Gold Price Forecast – Gold Lessons From May 2008 And May Seasonality

History tends to repeat itself. And if not repeat, then at least rhyme. But it can’t be argued that examining what has happened and how it’s relevant to today, is valuable. After all, that’s what technical analysis is about.

We’ll focus on two key periods that relate to each other – the 2008 and 2020 ones. Precious metals have been rising as the stress in the 2008 financial system was reaching new highs, culminating with the Lehman moment. While the 2020 situation is different as we have a Great Lockdown and not yet a Much Greater Recession (we haven’t seen bank runs and only a handful circuit breakers were triggered so far this year…), gold has seen a quite a steep rise too. Will it be hiccup-free, or will we get a selloff just as in autumn 2008?

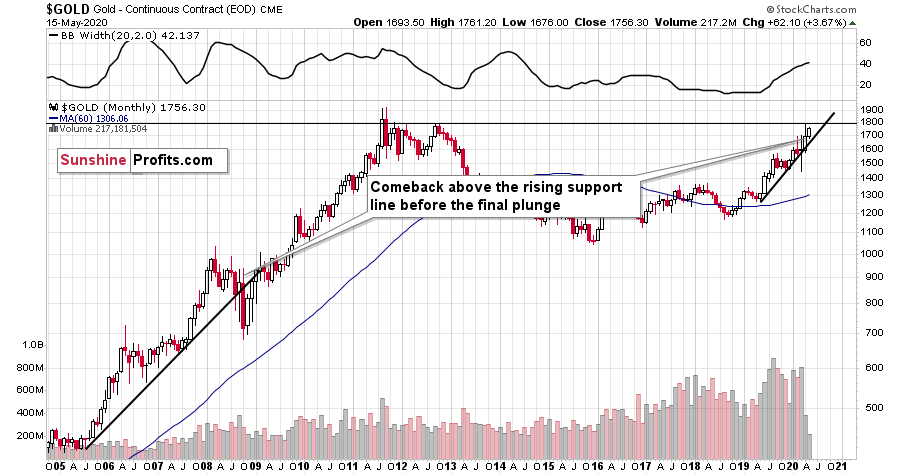

With that in mind, let’s take a look at the below monthly gold chart.

In 2008, after the initial plunge, and a – failed – intramonth attempt to move below the rising support line, gold came back above it and it closed the month there. The same happened in March 2020.

During the next month in 2008, gold rallied and closed visibly above the rising support line. The same was the case in April, 2020.

In the following month – the one analogous to May 2020 – gold initially moved higher, but then it plunged to new lows and finally closed the month below the rising support line. We might see something very similar this month. Today’s profound reversal in gold seems to confirm the above theory.

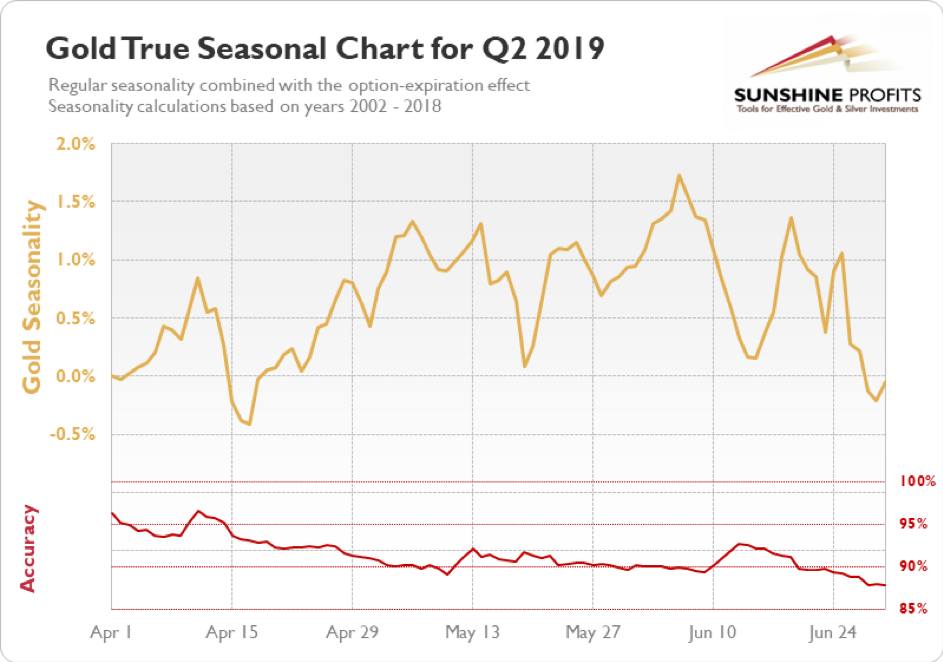

Speaking of this month in particular, let’s check how gold usually performs in May.

In short, gold usually tops in the first half of the month, and bottoms in its second half. Then, it recovers – but moves to new highs only in June. This more or less fits what we expect to see later this month and also this year.

Summary

Gold’s historical performance in 2008 and its May seasonality, bring important findings. Namely, that a gold plunge later this month wouldn’t be out of the ordinary. The yellow metal’s performance in spring 2008 and 2020 coupled with the seasonal tendency to decline in the latter half of this month, confirm that.

The following days are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the king of metals, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,