Gold (Yes Really) Records a Third Consecutive Down Week

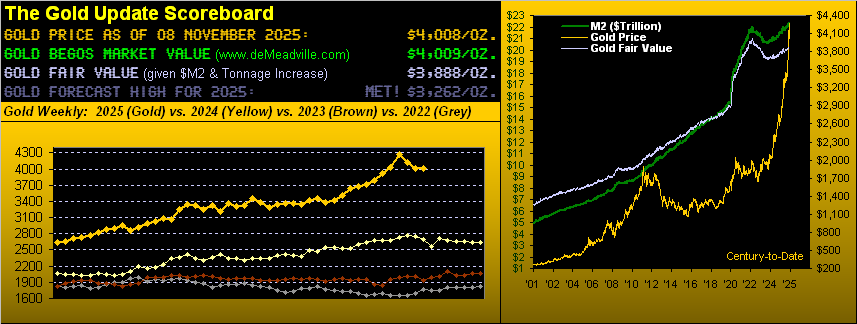

Four weeks ago for the first time ever, Gold settled above 4000, indeed at 4036 on Friday, 10 October. A week hence, Gold bettered that level with a Friday settle at 4268 on 17 October. And whilst Gold’s three successive Friday settles all have still topped the 4000 milestone, each in turn has been lower: from then 4126 to 4013 and now to yesterday’s weekly close a tad lower still to 4008.

“So yeah, three down weeks in a row, mmb, but aren’t you being a bit picky?”

Squire, partially picky perhaps, yet with this pointed reprise from last week’s piece: “…the last time Gold posted … three consecutive down weeks was … one year ago (those in 2024 ending 01 November through 15 November)…” Now a year later in 2025, Gold has again recorded three consecutive down weeks ending 24 October through 07 November. How’s that for seasonality(!) And thus from price’s All-Time High recorded just 15 trading days ago on 20 October at 4398, the yellow metal presently is off -8.9% … which is “noise” considering year-to-date Gold is up a net +51.9%, (and Silver the precious metals’ leader +64.6%).

Regardless, over these many years of The Gold Update (our 16th anniversary edition slated for 22 November), we’ve on occasion quoted — irrespective of price — the late great Richard Russell’s maxim that “There’s never a bad time to buy Gold“. Such statement until very recently essentially has been a truism ever since Nixon nixed The Gold Standard back in ’71, (even in having to weather price’s -45.7% decline from September 2011 into December 2015). For throughout — until that landmark week ending just this past 03 October — the market price of Gold has mathematically been subordinate to its Fair Value. But today, per the opening Scoreboard, Gold at 4008 is +120 points above its Fair Value of 3888.

Thus, from the “Feet on the Ground Dept.” — with the highest respect to Mr. Russell’s maxim — we are reminded of that stated by The Gold Update’s initial charter reader (JGS, whom we paraphrase): “The day to sell Gold is the day that everybody else wants it.”

And so it came to pass into this past summer’s end that Gold by the public eye metamorphosed from its discarded relic status into that of a meme stock, which in a mere 22 trading days (from 19 September into 20 October) soared +18.2% to the 4398 All-Time High, again in accordance with everyone having instantaneously become a Gold expert. And to extrapolate that compounding daily rate (+0.815%) for one year “would” exponentially bring Gold by next 19 September to (hold your breath) 28,262 … just in case you’re scoring at home.

So with everybody suddenly jumping onto the Gold Wagon, did you accommodate them by, (as our good StateSide mate THR would state) “taking a few chippies off the table”? Just don’t get carried away.

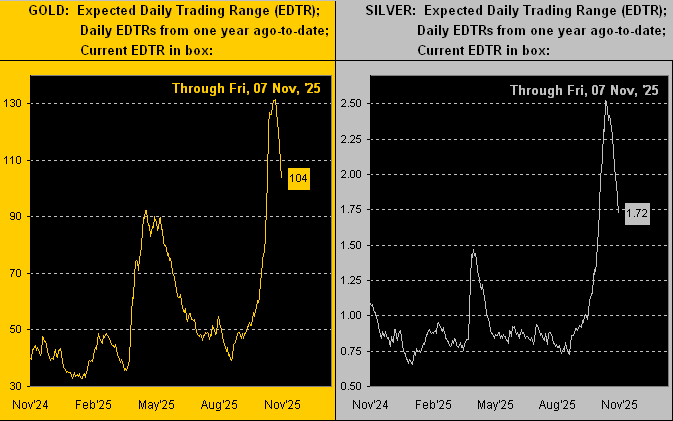

To be sure, across Gold’s recent three-week pullback of -8.9%, the past two weeks (albeit downers) are appearing more as a basing period, indeed with daily volatility slowing. Per the website, here we’ve the “expected daily trading range” (EDTR) for both Gold on the left and for Silver on the right. For you WestPalmBeachers down there, this neither is price nor its actual daily range; rather from one year ago-to- date ’tis the trading range we “guesstimate” for each ensuing trading day. And clearly by the rightmost declines, recent excitability over the precious metals is now coming off the boil:

Moreover, Gold’s trading range for the entirety of this past week was “only” 107 points (from 4043 down to 3936): ’twas the narrowest weekly stint of the past six. Thus as volatility is slowing, let’s go to Gold’s weekly bars and parabolic trends from one year ago-to-date. And therein note with 16 weeks of the rightmost blue-dotted parabolic Long trend in place, the remaining wiggle room from here (4008) to the “flip-to-Short” price for this next week at 3936 is but 72 points, i.e. within one session’s EDTR. So might we see a fourth consecutive down week for Gold? Heaven forbid! What might the mass of newly-minted Gold experts be thinking?

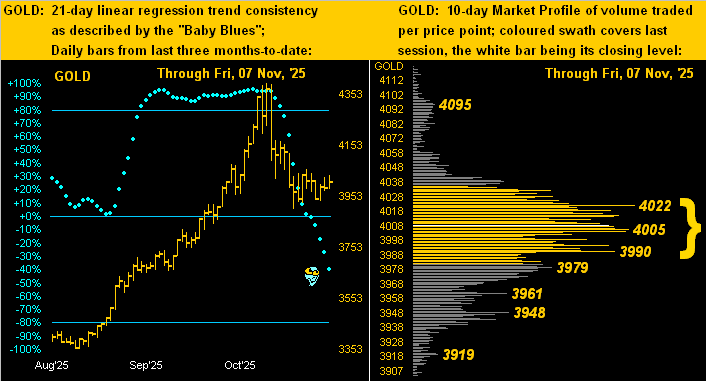

Irrespective of how “long” continues this parabolic Long trend, Gold’s “other” blue dots — indeed those “Baby Blues” that depict the consistency of trend — are in full plummet as next displayed at lower left for price’s daily bars from three months ago-to-date. And you regular readers well know the tune:  “Follow the Blues instead of the news, else lose yer shoes”

“Follow the Blues instead of the news, else lose yer shoes” –[mmb, circa 2000 A.D.] But as leerily leading are the Blues, price again is basing more than further falling, having already come well off the 4398 All-Time High. As well by the 10-day Market Profile at lower right, Gold looks nicely nested in that “fat” volume-dominant trading zone spanning as braced from 4022 down to 3990:

–[mmb, circa 2000 A.D.] But as leerily leading are the Blues, price again is basing more than further falling, having already come well off the 4398 All-Time High. As well by the 10-day Market Profile at lower right, Gold looks nicely nested in that “fat” volume-dominant trading zone spanning as braced from 4022 down to 3990:

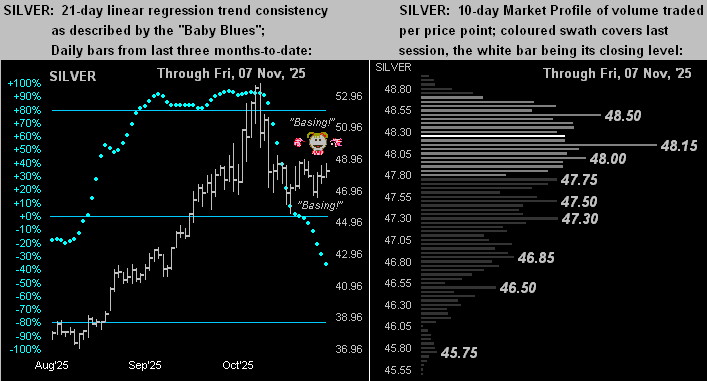

Similarly so, Sister Silver is cheering her apparent basing, even as her “Baby Blues”, too, further their fall (below left). Unlike Gold however, the white metal’s Profile (below right) is indicative of price having not been as suppressed across the past fortnight. To wit, the Gold/Silver ratio two weeks ago was 85.2x, whereas ’tis now 83.1x. Regardless, given the century-to-date average ratio being 69.4x, Silver remains the more attractive metal: priced to that average ratio today, Silver rather than at 48.23 would be nearly +20% higher at 57.76. So hang on to sweet Sister Silver!

Let’s next go to what little we know of the Econ Baro. As therein noted, from October-to-date we’ve 45 missing metrics; so who knows the real stance of the dark blue Economic Barometer line, the StateSide government “shutdown” still in full stride:

As for Q3 Earnings Season (with still two weeks to run), year-over-year results have increased at an above-average pace: 71% of the 428 reporting S&P 500 constituents have improved their respective bottom lines from Q3 a year ago; typically ’tis only around 66%. That’s the Good News.

Now for the Bad News: the median earnings per share gain (encompassing 420 constituents with positive earnings from both a year ago and now) is +9.4%; such improvement instead ought be ’round +100% just to get the price/earnings ratio back down to some reasonable valuation and the yield (1.172%) more competitive with three-month U.S. annualized dough (3.757%). For as shown in the above graphic, such p/e is presently 55.9x, (the formula provided for proof). “AI” (“Assembled Inaccuracy”) begs to differ with 29.3x; but as we’ve stated before, if actually fed that formula, “AI” replies ’tis incapable of obtaining the answer.

Thus be it the “Look Ma! No Earnings!” crash or the “Look Ma! No Money!” crash, we — as do many others with whom we communicate — await the inevitable S&P “Dash for Cash!” crash. After all, given the S&P’s current market capitalization of $59.5T supported by a liquid money supply (“M2” basis) of “only” $22.4T, ’twill be a heckova train wreck … perhaps further derailed by Gold?

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********