Gold SWOT: The “Safe Haven” of Choice is Shifting From U.S. Treasuries to Gold

Strengths

- The best-performing precious metal for the past week was silver, but still lower by 2.32%. Scotia views the Ontario Teachers Power Plan deal as positive for New Gold shares—not only is the deal structure financially accretive by their estimates, but it increases exposure to a known asset (New Afton) with a long operating history in a stable jurisdiction. They see this removing a potential overhang on NGD shares and allows the focus to shift to value creation through exploration and optimization.

- Silver’s rally is making waves in China as precious metals including gold surge. Futures for the cheaper commodity in Shanghai touched the highest in more than a decade as investors bet on rising demand, according to Bloomberg.

- Equinox Gold announced that it has poured first gold at the Greenstone mine. This is in line with the May timeline that management had been guiding for. All equipment is operating as expected, and the operation will now ramp up towards commercial production expected in Q3, according to BMO.

Weaknesses

- The worst-performing precious metal for the past week was platinum, down 4.89%. Gold fell for a third straight day after U.S. economic data showed an expansion in business activity amid a pickup in inflation, which may delay the Fed from lowering borrowing costs, according to Bloomberg.

- China’s bullion imports slowed last month as demand in the world’s biggest consumer begins to buckle in the face of record prices. Overseas purchases of physical gold fell to 136 tons in April, a 30% decline from the previous month and the lowest total for the year, according to the latest customs data.

- Anglo American says the value of rough-diamond sales from global sight holder sales and auctions in De Beers’ fourth sales cycle fell to $380 million compared with $446 million in the third cycle, according to Bloomberg.

Opportunities

- Citigroup Global Research Global Head Max Layton says gold is on track to reach $3,000 in the coming 12 months. He also comments on what he calls “off the charts” demand for gold coming from China, where the market is seeing a “big shift” from property spending into gold retail. Elsewhere in Asia, South Korea’s National Pension Service has begun to explore ways to invest in gold, commodities and private REITs, Seoul Economic Daily reports, without citing anyone.

- Idanna Appio spent 15 years at the Federal Reserve Bank of New York analyzing the history of sovereign debt crises. Now, as a fund manager at the $138 billion First Eagle Investments, she’s reached a conclusion: U.S. Treasury bonds are too risky to hold, as reported on Bloomberg. Rather than buying what’s deemed the world’s safest asset to balance out her equity and credit holdings, Appio is adding gold to her portfolio. Alice Atkins and Sujata Rao, the authors of the reported story “The Investment Implications of a World That’s Fast Getting Older” penned an interesting report on the changing demographics, particularly with falling birth rates, labor supply, and inflation. The shift of assets away from U.S. debt for a pension is leaning more into equity, commodity markets, and investing in infrastructure projects with revenues linked to future inflation.

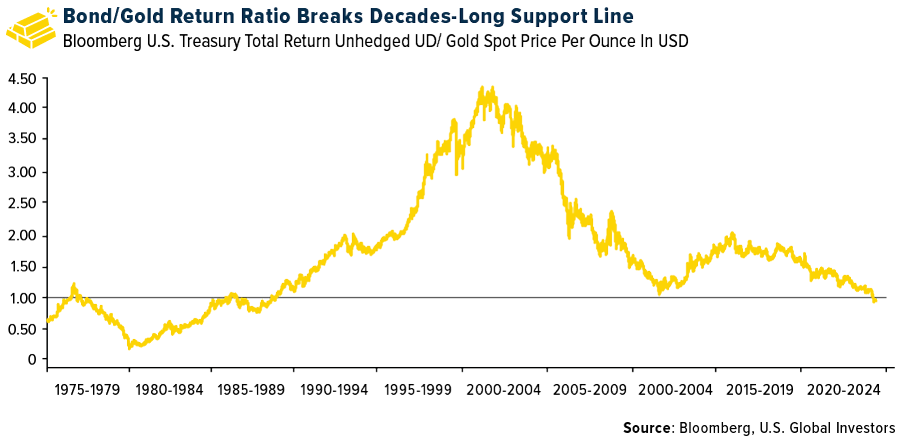

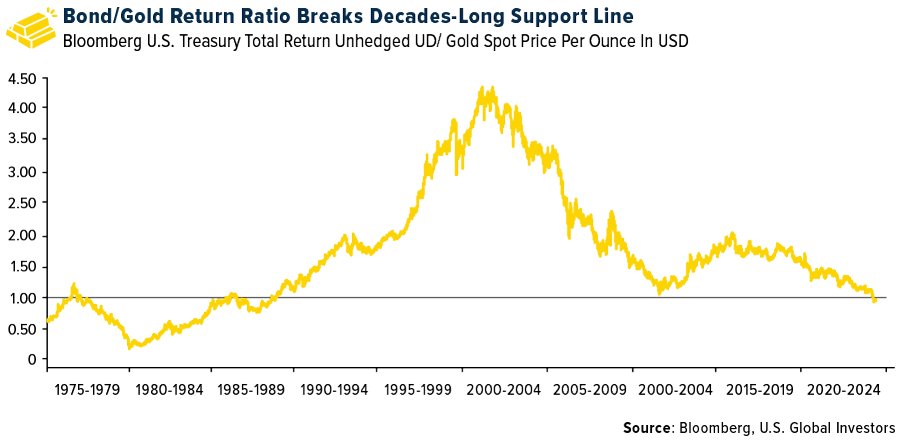

- For much of the past half century, U.S. Treasuries have handily outpaced gold as a buy-and-hold investment. Now, bonds’ status as the ultimate haven is facing one of its biggest challenges yet. Investors traditionally flocked to US debt as a super-safe investment paying steady income and backed by the world’s economic powerhouse. This relationship has been shifting lately, as echoed in the bullet point above, with recent trends moving in gold’s favor, according to Bloomberg.

Threats

- Without new mining concessions, Mexico’s mining production will likely decline over time. There are risks of potentially lower global supplies of silver (Mexico is the world’s top producer, contributing 24.6% of total production in 2023), according to Scotia. This likely will be supportive of the silver price but projects in Mexico may face additional delays.

- Despite event-driven uncertainty surrounding the potential de-merger of Amplats, and in the absence of clarity around the pace and structure of an Amplats de-merger JP Morgan thinks Amplats’ rally ahead of both the peer group and the basket price could underpin volatility, with immediate risk skewed to the downside.

- IAMGOLD announced a $300 million equity-bought deal financing, which takes advantage of the strong share performance, and from a position of strength, boosts cash balance to enable IMG to accelerate the plan to repurchase its 9.7% interest in the Côté Gold Mine from Sumitomo (returning to an effective 70%-interest in the operation). There is the risk of dilution from this transaction, according to Bloomberg.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of