Gold Price Forecast - Another Day, Another Attempt To Break Higher

Responding to global risks and events, in most cases, precious metals are in a constant compulsion of the ever-fluctuating USD. After all, the U.S. Dollar is the currency that gold is priced in, and it is a market that will always continue to go back and forth with the USDX movements.

At times, the current precious metals market movements may seem slightly tedious. To tell you the truth, observed from a short-term perspective, they can be quite boring. Nevertheless, there are some important and rather interesting indications in this sideways movement.

Yesterday, I discussed gold's strength regarding the USD Index and the mining stocks' strength in relation to gold. Both of them were weak, which ultimately resulted in a bearish combination. So, have yesterday’s and today’s pre-market movements validated or invalidated these observations?

Long story short, they confirmed them. Despite its recent very short-term breakout, the USD Index moved lower, moving towards new short-term lows in the process.

So, how much have things changed as a result? Hardly anything changed. But, what matters the most is the breakout above the declining medium-term resistance line. More significant than it initially seemed, the post-breakout consolidation is still just that – a post-breakout consolidation, meaning that the USD Index will most likely rally significantly anyway.

However, if we consider the next few days, the USDX could move lower, perhaps as low as 92. This target presupposes that the pullback could take the classic zig-zag formation, where the two short-term declines are alike. The aforementioned is marked with dashed lines on the chart above.

Simultaneously, this would take the USDX close to its September lows, completing the process's broad bottom formation. Bear in mind that this final bottom would occur after the USD Index had already broken above the declining medium-term resistance line. That’s what increases the probability that this move lower would be the final part of the broad bottom and not the beginning of a new big slide.

Yes, the breakout above the declining short-term resistance line was just invalidated, and I am not entirely sure that the breakout above the medium-term resistance line will not be invalidated as well. But the resistance lines based on more profound price extremes and that have formed over a longer timespan are more important. Hence, just because the very short-term breakout failed to hold, that doesn’t mean that the breakout above the medium-term line will fail as well. Conversely, it’s a bullish factor that remains intact.

Now, the USD Index moved below its previous October lows. So, in response to the above, did the yellow metal moved above its October highs as well?

In short, it didn’t. Instead, it just made another attempt to break above the declining resistance line. If the US Index declines further, it might be successful in this attempt. But, I wouldn’t count on it too much. After all, the previous effort was invalidated relatively quickly.

Please bear in mind that the USD Index moved below its October lows only in today’s pre-market trading. It could be the case that it invalidates this small breakdown and rallies right away, thus triggering a decline in gold.

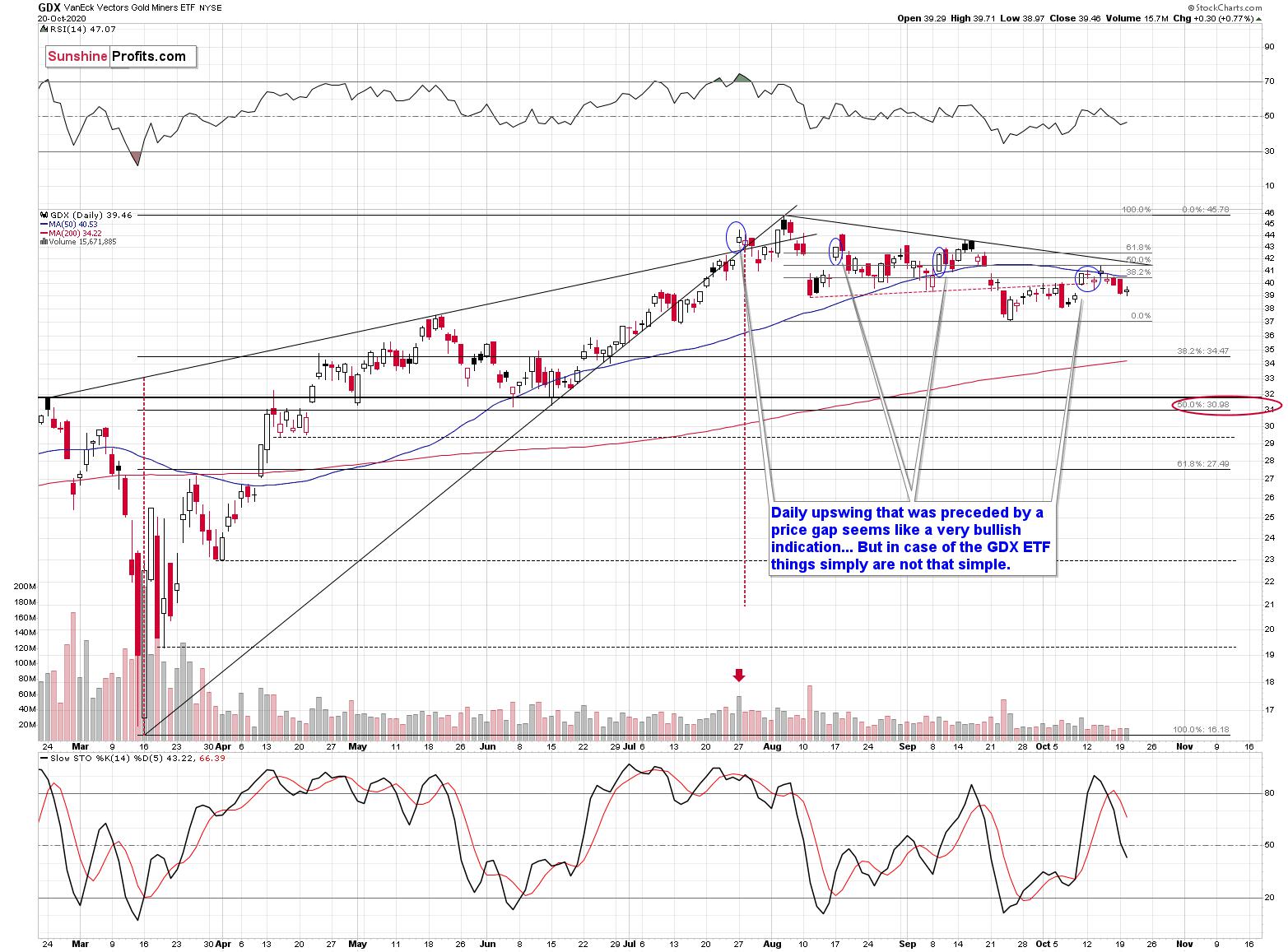

Right now, it seems that this is the outcome that mining stocks favor.

Looking at the miners alone, one wouldn’t probably say that they are moving higher this week.

Closing higher yesterday in a move higher by a mere $0.30 was hardly anything compared to the previous days’ decline and the gold upswing with the consequential USDX downswing.

In other words, we’ve witnessed yet another bearish confirmation from the miners, as they were weak once again.

This means that even if gold rallies due to the USD Index declines, miners’ upswing would probably be limited. On the other hand, if gold declines due to USD’s rally, miners will likely drop significantly. Let’s keep in mind that gold itself didn’t reinforce USDX’s bullish signals, but instead, it strengthened the bearish ones.

All in all, given the limited bullish and the sizable bearish potentials, from today’s point of view, the bearish outlook for the mining stocks continues to be justified. And if they are about to move lower, then gold is unlikely to be starting its next major upswing without declining first.

To sum things up, even though prices moved higher in previous months, the following weeks are possibly not the best time for jumping on the bullish bandwagon. As many times before, what’s profitable initially is rarely the thing that pays off in the long run. As silver often moves in close relation to the yellow metal, forecasting gold’s rally without a bigger decline first is likely to be misleading.

The times when gold is lastingly trading well above the 2011 highs will come again, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing, and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up for our FREE gold newsletter for daily updates. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,