Gold Prices In 2015

The Jobs numbers on Friday (3/6/15) created a large down day for gold. Consequently, we thought it necessary to update readers to our current views regarding gold prices in 2015. Below we give three possible scenarios as far as timing and potential price targets.

The Jobs numbers on Friday (3/6/15) created a large down day for gold. Consequently, we thought it necessary to update readers to our current views regarding gold prices in 2015. Below we give three possible scenarios as far as timing and potential price targets.

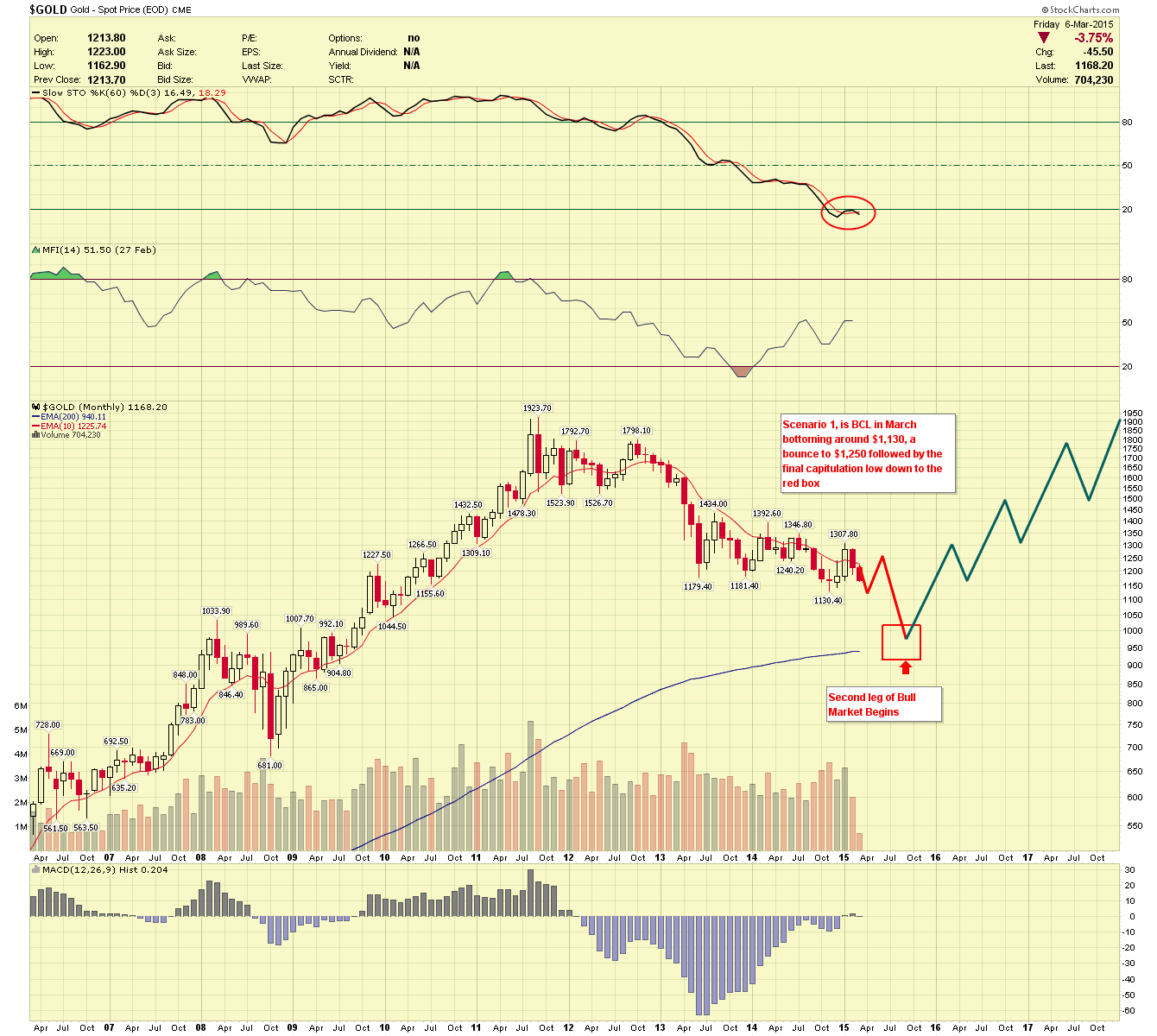

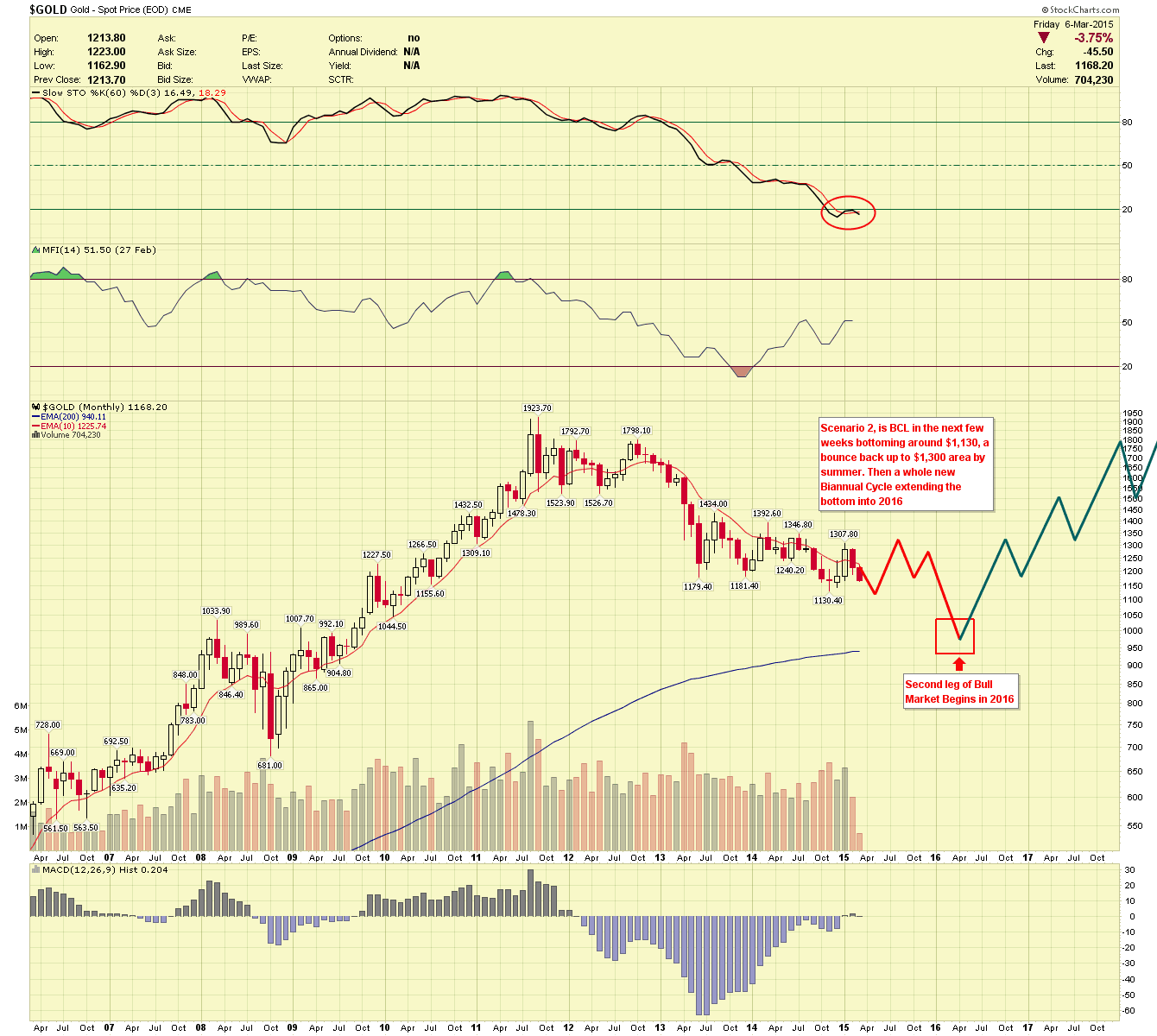

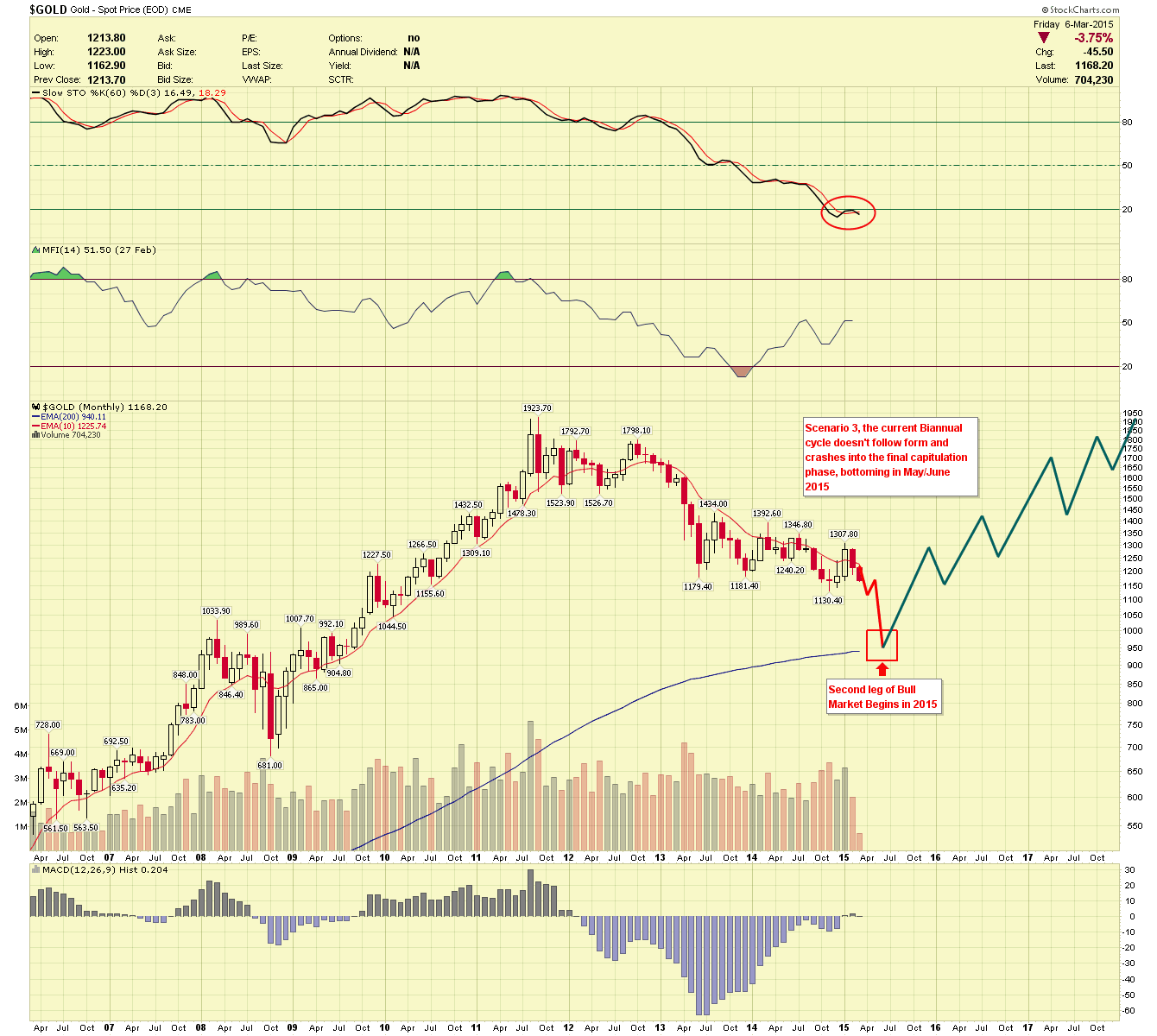

Where we currently stand, gold is starting the 18th week of its current Biannual Cycle, which average between 20 and 28 weeks in duration with 25 weeks being most frequent. Because the current Biannual Cycle is right translated, price should not exceed the previous Cycle low ($1,130.40) by much if at all. As a rule right translated cycles stay above their previous low, whereas left translated cycles breach/break their previous low. Price may test and even break the $1,130.40 area, slightly during the Biannual Cycle Low (BCL) forming.

To address the timing of the coming Biannual Cycle Low, our models found several possibilities. Listed below are the three we view most likely with the current price data.

1) We simply consolidate a few days (from current levels), followed by a grinding lower and a forming of the Biannual Cycle low in Mid-Late March 2015. Then there will be one more Biannual Cycle (5-6 months in duration) finally ending this gold correction in August September 2015.

2) Gold bottoms in a Biannual Cycle Low (BCL) in spring of 2015, followed by a rally back up to the $1,300 area topping out in the summer of 2015. At which point it will begin an additional Biannual Cycle (5-6 months in duration) finally bottoming and ending this extended gold correction in early 2016.

3) Gold forms a failed right translated cycle, blasting through the previous $1,130.40 low and capitulating price down to the $1,050-$940 level, by June/July of 2015.

We think the key date for all scenarios may be March 18th 2015. This is a significant Fed day, ending a two-day meeting, and followed by a press conference. There is a real likelihood of a bottom forming that day or in the case of the third scenario, it may start a capitulation phase.

The Chartseek Example Portfolio (EP) should be able to structure an options trade benefiting from any of the three scenarios and will keep Premium Subscribers informed. There is still much data to review, but March 18th appears to be a crucial date in our timing model.

********

Click here for a 14-day Free Trial to our Basic Newsletter service