Gold Forecast: Post-Fed Collapse Testing Critical Support

Gold prices are consolidating after its post-Fed collapse. Gold formed a bullish engulfing candle on Monday but needs to close above $1800 to support a possible bottom. A continued breakdown below $1750 would be near-term bearish.

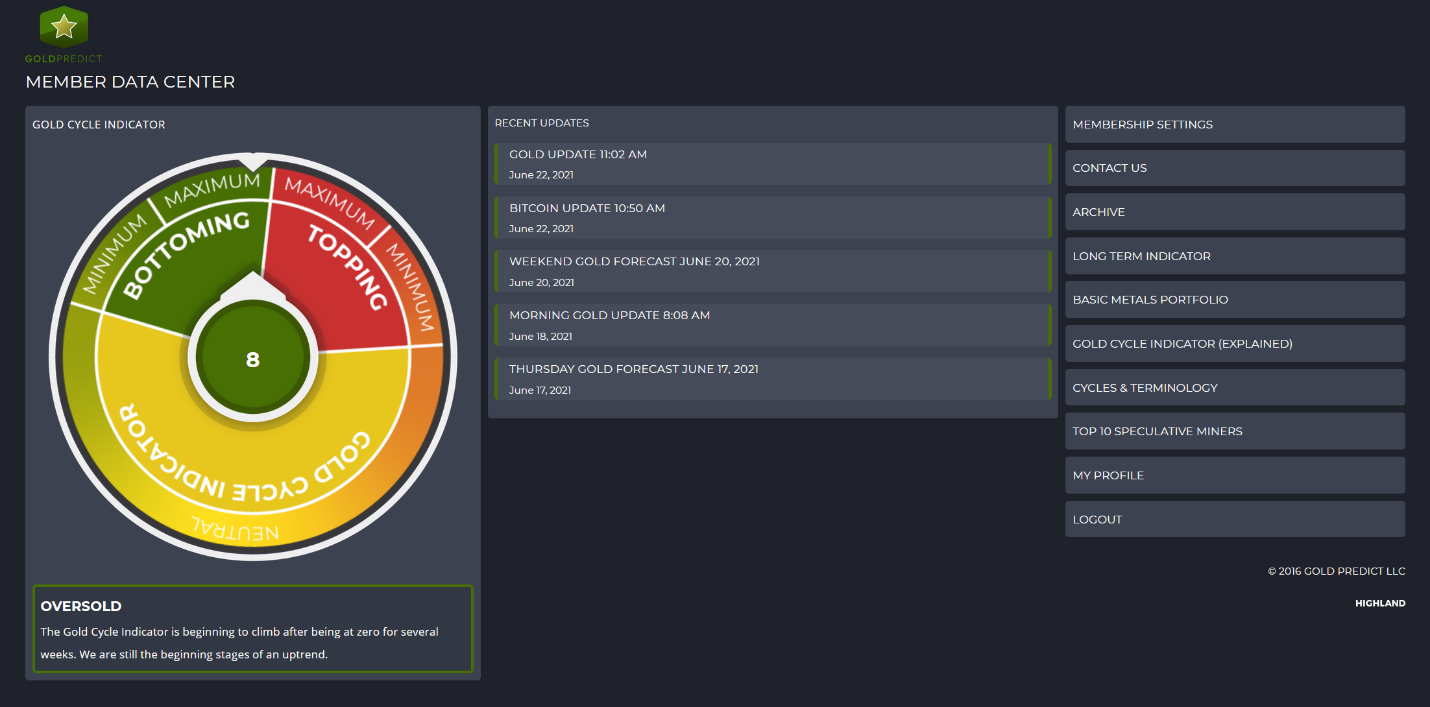

Our Gold Cycle Indicator finished at eight (8). If it sinks below zero, I will put the available funds to work in the Premium Metals Portfolio.

Gold Daily

Gold prices formed a bullish engulfing candle on Monday. Prices need a strong close above $1800 to support a possible bottom. A continued breakdown below $1750 would promote a retest of the March lows and potentially lower.

Silver Daily

Silver prices are constructing a multi-month ascending triangle. Silver needs to hold support near $25.00 to maintain the structure. The pattern continues to favor an upside breakout above $30.00. On the bearish side, silver prices would have to break below $22.00 to recommend a more profound correction back towards support surrounding $19.00.

Platinum

Platinum prices formed a swing low after testing support surrounding $1040. I'd like to see progressive closes back above $1100 to recommend a bottom. Otherwise, a continued breakdown below $1000 would support a drop back towards $800.

GDX

Gold miners are trying to hold support surrounding $34.00. It would take a daily close above $35.10 to form a swing low. However, to recommend a bottom, I would need to see a decisive close above $37.00.

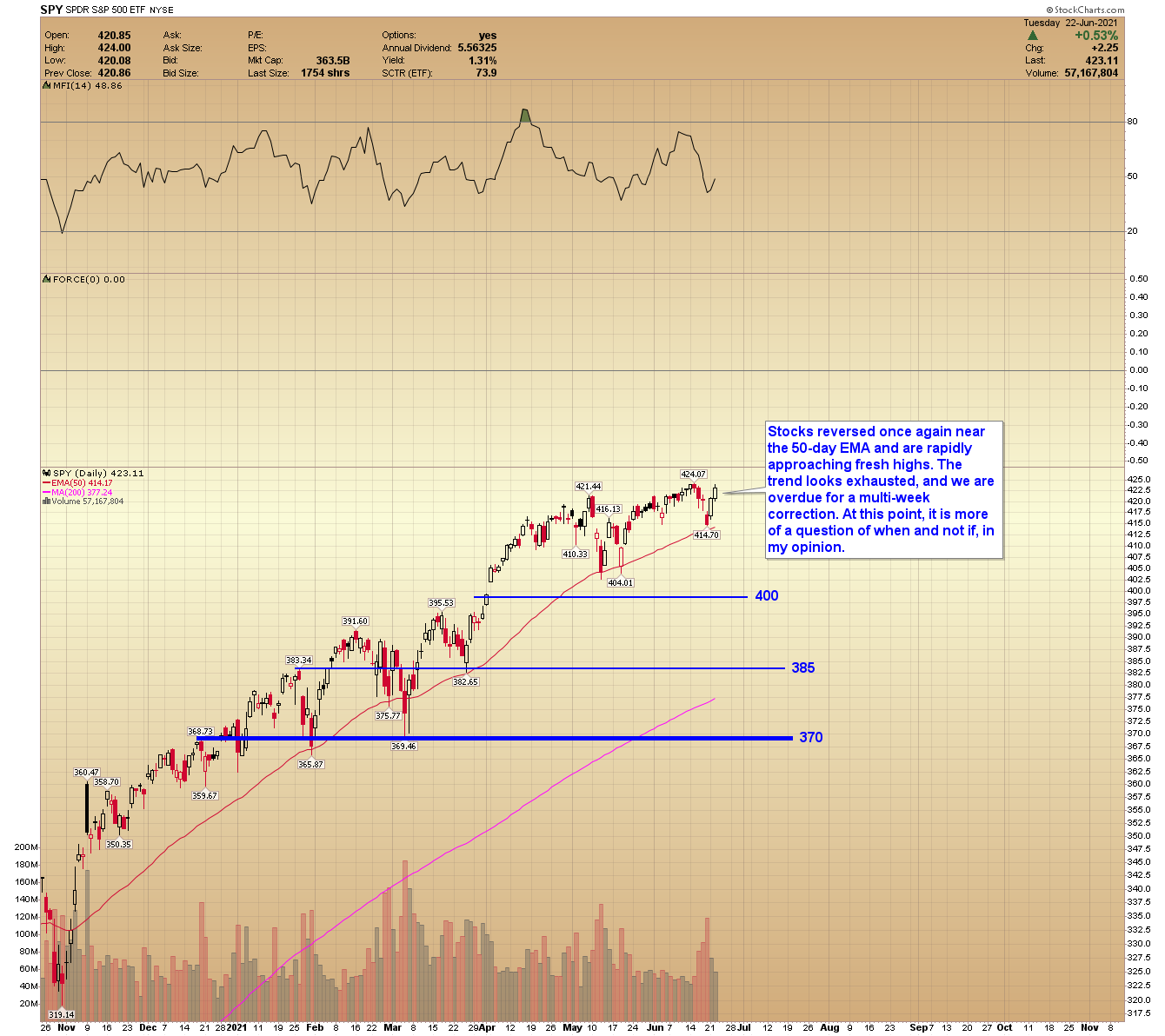

SPY

Stocks reversed once again near the 50-day EMA and are rapidly approaching fresh highs. The trend looks exhausted, and we are overdue for a multi-week correction. At this point, it is more of a question of when and not if, in my opinion.

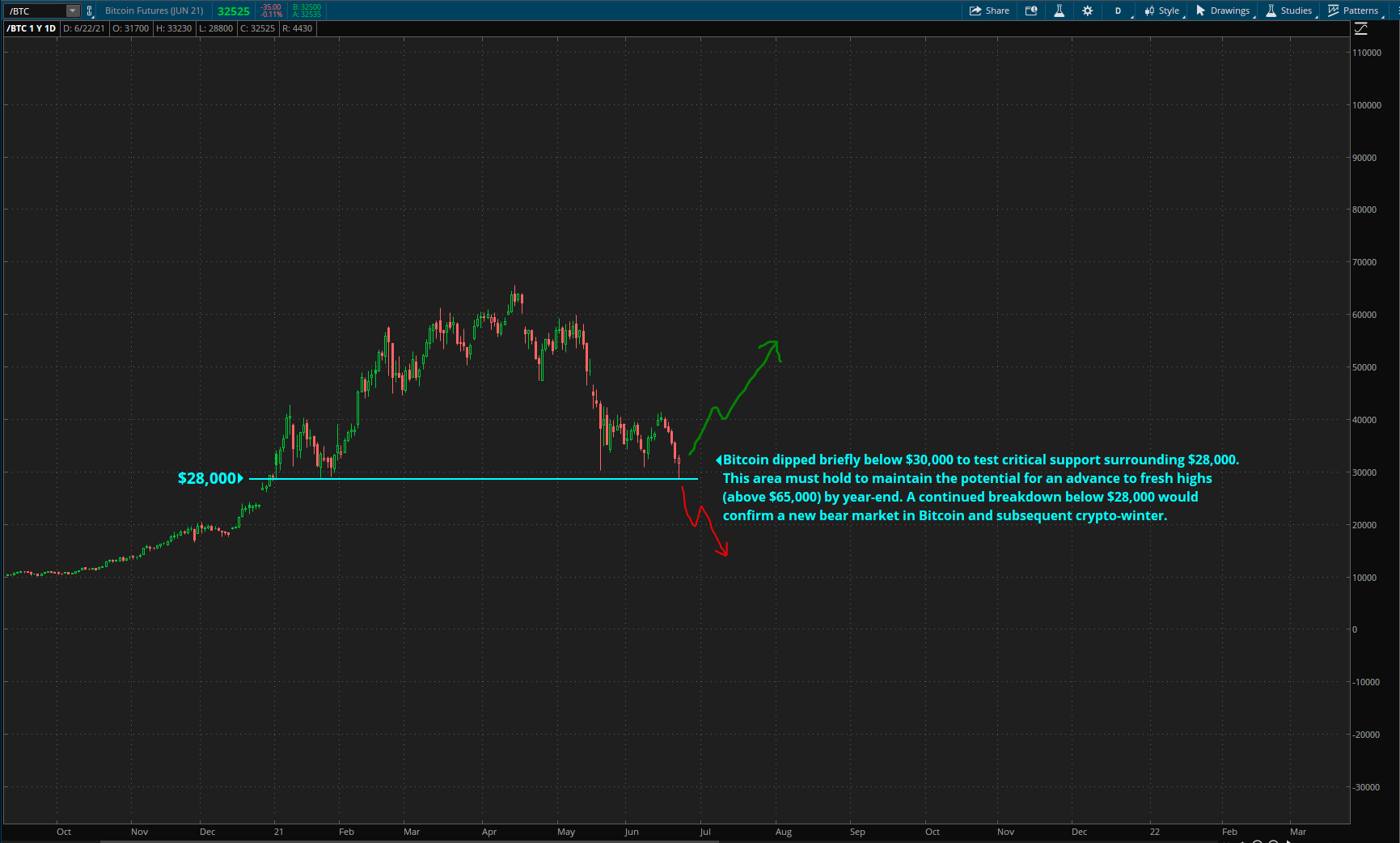

Bitcoin Daily Chart

Bitcoin prices dipped briefly below $30,000 to test critical support surrounding $28,000. This area must hold to maintain the potential for an advance to fresh highs (above $65,000) by year-end. A continued breakdown below $28,000 would confirm a new bear market in Bitcoin and subsequent crypto-winter.

My Bitcoin analysis still supports one final rally towards $90,000 by year-end, but the crackdown in China and brewing regulatory pressures in the U.S. may prove overwhelming. Prices must hold $28,000.

********