Gold Forecast: Despite Russian-Ukrainian Drama, Gold Will Divorce Bullish Prospects

Gold will benefit as long as there are turbulences on the eastern European border. It may be a short-term growth period, but it certainly won't last forever.

Gold will benefit as long as there are turbulences on the eastern European border. It may be a short-term growth period, but it certainly won't last forever.

After Russian President Vladimir Putin ordered troops to enter Ukraine to “maintain peace,” the conflict escalated on Feb. 21. However, while the Russia-Ukraine saga will likely dominate the headlines in the short term and may uplift the PMs in the process, the outlook is much different over the medium term.

To explain, with inflation still elevated, Fed officials continue to sound the hawkish alarm; and with a March rate hike likely a done deal, the liquidity drain that hurt the PMs in 2021 should accelerate in 2022.

For example, Fed Governor Lael Brainard said on Feb. 18 that officials will use rate hikes and quantitative tightening (QT) to “bring down inflation over time”. “The market is aligned with that. We’ve already seen the kind of tightening facing households and businesses that is consistent with the economy’s outlook,” she added.

As a result, she expects a “series of rate increases” in the coming months.

Please see below:

Source: Bloomberg

Echoing that sentiment, Cleveland Fed President Loretta Mester said on Feb. 17 that sticky inflation may force the Fed to shift away from explicit forward guidance and instead convey an “overall trajectory of policy and give the rationale for our policy decisions.”

In a nutshell: she means that surging inflation may prevent the Fed from providing investors with “advance notice.” If the Consumer Price Index (CPI) keeps running hot, the Fed will have to react in real-time instead of telegraphing its next move.

Please see below:

Source: Reuters

On top of that, Fed Governor Michelle Bowman said on Feb. 21 that she is undecided about a 50 basis point rate hike in March:

"I, as all of my colleagues will as well, will be watching the data closely to judge the appropriate size of an increase at the March meeting.” However, she added: "I intend to support prompt and decisive action to lower inflation."

As a result:

Source: Reuters

If that wasn’t enough, New York Fed President John Williams (a major dove) conceded on Feb. 18: “I think we can steadily move up interest rates and reassess.” As a result, even the doves expect a 25 basis point rate hike in March.

Furthermore, while I warned throughout 2021 that surging inflation would elicit a hawkish shift from the Fed, officials’ overconfidence is coming back to bite them. Moreover, with Fed officials materially shifting their stance, institutional investors are also showcasing heightened anxiety.

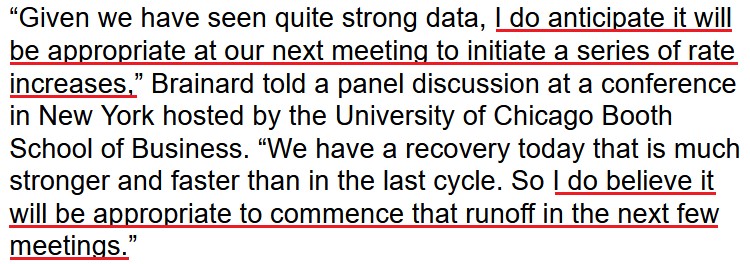

For example, Bank of America’s latest Global Fund Survey shows that 39% of institutional investors believe inflation is permanent, while slightly more than 50% believe it’s transitory. However, in September 2021, 28% of respondents thought that inflation was permanent, and 69% thought it was transitory. As a result, institutional investors are also grappling with the change in sentiment.

Please see below:

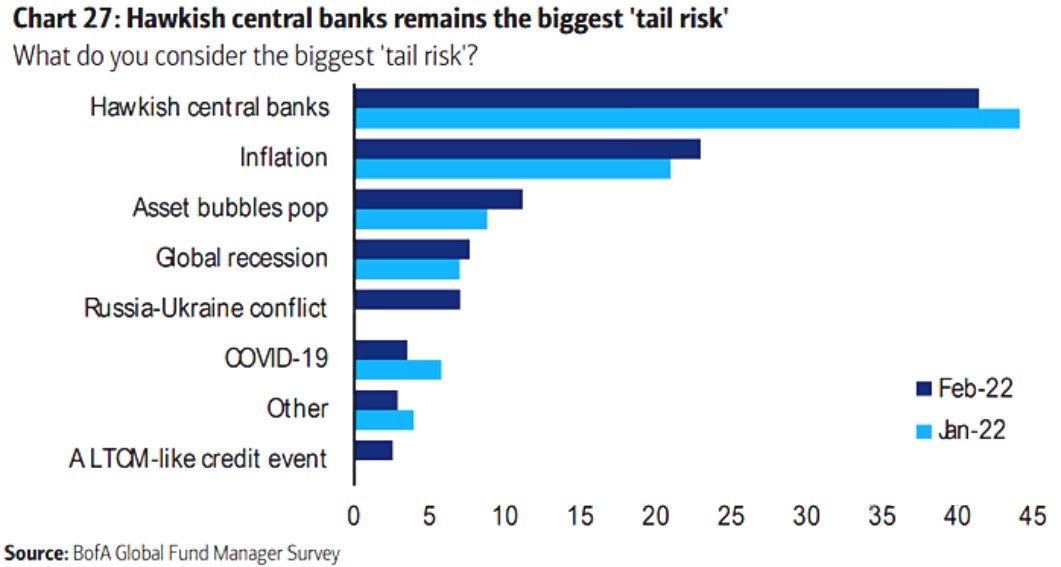

To that point, inflation and central banks have become the most significant tail risks confronting the financial markets.

Please see below:

To explain, a “tail risk” is a low probability, high-risk event that could impair financial assets. If you analyze the chart above, you can see that inflation fears increased in February, while the risk of hawkish central banks remains in the top spot.

Furthermore, if you analyze the row labeled “Russia-Ukraine conflict,” you can see that institutional investors aren’t apprehensive about the medium-term impact on their portfolios. As a result, while the conflict has uplifted the PMs in the short term, it’s prudent to look beyond the current headlines and focus on the coming months.

For context, I wrote on Feb. 14:

With another dire warning from the White House uplifting gold and mining stocks on Feb. 11, Russia and Ukraine's 'will they or won't they' saga has shifted sentiment. However, it's important to remember that geopolitical risk rallies often have a short shelf life and dissipate over the medium term.

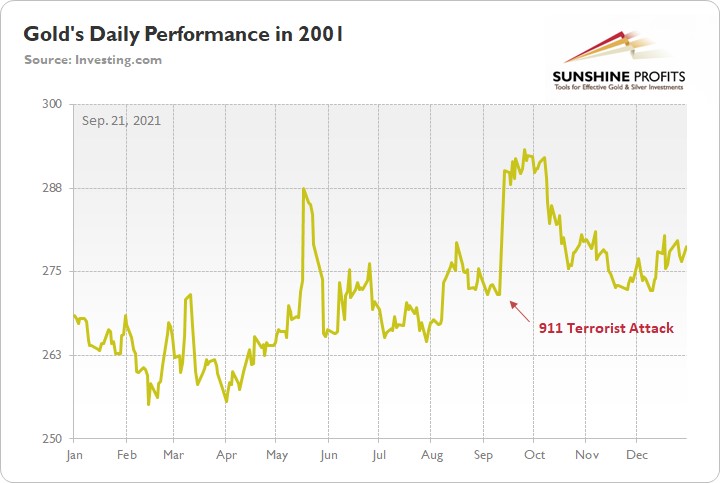

To explain, I wrote on Sep. 21:

When terrorists attacked the World Trade Center roughly 20 years ago, gold spiked on Sep. 11, 2001. However, it wasn’t long before the momentum fizzled and the yellow metal nearly retraced all of the gains by early December. Thus, when it comes to forecasting higher gold prices, Black Swan events are often more semblance than substance.

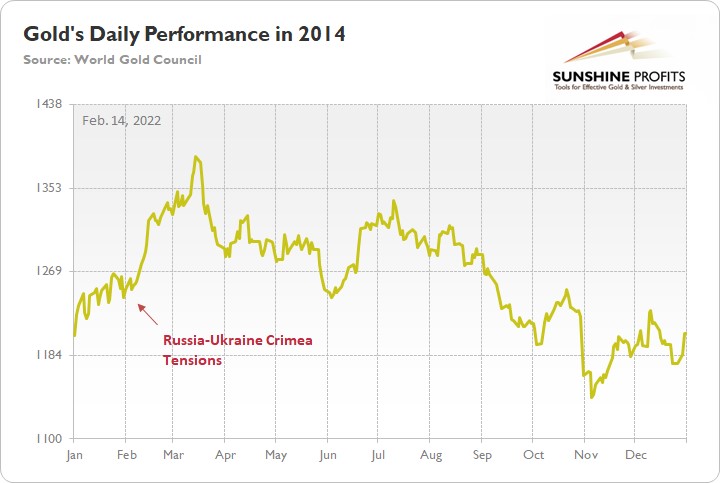

As further evidence, when Russia annexed Crimea from Ukraine in 2014, similar price action unfolded. For example, when rumors swirled of a possible invasion, gold rallied on the news. Then, when Russia officially invaded, the yellow metal continued its ascent. However, after the short-term sugar high wore off, bearish medium-term realities confronted gold once again. And in time, the yellow metal gave back all of the gains and sunk to a new yearly low.

Please see below:

Thus, while conflicting reports paint a conflicting portrait, the algorithms don’t care whether Russia invades Ukraine or not. With the rumor enough to pique investors’ interest, quantitative traders see it as an opportunity to capitalize on the momentum. However, once that momentum fizzles, history shows that the quants rush for the exits. As a result, is this time really different?

To that point, while the general stock market continues to suffer, the Russia-Ukraine saga has propped up the PMs. In the absence of that, gold, silver, and mining stocks would likely confront some of the pressures plaguing the NASDAQ Composite. For context, the PMs and Big Tech benefit from low real interest rates. However, the fundamental dynamic often hurts both asset classes when the outlook shifts.

Please see below:

To explain, the light blue line above tracks the NASDAQ 100, while the dark blue line above tracks the equity risk premium. If you analyze the relationship, you can see that spikes in the latter often result in drops in the former. With the Fed’s fears helping to uplift the equity risk premium in recent months, the NASDAQ 100 finally cracked.

More importantly, though, when the Fed’s rate hike cycle roiled the NASDAQ 100 in 2017-2018, the GDXJ ETF suffered too. Thus, while the Russia-Ukraine drama has provided a distraction, the fundamentals that impacted both asset classes back then are present now.

Please see below:

To explain, the green line above tracks the GDXJ ETF in 2018, while the black line above tracks the NASDAQ 100. If you analyze the performance, you can see that the Fed’s rate hike cycle initially rattled the former and the latter rolled over soon after. However, the negativity persisted until Fed Chairman Jerome Powell performed a dovish pivot and both assets rallied. As a result, with the Fed Chair unlikely to perform a dovish pivot this time around, the junior miners have some catching up to do.

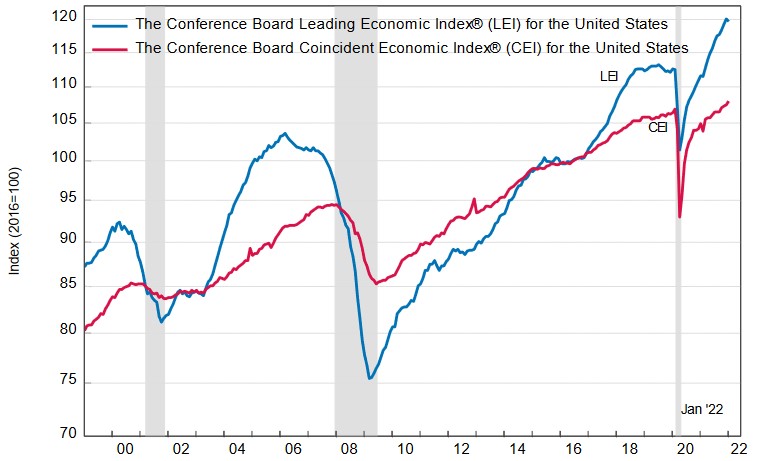

Finally, while a strong U.S. economy keeps the pressure on the Fed, The Confidence Board released its Leading Economic Index (LEI) on Feb. 18. While “the U.S. LEI posted a small decline in January, as the Omicron wave, rising prices, and supply chain disruptions took their toll,” Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board, said that the bullish medium-term outlook remains intact:

“Despite this month’s decline and a deceleration in the LEI’s six-month growth rate, widespread strengths among the leading indicators still point to continued, albeit slower, economic growth into the spring. However, labor shortages, inflation, and the potential of new COVID-19 variants pose risks to growth in the near term.

“The Conference Board forecasts GDP growth for Q1 to slow somewhat from the very rapid pace of Q4 2021. Still, the US economy is projected to expand by a robust 3.5 percent year-over-year in 2022 – well above the pre-pandemic growth rate, which averaged around 2 percent.”

Please see below:

The bottom line? While the Russia-Ukraine saga may continue to drive the short-term narrative, history shows that bullish sentiment doesn't last over the medium term. Moreover, with the Fed even more hawkish than in 2021, geopolitical factors have distracted the PMs from the more important fundamental development. As a result, the 'big picture' signals that their medium-term prospects are profoundly bearish.

In conclusion, the PMs were mixed on Feb. 18, as positive and negative developments in the Russia-Ukraine conflict continue to shape sentiment. However, while the short term is difficult to predict in geopolitics, the medium-term implications for the precious metals market remain intact: the Fed is hawked up, and tighter monetary policy supports a stronger USD Index and higher U.S. real yields. With the PMs often moving inversely to their main fundamental adversaries, this time shouldn't be any different. Also, this week’s weak reaction to what’s happening in Ukraine suggests that the precious metals sector is not far from its top.

Summary

To summarize, despite appearances to the contrary, the outlook for the precious metals sector still remains bearish for the next few months.

Gold is still benefiting from geopolitical turmoil. The disturbing information about the rise in tensions on the Russian-Ukrainian border allowed it to rise sharply. However, as history shows, even if a military conflict did break out and gold continued to rise, this is a short-lived move and the likely decline could be painful. The medium-term outlook remains pessimistic.

As silver often moves in close relation to the yellow metal, when gold falls, silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*******

Przemyslaw Radomski,

Przemyslaw Radomski,