Gold Price Forecast: Thin Line Between USD Bottom And Gold Top

Gold prices eased on Thursday (Jan. 7), the first time they did so after experiencing a strong start to the year, and the U.S. dollar remains firm for the moment. Last week we examined how gold has fared historically in the month of January, but now let’s get back to the present and see where we stand. The fact is that the U.S. dollar doesn’t need to do much to break above its declining resistance line, and once it does and climbs back up, gold and the precious metals will tumble.

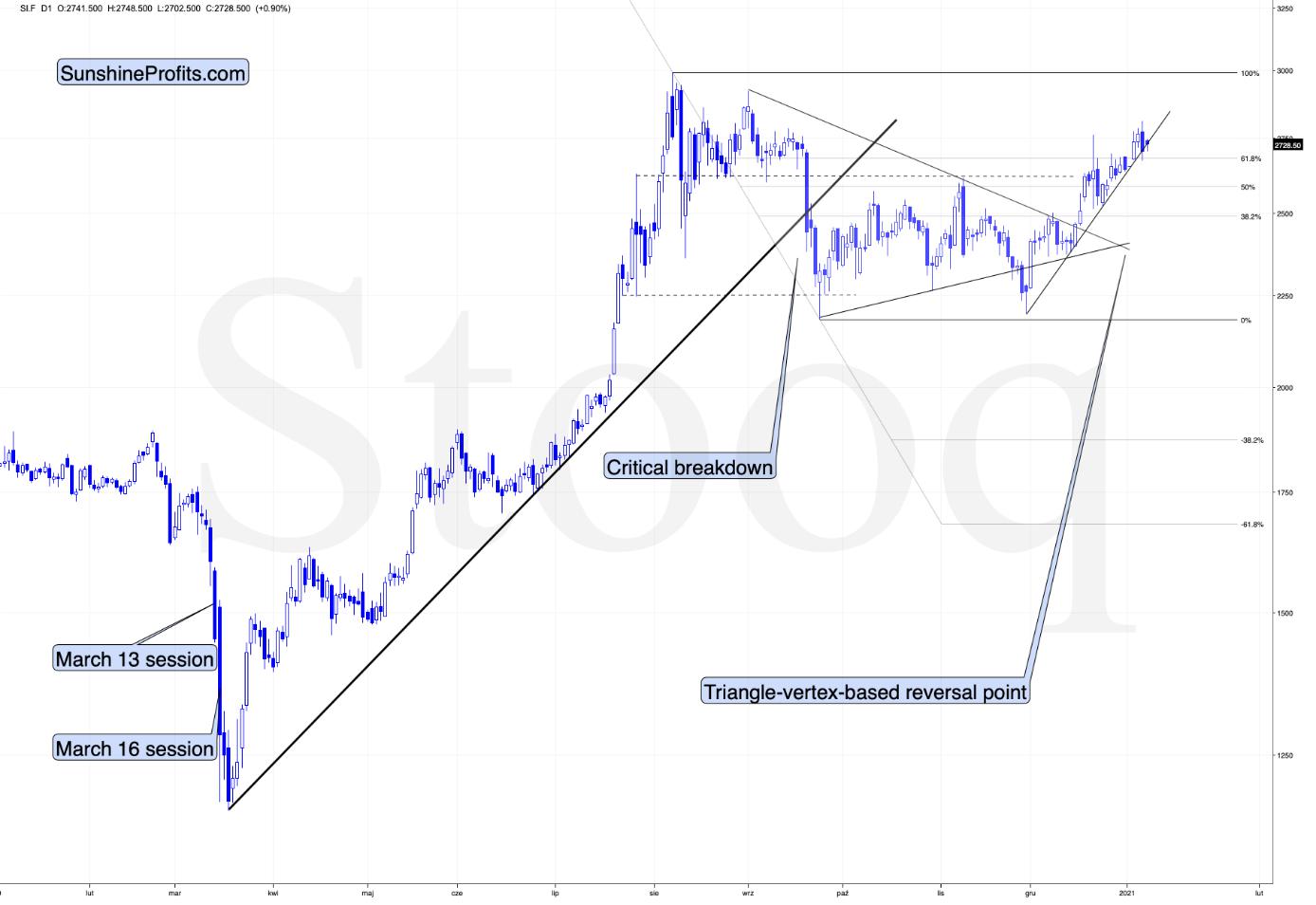

In the first days of January 2021, gold was likely to top at its triangle-vertex-based reversal, similarly to what it did in November, and that’s exactly what happened.

Figure 1 - COMEX Gold Futures

The daily slide was not as big as the one we saw in early November, but the rally in the USD Index was also not as big as the one in early November.

Figure 2 - USD Index

In fact, the USD Index closed yesterday’s (Jan. 6) session just slightly higher in terms of the futures prices, and it actually closed slightly lower in ETF terms (UUP ETF in this case).

Figure 3 - SPDR Gold Shares (GLD) and Invesco DB US Dollar Index Bullish Fund (UUP)

Comparing both ETFs with identical opening and closing hours, we see how closely gold was reacting to moves in the U.S. currency, but at the same time how it was magnifying the USD’s rallies (by declining more) and how it was mostly ignoring the USD’s declines (by rallying less).

Ultimately, the UUP ETF ended yesterday’s session slightly below the Jan. 5 closing price, and the GLD ETF didn’t end above its Jan. 5 closing price. Conversely, it didn’t even manage to erase half of the intraday decline before the closing bell.

The above tells us that if the USD Index rallies more visibly here and breaks above the declining resistance line in a decisive manner, gold would be likely to truly plunge.

And that’s exactly what’s likely to happen! The USD Index is extremely oversold and just a little strength here will allow it to break above the steep resistance line.

Figure 4 -USD Index (ICE), USD, GOLD, GDX, and SPX Comparison

With the situation looking just like it did in early 2018, it seems that the USD index is bottoming, and the precious metals sector is topping.

The USD Index is slightly below the Fibonacci-extension-based target based on the size of the most recent corrective upswing and the declining dashed resistance line. The same situation in 2018 (also please note that cryptocurrencies are in a price bubble now just like they were in early 2018) meant that the final bottom was already in. The situation in the RSI indicator is similar as well.

Let’s get back to gold.

Figure 5 - COMEX Gold Futures

Please note that after topping at its triangle-vertex-based reversal, gold then declined but stopped at its rising support line.

Figure 6 - COMEX Silver Futures

Silver did pretty much the same thing.

They both stopped where they were likely to stop, which is quite normal. The USD Index didn’t rally yet in a particularly visible way and the UUP ETF even declined somewhat yesterday. But the day when the PMs are going to get a significant push lower is coming. It’s likely very, very close. And then, once gold and silver break below their rising support lines, we’ll see significantly lower prices.

Figure 7 - VanEck Vectors Gold Miners ETF (GDX) and Slow Stochastic Oscillator (Slow STO) comparison

Mining stocks moved somewhat lower yesterday, but the decline was relatively small at first sight. Are miners showing strength here?

Let’s take one more look at the GDX while comparing it with the GLD ETF so that they both have the same opening and closing hours.

Figure 8 - GDX and GLD ETFs comparison

As you can see, both ETFs have actually moved to their mid-December highs and then moved back up yesterday. The GDX corrected a bit more of the daily decline, but nothing more.

What seems like a show of strength is more of an intraday price noise. If this persists and miners hold up well despite gold’s declines, it might be a bullish indication, but it’s way too early to draw bullish conclusions from miners’ performance.

The spike in volume in the GDX ETF that we saw recently continues to emphasize the similarity between the recent top, the November top, and the late-July top. The implications remain bearish.

Summary

The top in gold is most likely in, and the following days are not likely to be pleasant times for anyone who jumps on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the yellow metal, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. Silver is likely to slide as well. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care.

* * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,