Gold Price Forecast: Gold Is Going To $10,000

Frank Holmes, CEO of U.S. Global Investors, discusses why he believes gold will go to $10,000, weighs in on the cryptocurrency versus gold debate, and explains why his gold and precious metals ETF is outperforming its peers, naming some of its top performing companies.

The Gold Report: Frank, you've said you expect gold to reach $10,000/oz. Can you tell us about your prediction and the factors that you see behind it?

Frank Holmes: When you look at the world of gold and at negative real interest rates, it is unprecedented that in the world, especially in the European Union (EU), there's a real lack of commitment to fiscal stimulus by streamlining business-killing regulations. Instead, the strategy has been to make money have no value, a negative real interest rate. Denmark, for instance, offers you to take out a mortgage. It pays you to take out a mortgage. It's ridiculous, and it doesn’t address the underlying cause of the economic slowdown.

And so you're seeing Switzerland printing money. It floats a bond issue, no yield on it really, and then no one buys it except for itself. And then it goes and buys 15%, and it owns 15% of its own stock market. Japan has done the same thing. You're seeing other countries like China continue to buy gold, and many of the Eastern European countries continue to buy gold.

There's a very strong demand with the zero interest rate monetary stimulus, and every time we have a slowdown, there are more and more trillions of dollars needed to actually move the dial of 1% gross domestic product (GDP). So currencies are devaluing, and countries are doing it in concert. The masquerade is that the G20 used to compete against each other. Now these finance administrators and central bankers all get together, and they have a concerted effort to synchronize taxes and regulations and use monetary policy as a way to try to stimulate economic growth.

When you realize the magnitude of it, it's very easy to see gold go up as the real asset. It's a very rational argument. The last time we saw gold go in a cycle like this, it went from $275 up to $700, then ratcheted back, and then went to $1,900. You can easily get a fivefold increase in the price of gold.

And that's where I said gold could reach $10,000, because the supply of gold is not increasing the way money supply is being increased, and GDP per capita is increasing in China and India, which together constitute 40% of the world's population—and which love gold for love and gift giving.

After I came out with the $10,000 gold prediction, I got topped by the great Pierre Lassonde, chairman of Franco-Nevada Corp. (FNV:TSX; FNV:NYSE). At the Denver Gold Forum he said that he's looked at gold in the past 30 years, how much it's gone up, who were the biggest gold producers 30 years ago, who they are today, the total supply, etc. And he said for the next 30 years, gold could easily be $25,000 on the upside, minimum $5,000. It could happen earlier. So I think now that $10,000 is a very reasonable and rational argument.

The other interesting part is that the best performing asset class for the past 20 years has been real estate investment trusts. The second best has been gold. Long-term tax-free bonds have been unbelievably successful also.

So the thought process that there's no real change in this interest rate scenario as we had in 1980, when gold peaked because interest rates rose to 20%—this is a very different cycle from where monetary and fiscal policy were rebalanced by Paul Volcker and Ronald Reagan. We don't have that conviction to balance that. So I remain very bullish. Ray Dalio, who runs the largest hedge fund in the world, is a big advocate of gold. Six to 10% is a very sound positioning place in a portfolio.

Gold's supply side is limited. There have been no major discoveries, and it's very difficult to bring on new supply. So we do have peak supply. And we did have it, by the way, in oil until the frackers came along. But there's no innovation similar to fracking that's going to change the world of gold.

TGR: Do you see silver and platinum group elements moving in lockstep with gold?

FH: Palladium has had a bigger move for very sound reasons, and that is supply side is restricted. The biggest producer is Russia. And for catalytic converters, the demand remains strong, even though car sales have slowed down. We're only using platinum. So I think with platinum and palladium, one has to take a look at the supply side. When the trade war finally gets settled, and the Purchasing Managers' Index, which is forward looking, turns positive—where the last month is above three months—then I think that platinum and palladium will rise even more so.

But I think silver is the special one. I just love silver. Silver's the best gift to give to your children, your grandchildren. Unlike toys and video games, if you get them silver, they always keep it. I think it's inexpensive. The DNA of the volatility of silver is basically 50% greater. So if gold goes up 10%, you can expect silver to go up 15%. I think that silver was lagging until recently, so I remain very positive and constructive on silver. And with the whole technology buildout and healthcare and the aging population, silver is a very important part of the healthcare demand.

TGR: Let's move to cryptocurrency. You're in a unique position as chairman of HIVE Blockchain Technologies Ltd. (HIVE:TSX.V; PRELF:OTC), a cryptocurrency mining company. Where do you stand on digital currencies versus gold?

FH: That's a great discussion because you hear all the time that some young technos think gold is bad and Bitcoin is good. So HIVE: What's so special is that it was the first industrial-scale miner of Ethereum and then Bitcoin. We recently announced our quarterly results, and I'm happy that we had healthy margins, much bigger than the gold mining companies on average. Only gold royalty companies have bigger margins. And I think that this debate is sort of silly. Millennials and the Y Generation are used to playing video games, which is a multibillion-dollar business. I'm talking about a business bigger than movies, theater and music combined. More than $35 billion a year is spent on mobile gaming. A lot of the games over the years have been paying these kids, when they're good, in cryptocurrency, digital money. And so they're used to digital money, and they're used to speculating. If they're good at the games, they get these coins, and then they can upgrade within their system.

So along comes this idea of cryptocurrency and moving money around the world digitally. Younger people understand digital money much easier than guys my age. So I believe that digital money is just not going to go away.

I also believe this is true for gold; gold is not going to go away. We all have to remember that when Cyprus' banks went basically insolvent, what did they do? They froze the ATM machines. You couldn't get your paper cash either, and you couldn't get your money. Those who owned gold and silver outside of it had liquidity. We can take a look at San Juan, Puerto Rico. When the hurricanes hit, electricity doesn't work. Guess what? They can't use Bitcoin. Cash works, as do gold and silver for that liquidity. And when people wanted to get out of Syria, the first people to get out were the mothers who had gold. They didn't have Bitcoin, and they didn't have digital money.

So, I don't think we should sell gold to buy Bitcoin. I think they're both alternative asset classes, and they're important parts of a portfolio. I believe that 10% weighting in gold is prudent and rational, and having a couple points in digital currency, especially when you're younger, is a clever way of having that diversified portfolio.

TGR: Would you talk about HIVE? It has been on a rollercoaster. What's been happening with the company and where is it today?

FH: Great question. Bitcoin peaked at $19,000 with the futures market. When that futures market came out, it was used as a proxy, as a force to buy Bitcoin down. JP Morgan knocked it and had its consultants knock Bitcoin, Ethereum, etc., throughout all of 2018 until February 2019, when it came out with its own coin. And then, all of a sudden, that was the bottom in cryptocurrencies.

Also in 2018, Facebook and Google stopped allowing cryptocurrency advertising on their sites. Then all of a sudden on Facebook you can advertise again, and in May it came out with plans for the Libra coin. Immediately Bitcoin soared even further. Now, it's come off because the Bank of International Settlements and central banks are fearful of digital money. But it's coming. And other central banks are talking about why it's important.

And so that knock against Facebook immediately started a selloff, then we had a rally. Now, Mark Zuckerberg, the CEO of Facebook, has to meet with government officials on his coin. He's hired consultants and lobbyists to push this agenda through.

I think digital money is for real. I think that if you had a Libra coin backed by 20% gold, as Steve Forbes recommended to Zuckerberg, because it has 2 billion followers around the world, digital currency would explode to the upside. It's a stable coin, as they call it, which is different. So there's something happening.

And the thing that really impressed me in 2001, when gold took off for us up to 2005 and there was a big correction, from $500 back to $400-and-change—money kept coming in. New shareholders were coming in and buying gold stocks, and buying and buying and buying during the whole correction, so that when gold ran up to $700, they participated in that.

And in that whole crash of Bitcoin and Ethereum, the number of new players coming in has grown at a 45-degree angle. This is a unique market that's not leveraged, that doesn't have obligations against it and that has the ability to trade much higher. So I remain bullish on it.

Our company HIVE Blockchain mines what it calls virgin coins, newly minted coins, because we have to lock and re-lock the code, and we get paid new coins for doing that. They're virgin coins, so they have no anti-money laundering concerns. That's why the Securities and Exchange Commission has not allowed an exchange-traded fund (ETF) to go through, because it doesn't want to find out someone from the dark market slipped their coin into an ETF listed on the New York Stock Exchange (NYSE). We don't have that issue. Our coins are very valuable because they've never been touched.

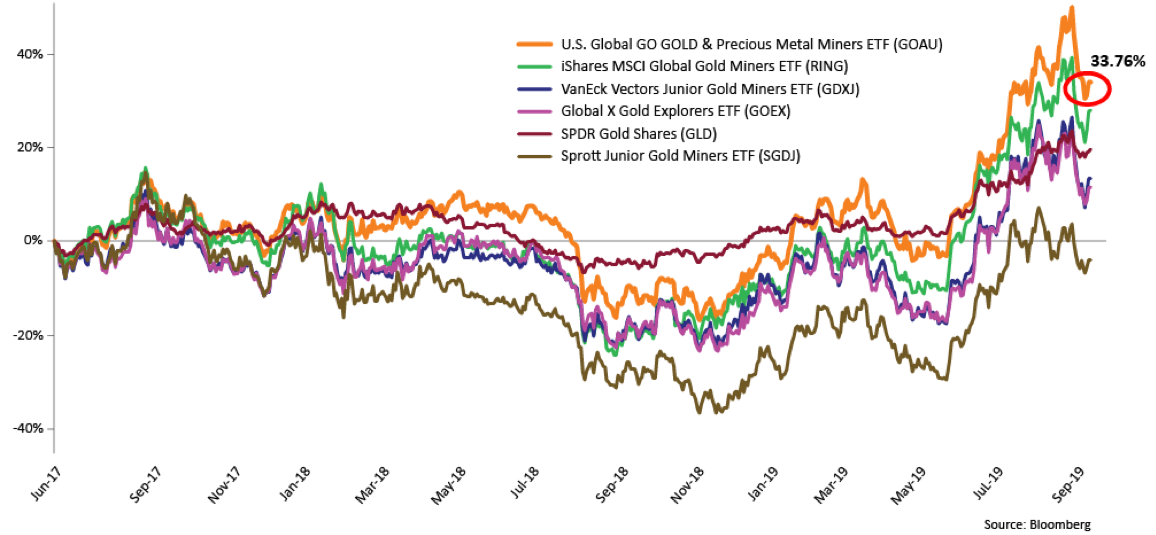

TGR: Let's move on to gold. U.S. Global Investors has the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU:NYSE.Arca), which has been in existence for a couple of years now, and it's been outperforming many of its peers in this latest gold run-up. First, can you explain how your stock selection works?

FH: I had become frustrated in seeing in the gold market the way the stocks were acting, and so we started applying our quant approach. We used 100 different factors. We spent over 8,000 hours digging to try to understand it. What we noticed is there are some macro forces that all investors should realize. Of all these factors you look at, some are good for screening stocks, others are very good for picking stocks.

And I noticed that they like royalty companies, and so do I. And I've always advocated to your readership Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) and Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) because they have a superior business model that has lower volatility in revenue, cash flow and earnings, and royalty companies have the highest revenue per employee of any industry group on the NYSE.

If both revenue and cash flow of last quarter are above four quarters, you start getting more people interested in your stock. The quant funds buy the gold stocks that are demonstrating that. They look for companies that have higher returns on cash, higher returns on invested capital.

We started building a model. We went down to 28 stocks. The three biggest royalty companies are 10% each. They rebalance each quarter. And among the rest of them, the turnover is based on which has the cheapest relative value to cash flow multiples, which has the highest returns on invested capital and which has the strongest momentum in revenue and cash flow. We go down to $200 million ($200M) market caps, and we pick those stocks.

With the Market Vectors Gold Miners ETF (GDX:NYSE.Arca) and Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.Arca), a lot of these gold mining companies have done mergers that make the topline look great, but on a per share basis, it's destructive. So the quant funds don't buy those stocks. They buy those companies that are accretive, that do acquisitions that are accretive and the reserves per share are growing, the cash flow per share is growing, the revenue per share is growing.

I'll give you a classic example. The GDXJ in the past decade has diluted the shareholders' factors by 47%. That is, all the constituents in there have done so many mergers or dumb financings that are non-accretive, that basically those stocks become orphaned until they repair themselves.

A great stock was IAMGOLD Corp. (IMG:TSX; IAG:NYSE). It had that revenue per share of over four quarters, it had the cash flow, it had returns on capital that were extremely attractive. Then we raised our model. The stock went on a huge run and then in January, it had problems. Its revenue and its cash flow per share dropped. We kicked it out, and it's done nothing but fall down. When it finally gets that turned around, then it can apply. So our model is very efficient because it's looking at those factors. GOAU has performed very well.

TGR: What companies have been leading the pack in the GOAU ETF?

FH: Half of them are looking for who has momentum. The other half are looking for who's the cheapest. So at the beginning of this run, the Australian stocks had very, very attractive multiples. They were the best performers. So they were very instrumental for us when we looked at those names.

But if I take a look today at the holdings with the royalty companies, we don't know who's going to win the race each quarter, but something's going to happen.

One of the stocks that is really inexpensive or has that momentum is North American Palladium Ltd. (PDL:TSX; PAL:NYSE). It looks like Brookfield Business Partners (BBU:NYSE) wants to sell its position, and I think that's a stock to be taken out. It's probably going to be taken out at a much higher price. It showed up in the model because of the five factors we use; it knocks the ball out of the park.

Another one is Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE).

The new kid on the block that has very attractive metrics is K92 Mining Inc. (KNT:TSX.V).

Another one would be OceanaGold Corp. (OGC:TSX; OGC:ASX), which has the Haile project coming onstream on the East Coast in the Carolinas. That's a stock that's done exceptionally well.

Detour Gold Corp. (DGC:TSX) has shown up, which is interesting, as a stock that has made a turn.

A stock that has very attractive factors that's in West Africa is SEMAFO Inc. (SMF:TSX; SMF:OMX). We used to own Endeavour Mining Corp. (EDV:TSX; EVR:ASX). It went out. It didn't meet those factors, whereas SEMAFO is extremely attractive both on relative valuation—it's inexpensive—and it has momentum.

TGR: Do you rebalance quarterly?

FH: Yes, we rebalance quarterly. So really, it's almost active. It's rules based. And we have a third party that has our quant model, the algorithm. They run it, and they pick the stocks. And we run it. And then there's a discussion about whether we missed something because the biggest thing I learned in this whole exercise is you have to check the data all the time. You just can't have a black box. Your margin of error starts to rise each quarter if you don't double check and triple check your data.

By the way, it's interesting, because the quant model led me into another company called Goldspot Discoveries Inc. (SPOT:TSX.V), which I became the chairman of, and invested in. We've had a very unstable investor who has been blowing up the stock. But I went into this company because it has artificial intelligence (AI) at the core. We have nine people on the Goldspot team with doctorates. Did you know that a Ph.D. in Silicon Valley is worth $5 million? We have nine of them. That's worth US$45 million or CA$60 million. This is a company with a $10 million market cap that's profitable when we take a look at the turn. And it has leverage from the upside, because it gets stock positions and royalties on some of the junior mining.

Major figures in mining like Eric Sprott own a big piece. We have Elliott Management Corp., through its Triple Flag Mining Finance. It is a major shareholder, like ourselves. It has a huge institutional sponsorship. But one of the early founders is basically liquidating his stock, looking for other adventure investing, and it's provided just a great opportunity to accumulate. And I like it because it's technology based, and it has helped Rob McEwen find a couple new discovery holes. Hochschild's chief financial officer is on the board, and the company has used it to remap everything in Peru. It found it extremely useful. I think this technology applied to mining is going to be the future.

TGR: Earlier you said that precious metals mining hasn't seen innovation equivalent to fracking in the oil industry, and is unlikely to, but it sounds like this could be the closest thing to it.

FH: Yes, it could be. It diminishes the risk of exploration spending. When Goldcorp was using IBM's Watson—IBM didn’t have nine Ph.D. geoscientists that we have, along with 11 other scientists.

Goldspot is doing work for Gran Colombia Gold Corp. (GCM:TSX). That's another one of those stocks I've recommended before, especially its gold notes listed on the Toronto Stock Exchange. It pays 8.25%. When gold is above $1,250/ounce, it pays a higher yield. So I'm enjoying a 12% coupon. The rest of the world is going to zero interest rates. It's in our mutual funds, and guess what? It covers all the fund expenses. You only have to have 5%, and it's very stable. But it has a high, high yield. So we've gotten our money back already, once when we first made that initial investment from the coupon. Gran Colombia is now using Goldspot to help fast-track the development of its production in Colombia.

Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) is using Goldspot's technology too. The chairman of Yamana has told me that he finds it exceptional—a detailed analysis—and it helps identify locations the company never thought of.

Eric Sprott loves it. He's a big shareholder. He's used it and continues to use it.

So Goldspot is growing. It has a new product that's very inexpensive for the junior explorers, like $50,000, to help organize all their data and to give them, basically, a screening positioning, so they can become more digital and coordinate all of the different geoscientists for that. Then if they want detailed mapping on the ground, etc., that will cost hundreds of thousands of dollars more. But it has that product that I think the junior explorers need to help them get caught up with this digital world.

TGR: Any parting thoughts for our readers?

FH: I think you have to realize, what I call, the DNA of volatility of gold. Most of the New York mob, as I like to call it, are still anti-gold, and you just have to recognize that. They try to spin that gold is more volatile than the S&P 500, but we just did an analysis. The 10-day volatility of gold is 2%, and the S&P is 3%. So over any rolling 10-day period, it is a non-event 7% of the time for the S&P to go up or down 3%, and gold is only 2%. And quite often, if the S&P falls 3%, gold is up 2%, so it's a great counterweight to a portfolio.

Also recognize that silver's volatility is more than that. Silver is more like the 3%. And when we look at the digital currencies, they're more like a huge magnitude, they're 12% volatility, so much more volatile. But you can use the volatility to your favor. I've written about it extensively in Managing Expectations, on our website at usfunds.com, to explain what sigmas mean and how you can think like a quant trader.

TGR: Thank you for your time, Frank.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors, which manages a diversified family of funds specializing in natural resources, emerging markets and gold and precious metals. In 2016, Holmes and portfolio manager Ralph Aldis received the award for Best Americas Based Fund Manager from the Mining Journal. In 2011 Holmes was named a U.S. Metals and Mining "TopGun" by Brendan Wood International, and in 2006, he was selected mining fund manager of the year by the Mining Journal. He is also the co-author of The Goldwatcher: Demystifying Gold Investing. More than 30,000 subscribers follow his weekly commentary in the award-winning Investor Alert newsletter, which is read in over 180 countries. Holmes is a much sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg, BNN and Fox Business, and has been profiled by Fortune, Barron's, The Financial Times and other publications.

Disclosure

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Frank Holmes: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this interview: HIVE Blockchain Technologies. Funds controlled by U.S. Global Investors hold securities of the following companies mentioned in this article: Franco-Nevada, Wheaton Precious Metals, Royal Gold, IAMGOLD Corp., North American Palladium Ltd., K92 Mining Inc., OceanaGold Corp., Detour Gold Corp., SEMAFO Inc., Gran Colombia Gold Corp. and Yamana Gold Inc.. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada, a company mentioned in this article.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of