Gold SWOT: Gold Moves Higher As Investors Evaluate The Fed’s Tightening Path

Strengths

- The best performing precious metal for the week was platinum, up 7.73% as hedge funds cut their bearish platinum outlook to the lowest in six weeks. The Reserve Bank of India boosted its gold holdings by 65 tons in the year ended March to 760.4 tons, according to the central bank’s annual report. Of the 760.4 tons, about 295.8 tons are held in India as backing for notes issued and the rest is held overseas as assets of the banking department, the Reserve Bank of India (RBI) said in the report

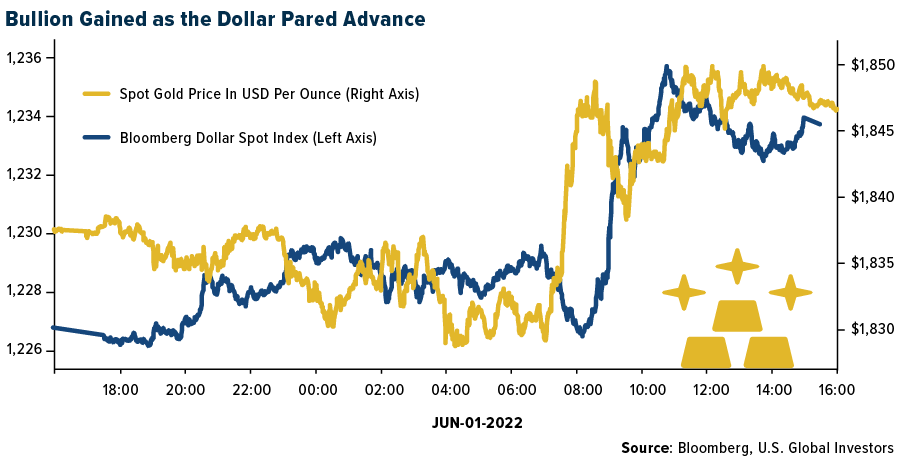

- Gold advanced as investors assessed developments in the Federal Reserve’s path to monetary tightening as inflation and rising volatility weigh on economic prospects. Concerns that central bank rate hikes may induce a recession are keeping investors guessing about the outlook for the economy as rising food and energy costs squeeze consumers, and volatility in the markets has picked up. Bullion had a choppy month in May as traders weighed aggressive monetary tightening and prospects of an economic slowdown. “Fundamentals overall are supportive for gold, but not aggressively so as the markets try to figure out whether we’re in inflation, stagflation or recession,” said Rhona O’Connell, an analyst at StoneX Group. Traders are also probably waiting for the Fed’s assessment of the economy today and Friday’s job numbers, she said.

- The demerger of Leo Lithium from Firefinch concluded on Friday with trading set to begin in Leo Lithium around June 16. Holders of Firefinch received 1 Leo Lithium share for every 1.4 Firefinch shares they held. In addition, an A$100 million raise was taken up by 90% of the Firefinch shareholder. Firefinch retained 20% of the Leo Lithium shares and is working towards producing 100,000 ounces of gold from the Morilla Mine in Mali. Based on the rerating post the spinout of Leo Lithium, their share price relative to their resource statement is significantly undervalued. Leo Lithium is partnered 50:50 with Chinese lithium mining and processing giant Ganfeng with anticipating lithium production by 2024.

Weaknesses

- The worst performing precious metal for the week was palladium, down 4.81% on little metal specific stories. A recent Bloomberg report showed that a third Americans earning at least $250,000 annually, are faced with living paycheck to paycheck. This underscores how inflation is taking a bigger bite out of household budgets at the end of the month. The $250,000-plus income bracket represents the top 5% of earners in America. Obviously, they are not suffering the same stresses as the other 95% have experienced but seems to highlight what used to be a good income in America doesn’t cut it anymore.

- With the banning of seaborn Russian oil by Europe, diesel prices spiked 19% to over $40 per barrel. Russia is the biggest supplier of diesel to Europe but oil is an international market and we are likely to see knock on affects to world markets, which will impact the large open pit miners more so on cost.

- Appian Capital Advisory LLP has filed a claim at the High Court of England and Wales seeking compensation from Sibanye Stillwater and its subsidiary Sibanye BM Brazil for Sibanye’s failure to close on a $1.2 billion transaction to acquire two mines in Brazil, according to an emailed press release. Appian says Sibanye’s termination of the deal was based on the incorrect assertion that a geotechnical instability at Atlantic Nickel’s Santa Rita mine constituted a material adverse effect Appian is seeking to recover its losses in full.

Opportunities

- In an unexpected announcement (in part because Yamana is hosting two mine tours this week), Gold Fields and Yamana jointly announced that Gold Fields is acquiring Yamana to create a top-4 gold producer (3.4M ounces per annum) headquartered in Johannesburg. In an all-share offer by Gold Fields, the exchange ratio is 0.6 Gold Fields share for each Yamana share, implying a value of $6.7 billion for Yamana, a 31% premium to the last $5.1bn market cap. North American investors did not appreciate the offer as Gold Fields sold off 23% on the day of the announcement as they have largely ignored the South Africa gold miners, which have diminished impact on world supply in recent decades. However, Gold Fields and the other South African gold stocks have proven to have very lucrative prices moves with a strong gold market.

- According to RBC, mergers have been driven by a few fundamental sector themes: first, the reserve replacement challenge – gold producers are having increasing difficulty replacing the reserves they mine each year; second, scale for relevance – generalist investors continue to prefer gold companies with large market capitalizations; third, scale for cost – particularly relevant in the current inflationary environment, larger producers tend to have better buying power and can better maintain costs and margins; fourth, ESG performance – gold companies with mines in more challenging jurisdictions and higher emissions intensity seek to diversify; and fifth, high industry fragmentation – the gold sector is much more fragmented relative to other mining sectors.

- Nano One Materials has entered into a joint development agreement with BASF for evaluating Nano One’s patented M2CAM One-Pot process for BASF’s next generation of cathode active materials. BASF has a family of cathode active materials (CAM) products well suited for the drivetrains of electric vehicles (EVs). Nano One’s technology will allow BASF to have higher functionality during the crystal growing processes to increase performance and lower the costs of production.

Threats

- The Democratic Republic of Congo was reported by Bloomberg to be considering establishing a stabilization fund to ensure its booming mining industry isn’t undermined by external events like the war in Ukraine or a future pandemic. Interesting they cite how high fuel costs have eroded government revenue. While many miners have faced higher diesel cost it is not likely the government is funding these fuel purchases for the miners. The idea appears more be a new taxation attempt.

- The U.S. Energy Information Administration (EIA) expects wholesale electricity prices in the western U.S. electricity markets as the Northern California snowpack was at only 26% of normal levels back in April, an indicator that the reservoirs at western power plants will have enough stored water to meet power demand.

- According to RBC, automobile sales are expected to remain challenged in 2022 given supply constraints and the impact of inflation on consumers. With supply from Russia seemingly uninterrupted so far, they expect platinum prices to stay soft through 2022.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of