Gold Forecast: Want to Take Advantage of Declines? Keep an Eye on Gold Stocks

Very little happened in the precious metals sector yesterday, and practically everything that I wrote yesterday and in Monday’s flagship analysis remains up-to-date.

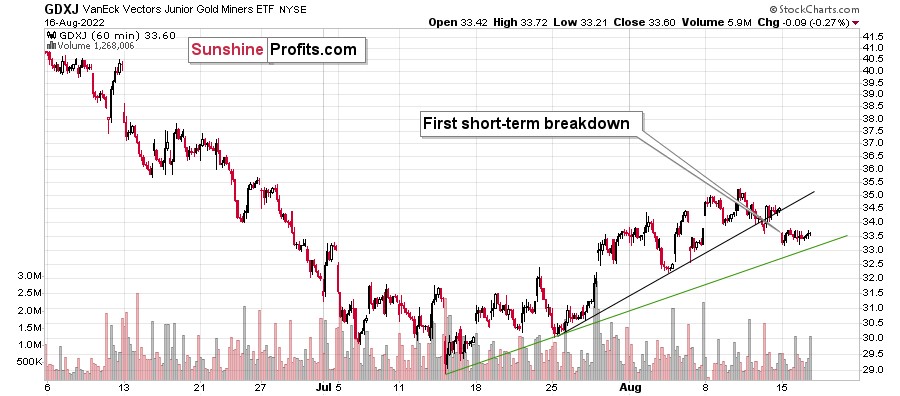

Let’s start with a quick update on the GDXJ’s very short-term chart.

Yesterday, I wrote the following:

Gold declined yesterday, and it did so in tune with what we saw in 2013. The back-and-forth trading continues, but we have some signs that it’s getting close to being over. In other words, it’s likely the case that we won’t have to wait for the decline to re-start much longer.

One of those signs comes from the very short-term GDXJ ETF chart.

Junior miners are after a breakdown below their rising black support line, and the move above the early-August high was clearly invalidated. This means that we saw two small sell signals.

Once the GDXJ declines below the rising, green support line, it will be a good indication that the next big move lower is already underway. Right now, it’s quite possible, but not very likely. In other words, if we see more back-and-forth movement this week, it would still be normal in light of the analogy to 2013 and it would not be something bullish.

Indeed, the junior miners’ ETF moved slightly lower, but overall it stayed between the two support lines. Once we see a breakdown below the green line, we’ll likely “know” (there are no certainties in any market) that the next big move lower has just started.

Gold and silver haven’t done much, and the USD Index declined a little.

This tiny decline is perfectly normal given the recent short-term breakout. It’s most likely just its verification. Consequently, my previous comments on the above chart remain up-to-date:

Another indication comes from the USD Index, which just moved above its declining red resistance line. It’s up by about 0.3 in today’s pre-market trading, which indicates that the move is likely to continue.

This fits the subtle clues coming from gold and junior miners – the top might already be in.

Even if it’s not, I think it remains a good idea to be well positioned to take advantage of lower prices in the precious metals sector, especially in the junior mining stocks.

One thing that I would like to add today is that the general stock market is approaching a combination of strong resistance levels.

One of them is provided by the all-important 61.8% Fibonacci retracement level based on the entire 2022 decline. The other is the declining resistance line based on the previous 2022 highs. These levels coincide just slightly above the current values of the S&P 500 index – at around 4,365 – implying that the S&P 500 index’s short-term upside is very limited.

The best (here: most bearish) thing about the above chart is not only the above. It’s also a fact that the precious metals sector has already stopped reacting to higher stock market values. Consequently, when stocks finally decline, it’s likely that they will contribute to lower PM values, but at the same time, if they keep rallying, it’s not necessarily likely to make PMs move higher.

This is just one of the factors that creates a great risk-to-reward situation for a short position in the precious metals sector, especially in junior mining stocks. As a quick reminder, the prices of junior miners are more correlated with other stocks than the rest of the precious metals sector.

Summary

Summing up, it seems that the corrective upswing is over (or close to being over), which means that the powerful medium-term downtrend can now resume.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,