected to give way to a very strong rally into what is looking to be later this year - before forming yet another peak with the 154-day cycle. In terms of price, that rally could be in the range of 15-25% off the lows, which is something to keep in mind as we move towards the Spring of this year.

The Bottom Line

The overall bottom line is that the very short-term cycles are looking for additional strength, though with the potential for a 72-day cycle top already in place. If not, then any new high would be the odds-on favorite to peak the same, with the next move being a correction into April with this same cycle. From there, we will need to be on the lookout for technical evidence of the next mid-term trough forming, which should come from the combination of 72 and 154-day waves - giving way to a sharp rally into later this year. Stay tuned.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/

********