Gold Forecast: Stocks – An Albatross Around Gold’s Neck

Looking at the latest results of precious metals, it’s hard to cast out the impression that stocks are like a ball and chain for gold. Should we expect a repeat of the 2013 slide?

Looking at the latest results of precious metals, it’s hard to cast out the impression that stocks are like a ball and chain for gold. Should we expect a repeat of the 2013 slide?

In today’s analysis, I would like to draw your attention to something that’s extremely important but that might be hidden in plain sight.

It’s the way gold stocks perform relative to gold. More precisely, how they fail to perform.

This is an important sign, and I have written about it on multiple occasions. However, what might not be obvious is that the implications of the relative strength or lack thereof are exponentially more important if the same indication is repeated over and over again. At some point, the day-to-day weakness becomes a medium-term trend, and that’s when it becomes really meaningful.

Gold and silver are currently more or less where they were trading about two years ago (before the final part of the mid-2020 rally).

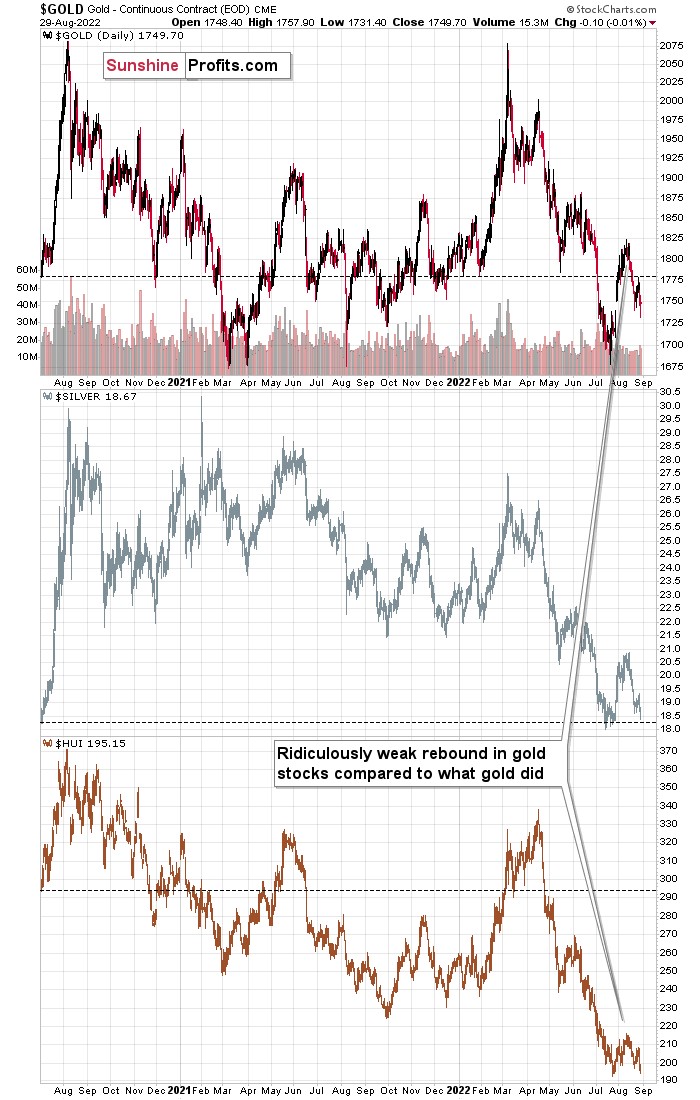

What about gold stocks? The HUI Index would have to rally by almost 50% in order to get back to those analogous price levels!

Gold stocks usually lead gold higher and lower (there are some short-term exceptions, but they are not really applicable right now), and there’s no doubt that miners currently lead gold lower.

Please consider the size of the recent corrective upswing in gold, then in silver, and next, please look at how “much” gold stocks rallied.

Laughable, isn’t it?

Not only that – gold stocks already gave away almost the entire rally, even though gold is only about halfway down.

If you think that this is extremely bearish, then… Of course, you’re right. However, the situation is actually even more extreme than that.

You see, that’s the same thing we saw on the precious metals market in 2013, right before the biggest part of the slide!

While gold was still in a medium-term horizontal trading pattern, gold stocks were already in a medium-term downtrend – just like what we see right now and what we’ve been seeing in the previous months.

Yes, the profits on our short positions increased once again yesterday, but the above tells us that it’s small potatoes compared to what’s to come. As always, I can’t make any guarantees with regard to price moves or profitability. However, I do think that the upcoming slide will truly be epic. Ever wanted to get back in time and not miss the profits on the 2008 and 2013 declines? Time travel is not yet included in our services, but the current slide is – in my opinion – the next best way to fulfill this wish.

If you can’t or don’t want to profit from declining mining stock prices, I also have good news. Please keep in mind that the decline is not likely to last forever. Based on how the precious metals sector declined in 2008 and 2013, and based on multiple other indications, it seems that we’ll see a major bottom this year. While higher prices are encouraging, please note that there are two moments that determine a given trade’s or investment’s profitability – it’s not just the exit price, but also the entry price.

Thanks to declines and lower prices, one can get in at much lower levels and thus greatly increase the profits (again, I’m not guaranteeing any profits or market performance – nobody can guarantee it) from the entire huge rally that’s likely to take place in the following years.

The “mother of all buying opportunities” in the precious metals sector is likely not here yet, but it’s likely to present itself in the not-too-distant future. Stay tuned!

If you’d like to get follow-ups to my analyses, and also get at 7-day free, no-obligation access to my premium service, I encourage to sign up to my free gold mailing list – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*******

Przemyslaw Radomski,

Przemyslaw Radomski,