Gold SWOT: U.S. Gold Coin Sales Are On Pace To Have The Strongest Year Since 1999

Strengths

- The best performing precious metal for the week was gold, up 1.41% after the market digested the Friday CPI print of 8.3%. India's gold imports for May jumped 677% in one year, the highest surge seen on a yearly basis. The rise in imports comes on the back of a correction in prices just before Akshaya Tritiya, a key festival for Hindus and Jains celebrated in the first week of the month. The wedding season also boosted sales of retail jewelry.

- Vox Royalty Corp. announces that it has executed a binding royalty sale and purchase agreement with an individual prospector residing in Canada. The agreement would be to acquire the rights to three Canadian gold royalties for total consideration of up to C$1,800,000. “We are very excited to add these rapidly advancing Canadian gold royalties to the Vox portfolio, which offer significant near-term exploration and development catalysts for shareholders,” said Vox CIO Spencer Cole.

- Data from the U.S. Mint shows that sales of American Eagle and Buffalo gold coins totaled $365 million (or 199,000 ounces) in May, reports the World Gold Council. Sales rebounded from the April 2022 lows to slightly higher than the year-to-date average. Sales are on pace to have the strongest year in terms of U.S. coin sales since 1999, the report continues.

Weaknesses

- The worst performing precious metal for the week was platinum, down 4.32%. Gold ETF net outflows totaled 53 tons in May, reports the World Gold Council, with year-to-date inflows of 262 tons. All regions experienced outflows during the month with North American funds leading the way, with 34 tons of outflows, followed by European funds, the report continues. Weaker momentum and positioning are noted as driving these outflows.

- Victoria Gold Corp. last week had the biggest increase in short interest relative to tradable shares among Canadian companies, according to data from financial analytics firm S3 Partners. U.S. diesel prices continued to climb this week with a substantial pick-up in European demand being supplied by U.S. domestic production. This is driving up fuel costs and hitting the earnings of companies that rely on trucking and mining.

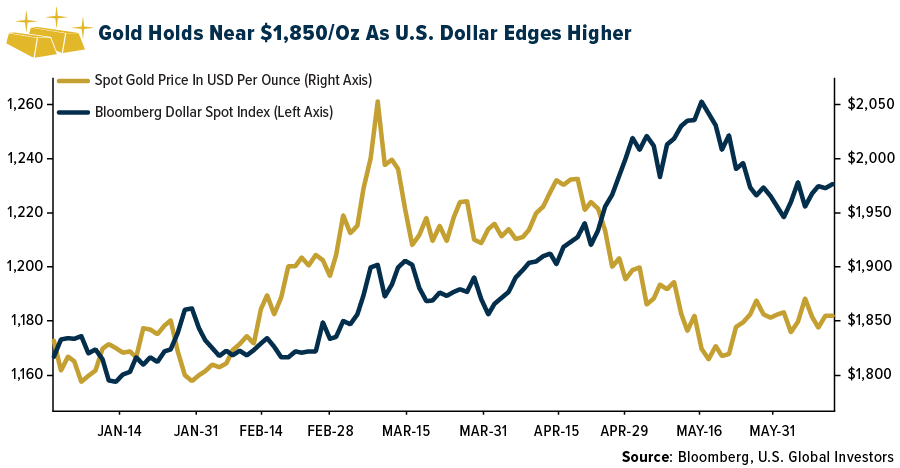

- Gold has edged up since mid-May on more troubling signs in the global economy, reports Bloomberg, although an uptick in the dollar and bond yields has weighed on prices. Still, bullion held Tuesday’s gains, with warning signs of slowing world economic growth amid a surge in inflation bolstering its appeal as a haven asset. Gold was largely capped for the week, as markets awaited the CPI print that came in higher than expected. This prompted some economists to call for a 75-basis points hike at the next Fed meeting. Gold sold off initially but closed the week with a gain.

Opportunities

- Rio Tinto, a leading global mining company, makes a $10 million strategic equity investment in Nano One, a clean technology innovator in battery materials. This agreement falls on the hills of Nano One acquiring the LFP battery production facilities of Johnson Matthey in Quebec along with their team. In addition, BASF recently partnered with Nano One on developing their process with reduced byproducts. What the purchase of the Quebec facilities will do is allow Nano One to produce its patented cathodes on scale in the thousands of tons versus its Vancouver facility, which can now be devoted to testing new battery chemistries and the integrity of the crystals produced.

- Weddings continue to be great for diamond sales. In fact, sales rose more than 60% in 2021, according to Bain & Co., while production increased by just 5%. This shows that diamonds have been getting more expensive, with global prices up 21%. Supply from diamond mines declined every year from 2017 to 2020, with the total sliding from 152 million carats to 111 million. Bain & Co’s research says production will likely grow by just 1% to 2% annually over the next five years. De Beers recently raised its prices for small stones as Russian supplies have disappeared.

- According to Stifel, Chris Jordaan joined Superior Gold (SGI) as CEO in May 2021 and has led the company through a turnaround. The operations side of the business has delivered, with seven consecutive quarters of increasing gold production. Management has also delivered a new reserve and resource statement with a 66% jump in reserves. Stifel maintains a positive view of the long-term potential of the SGI portfolio during this time.

Threats

- According to RBC, the bear case for Gold Fields is as follows: 1) it is tough for existing and new investors to own the GFI ADR trading in the U.S. and/or the South African listing, creating further forced selling pressure from Yámana shareholders pre/post-deal close, 2) South African headquarters makes it a tough sell to some investors, with potentially less management access, 3) perhaps skeletons in either miners’ portfolios, which is a headwind on both the pro-forma story and standalone GFI story, and 4) the multiple re-ratings due to size may take some time to be realized. That’s the bear case clearly stated. The market will vote with its dollar.

- Barrick Gold said on Tuesday it has sold its entire 8.5% stake in Perpetua Resources Corp. for gross cash proceeds of $21.73 million. Perpetua, which fell 8.5% in Canada trading on Monday, also said the Stibnite Gold Project in the U.S. is progressing into the later stages of the permitting process.

- U.S. inflation hit a 40-year high in May, signaling to some that the Fed needs to get even more aggressive on interest rate hikes. The 10-year TIP yield climbed to 0.37 basis points after the 8.3% CPI print. There is a long gap between real rates and inflation and the Fed will have to avoid any policy mistakes as it attempts to tap down prices. Investors can potentially help balance the volatility of their overall portfolio with a 10% allocation to precious metals and mining companies.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of