Gold Price Forecast: Breakout? What Breakout?

In Wednesday's analysis, we wrote that we didn’t trust gold’s breakout above the November 2011 high and that we thought that it will be invalidated shortly. We didn’t have to wait for long. Gold invalidated this breakout several hours after we posted the above.

Invalidation of a major breakout is a major bearish development and a confirmation of the outlook that we outlined previously. In particular it indicates that gold has just topped or that it will top shortly. Quoting yesterday’s analysis:

Gold just moved to the November 2011 high and in today’s pre-market trading it even moved above it. The volume on which gold moved up last month was relatively small, which doesn’t support the bullish case, but a confirmed breakout above the November 2011 high would be an important technical development, nonetheless.

The key word here is “confirmed”. The November 2011 high was $1,804.40, and at the moment of writing these words, gold futures are trading at $1,805.15 – that’s less than $1 above the above-mentioned high.

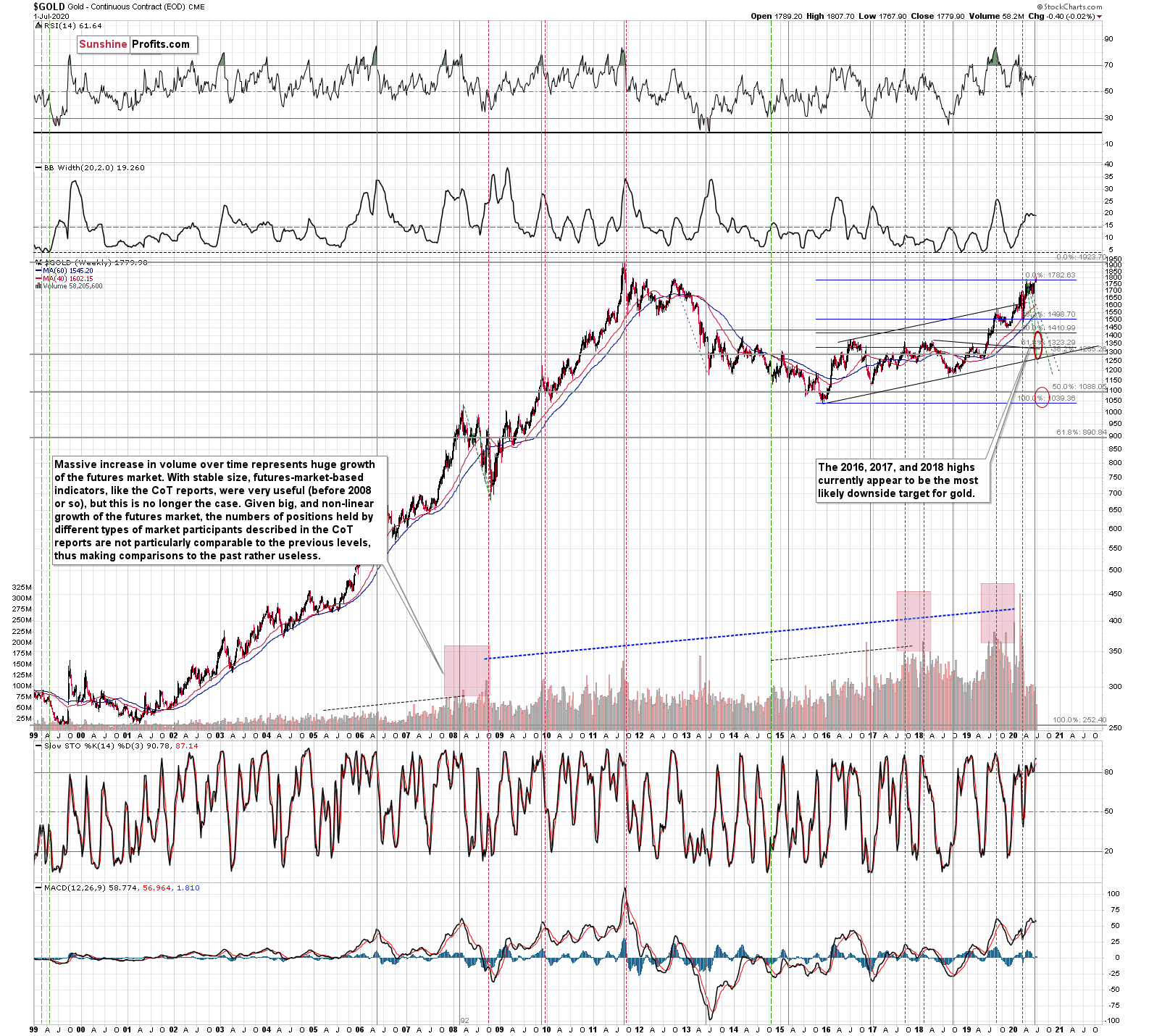

The way in which gold moved between 2012 and 2020 created a near-perfect cup from the cup-and-handle formation. Generally, the bigger the base, the stronger the move, and this time the base is huge. Still, the “handle” of the pattern is still missing, and it could take form of a volatile plunge. This would be in tune with how gold reacted to the first wave of coronavirus.

The breakout above the November 2011 high is far from being confirmed, and in our view it’s unlikely to be confirmed. Why?

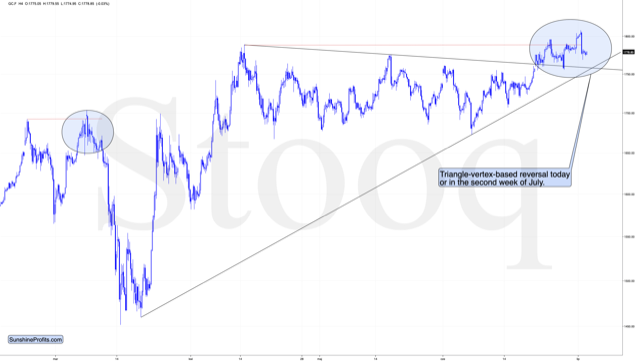

There are multiple reasons for it, but the most precise and technical ones are gold’s likelihood to reverse its direction based on the triangle-vertex-based reversal and the long-term cyclical turning point.

The resistance line, above which gold tried to break and the rising support line based on the March and June lows cross more or less in the first days of July. The triangle-vertex-based reversals have pointed to many important tops and bottoms in the recent weeks and months.

We previously wrote that the above-mentioned reversal might correspond to a bottom in gold, but as of today, it’s clear that if any reversal is to take place, it’s going to be a top, not a bottom, as gold’s most recent short-term move has been up.

Yesterday’s top took place very close to the reversal, but at the same time it was not reached precisely. Consequently, we wouldn’t be surprised to see one final pop up before the slide. This doesn’t have to take form of a move to or above yesterday’s high – it could be a smaller move up, just like the one that we saw in the first half of March – the final move higher on the right side of the area marked with a blue ellipse.

Let's keep in mind that gold's long-term turning point is here (the vertical gray line on the chart below), which further emphasizes the likelihood of seeing a major turnaround right now.

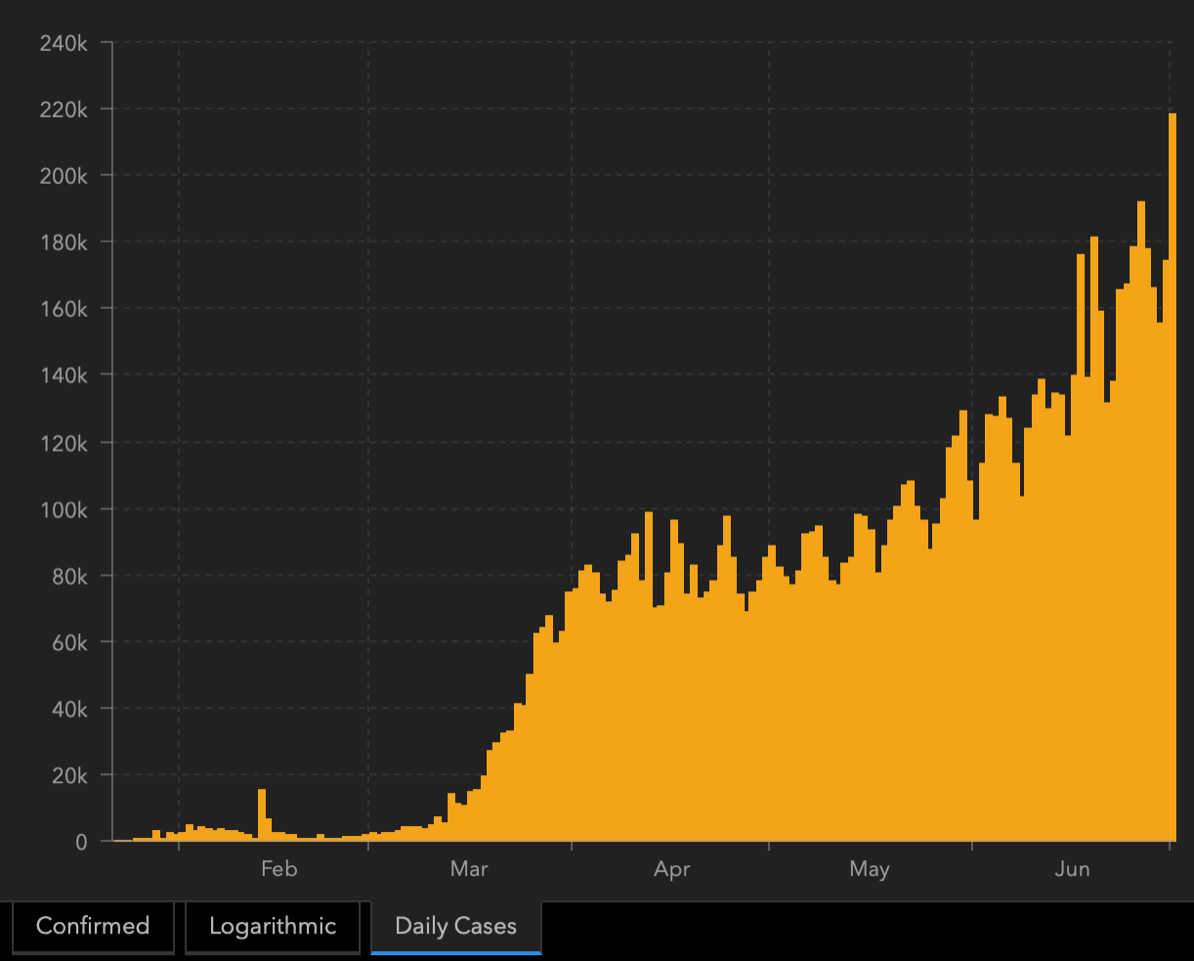

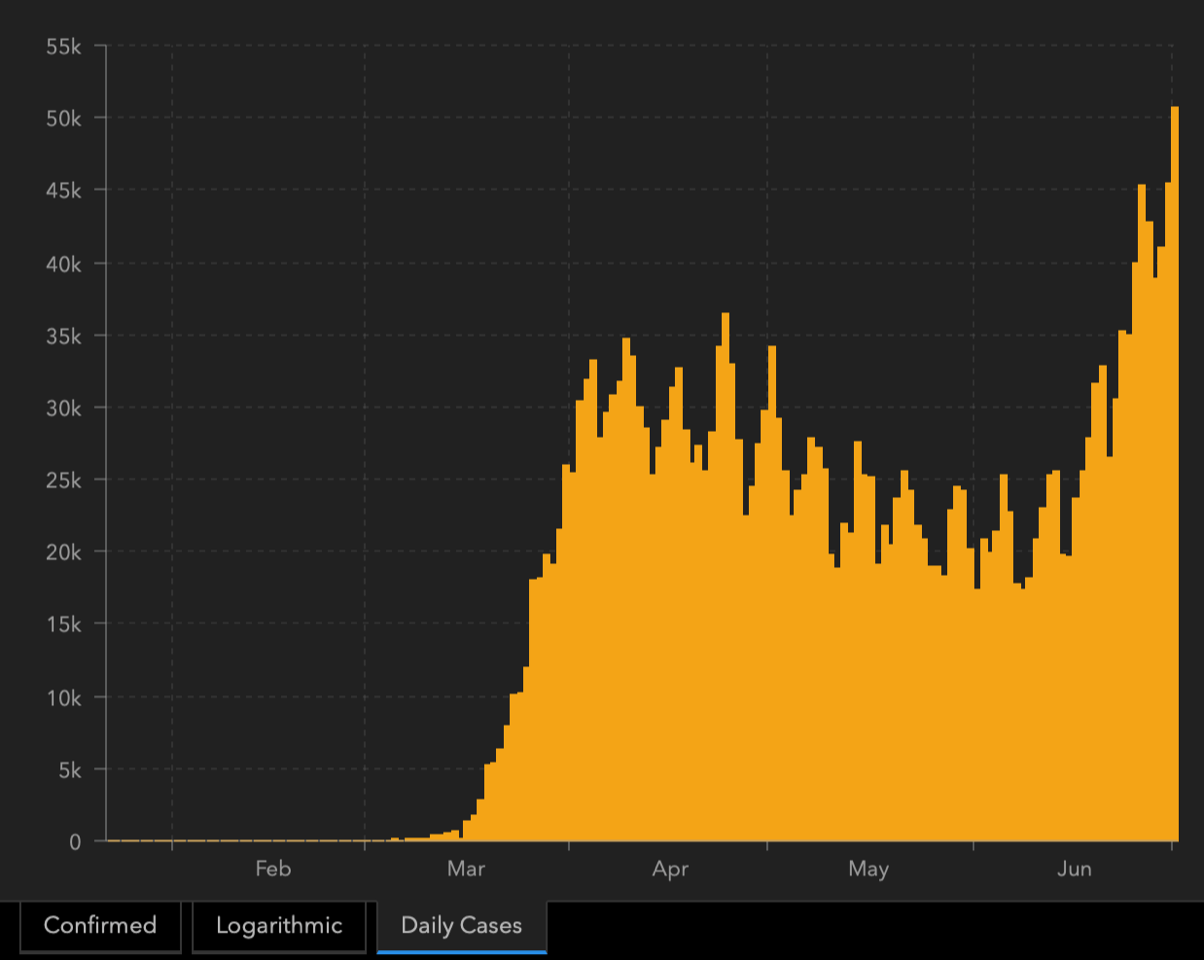

We already wrote this previously, but it’s worth restating that the rising coronavirus cases have initially (!) triggered a precious metals sell-off in March and something similar is likely to take place shortly. The sell-off started when people started really considering the economic implications of the pandemic and the lockdown, so this kind of thinking is likely to be back once the pandemic prevention mechanisms are going to be re-introduced on a bigger scale.

Please remember that the longer the authorities wait with re-introducing the social distancing measures, the worse the situation is likely to be. And it’s getting worse quite fast.

We just saw a fresh high in new daily Covid-19 cases both: globally, and in the U.S..

With no new social distancing measures, this trend is likely to stay in place and the longer we wait, the worse it will be, and likely the more severe the measures will have to be taken.

And, in my view, once those measures are finally taken, the stock market and the precious metals market (initially) are likely to slide.

Summing up, gold stole the spotlight, trying to break above the $1,800 barrier and the November 2011 high, but this move was quickly invalidated, which served as a bearish confirmation. Gold did end the previous month and quarter at exceptionally high level, but the monthly volume was low, and it was the only part of the precious metals market that showed this kind of strength. Silver is just a few dollars above its 2015 low and over $30 below its 2011 high, while miners are trying to get above their 2016 high – well below their 2011 high. Given the above and gold’s looming reversals, I think that a big decline is in the cards for the entire precious metals sector.

The following days are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the king of metals, predicting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits: Analysis. Care. Profits.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,