Gold Price Reacts To Jobs Report – What’s Next?

Strengths

· The best performing precious metal for the week was platinum, which recorded a slight loss of 0.24 percent after falling on Friday in sympathy with the pullback in precious metal prices.

· The Austrian Mint had its third best year on record in 2015, according to its annual gold sales report, showing 756,200 troy ounces of Vienna Philharmonic gold coins sold. Although the bulk of sales are to Austrians, the report is used as a barometer for overall European and global physical gold demand. Sales of silver coins have also seen positive market reaction, with sales of the Perth Mint’s 2016 Australian Kangaroo coins surging to 10 million coins, when expectations were just 5 million for the year, reports GoldCore. According to Bloomberg, investors also amassed the most silver on record in exchange traded funds in July.

· The Bank of England cut key rates this week for the first time in seven years, sending gold higher on the news. The yellow metal also moved in reaction to details of a stimulus package in Japan, reaching a three-week high before the release of the U.S. jobs report on Friday. BullionVault reported that its Gold Investor Index (which measures a balance of client buyers to sellers) rebounded from an eight-month low this week, rising to 53.4 versus 51.4.

Weaknesses

· The worst performing precious metal for the week was silver with a loss of 3.10 percent. Relative to the 1.14 percent pullback in gold, the move was about as expected.

· Gold declined from its highest level in more than two weeks as the U.S. jobs report came out much better than expected on Friday. According to Deutsche Bank’s GDP growth model, the bank’s economists were expecting a much slower pace of job additions, around 150,000 in July, when in reality the U.S. created 255,000 jobs last month. Most economists are modeling the expected jobs number off relative GDP levels and they have come in below expectations for the second quarter, thus they were expecting the jobs number to fall too.

· Indian gold demand continues to slow, according to analysts at Desjardins. Gold imports fell for a sixth consecutive month, with purchases slumping 77 percent to 22 tonnes in July from this time last year. One explanation could be the surge in gold price by 29 percent so far in 2016. “Customers are staying away, as they feel these prices are too high and they are waiting for a correction,” said Bachhraj Bamalwa, a director at the All India Gems & Jewelry Trade Federation.

Opportunities

· HSBC has a positive outlook for silver in 2017, according to its latest Global Commodities report. In regards to supply and demand of the metal, the group notes that one side of the equation is anticipated to remain consistent while the other is expected to rise, reports ValueWalk. Francisco Blanch of Bank of America Merrill Lynch says that investing in gold right now makes sense for two important reasons. Not only does gold make an attractive investment when one-quarter of global bonds are offering negative yields, he told Bloomberg News, but gold’s carry costs are even lower compared to some currencies. “The negative carry on gold is actually smaller than the negative carry on, say, the euro or some other currencies,” Blanch explains.

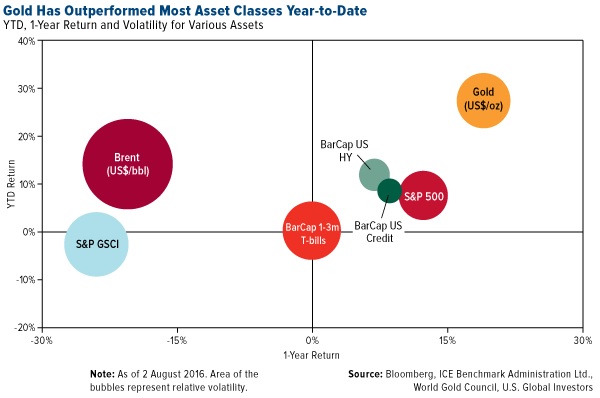

· Barclays points out that inflows into precious metals in 2016 have topped previous records for the amount of money flowing into exchange-traded products featuring precious metals. Just in the last two months, nearly $8 billion has poured into these products, bringing the tally for the first seven months of the year to $50.8 billion. As the chart below illustrates, gold’s returns have dominated other asset classes and done so with less volatility than Treasury bills and just slightly more volatility than the S&P 500 Index. Note that volatility is graphically represented by the size of the circles.

· Dovish central bank policies by the Federal Reserve, the Bank of Japan and the Bank of England are lending support to gold, says UBS. The group says that, overall, the regime has not changed, and as such, the macro story for gold remains intact, noting that bouts of weakness are potential buying opportunities. The report reads: “Weaker growth outlook and lower real yields—especially with potential tolerance for inflation to overshoot—in a sense reinforce the themes that have driven investors towards gold this year.”

Threats

· “We take the seemingly unpopular view, and contend that gold has already seen its 2016 peak,” said Christopher Louney, commodity strategist for RBC Capital Markets. In a report released by RBC last week, Louney notes that investors should be cognizant of just how much/little runway remains for gold appetite, reports Bloomberg, especially since its rally has stemmed almost entirely by investor demand. He does not see the metal moving significantly higher, at least not absent another significant risk-off event.

· Japan’s Government Pension Investment Fund, the world’s largest retirement savings pool, lost $50 billion last year, reports ValueWalk. A root of the issue stems from Prime Minister Abe’s redirection of the country’s financial assets from Japanese bonds to equities, searching for higher returns. The markets that Abe said would go up declined instead, and now the fund’s plans include buying junk bonds and emerging market debt. The bottom line is, the fund now pays out to retirees more than it takes in, the article continues.

· Alan Greenspan says we’re seeing the early stages of inflation, Bloomberg reports, noting things like slow productivity around the world, a pickup in wages and a pickup in money supply. Greenspan said the U.S. won’t be able to pay for entitlements, pushing the idea that the economy won’t be able to recover until politicians deal with the issue. He added that it’s crowding out and scaring off investment.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of