Gold SWOT: Could This Be the Start of a New Bull Market in Bullion?

Strengths

- The best performing precious metal for the week was gold, up 5.22%. Gold in China jumped to trade at the second-highest premium on record against the international benchmark, as mainland markets reopened following the Golden Week holiday. The Shanghai spot price was more than $112 an ounce higher than levels seen in London on Monday, according to Bloomberg calculations and based on exchange data. The gap between the two markets has only been wider one other time, when Chinese prices last month blew out to trade at a premium of more than $120 over London, as Beijing restricted shipments in a move that squeezed the market.

- Calibre Mining Corp. reported Tuesday record gold production of 73,485 ounces in the third quarter, a 50% year-on-year increase. The company said this marked the fourth consecutive quarter that it achieved record quarterly gold production. Year-to-date production increased 30% to 160,704 ounces as the company remains on track to deliver its full-year 2023 guidance of 250,000 to 275,000 ounces.

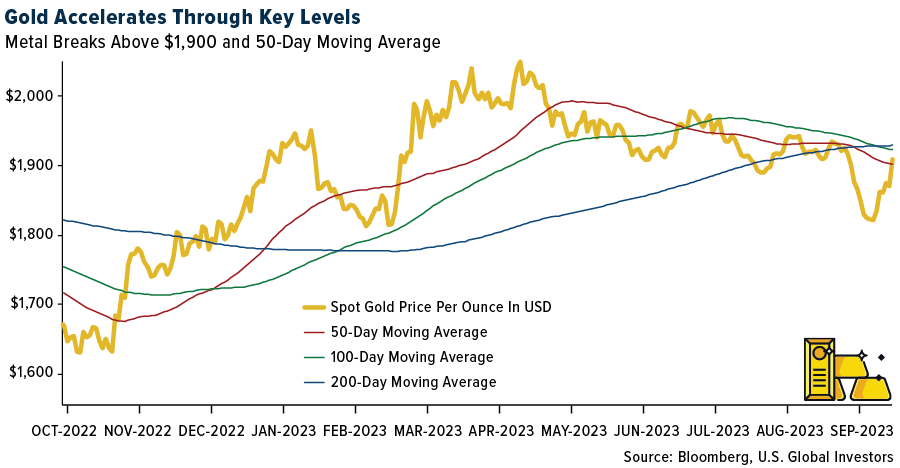

- Gold surged above $1,900 on Friday as conflict in the Middle East appeared to be headed for escalation this weekend. The precious metal steadied after jumping 1.6% on Monday, the most since May, as haven demand rose on the back of Hamas’ shock attack on Israel over the weekend. However, the developments on Friday sent gold climbing over 3% on the day.

Weaknesses

- The worst performing precious metal for the week was palladium, down 1.30%. According to JPMorgan, platinum and palladium prices slumped to a year-to-date low earlier this week as continued higher-for-longer interest rate pricing finally cracked resilience in precious metals prices over the last few weeks. More broadly, platinum deficits have not been felt in the broader physical market as China has likely destocked domestic above-ground inventory imported over recent years. Power disruptions in South Africa have also not materially disrupted supply, eroding a risk premium that was embedded in prices earlier this year.

- For K92 Mining, as a result of the unexpectedly challenging first quarter and the impacts of the safety incident on June 28, 2023, the company is updating its production guidance to 111,000 from 116,000 ounces gold (originally 120,000 to 140,000 ounces). Given K92's strong liquidity position for the Stage 3 and 4 Expansions and the positive reported exploration results to date, it is increasing exploration expenditures for 2023 to $20 million from $13 to $16 million originally planned.

- The CPI print on Thursday morning took what was looking to be a good rally in the price of gold to start the day to a deflating loss. The data supports the thesis for another rate hike this year but it’s not certain. However, investors versus the pundits calling for a cut in rates may set the path forward with higher long rates continuing to increase. As Bloomberg noted, price agnostic buyers, U.S. commercial banks, hedge funds, insurers, and pensions, are move aggressive and likely to demand higher yields to finance long-term government debt.

Opportunities

- Could this be the start of a new bull market in bullion? No one knows the answer to that question, but looking at some of the initial stock price performance for some of the best performing senior peers for the week shows promise: Harmony Gold Mining up 27%, Gold Fields Ltd. up 26% and AngloGold Ashanti Plc. up 22%. While this is intriguing performance, it doesn’t translate to gains per say, unless investors already owned the companies in a portfolio. That is where the opportunity lies; gold stocks have been ignored relative to the price of gold with the digital asset frenzy of recent years. Gold stocks, in particular the junior gold exploration and development tiers, have been eschewed by new investors in search of quick riches.

- Bank of America thinks that the royalty & streaming (R&S) names are the preferred picks in this type of environment given fortress balance sheets, low costs that are insulated from cost inflation, and lower gold price operating leverage. The bank highlights R&S companies Franco-Nevada and Wheaton Precious Metals given their large market caps, deep liquidity, and substantial asset and commodity diversification.

- According to Bank of America, as to gold, Heraeus outlines that "Despite net negative demand in April and May this year, strong buying activity by central banking institutions has returned.” There were no notable sales in August, while purchases totaled 77 tons. The Chinese central bank added 29 tons to its gold reserves in August, continuing a streak of buying that began in November last year. Central bank purchases have supported gold.

Threats

- According to BMO, Dundee Precious Metals reported its third quarter 2023 production results with gold and copper production slightly lower than its estimate. Overall, gold production remains well on track to meet 2023 guidance, but copper production could achieve the lower end of guidance.

- According to CIBC, Karora Resources reported consolidated third quarter 2023 production results of 39.5koz, below consensus of 41.6koz. Third quarter production brought Q1-Q3 production to 120.2koz, tracking in line with the high end of unchanged 2023 guidance of 145koz-160koz.

- An unsolved $17 million heist of Swiss gold and cash near Canada’s busiest airport has led Brink’s Co. to sue Air Canada for allegedly letting a thief slip away with the loot. Miami-based Brink’s accused the airline of “negligence and carelessness” in a lawsuit after a heist at a Toronto cargo facility netted thieves about 400 kilograms (882 pounds) of gold and $1.9 million in bank notes.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of