Gold Price Forecast: The Upcoming Bottom Followed By Recovery That Gives Way To…

While our contributions are usually about gold’s long-term price path, it pays off to supplement them with short-term opportunities when we see one. That will be the subject of the first part of this article, as we’ll discuss the upcoming short-term bottom and turning point in gold that is in tune with its True Seasonal tendencies.

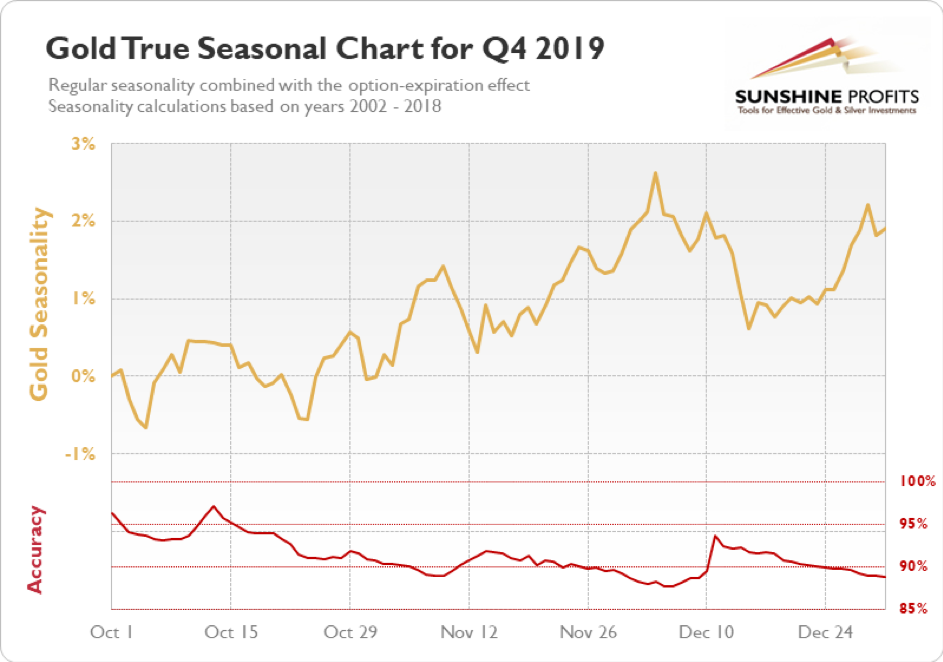

Gold Seasonality Lessons

Seasonally, gold tends to bottom close to the middle of the month. It’s not enough to report that gold will indeed bottom this or next week, but it’s not the only thing that points to such an outcome.

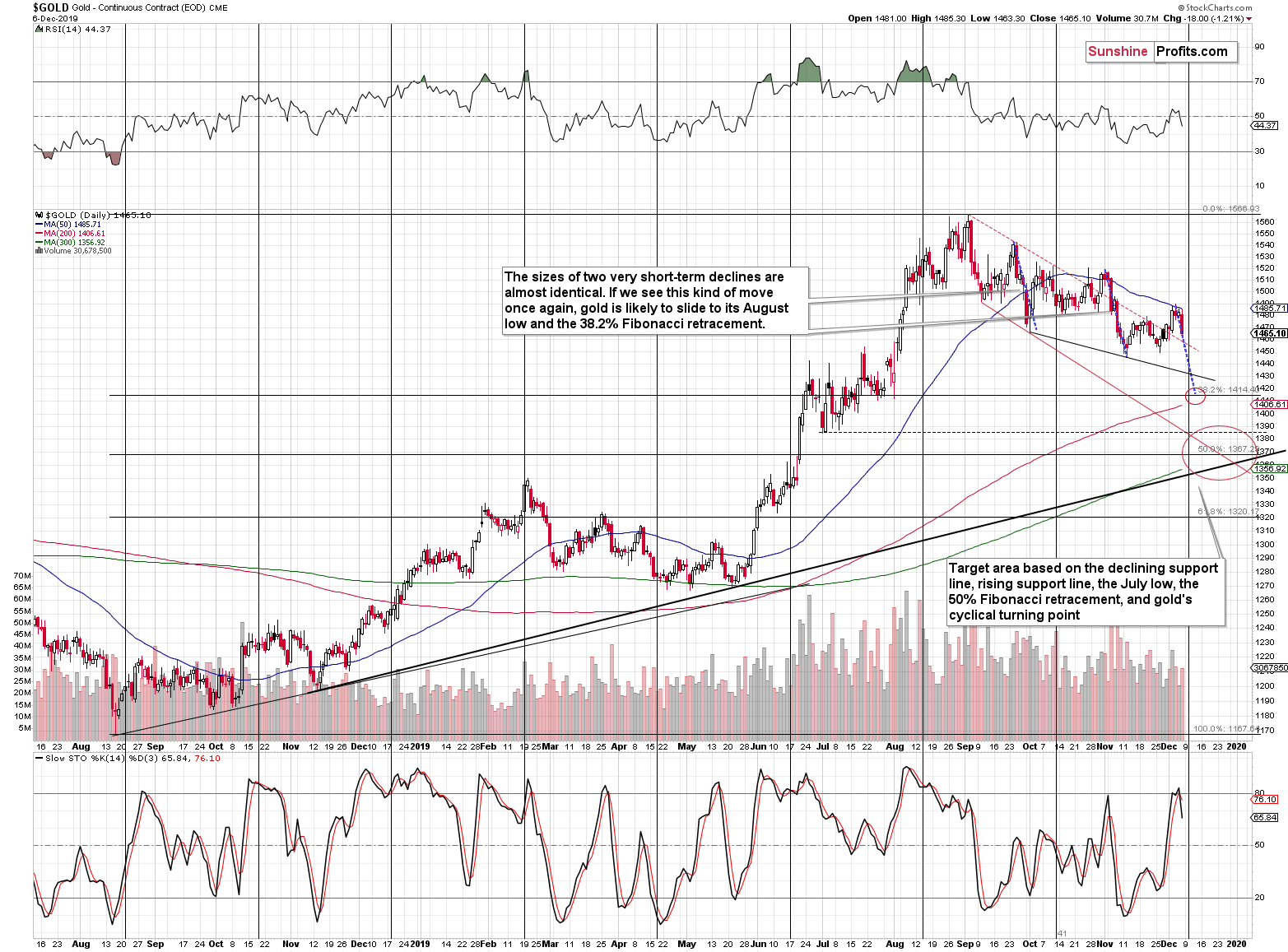

The turning point is just around the corner, and if gold is to decline at a similar pace as it did in September and November, then it’s likely to bottom slightly after the turning point. This “slightly after the turning point” is in the middle of the month, which is in perfect tune with what we wrote earlier.

The seasonality itself suggests a comeback before the end of the month and this might indeed be the case, but it could also be the case that we’ll see yet another downturn and then the final bottom right at the end of the year. Why? Because of the triangle-vertex-based turning point that we have at the end of 2019. There is also one more – indeed a long-term oriented – turning point.

The Support, the Turning Point and Gold’s Path

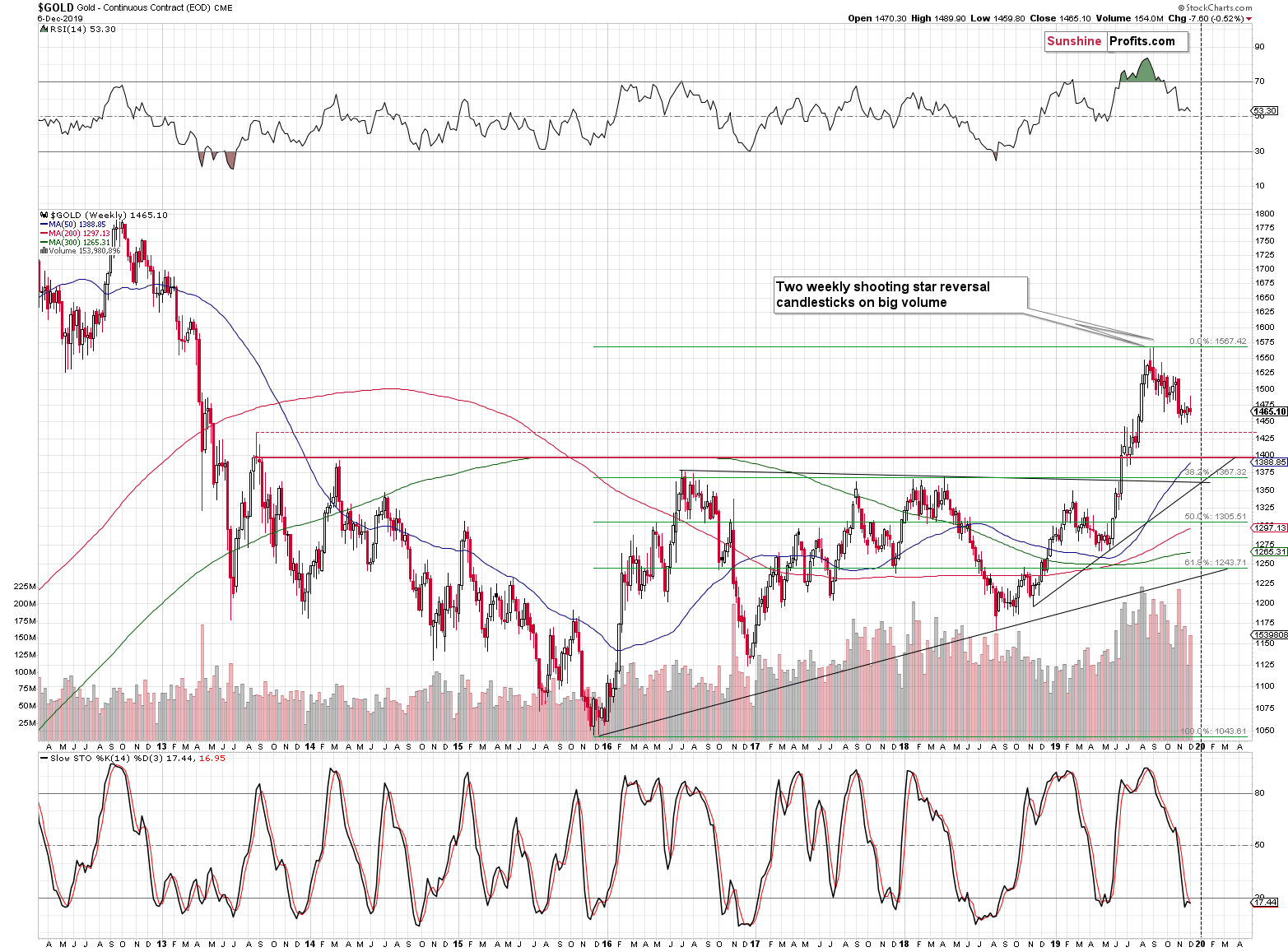

The rising medium-term support line crosses with the support line that’s based on the 2016 and 2018 highs, which makes the $1,360 (approximately) support particularly strong. Moreover, let’s keep in mind that since these two major lines are crossing at the end of the year, we’re likely to see a reversal at that time.

This triangle-vertex-based reversal corresponds to the reversal from the previous short-term gold chart. This means that both reversals confirm each other and that makes them even stronger as a result. In other words, gold is very likely to stage a reversal close to the end of the year.

Naturally, the reversal could be a local top, but this would imply a decline in January, and January is seasonally one of the strongest months for gold. If there is going to be some kind of major reversal at the end of the year, then gold can’t rally relentlessly between mid-December and February. There has to be a local top or bottom in between, perhaps both. The scenario in which gold declines shortly, but then corrects close to the middle of the month and then declines once again until the end of the year, seems to be the most likely outcome based on the data that we have right now.

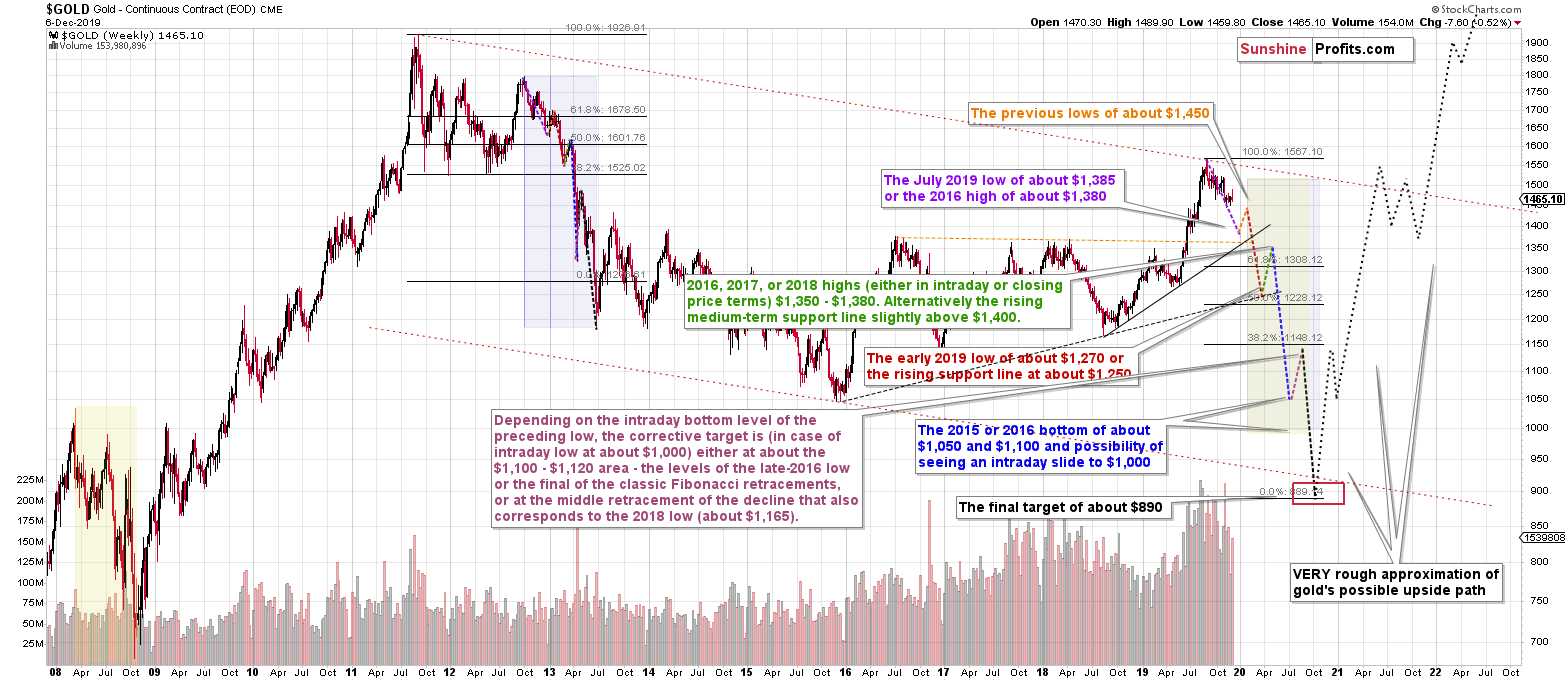

Before summarizing, we would like to reply to a question that we received from a few of our subscribers recently. The question centers on how long it could take before gold resumes its long-term bull market. In short, it could take – approximately – another year before that happens. The chart below provides our current best estimate of what’s likely to happen in the following months – our gold forecast.

Before dismissing the above chart as too bearish and ridiculous, please note that gold declined in a similar way in 2012 and 2013, and – most importantly – that gold should decline substantially if the USD Index is to rally considerably. And the USD Index is after a huge, long-term, and extremely important breakout that was more than confirmed.

Gold is likely to decline similarly to how it declined in the mid-90s and gold miners appear to be repeating the pattern from about 20 years ago. There are quite a few other medium-term factors that suggest that the decline in gold, silver, and mining stocks that started in 2011, is not over yet.

Naturally, there will be counter-trend rallies along the way, and some of them will be tradable, just as the recent gold rally that we profited on. Our Gold Trading Alerts will include such details as soon as they emerge.

Summary

Summing up, multiple signs point to the upcoming gold bottom this or next week, and the subsequent recovery followed by renewed move lower seem to be the most probable scenario currently. To be honest, that upcoming recovery will likely only represent a counter-trend rally within a larger downswing though.

In other words, the following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,