Gold Forecast: The Hawkish Flame Begins To Smolder

With Fed Chairman Jerome Powell officially reappointed for a second term and Fed Governor Lael Brainard promoted to Vice-Chair, the chess pieces are now in place atop the FOMC. However, with inflation surging and the Fed materially behind the curve, the central bank has begun to ratchet up the hawkish rhetoric.

With Fed Chairman Jerome Powell officially reappointed for a second term and Fed Governor Lael Brainard promoted to Vice-Chair, the chess pieces are now in place atop the FOMC. However, with inflation surging and the Fed materially behind the curve, the central bank has begun to ratchet up the hawkish rhetoric.

To explain, I wrote on Oct. 21:

While the deflationists have receded into the background and the Fed is hoping that 2022 will be more kind to its “transitory” narrative, inflation is still accelerating. And while the death of QE should help calm some of the fervor, an accelerated taper that concludes “by the middle of next year” is extremely bullish for the USD Index. Moreover, with the Fed still materially behind the inflation curve, hawkish whispers of further tightening should hit the wire in the coming months.

And right on cue, Fed Vice Chairman Richard Clarida (who still holds the position until January 2022) said on Nov. 19 that he’s concerned about the “upside risk to inflation.”

“I’ll be looking closely at the data that we get between now and the December meeting. It may well be appropriate at that meeting to have a discussion about increasing the pace at which we are reducing” our asset purchases.

For context, the FOMC announced the taper only 20 days ago. And now, Clarida is hinting at accelerating the Fed’s already accelerated taper timeline. Furthermore, Fed Governor Christopher Waller (another voting FOMC member) said on Nov. 19 that two outcomes are possible over the coming months:

If “some other factor substantially slows the recovery, hindering the progress toward maximum employment, the FOMC could slow the taper,” Waller said. “But if the economy makes quick progress toward maximum employment or inflation data show no signs of retreating from their currently high readings, the committee may choose to speed up the taper, which would position it to accelerate subsequent steps in tightening monetary policy if necessary.”

And on which side does he reside?

Source: Bloomberg

Likewise, following the reappointment on Nov. 22, Powell said that “we know that high inflation takes a toll on families, especially those less able to meet the higher costs of essentials, like food, housing, and transportation. We will use our tools both to support the economy – a strong labor market – and to prevent higher inflation from becoming entrenched.”

And U.S. President Joe Biden added on Nov. 22 that he’s “confident that Chair Powell and Dr. Brainard’s focus on keeping inflation low, prices stable, and delivering full employment will make our economy stronger than ever before.”

Likewise, a statement by The White House had a similar message:

Source: The White House

The Hawk Talk

And why is all of this so important? Well, because I warned on Nov. 18 that ‘the war on inflation’ is already underway. I wrote:

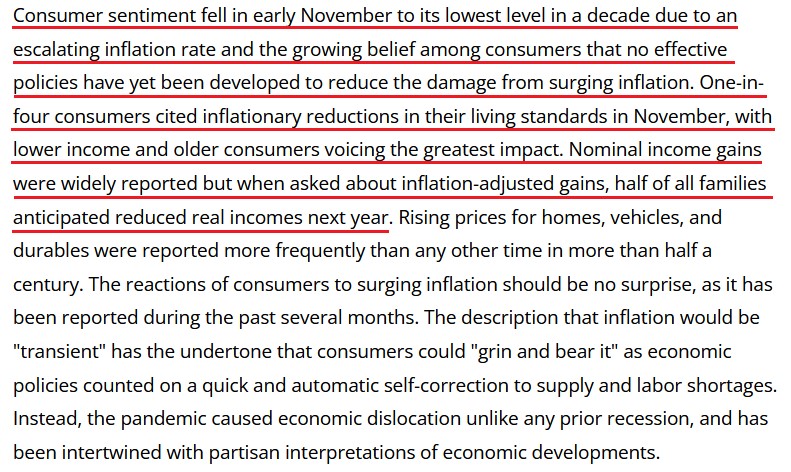

The University of Michigan released its Consumer Sentiment Index on Nov. 12. And with the index hitting a 10-year low, it’s no coincidence that The White House (and soon likely the Fed) has made inflation Public Enemy No. 1.

Please see below:

Source: the University of Michigan

Second, the political component shouldn’t be ignored. Biden’s approval ratings keep hitting new lows along with consumer confidence. Thus, is it in his best interest to maintain the status quo? Of course not. That’s why he’s been so forceful on inflation over the last few weeks. Essentially, if he (and/or the Fed) does nothing, he’ll likely lose the next presidential election and the Democrats will likely lose control of Congress. However, if he tames inflation, then he’s a hero. And left with those two options, which one do you think he’ll choose?

Thus, it’s important to remember that reappointing Powell was a hawkish move. And while the statement may seem laughable due to his dovish disposition over the last 10 months, Powell is still more hawkish than Brainard.

However, given the nature of U.S. inflation, we believe that it doesn’t matter who runs the Fed. The reality is: if prices keep rising and consumer confidence keeps falling, eventually demand destruction unfolds. Thus, whether it’s Powell or Brainard calling the shots, failure to solve the inflationary conundrum will likely push the U.S. economy into recession.

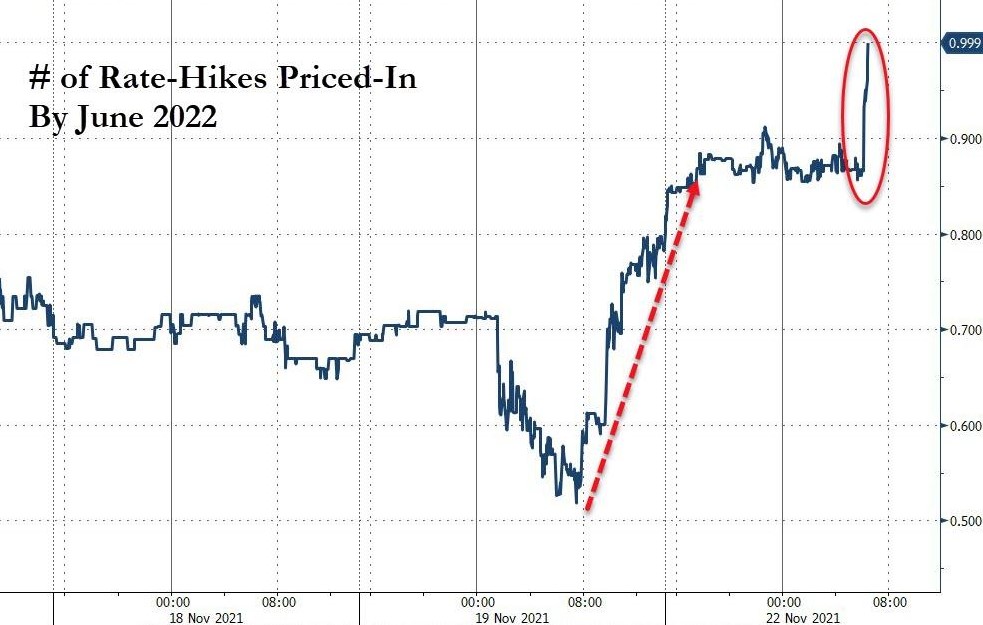

Despite that, though, investors reacted on Nov. 22. And after the reappointment of Powell lit a hawkish fire, rate hike bets began to smolder. To explain, futures traders previously expected the Fed to raise interest rates in September 2022. However, after the headline Consumer Price Index (CPI) surged by 6.2% year-over-year (YoY) on Nov. 10 – the highest YoY percentage increase since 1990 – the forecast was pulled forward to July 2022.

Now, with Powell reappointed on Nov. 22, futures traders expect the first rate hike to materialize in June 2022.

Please see below:

Source: Bloomberg/ZeroHedge

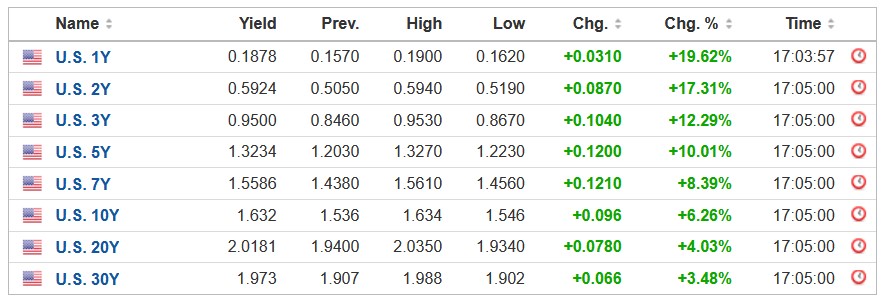

What’s more, the U.S. yield curve surged on Nov. 22, and the U.S. 5-Year Treasury yield hit a new 2021 high.

Please see below:

Source: Investing.com

However, while the drama helped uplift the USD Index and upend the PMs, the ‘hawk talk’ is likely far from its peak. And with inflation still surging and the Fed still materially behind the curve, the FOMC will likely pivot from hawkish rhetoric to hawkish policy in the coming months. This means that bearish forecasts for gold and bearish forecasts for silver “have legs”.

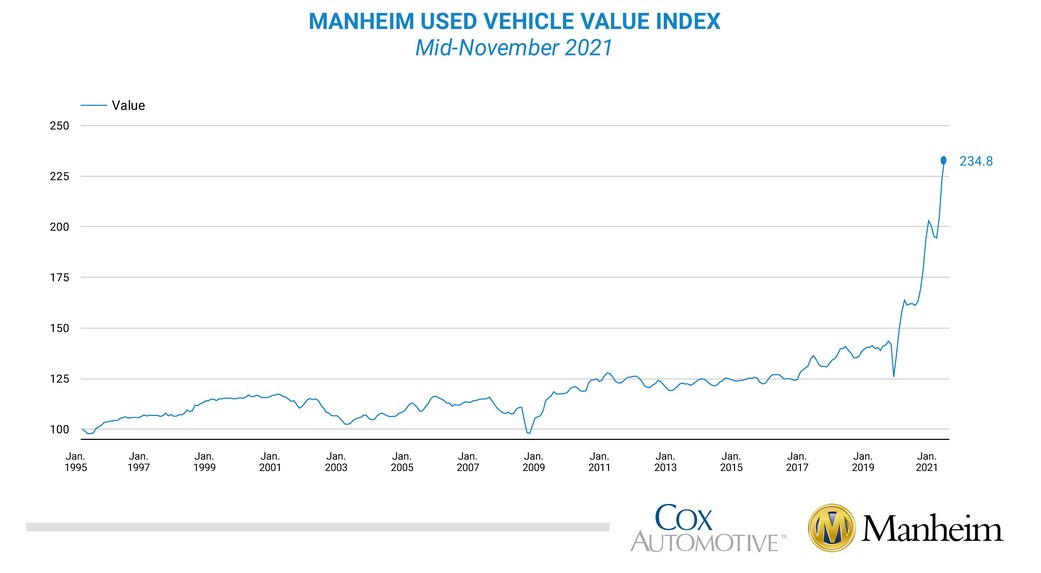

To explain, the Manheim Used Vehicle Value Index “increased 4.9% in the first 15 days of November compared to October. This brought the Manheim Used Vehicle Value Index to [a record high] 234.8, a 44.9% increase from November 2020.”

Please see below:

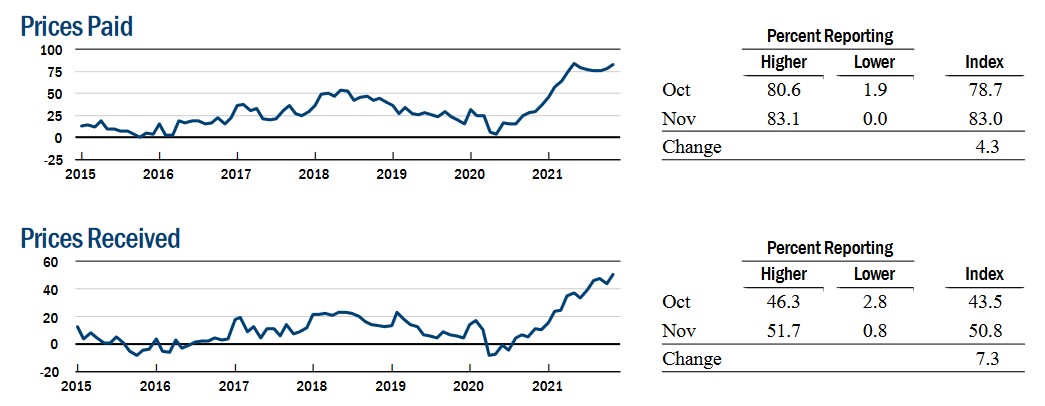

Second, the New York Fed released its Empire State Manufacturing Survey on Nov. 16. And while the headline index increased from 19.9 in October to 30.9 in November, the report revealed:

“The prices paid index edged up four points to 83.0, and the prices received index moved up seven points to a record high of 50.8, signaling ongoing substantial increases in both input prices and selling prices.”

Please see below:

Source: New York Fed

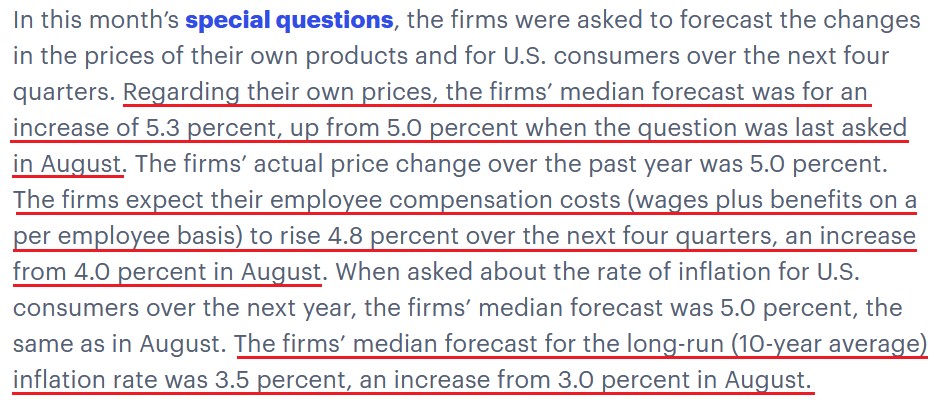

Third, the Philadelphia Fed released its Manufacturing Business Outlook Survey on Nov. 18. And while the headline index increased from 24 in October to 39 in November, inflation remains the talk of the town. The report revealed:

“Firms continued to report increases in prices for inputs and their own goods. The prices paid diffusion index rose 10 points to 80.0, its highest reading since June’s 42-year high of 80.7. Over 82 percent of the firms reported increases in input prices, while 2 percent reported decreases. The current prices received index increased 12 points to 62.9, its highest reading since June 1974.”

On top of that, when Philadelphia manufacturing firms were asked about their pricing plans over the next four quarters, can you guess what they said?

Source: Philadelphia Fed

The bottom line? 'The war on inflation' is upon us, as policymakers realize that pricing pressures won't abate without an active response. As a result, the FOMC's priorities have shifted from maximum employment to containing inflation. And while I've been warning for months that surging inflation would elicit hawkish shifts from the Fed, there is still plenty of room to run.

For example, the Fed is nowhere near its 2% annual target and likely won't be without raising interest rates. And while the U.S. dollar has been on fire recently, the more 'hawk talk' that materializes, the more bullish it is for the USD Index. As a result, while I seem to repeat the statement weekly, the U.S. dollar's fundamentals are stronger now than at any other point in 2021.

In conclusion, the PMs declined on Nov. 22, and the USD Index continued its bullish assault. And with U.S. Treasury yields waking up from their slumber, the two-headed monster showcased its fundamental might. Moreover, with inflation surging and the Fed poised to pivot even further in the coming months, gold should suffer more daily 'flash crashes' along the way.

Summary

The PMs declined last week after rallying on the previous week when their momentum has teetered on euphoria. However, when prices diverge from fundamentals, sharp sell-offs often occur when sentiment shifts. As a result, caution is warranted, and the PMs’ recent bout of optimism will probably end in disappointment. This disappointment has likely already started on Nov. 16, in tune with the previous high-volume-based patterns.

Since it seems that the PMs are likely about to start another short-term move lower more, I think that junior miners would be likely to (at least initially) decline more than silver.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

And as silver often moves in close relation to the yellow metal, when gold falls, silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,