Gold Forecast: Could Evergrande be Stocks’ Goat to Scape?

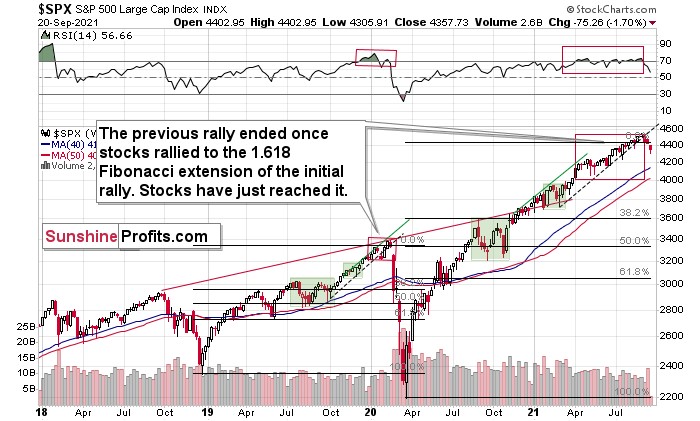

Evergrande. That’s the topic everyone requested me to cover, so I will. But before I do, I would like to emphasize that I’ve been writing about it for months. No, not about Evergrande per se, but about the situation being similar to 2008. The exact trigger and the name of the company are not really relevant. What is important is that the storm has been brewing for some time, and now, when we finally see the straw that broke the camel’s neck, it seems like a game-changer. But it’s not a game-changer. It’s a milestone telling us that the game is going very similarly to how it was played 13 years ago (in 2008).

Evergrande. That’s the topic everyone requested me to cover, so I will. But before I do, I would like to emphasize that I’ve been writing about it for months. No, not about Evergrande per se, but about the situation being similar to 2008. The exact trigger and the name of the company are not really relevant. What is important is that the storm has been brewing for some time, and now, when we finally see the straw that broke the camel’s neck, it seems like a game-changer. But it’s not a game-changer. It’s a milestone telling us that the game is going very similarly to how it was played 13 years ago (in 2008).

Can the markets repeat both previous patterns at the same time (2008 and 2013)? Sure, why not. The history doesn’t repeat itself to the letter, it rhymes instead. And the current rhyme is somewhat similar to both previous situations.

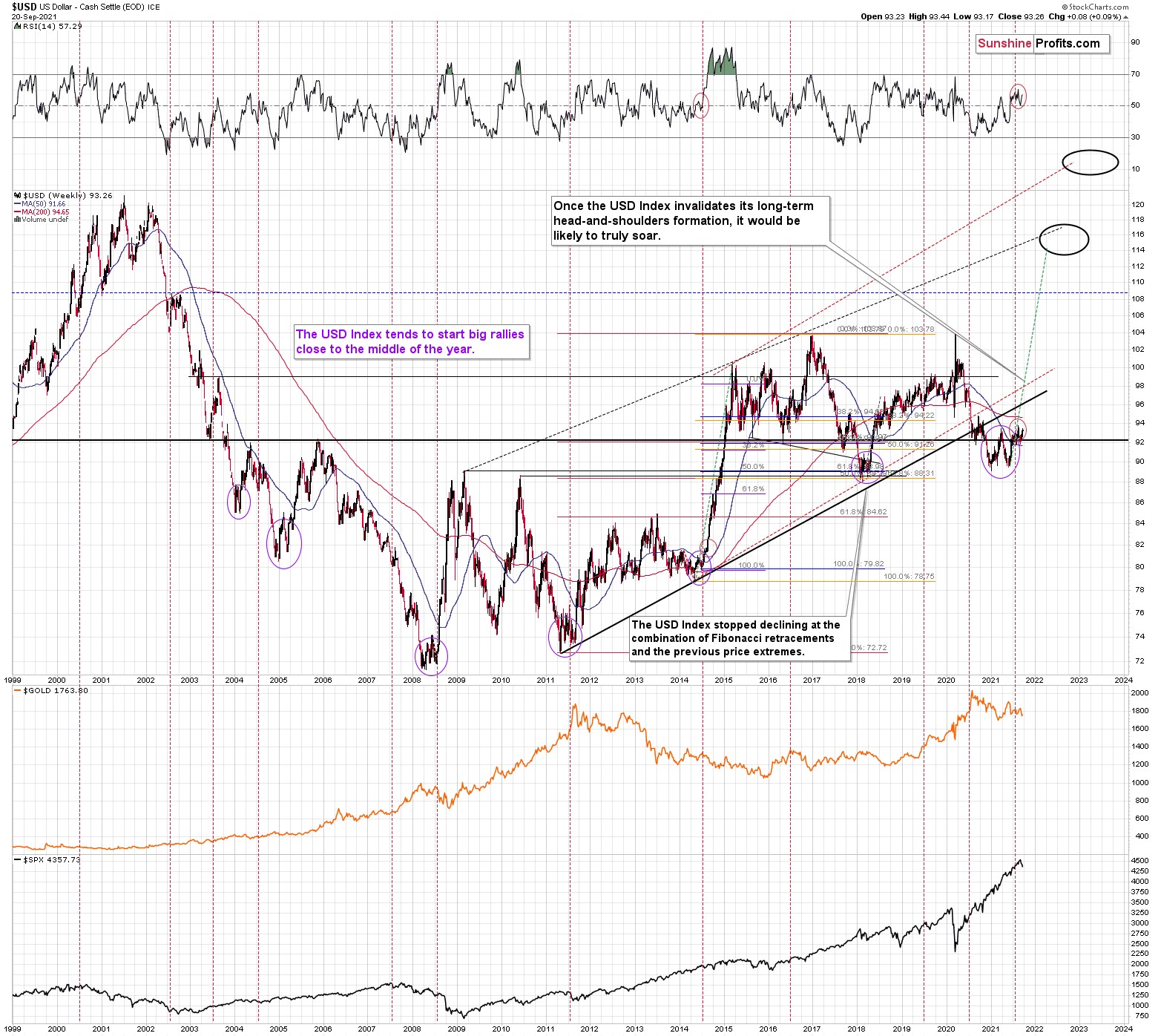

Previously, gold and gold stocks have been quite clear with the repeat of their respective 2011-2013 price actions. The USD Index is moving steadily (with corrections) higher this year, also similarly to what we saw then.

However, if the general stock market is about to plunge, then we might lean more toward its 2008 counterpart, as that was the key thing on the charts at that time (as far as the main markets are concerned). The USD Index soared at that time, which might happen this time as well. But the most important implication from the point of view of a precious metals investor and trader is the dramatic slide in mining stocks and in silver that we saw in 2008. Yes, I’ve been repeating that these two parts of the precious metals sector were likely to fall the most (perhaps miners first, silver a bit later – a’la 2020), but what we’re seeing now in the general stock market and what kind of news accompanies it (major bankruptcy threat related to the real estate market) has 2008 written all over it.

The Plunge Protection Team

And yet, there is one thing I haven’t considered previously that hit me today regarding Evergrande. There is something different this time that makes the declines in stocks and the precious metals sector (especially silver, gold stocks, and silver stocks) even more likely.

One might say that the thing that prevented the stock market from declining was the rising dashed line. Or the 50-day moving average. And they have likely indeed played an important part on a technical level. But the thing that really prevented the stock market from declining was… the issue of blame.

You know, it’s not rocket science that the stock markets are overheated. There are myriads of indicators pointing to the overbought status, and I’ve been featuring them for months. Furthermore, the authorities know that.

Earlier this year, the largest U.S. banks had to prove that they would be able to withstand a 55% crash in the stock market. Interesting, right? Of course, one could say that it was just a normal precautionary test, irrelevant to the authorities knowing that stocks will need to crash eventually.

If the Powers That Be know that stocks have to crash and that banks can take it, then it’s safe to let the markets do their thing, right?

Wrong. People might put the blame on those Powers, and the Powers wouldn’t like that, as they like votes, power, money, and such. Blame doesn’t go well with those.

So, if there is indeed the “Plunge Protection Team” that’s been actively working on keeping the stock market afloat until it’s obvious that the blame can be placed somewhere else, ideally on a political adversary, then they just had their dreams fulfilled.

The Evergrande Group – a Chinese real estate developer – is a perfect scapegoat here. Of course, the real reason that the stock markets got too high practically all over the world is caused by excessive money printing / stimulus of all kinds. But from the political point of view, it can now be narrated to be someone else’s fault.

“Yes, folks, it’s very unfortunate that you lost your retirement money, and your kids will have trouble finding jobs in this stagflation… But it’s all because of China! We did all we could, but they caused all this – we couldn’t prevent it despite all our best efforts. Good luck to you and vote for us again so that we may fight for your rights and your financial safety on your behalf!”

Or something along those lines. That’s what the narrative might be once the stock markets crash globally and once the real-life implications kick in.

I’m not sure if anyone already called it “the Chinese crisis”, but if not, please mark it in your calendars that I’m forecasting today (Sep. 21, 2021) that this name will emerge sooner or later. Also, please keep in mind that months ago, I wrote that bitcoin was topping (at least in the medium term) at about $50,000. It then moved higher somewhat, but overall, it seems that we’re seeing a broad top in this market. The rising USDX is unlikely to help it, either way.

Also, please don’t get me wrong. I’m not “cheering for China” here, defending China, etc. In fact, I’m not cheering at all. I’m just analyzing the situation as realistically (perhaps even “brutally”) as I can, and I’m reporting my findings to you, along with discussing the implications for the precious metals sector.

And the implications for the precious metals sector of the above are very bearish.

Where Are the Metals Headed?

Now, on a short-term basis, the reactions might be relatively chaotic, as on one hand, the situation getting out of hand might trigger safe-haven buying for gold, and on the other hand, it might trigger safe-haven buying for the USD Index. This might trigger quite many erratic price swings in the short run.

Gold moved higher by $12 yesterday, but this move seems to have just been a breather after a powerful daily decline.

Why? Because gold miners are confirming their breakdown and they completely ignored gold’s rally, for instance.

The GDX ETF closed below the previous 2021 lows for the second consecutive trading day. If we get a daily close below these lows today, the breakdown will be fully confirmed, and the road to new lows will be fully open.

Just as I wrote previously, the outlook for the precious metals market remains extremely bearish for the next several months.

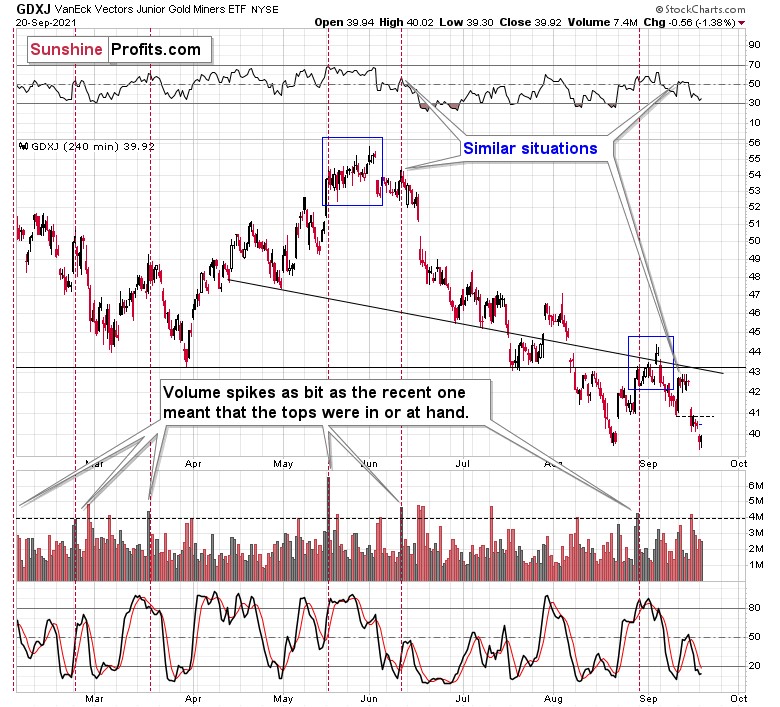

Junior miners moved lower yesterday, catching up with the GDX’s decline. The GDXJ didn’t close below the August lows yet, but it’s very close to them. The outlook for the junior mining stocks remains very bearish, especially given the likely declines in the general stock market. Remember how profoundly juniors plunged in 2020 when the general stock market declined? In my view, we’ll likely see something similar also this time.

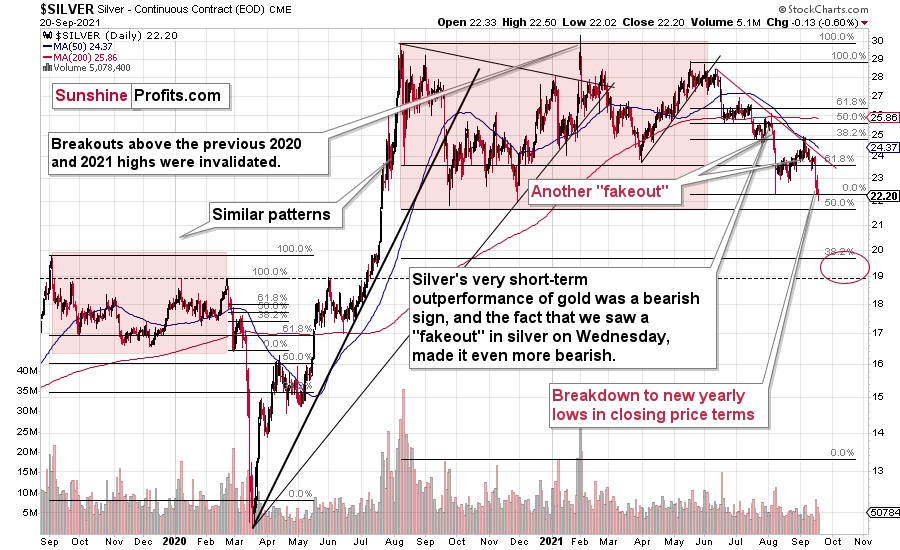

In yesterday’s analysis, I wrote that silver moved to a new yearly low in terms of the daily closing prices. This move was confirmed, and the bearish outlook was emphasized by the move to new intraday 2021 lows. The losses of those who purchased silver close to its yearly top are now very significant. And it’s going to get worse, as silver is likely to decline more – likely much more – before it rallies back up.

The USD Index suggests caution in the very short term, as it reversed before the end of yesterday’s session, and it did so after moving to its March highs.

Indeed, the USD Index is declining in today’s pre-market trading. But does it change much? It doesn’t. Even if the USD Index declines a bit here (and PMs move a bit higher), it’s still likely to soar soon (and PMs are likely to plunge soon).

The long-term USD Index chart and the analogy to its previous performance after mid-year bottoms continue to have bullish implications for the medium term. In particular, the analogies to 2014 and 2008 are particularly bullish.

Summary

To summarize, the outlook for the precious metals sector remains extremely bearish for the next few months.

The decline to new lows in the GDX and silver as well as the strength that we saw in the USD Index were important short-term confirmations for the bearish case, but the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. Both suggest much lower prices ahead.

And as silver often moves in close relation to the yellow metal, when gold falls, Silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,