Gold Miners’ Extraordinary Slide and Opportunity

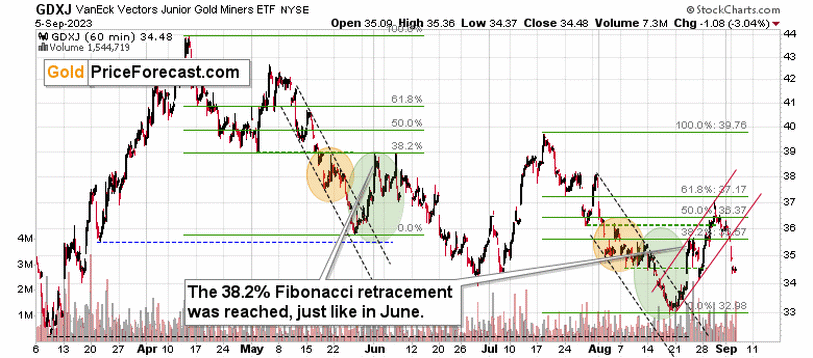

The breakdown below the rising trend channel was followed by a decline that was big enough to confirm it, even though it was just the second close below it.

That’s right, even though this important piece of news didn’t make it to the headlines, the breakdown below the rising trend channel actually materialized last week. Even though I’m normally not posting anything during U.S. market holidays, I posted a Labor Day Special in which (in addition to increasing the size of the short position) I wrote the following about GDXJ’s breakdown:

This is a bigger deal than it may seem at the first sight. This breakdown – if confirmed – will mean that the corrective upswing that started in late August is over. This, in turn, will mean that the huge downtrend has just resumed, and it will serve as the final chance for everyone to get out of their long positions and perhaps enter short ones. As it’s often the case, very few will notice while the signs are obvious, but the overall sentiment is still positive. And then they will change their mind after the big decline already takes place, thus missing it.

But you know.

Zooming out shows that yesterday’s decline was big enough to take junior mining stocks below their rising blue support line.

Previously, this breakdown was invalidated, but since we’re already after a corrective upswing, it seems that this time the slide can continue. And that’s not the most important indication pointing to this bearish gold forecast.

The key thing is…

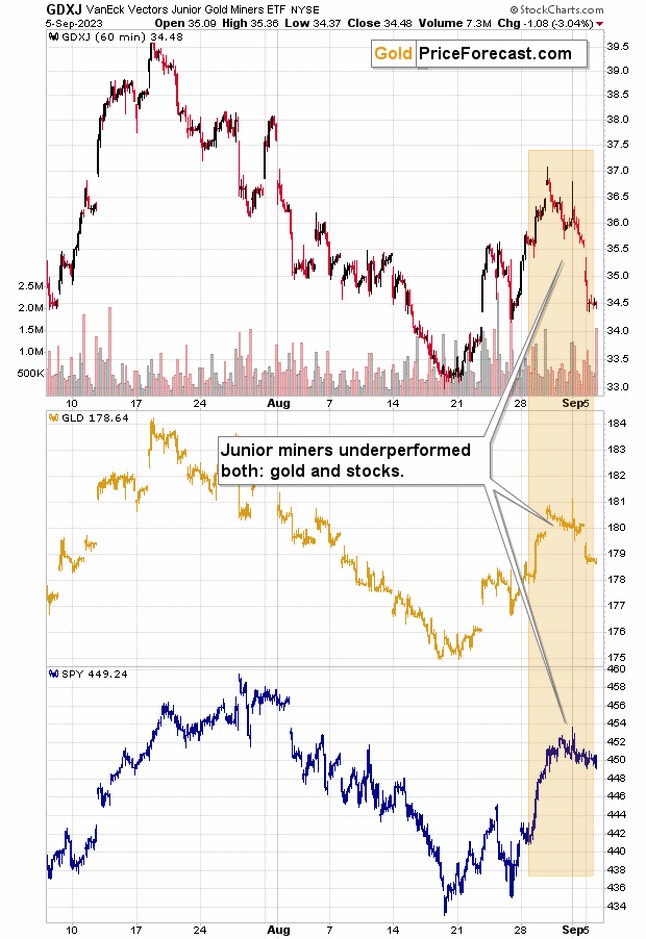

The key thing is that junior miners are so remarkably weak relative to both its drivers: gold and stocks!

The orange rectangle emphasizes just how severe this underperformance is. While both the GLD and SPY ETFs (proxy for gold and stocks, respectively) are up in the marked period, the GDXJ is down – and quite substantially so.

And when miners are so weak, lower – oftentimes much lower – prices follow. And this is the case not only with regard to miners, but also in case of the prices of underlying metals: gold and silver.

Will a correction in the USD Index save the day?

I wouldn’t count on that.

The USD Index just moved above its May highs, and even though the RSI is close to 70, I don’t see a decline from here as a likely outcome.

Why?

Because of the invalidation of the breakdown to new yearly lows that we saw in July. Back then, I wrote that this event was much more important than it seemed at first sight, and that the implications will be visible in the many weeks to come.

It’s true that the USD Index tends to reverse its course close to the turn of the month, but that already happened. We saw a small correction, and the USD Index rallied shortly thereafter.

Besides, given the importance of the above-mentioned invalidation, it’s likely that a much bigger rally is ahead, and when we saw one in 2021 and 2022, when RSI was in a similar position, we haven’t necessarily saw huge declines.

I marked two similar cases with red, dotted lines. Back in November 2021, it was actually a local top in gold and silver. And back in April 2022, a big, medium-term decline following in the precious metals sector, while the USD Index soared.

So, while I’m not saying that the RSI at 70 is bullish on its own (it isn’t), I am saying that in the current market juncture, it’s not necessarily a reason to be concerned, especially given many other factors and gold’s tendency to slide after the U.S. Labor Day.

Quoting my Monday’s Gold Trading Alert:

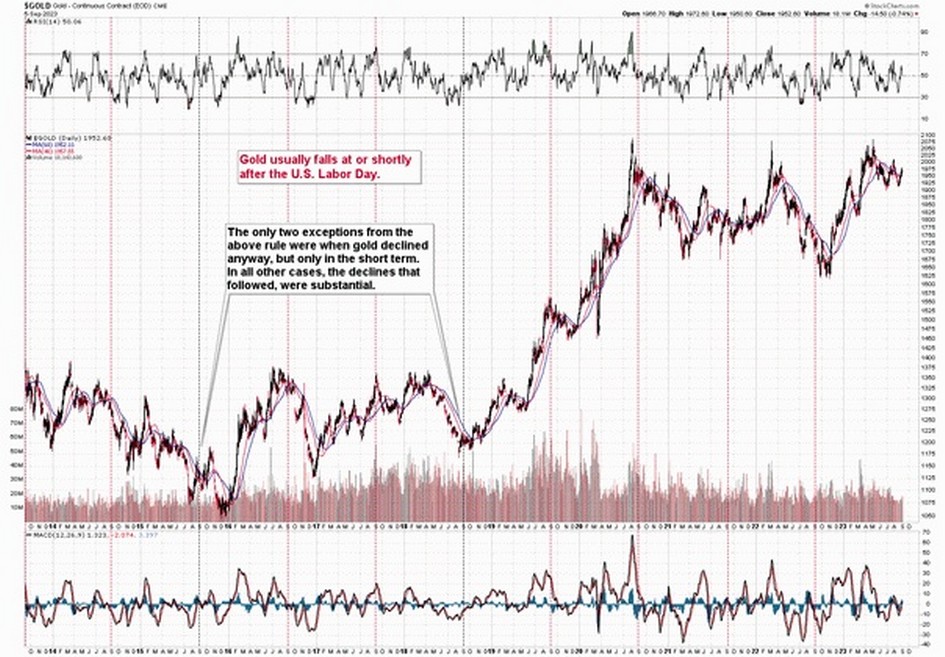

Here’s what gold tends to do after the U.S. Labor Days.

It almost always declines!

This pattern has been remarkably stable throughout the recent years, and the only two times when gold didn’t decline in a really visible manner after the U.S. Labor Day… Were times when it declined anyway, but not significantly so.

This kind of reliability of this simple tendency is outstanding especially given the fact that gold moved higher on average in the past decade – this means that it was much easier to catch bottoms than tops. And yet, this rule proved to be very useful.

So, what’s likely to happen? Junior miners are likely to slide, and our profits from the short position in them are likely to increase.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,