Gold: Is It Different This Time?

As if the world economy isn’t fragile enough, it appears that we are on the brink of a trade and currency war, compounded by a protectionist reversal of globalisation that could sink the dollar which already has lost its traditional safe haven appeal. As the United States inflames relations with China and Japan, it risks a retaliation that could cause fearful investors to dump dollars and seek refuge in yen, euros and gold. Stock markets around the world plunged on fears of an old fashioned “tit-for-tat” trade war, evoking dark memories of the Smoot-Howley Tariff Act of 1930 that exacerbated the Great Depression, when global trade collapsed under a 40 percent duty increase. Ironically that disaster was the genesis for more liberalized trade,with America one of the chief architects. Yet politicians never seem to learn from history.

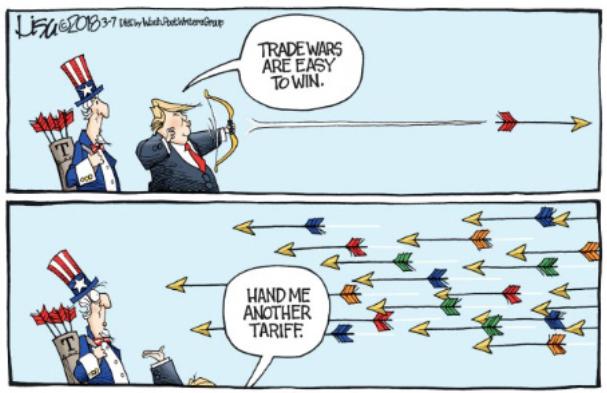

Start with trade, in 2002 President Bush slapped a 30 percent tariff on steel imports, causing the market to drop 30 percent sending the US dollar lower but only 21 months later, reversed those tariffs to avoid a trade war with Japan and Europe. Today, although the US imports four times as much steel as they export, Trump called for a trade war, declaring them “easy to win” and then imposed a global tariff on steel and aluminum imports affecting some 100 countries. Ironically, China sends less than 2 percent of its steel to the US. Risky as well is the expected defensive reaction to America’s new found economic nationalism, in the form of a “beggar thy neighbour” stance where every country turns to protect their own national interest. The omens are bad. History shows that trade wars are bad and impossible to win.

Of concern is that this confluence of events echoes the blunders of the 1930s. And, with inflationary pressures already stalking the market, we believe the trade moves will further fan the inflationary fires, increasing a growing trade deficit. This move on tariffs has already triggered the resignation of Trump’s economic czar, Gary Cohn who thought the levies would kill jobs, blunt economic growth and further marginalize the United States. And with the firing of Tillerson, Trump’s anti-trade advisors are on the ascendance, undermining the very rules-based trading system America helped create over seventy years ago.

American Economic Hegemony Is Changing

Yet the market thinks it is different this time. At the core of this argument is a basic misunderstanding of the role of trade. There is no zero-sum equation. Currencies are the key and the supply is controlled by the cartel of central banks. In the US, the Fed controls the supply of dollars. Recently the US dollar has slipped on concerns that Trump’s budget and trade policies would add up to a weaker greenback and change in an American world order. Moreover, Trump is set to become the biggest spender since the Depression.

In the Sixties, President Johnson introduced deficit spending to finance his Great Society program as well as pay for the Vietnam War. Yet, US debt to GDP was only 30 percent then and America was a creditor nation. However, that bout of money printing caused the Great Inflation which flirted with hyperinflation until Fed Chairman Paul Volcker drastically cut back money supply, sending interest rates to double digit levels. In the Eighties, Ronald Reagan introduced the Tax Reform Act of 1986, which saw supply-siders predict tax cuts would stimulate growth. Instead inflation soared and the US dollar collapsed as foreign lenders realized Mr. Reagan was debasing the very currency they held. In 1988, the Plaza Accord was signed, which devalued the dollar to reduce America’s current account deficit. Ironically, only two years later Japan emerged even stronger, giving way to the Louvre Accord to halt a subsequent 40 percent slide in the dollar.

Gold, the classic hedge against inflation, was the best performing asset, increasing 1,500 percent in a 20-year run from $32 an ounce to over $500 an ounce. Today, what is different is that the debt burdens are much higher with debt to US GDP over 100 percent and, America’s spending is much higher. The common denominator of then and today? The persistent rise in the supply of money. It is not so different this time. Gold is set for its next bull run.

China Has Many Levers to Pull

Importantly, there appears to be a sea-change in the relationship between Washington and Beijing. Washington views China as a “strategic competitor” citing China’s exports and trade policy as threats to America’s economic future. This change has several ominous dimensions. Tariffs was America’s first volley as the White House hopes to cut the annual trade deficit by $100 billion by slapping a whopping $60 billion of tariffs on Chinese goods. China’s initial response to the salvo was levying only $3 billion of tariffs on American imports. So it begins. China also offered to loosen investment rules and purchase American semi-conductors, even after US blocked earlier moves. Yet China has many levers to pull.

First is financial. China is the world’s largest external holder of US debt holding some $3.1 trillion of foreign exchange reserves with more than $1 trillion in US debt despite selling in December and January. China’s large US treasury holding is only one of the levers and the People’s Bank of China (PBOC) has already been publicly quoted as seeking alternatives to the dollar. China is the world’s largest oil importer and has swapped oil for gold, becoming the world’s largest trader in physical gold. China has even begun trading in oil futures in another step towards more financial independence from the dollar.

Second, China is the world largest exporter and the slapping of some $60 billion of tariffs on Chinese products could see wider and more damaging Chinese tariffs on Boeing airplanes, Harley Davidsons, American wine, soybeans or wheat. Consumer electronics, such as Apple products to which American consumers have developed a voracious appetite, unwittingly would become more expensive in a “tit for tat” war, as well as face a potential Chinese boycott on US goods.

Third, China has internationalized the renminbi and purchased gold with its mammoth reserves to lessen the dollar’s hegemony. For over a century, Britain led global trade until its economy was devastated by World War I and eventually became so weak financially that they were forced to abandon the gold standard, causing the American dollar to replace Britain’s pound. Ironically, the US too was forced to end the dollar’s linkage to gold in 1971 under the financial strain of the Vietnam War and Lyndon Johnson's Great Society. Subsequently, the dollar became a fiat currency allowing the US to accumulate debt on a horrific scale. In fact, the Federal Reserve deserves a share of the blame since its inflationary policies have priced out American goods from global trade, resulting in the trade deficits that so angers Mr. Trump.

China is The Lender of Last Resort

From multi-billion bond-buying programs, to supply side economics, to negative rates, to fighting two wars with deficit spending, to trillion dollar tax cuts, the Fed experimented with extreme Keynesian measures to keep the economy going, only to rack up more debt. By debt financing its deficits, the United States has become the world’s largest debtor with an astonishing $21 trillion in debt, doubling since the Fed began its QE experiment ten years ago. America itself is a bubble, particularly disturbing to those countries who are creditors of the United States. With America mired in deficits and the dollar losing influence, we believe a new monetary regime is in the making, primarily because China, the world’s largest creditor has become the lender of last resort.

Looking to China though is problematic. Not only is China considered a strategic economic rival, but lately the United States has restricted Chinese investments and technology, vetoing the purchase of a small stock exchange and a semiconductor testing company and of course, firing the first shot in a potential trade war. The dilemma for America is how to safeguard domestic industries, court Chinese investments and trade with Beijing at the same time. Mr. Trump has already taken a hardline stance, undermining the rules based system in which America was one of the key architects. Meantime, the Chinese government takeover of indebted Anbang sees the Chinese now owning chunks of American real estate. Other conglomerates like Dalian Wanda, HNA and Fosun also own chunks of US businesses. While hotels are not strategic, the growth of protectionism and the escalating risk of a protectionist trade war with the United States makes the task of financing America’s prolificacy increasingly difficult. Is it different this time?

How Will America Fund Its Deficits?

America’s economic hegemony is undermined by its growing deficits and debt load. The overvalued dollar and this huge mountain of debt is one of the most vulnerable pillars of global stability and America’s Achilles’ heel. Wikipedia says that, “hyperinflation occurs when a country experiences very high and usually accelerating rates of inflation, rapidly eroding the real value of currency….. hyperinflation sees a rapid and continuing increase in nominal prices, the nominal cost of goods and in the supply of money”. Since 2008, money supply has increased at 6 percent whilst US GDP has only grown by 1.42 percent. So much money, so few results. So far the imbalance between the supply and demand for money has shown up in the stock market, hard assets and classic cars, as too much money chased too few goods.

However, in the last few months, labor markets have tightened, inflation has burst through the two percent level and commodities are at five-year highs. At this time, the central banks should be tightening. The dilemma for central bankers is that they have piled up a mountain of high-powered money reserves whilst their governments have racked up more deficits and debt. A core principle it seems is that there is no restriction to debt issuances. Price or interest rates seem to the key. Amid the recent pickup in activity and velocity, Mr. Trump has added to the problem with self-inflicted wounds, from trillion dollar tax cuts to very expensive infrastructure plans made more expensive by his tariffs. Further, his ill-suited trade policies could spark a trade war, which would have inflationary implications. Perhaps the self described “king of debt”, with a decades long real estate background, push for an inflationary agenda, is really a mechanism to ease America’s debt burden.

In the interim, someone must lend America the money to fill their outsized deficit gap. More money printing? Unlikely given the market vigilantes. America is to discover that it will be increasingly difficult to attract flows of the magnitude needed, particularly when Trump erects more trade barriers on its creditors who have financed over half of its debts.

What Are Friends For?

At one time, economists envisioned that Asia and the Americas would one day join in a single deal so large that would span the globe. That dream is still a dream but it appears that there are now competing visions between the West and the East with the likelihood of Asia replacing the US-led global economic order. There is nothing dreamy about Donald Trump in making “America first”. Trump’s erection of trade barriers is based upon a belief that competition will be won by winning a bilateral trade fight that he has already lost, mainly because of America’s propensity to consume more than they produce.

China has become a rising economic superpower with a huge savings surplus and in Trump’s words, a “strategic competitor”. However in scrapping America’s long-standing commitment to liberal trade and globalism under Trumponomics, China has displaced it in importance, cementing deals with many of America’s trading partners with the result being a dramatic increase in China-led export growth. China has emerged as the global trading engine and the world’s largest exporter, necessary to keep the economy of 1.4 billion people growing.

In reshaping its institutions, mercantilist China is enjoying a growing economy allowing it to spread its wealth and influence, rebuild its military strength and unlike the West, possess a single-minded and now, leadership for life. China is even needed to reverse North Korea’s nuclear programme. Notwithstanding the US imposition of tariffs, China’s reaction has been fairly muted, even possibly strategic. That is unlikely to last. Trump’s broadside firing at China’s steel industry missed its mark with collateral damage to trading partners, Canada and Brazil who are the largest exporter of steel to the US. China stopped shipping to the US for that very reason. Moreover while the Trump administration is eyeing limits on Chinese investments, a trading relationship worth some $630 billion is at risk and no one will emerge unscathed. In fact, as Canada discovered, everyone suffers.

The Chinese have been adept at capitalizing on the vacuum created. For example, the 11 nation Trans-Pacific Trade deal (TPP) which was conceived and constructed by the United States and quickly scrapped by Trump, will reshape trade in the East, without America’s input. China’s leader, President Xi created the Asian International Infrastructure Bank (AIIB), that rivals the World Bank. Rather than bailout the entire financial infrastructure as the US did during the subprime crisis in 2008, Beijing seized control of Anbang and arrested its Chairman, which once held assets of $310 billion (no executive was jailed after the 2008Wall Street collapse). And while Obama and Trump were trading barbs, China unveiled the $1 trillion One Belt, One Road initiative linking some 70 countries with rails, bridges and roads from China to Africa to Europe and even Latin America. This geopolitical initiative is many times larger than the Marshall Plan created over seventy years ago to revive Europe’s war ravaged economies that cemented America's global influence. Citigroup, HSBC and Standard Chartered lined up for a piece of the action despite lukewarm support from the West.

Is it Different This Time?

While this president has blown up the federal debt with trillion dollar deficits, scrapped trade agreements and left his party behind on gun control and free trade, once the sacred cows of his Republican party, how can Mr. Trump finance his “America First” agenda?

We are at crossroads. Inflation embers are aglow, the US has turned more protectionist, Brexit threatens Europe, Italy the world’s largest eighth economy is beset by populism, and an Italian exit from the EU looms. In the Middle East, the Iran nuclear deal may be scrapped. America’s debt chickens are coming home to roost and a buyer’s strike of US debt is in the offing. We are now at the beginning of the end of the long bull run and the beginning of an inflationary storm that will not end well.

Although we are a long way from the “Dirty Thirties”, we believe that recent events will teach foreign investors that there is no longer easy money to make by shipping funds by the boatload to the world of Wall Street and leave them in the hands of their particularly discredited practitioners. America’s deficits can no longer be financed by this inflow of funds. We have been here before.

We thus believe gold will continue to rise in value as long as Americans are unwilling to boost savings, consume more than they produce and expect others to finance their current account and trade deficits. Ironically, this president is good for gold. Gold will be a good thing to have while so much fear stalks the world. We continue to expect gold to reach $2,200 an ounce within 18 months. In the near term, $1,375 remains resistance.

Recommendations

Agnico Eagle Mines

Agnico Eagle had a strong quarter and boosted its production guidance this year to 1.53 million ounces, with solid contributions from Canadian Malartic, Meadowbank and Meliadine which is ahead of schedule and will pour gold in 2019. Agnico will produce 1.7 million ounces in 2019. Agnico boosted reserves at Kittilä, in Finland and was one of the few producers to replace reserves. Agnico has a production target of 2 million ounces in 2020. The increase in guidance was positive and Agnico’s board has also given approval to spend almost $250 million at Kittilä which is the largest expenditure for a gold mine in Finland. Kittilä’s production base is between 250,000 and 275,000 ounces. The company will spend a little under $1.1 billion this year on Kittilä, Amaruq and Meliadine but this should drop off with the build-out. While Agnico boosted reserves by 3 percent, grade improved by 8 percent. We like Agnico shares for its growing production and reserve growth profile.

Barrick Gold Corporation

Barrick Gold, the house that the late Peter Munk built, had a strong quarter despite the street focusing on the declining production profile due to asset sales and problems at 64 percent owned Acacia in Tanzania. Production last year was 5.3 million ounces well within Barrick's guidance, but output will fall to 4.5 million ounces with AISC under $800 an ounce this year. Free cash flow was almost $700 million. As promised, the company reduced debt by another $1.5 billion and will easily meet its goal of around $5 billion by the end of this year. Barrick has restored its balance sheet with some $2.2 billion in cash and cash equivalents and an undrawn $4 billion credit facility.

Importantly, Barrick added eight million ounces of new reserves primarily at Turquoise Ridge in Nevada. Barrick's investment in digital increased in the quarter with Data Fabric tasked to computerize or digitize Barrick’s entire operations to reduce costs. Longer-term, Barrick's growth will come from the 65 million in-situ ounces of which, Gold Rush, Cortez Deep South and Turquoise Ridge’s third shaft in Nevada will be exploited. Turquoise Ridge has been in operation for all but two years since 1989 and reserves keep growing. Barrick was also able to offload Cerro Casales to Goldcorp, which is now responsible for the heavy financial lifting. In Argentina, Lagunas Norte, Veladero and Pierina are in a joint venture with Chinese Shandong Gold and both are looking for ways to expand, particularly Pascua Lama. Chairman John Thornton emphasized that Barrick would not grow by acquisitions having learned that past acquisitions often resulted in multimillion dollar write-downs. Organic growth is the key and Barrick's 65 million ounces of in situ reserves are its lifeblood. We continue to favour Barrick for the world’s largest in-situ reserves, astute management and quality assets.

Centerra Gold Inc.

Centerra Gold reported $300 million of free cash flow from Kumtor in the Krgyz Republic and Mount Milligan in BC, which produced about $127 million of positive cash flow despite a water problem that shutdown the mill. Nonetheless, Centerra produced 785,000 ounces in the year at an all in cost of $700 an ounce. Water remains a problem at Mount Milligan although the second ball mill was restarted and local wells will help. Centerra also has a pipeline of projects including Oksut in Turkey and the Kemess Underground which has a healthy capex bill. Of interest is that the recent pick-up in molybdenum prices focused attention on former moly producer Endako which is on care and maintenance. Hold.

Centamin PLC

Centamin’s Sukari mine in Egypt has been in production since 2009, had another strong year. Centamin is returning 100 percent of free cash flow to shareholders and the company mined 1.14 million tonnes of ore at a grade of 7.2 gram per tonne which was above guidance for both tonnage and grade. Centamin will spend about $110 million on the tailings storage facility as well as a secondary crusher, which will allow it to boost output. Cost control is a key here and Centamin’s balance sheet is rock solid. Centamin has $400 million in the bank and generated almost $700 million in revenue with operating costs of only $330 million. Sukari is a cash flow machine. Surprisingly the Egyptian government takes about 30 percent and Centamin has been able to operate in this part of the world without incident. Sukari has almost a 13 million ounce resource so the company will be there for a while. Centamin is also exploring in West Africa, Burkina Faso and the Ivory Coast where they have some 4500 km² and a further 2500 km under application. We like the shares here, despite the political risk.

Kirkland Lake Gold Ltd.

Kirkland had a very strong quarter producing 596,000 ounces, up from earlier guidance. Fosterville in Australia was a key driver with reserves now totaling 1.7 million ounces at a whopping grade of 23 g per tonne. Fosterville is a high grade, low cost mine, which Kirkland astutely turned around. Kirkland also has a strong balance sheet with $232 million in cash and is debt-free, having repurchased its debentures. Guidance for this year is over 620,000 ounces at AISC between $750 and $800 an ounce. Kirkland Lake was able to boost overall resources to 4.4 million ounces at just over 11g per tonne, with the bulk coming from Fosterville. Looking ahead, Macassa in Ontario is being deepened again and will produce 194,000 ounces, up from a year ago. The shares are a hold here.

Iamgold Corporation

Iamgold has four operating gold mines and had a strong year from Rosebel in Suriname. Rosebel produced 300,000 ounces last year and satellite deposits are to be sent to Rosebel’s facilities. Saramacca was a significant discovery and an initial reserve estimate is planned later this year with a possible production start a year later. Iamgold also benefited from a strong year from Essakane in Burkina Faso. Westwood in Quebec produced 25,000 ounces. A plus for Iamgold was the offloading of a portion of problem-prone Côté Gold to Sumitomo of Japan in a joint venture allowing Côte’s ounces to be brought onto Iamgold’s balance sheet. We still think much work has to be done, particularly drilling to verify ounces. We prefer B2Gold.

McEwen Mining Inc.

McEwen Mining had a good quarter unveiling plans for the recent Black Fox acquisition. Also, the uptick in copper prices improved the economics of the Los Azules copper project in Argentina which has a new Preliminary Economic Assessment (PEA) revealing a long life, short payback and low-cost operation. McEwen is building the Gold Bar mine in Nevada which costs about $68 million and will be funded from cash flow, equipment financing, equity and debt. Gold Bar will help McEwen reach its 200,000 ounces target starting in 2019. At Timmins, McEwen plans to spend $5 million for development and about $10 million in exploration. Currently there are 10 drill rigs at Black Fox which is more of an exploration than production project. Black Fox will replace declining production at El Gallo in Mexico where nearby deposits are to be mined at El Gallo’s facilities. Similarly, McEwen plans to ship ore from subsidiary Lexam VG to be processed at the Black Fox facilities which is operating at less than 50 percent capacity. We like the shares here.

Newmont Gold Corporation

Newmont had a solid quarter with improving free cash flow and increased its dividend. Newmont increased production with contributions from Merian and Long Canyon. Like Barrick, Newmont has a solid production base in Nevada and Australia. In Peru, the company is still developing the Yanacocha sulfide project. Newmont also is working with Continental Gold, a high grade gold project in Columbia. Newmont’s balance sheet is strong with total liquidity of $6.2 billion and no debt maturities until 2019. More than 70 percent of Newmont's production is located in the United States and Australia. Near-term production is expected from Northwest Exodus and the Twin Underground in Nevada. Importantly Newmont replaced depleting ounces last year. The shares are a hold here.

New Gold Inc.

New Gold is an intermediate gold miner producing 430,000 ounces of gold last year and about 104 million pounds of copper. All in cost was $730 an ounce and within guidance. Rainy River achieved commercial production in October last year. Nonetheless Rainy River’s carrying value was lowered by almost $200 million. Rainy River is still in the teething stage and cash flow is tight. With Rainy River production build-out behind them, this will be an important year and output will offset declines at New Afton and Cerro San Pedro. At New Afton, gold production declined due to a planned decrease in grade and guidance was lowered. Cash is about $216 million. Total gold reserves stand at almost 14.8 million ounces. We prefer B2Gold here.

Yamana Gold Inc.

Yamana was fortunate to offload its stake in Brio to Leagold but holds 22 percent of the combined company. Yamana also benefitted from the start-up of Cerro Moro in Argentina, which will be a contributor later this year. Gualcamayo in Argentina will produce 110,000 ounces this year. Of concern is that a large portion of Yamana's remaining assets are non-producing and Yamana remains in a sell mode. El Penon in Chile stabilized as about 145,000 ounces a year. Canadian Malartic continues to perform well. At Jacobina in Brazil, production was 150,000 ounces. Nonetheless, we believe Yamana’s assets are not enough to support the $1.7 billion debt load. Sell.

John R. Ing