Gold Stocks Warn Investors, but Are They Listening?

When gold and the USD are not supposed to give us clues about the market, what should we look for?

Is the Top in?

Before starting today’s analysis, I would like to emphasize that we might see some erratic price movements with regard to the USD Index – gold link. The reason is that today is the day when the news from Europe hits the market. The ECB President spoke, and the account of the monetary policy meeting will be released as well.

This can move the value of the USD Index because the EUR/USD is the largest (with over 50% weight) component of the index. So, if the value of the euro moves higher, both gold and the USD might move lower. And if the value of the euro moves lower, both gold and the USD might move higher – at least relative to the euro.

This might make one think that gold is either showing strength or weakness relative to the U.S. dollar, but it would actually be reacting to what’s happening in the Eurozone. So, while it’s usually a good idea to monitor the gold-USDX link, today it’s better not to focus on it too much.

Having said that, let’s check what gold did yesterday and what’s going on in today’s pre-market trading in gold futures.

Yesterday, gold moved slightly below the $1,900 level, the 61.8% Fibonacci retracement, and the rising support line.

Later, the gold price moved back up and ended the day slightly above the $1,900 level and the 61.8% Fibonacci retracement, but below the rising support line.

So, we had an invalidation of the breakouts above the $1,900 and 61.8% retracement levels in intraday terms and a breakdown below the rising support line in terms of both intraday prices and daily closing prices.

In today’s trading, gold is trading sideways, and it didn’t invalidate the breakdown below the rising support line. In fact, it seems to have worked as intraday resistance.

So, is the top in? That’s quite possible given how mining stocks are performing.

Like the Year Before

The GDXJ – proxy for junior mining stocks – just invalidated its breakout above the 50% Fibonacci retracement level, which is a very bearish sign. That’s the case on its own, but let’s not forget that the entire recent rally is similar to what we saw in early 2022. Once the GDXJ slides below its initial top, the key confirmation will be in.

As you can see on the above chart – the 2022 top was followed by a very sharp slide. The entire rally was quickly erased, and then the juniors declined much more.

Interestingly, in today’s London trading, the GDXJ is already down significantly, even though gold futures are hesitating.

Since miners tend to lead gold, this is a very bearish indication for the short term.

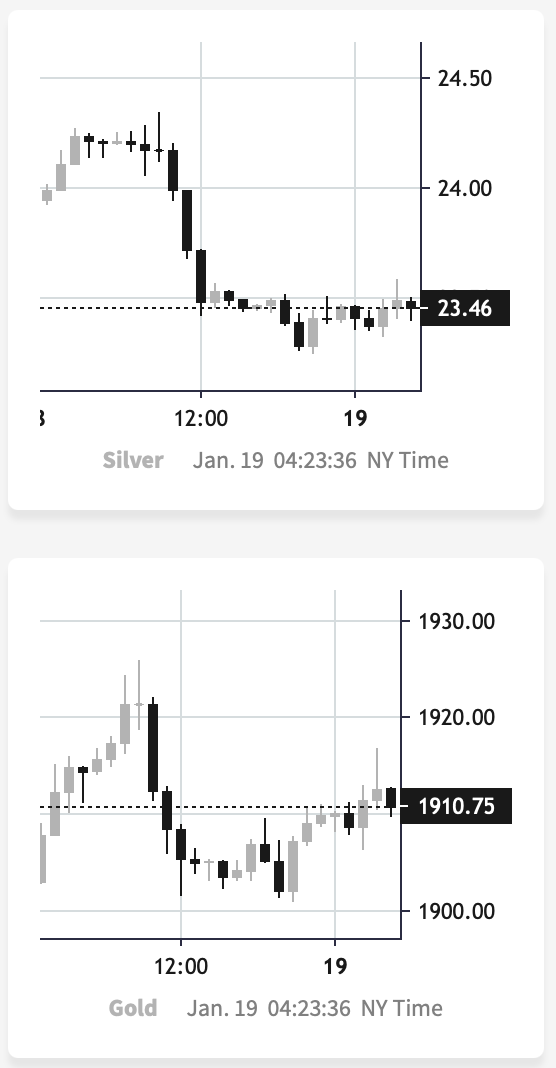

Meanwhile, silver (chart courtesy of https://www.silverpriceforecast.com) once again failed to hold above the $24 level.

That’s yet another reason to think that the top is already in. Whatever happens, the white metal is unable to rally more.

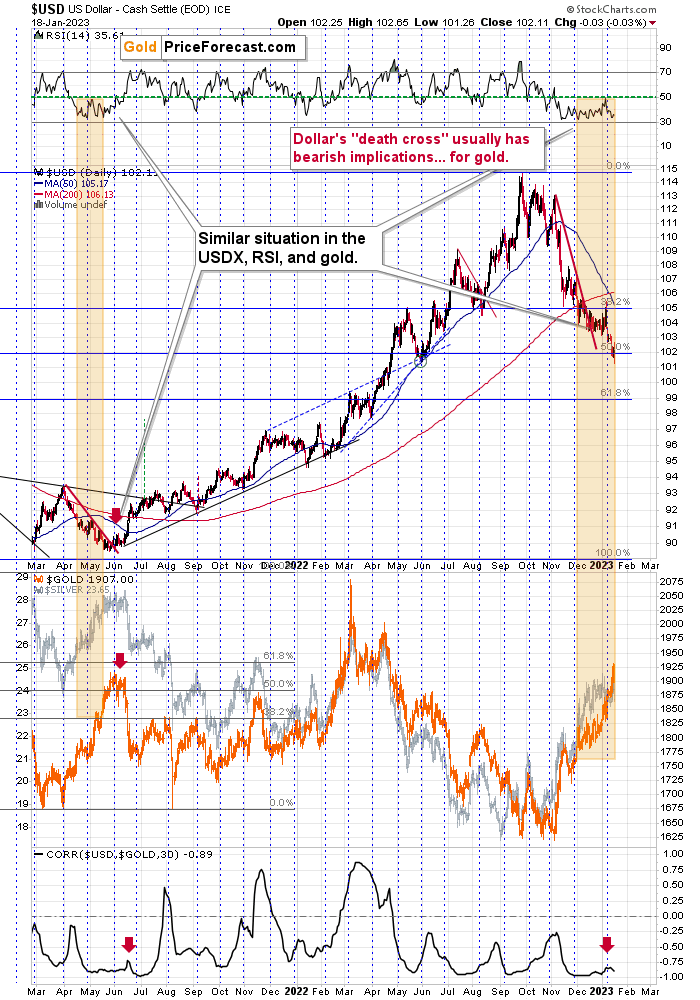

As always, context is critical. This time, we saw a major reversal in the key part of the context – in the USD Index.

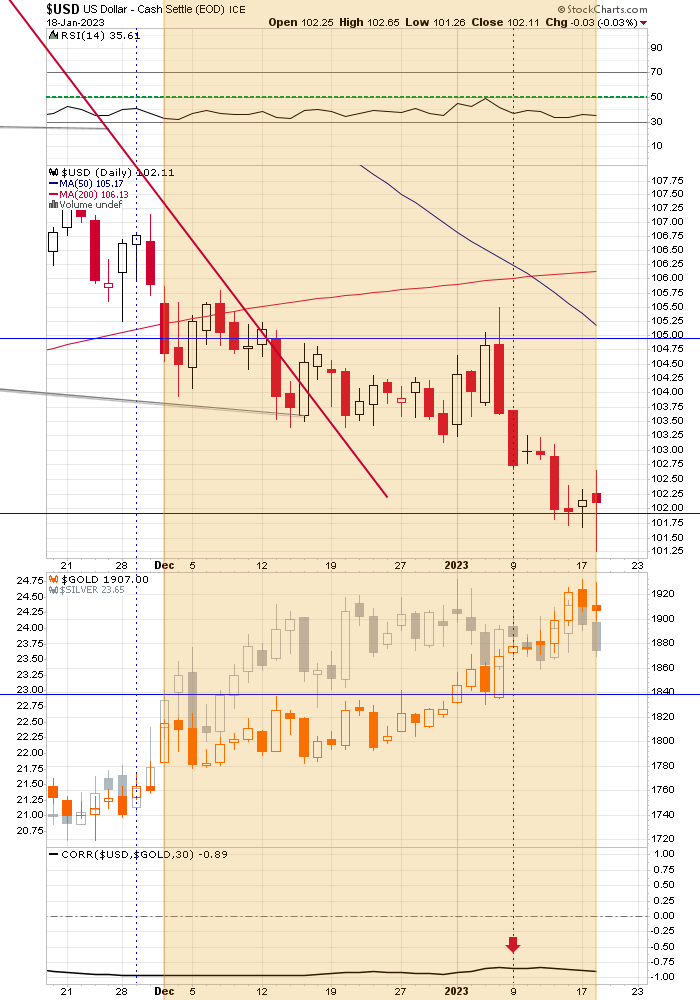

The USDX moved below and then rallied back above its 50% Fibonacci retracement level (reversing from more or less its mid-2022 low). It might not be clearly visible on the above chart, so let’s zoom in.

Now it’s clear that the move below 102 (and even 101.5!) was invalidated, and we saw a major reversal. At the moment of writing these words, the USDX futures are trading at about 102 – above the above-mentioned 50% retracement.

This means that the USD Index is likely to rally, and this – given the strongly negative correlation between the two – is likely to trigger declines in gold.

Of course, correlation doesn’t imply causation, but this actually is the case, as gold price is, well, priced in terms of the U.S. dollar.

All in all, the outlook for the precious metals market looks bearish, especially for junior mining stocks.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,