Gold Price Forecast In Yuan/Renminbi

China’s love and lust for gold is becoming increasingly voracious for several reasons. The next six years are expected to see China’s middle-class grow by over 60%, or 200 million people, to a total of 500 million," write the analysts at the World Gold Council. "Comparing this to the total population of the US, which stands at 319 million, puts the size of this new market of affluent consumers, with the propensity to buy gold into perspective. In addition to these newly emerging middle classes, rising real incomes, a deepening pool of private savings and rapid urbanisation across China suggest that the outlook for gold jewellery and investment demand in the next four years will remain strong."

The WGC just published massive amounts of research on the supply and demand dynamics of gold in China.

Here are six key facts that WGC highlights:

- China’s continuing urbanisation means that it now has 170 cities with more than one million inhabitants - within these cities, the middle-classes currently number 300million and are set to grow to 500million by 2020. Demand for gold amongst those with a greater disposable income and limited investment opportunities will continue to grow.

- Chinese savings levels remain high – there is an estimated US$7.5 trillion in Chinese bank accounts and household allocations to gold remain small, around $300bn. Gold is seen as a stable, accessible investment by consumers, particularly in the light of rising house prices and a lack of alternative savings options. Chinese investors have a preference for physical gold over paper, with investment focused on small bars, gift bars or Gold Accumulation Plans (GAPs). New gold investment products mean that medium term demand for bars and coins could reach close to 500t by 2017 – a rise of nearly 25% above its record level last year.

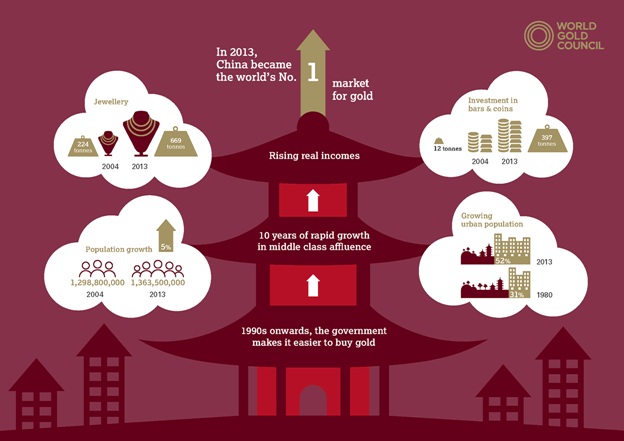

- China has become the world’s number one jewellery market, nearly trebling in size over the past decade – at 669t in 2013, it accounts for 30% of global jewellery demand. Estimates suggest that demand will continue to grow and reach 780t by 2017. There are now over 100,000 retail outlets selling 24k gold and thousands of manufacturers nationwide.

- Consumer sentiment toward gold is unwavering – although 40% of jewellery

consumption relates to weddings, the appetite for gold in China goes beyond occasions and gift giving. 80% of consumers surveyed for this report planned to maintain or increase their spending on 24-carat gold jewellery over the next 12 months believing that gold will hold its long-term value and because they expect to have a higher level of disposable income.

- Chinese electronics demand for gold will see small gains in the next four years – industrial demand has grown with electronics being the key driver (climbing from 16t in 2003 to 66t in 2013. China is also the leading market for gold related patents such as the use of nanogold in healthcare.

- Official gold holdings in China totalled 1,054t at the end of 2013making the country the world’s sixth largest holder of bullion- based on this declared stock, gold represents 1% of China’s total official reserves (down from a peak of almost 2% in 2012) due to the rapid growth of the country’s foreign exchange holdings which reached around US$3.8 trillion at the end of 2013. Speculation continues as to whether the Chinese government has increased its gold holdings.

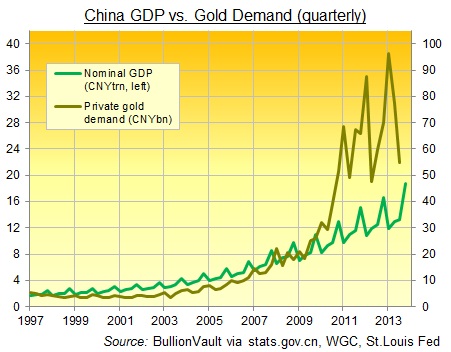

Already, the growth in China's gold demand since deregulation began in 2002 has been extraordinary (Source: BullionVault):

· China's GDP has grown four-fold over the last decade; private gold demand by value has risen 15 times;

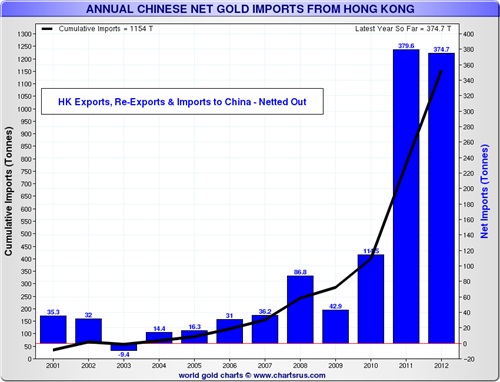

· On top of being the world's No.1 gold mining nation, China almost doubled its net imports in 2013 to more than 1,000 tonnes;

· That's five times the weight the country consumed as a whole in 2002, and pretty much matched the outflow of metal from Western gold funds and private accounts.

China’s Growing Per Capita Affluence Will Soon Drive the Price of Gold Into orbit:

(Source: Albert L. H. Cheng at the WGC)

The most spectacular item in the above WGC diagram is that total Chinese investments in gold bars and coins has enjoyed an awesome 42% CAGR for the past 10 years! This is even more astonishing when one takes into account China’s population only increased by 5% during the entire 10 years…that’s a CAGR of much less than 1%. Indeed China’s insatiable lust for gold is stunning…and growing exponentially.

China is accumulating gold from where ever it can get it.

During the past nine years China’s yearly gold imports has enjoyed a CAGR of 25% (Compound Annual Growth Rate). However, notice the rate of increased gold imports for Hong Kong has accelerated since 2010…and will most likely continue to go viral in years ahead as income growth inexorably increases.

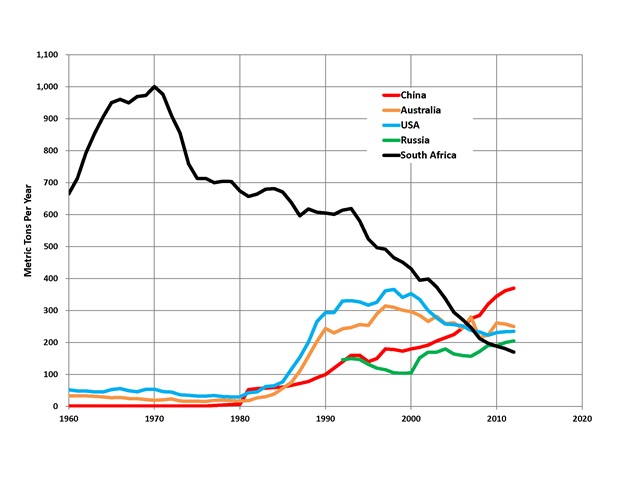

China is today the world’s largest gold producer…dwarfing all others

China has gone from being a minor producer to the world’s largest source of mined gold - in the past ten years production has doubled from 217t to 420t. In 2013 China became the world’s largest producer of gold. In the Sino nation produces 65% more gold yearly than second place Australia:

China has gone from being a minor producer to the world’s largest source of mined gold - in the past ten years production has doubled from 217t to 420t. In 2013 China became the world’s largest producer of gold. In the Sino nation produces 65% more gold yearly than second place Australia:

And whereas yearly gold production trend is falling in all major countries, China’s gold production has indeed accelerated higher since 1980.

The cardinal factor going forward driving the price of gold much higher will be for investment purposes. Unfortunately, heretofore there have been limited investment alternatives available to the teeming masses of China’s 1.3 Billion population. And Real Estate is not considered an investment per se by China’s consuming middle-class…but rather a home. And interest paid on savings accounts in the banking system is pathetically low. Consequently, since 2001 China’s middle-class was limited to investing only in stocks of the Shanghai Stock Exchange (SSEC). To be sure this has been an unmitigated disaster as the SSEC has pathetically appreciated less than 2% during the entire 13 year period. Au Contraire, the US$ price of gold has soared nearly 400% since 2001.

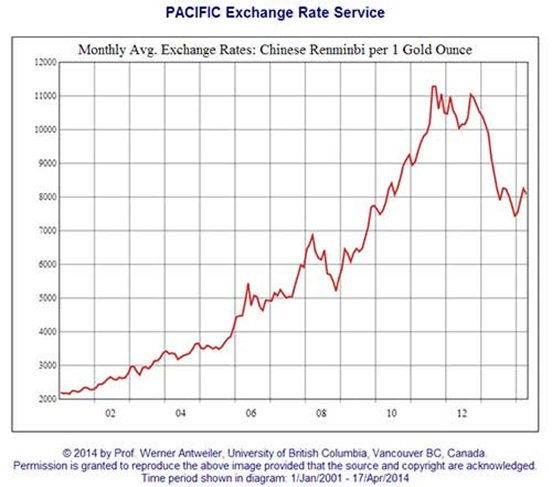

Consequently for Chinese investors who preferred to buy gold in Renminbi, the total return since 2001 was a very respectable +272%. Think of it: Since 2001 the Renminbi price of gold has soared +272%...that’s a whopping +12.7% Compound Annual Growth Rate (CAGR).

********

Gold Forecast In Yuan (Renminbi)

The gold price forecast assumes the following:

- Gold’s price correction is over

- Gold may continue to appreciate with a CAGR of +12.7% (as it did from 2001-2011)

- All the reasons cited above come into play to drive gold higher

By 2020 the price of gold should reach 15,100 Yuan/oz

By 2025 the price of gold should reach 25,100 Yuan/oz

By 2025 the price of gold should reach 25,100 Yuan/oz

However, it is logically conceivable the Renminbi price of gold might be substantially higher if The Peoples Republic of China decides and implements a GOLD BACKED CURRENCY. In this regard it behooves one to read, “China Gold Dragons”