Gold: Yen Lightning And Love Trade Thunder

Gold continues to track the sideways action of the US dollar against the Japanese yen, ahead of Friday’s important US jobs report.

Investors, who focus only on the USDX are focusing mainly on the action of one risk-on currency (the dollar) against another (the euro).

That’s a mistake because gold is the world’s premier risk-off asset. Gold’s price action against the dollar is highly correlated to the dollar’s price action against the Japanese yen.

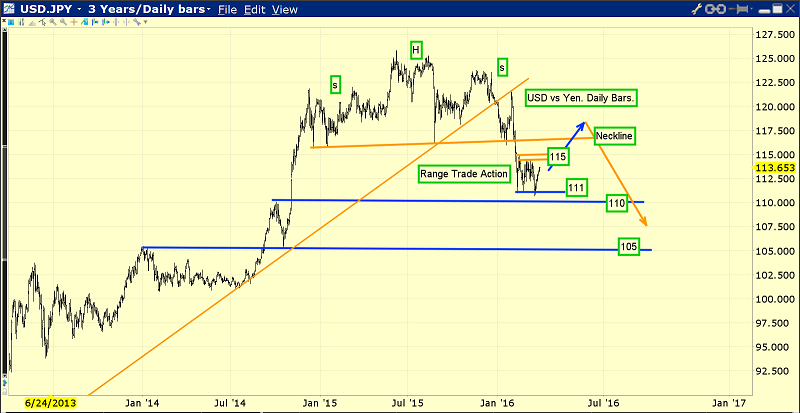

This daily bars chart of the dollar against the yen shows the dollar is meandering sideways, roughly between 111 and 115.

It’s unknown whether the dollar will break out to the upside or the downside from this trading range. In any case, the target price zone of the huge Head & Shoulders top pattern is the 105 -107 area.

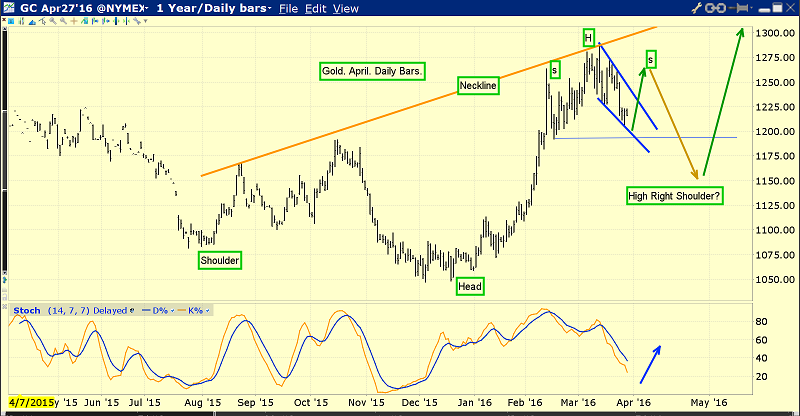

A decline in that area would probably be accompanied by gold rallying to $1350…and perhaps to as high as $1500. This is the daily bars gold chart.

There’s a very large inverse Head & Shoulders bottom pattern forming…and I expect the right shoulder low could occur around the April 19 time frame. Here’s why:

That’s when the Shanghai Gold Exchange (SGE) is scheduled to launch its gold price fix. The Chinese government has already told Western banks that their gold bullion dealings in China could be curtailed if they do not play a fair and significant role in the new gold fix platform.

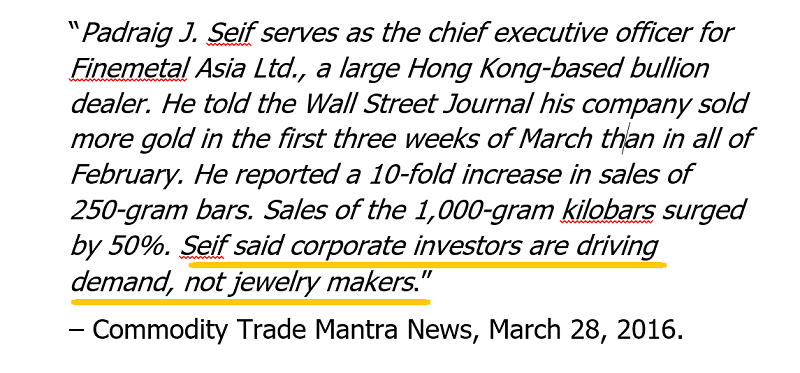

Gold often sells off quite strongly after Chinese New Year ends, but investment demand has surged, as I predicted it would when the gold market became more stable.

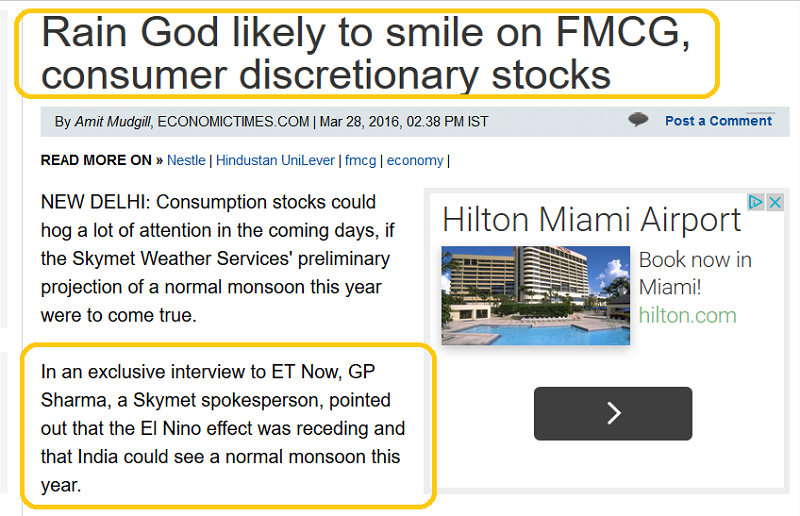

I have more good news for higher gold price enthusiasts about the love trade. The ebb and flow of Indian gold demand are highly correlated to the monsoon season.

For the past few years, El Nino has brought warm winters to the West…and relatively dry monsoon seasons to India. That’s about to change.

Not only is El Nino fading, but La Nina appears like it will replace it. This means bumper crops for Indian farmers, who are the world’s largest gold buyer class!

Also, La Nina can bring cold winters to the West…along with higher oil prices. Rising oil prices tend to be accompanied by rising gold prices.

The US jobs report occurs this Friday. Gold has a tendency to be soft in the days ahead of that report, and then stage a nice rally after the report is released.

As the power of the love trade grows, the importance of the US jobs report is waning, which is adding more overall stability to the market. That stability is highly attractive to Chinese investors.

Polls in the USA suggest that while elderly citizens may want to rebuild the America of the 1950s with a Trump/Cruz team, America’s youth are obsessed with socialist Bernie Sanders.

The US 1950s GDP “super boom” occurred after World War II ended. The America of the 1950s was built by hard working veterans. I’m a little worried that America’s senior citizens may be overestimating the heart of the current younger generation to rebuild what they built, even with better tools and technology.

So, my suggestion for stock market enthusiasts who dream of the past is this: Focus on Chinese and Indian stock markets, where billions of gold-oriented hard working citizens stand more ready to take on any task in order to get the job done.

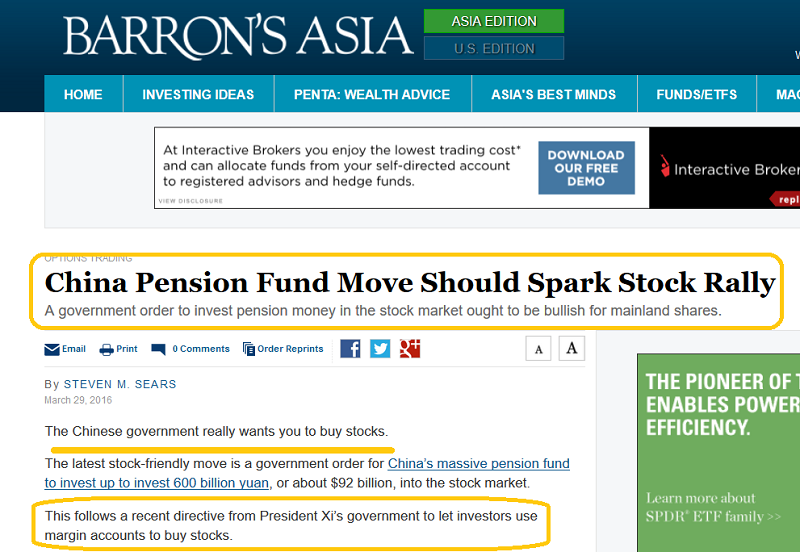

I’ve suggested that Chinese stock market declines and crashes need to be bought, rather than predicted. Chinese culture is very old. Therefore, the Sino-nation brings vastly more experience to the table than the West does. The latest news suggests that a major move higher in Chinese markets is coming…and probably in the very near future.

This is the key Chinese stock market chart. From a technical perspective, the upside implications I’ve annotated on this chart are in sync with the solid fundamentals and pension fund news that is now in play.

This daily bars GDX chart shows support in the $17 area. I think it’s very important for gold stock investors, who are presently out of this market to be substantial buyers in the $20 - $17 area.

I’m a buyer on every 25 cent decline in this price zone, using my systematic capital allocator. If GDX declines below $17, I won’t do any more buying, unless it makes a new low.

I don’t expect that to happen. Instead, I think GDX is going to surprise most analysts, and stage a big rally towards the $28 area. That’s mainly because of La Nina affecting Indian demand, the action of the dollar against the yen, and the re-emergence of the Chinese investor class!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “GDX Versus GDXJ, Mano A Mano!” report. As the gold price moves higher, GDX will lead at times, and GDXJ will lead at other times. I highlight key leading stocks within each ETF, with key buy and sell signals for each!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to: Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: