The Gold Update: Turbulence in The Metals Triumvirate

As you studied aficionados of deMeadville well know, we refer to those BEGOS Markets comprising Gold, Silver and Copper as “The Metals Triumvirate”. And lately, turbulent indeed has been its components’ price paths:

- Gold from 23 July through 30 July fell by as much as -5.4%;

- Silver from 23 July through 31 July fell by as much as -9.1%;

- Copper from 23 July through 31 July fell by as much as -27.3% (ain’t no typo).

Then specific to the week just past, Silver had no net weekly gain, and worse, “economy-leading, but now tariff-butt-kicked” Copper had no hope, period.

However, Gold was a gainer, its December contract settling yesterday (Friday) at 3416 for an actual net weekly advance of +0.7% (+23 points). Gold’s so-called “continuous contract” gained +2.3% (+78 points) given +54 points of fresh price premium per the August contract having rolled forward to December.

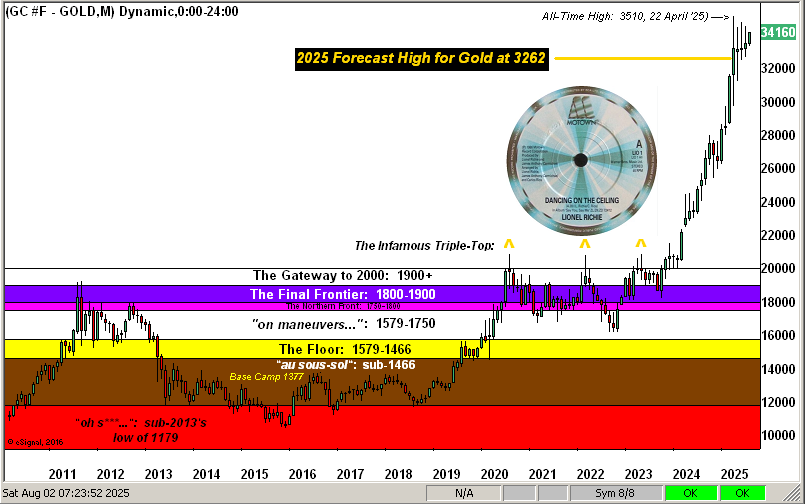

Thus, this being a graphics-rich “end-of-month, plus-a-day” edition of The Gold Update, let’s get going with the yellow metal’s weekly bars by the continuous contract from one year ago-to-date, highlighted by a second week of the fresh parabolic Long trend. The run from here to the All-Time High (3510 on 22 April) is another +2.8% (+94 points). And as we detailed a week ago, given recent parabolic Long trend history, that is reasonably within range during this stint:

As for Sister Silver — sadly donned in her industrial metal jacket — she was pulled down in sympathy with Cousin Copper’s colossal collapse, the Gold/Silver ratio in turn leaping from 87.1x just a week ago to now 92.1x (as above depicted). Surely Silver shall swiftly come to her senses and re-don her precious metal pinstripes. Either way, she’s had an amazing year-to-date, second only to Gold as we turn to our BEGOS Markets Standings. Think things are uncertain out there? Look at the top three podium positions:

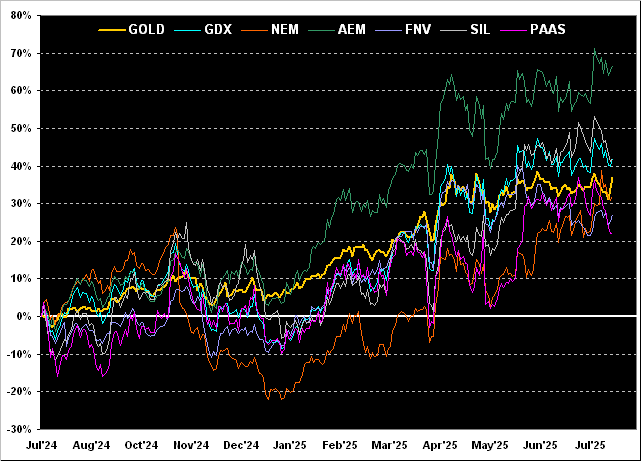

Indeed for the precious metals at large, “Up!” has been “It!” From this time a year ago-to-date, here we’ve the following percentage tracks of Pan American Silver (PAAS) +22%, Franco-Nevada (FNV) +27%, Newmont (NEM) +32%, Gold itself +37%, the Global X Silver Miners exchange-traded fund (SIL) and the VanEck Vectors Gold Miners exchange-traded fund (GDX) both +42%, and ever-amazing Agnico Eagle Mines (AEM) +67%. Is livin’ with equities’ leverage your favourite beverage? Per the “It All Depends From Where You Start Dept.”, Gold itself has been the Big Winner from 2020-to-date: +124%; the balance of the equities bunch then range from +103% for AEM down to +14% for PAAS … just in case yer scorin’ at home. Here’s the year-over-year graphic:

As entitled, “turbulence” has characterized The Metals Triumvirate of late. ‘Tis starkly evident here in going ’round the horn for all eight BEGOS Markets. Each frame depicts that market’s last 21 trading days (one month), grey trendline and “Baby Blues”, the directionally-leading dots which define the trendline’s day-to-day consistency. Specific to the metals’ turbulence, Gold has well-recovered most of its recent plunge; but not so Silver, nor clearly Copper. However: we see the biggest story therein as the S&P 500 (“SPOO”). We’ve purposefully re-coloured several of its blue dots in red, as when they fall (from above the +80% area), we anticipate lower prices. And akin to Copper, that’s one heckova long-anticipated S&P “Whoopsie!” in the lower righthand panel:

“But was yesterday just a one-day wonder-plunge for the S&P, mmb?”

Squire, if the market is at long-last coming to its senses, en route to reverting to important means — be they fundamental, technical or quantitative — no ’twas not a one-day wonder. As posted only internally for deMeadville on Thursday evening, (the S&P then 6339 and now 6238):

- “IF this is the beginning of the broad correction, the initial fib golden ratio retracement (basis today’s high to April’s low) is down to 5861; then the mid-point is 5673; then the full golden ratio retracement is to 5485. Retracement to the top of the 55-year regression channel is 4513. And retracement to the top of the “had covid never happened” regression channel is 2941.”

But that boldly stated, you know how this market behaves in The Investing Age of Stoopid: “Earnings mean nothing, stocks always triple, buy every dip!”

“You always go on about ‘earnings mean nothing’, mmb…”

And here is why, Squire. Look at the ongoing Q2 Earnings Season, (with two weeks to run in the balance). 80% of the S&P 500 reporting constituents have beaten the investment banker’s marketing tool known as “estimates”. Yeah, ok, so that’s cute. But comparatively, only 65% have actually done better year-over-year, which is a slightly below average pace. That never gets any notice. And with the honestly-calculated “live” P/E of the S&P now 46.5x but hardly any dividend yield (1.233%) versus “risk-free” (gulp!) short-term U.S. dough paying 4.182%, the problem is obvious: the overall level of S&P 500 earnings is not sustainable for price. Period. We’ve been through this before — and barring Stoopid continuing to prevail — here it comes again. For whenever the next material correction does come, the fear factor shall be massive: “But, we were never taught about ‘selling’!” Have the popcorn ready.

Moving on to the Federal Reserve, when was the last time you read dissent into the foot of the Open Market Committee’s Policy Statement? Oh to be sure, there’s been some minor disagreement in recent years; but this past Wednesday, both Ms. Bowman and Mr. Waller voted in the minority for a -0.25 basis points reduction in the bank’s Funds Rate, which instead rightly was maintained in the target range of 4.25%-to-4.50%.

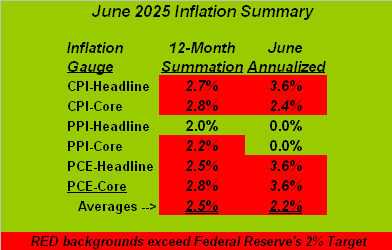

Meanwhile, President Trump’s contention is that a rate cut is absolutely necessary because (paraphrasing): “the economy is strong and inflation is low”. Having spoken with a number of market mavens ’round here, all agree that opinion makes no economic sense. Moreover, inflation has reversed its recent pace of slowing and is again growing. Here’s our June Inflation Summary table, nonetheless noting therein the benign wholesale pace of the Producer Price Index. Still, “Fed-favoured” Personal Consumption Expenditures ratcheted higher:

As to the past week’s biggest surprise, for us ’twas the initial read of Stateside Q2 Gross Domestic Product: the consensii had it pegged for a +2.5% annualized pace, whereas we wouldn’t have been surprised by a negative pace given both the leading Q2 fallout in the Economic Barometer along with the Conference Board’s lagging report of “Leading Indicators” which hasn’t been positive since last December. So what happened? The GDP came in at +3.0%. To quote John Patrick McEnroe: “You canNOT be SERious!!” –[The All England Lawn Tennis & Croquet Club, 22 June, 1981]. Let’s see what the first GDP revision is come 28 August. Here’s the Baro:

Indeed, of the Baro’s 18 incoming metrics last week, 10 improved period-over-period. Cursiously though again, July’s ADP Employment creation directionally differed from Labor’s Payrolls. The former beat consensus and had June favourably revised; the latter missed consensus and had June unfavourably revised. Reprise: “It depends thus on who’s counting what.“

What we can count on from week-to-week are the 10-day Market Profiles for the precious metals. And next on the left we’ve that for Gold (in December pricing), the present 3416 level being the white bar near the Profile’s center. But on the right, Silver’s dallying with Copper finds her price (37.11) lower down in the stack. “C’mon, Sister Silver…”:

Naturally it being month-end, plus one trading day, here is the monthly Gold Structure for the past 15 years. The rightmost green bar is merely Friday (yesterday) alone, it having been 01 August. ‘Tis been quite the run for Gold across this time frame, ‘specially after only just two-to-four years ago when Gold’s infamous Triple-Top pricing was  “Dancing on the ceiling…”

“Dancing on the ceiling…” , –[Lionel Richie, ’86]:

, –[Lionel Richie, ’86]:

Metals turbulence notwithstanding, next week is a bit more benign for the Econ Baro with just eight metrics due, including improved (purportedly) Productivity for Q2. Are you productively maintaining a sound supply of Gold?

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

*******