Golden Opportunity For Global Investors

From early 2001 to the fall of 2011, gold performed in stellar fashion. The shiny yellow rose steadily from $256/oz to an intra-day all-time high of $1,921 in September 2011…an incredible appreciation over 650%.

From early 2001 to the fall of 2011, gold performed in stellar fashion. The shiny yellow rose steadily from $256/oz to an intra-day all-time high of $1,921 in September 2011…an incredible appreciation over 650%.

(See http://tinyurl.com/keysuef)

During the secular gold rally period (2001-2011), the Dow Stock Index rose a measly +34%...versus gold’s +650%. Literally, gold left New York stocks stinky dead in the toilet.

Moreover, gold’s incredible performance to date even after the substantial correction during the past three years clearly shows gold has been a far superior investment than fiat paper stocks: To date gold is up +355% versus a pathetic +78% for the Dow Index. (See http://tinyurl.com/lyk6otl)

Fast-Forward to November 2014

Several internationally renowned market pundits are getting excited about the evolving Golden

Opportunity For Global Investors vis-à-vis the unbridled irrational exuberance levitating stock markets worldwide. The sage consensus is that the US stock market is grossly over-valued at the current all-time record highs, whereas gold is grossly under-valued in view of its bullish fundaments. Furthermore, the correction in the gold price since 2011 has presented an outstanding opportunity for investors who wanted to own gold, but were heretofore leery of its lofty price. Indeed, it is the considered opinion of this analyst that today is a once in a lifetime opportunity for millions of investors worldwide. There are 9 Fundamental Factors for this bullish opinion on the oldest form of money.

- Universal acceptance of gold as a timeless currency and store of value

- Gold’s price runs parallel with growth in the monetary base and to money supply

- Many major Central Banks worldwide are accumulating gold reserves

- Total Assets of the ECB and Federal Reserve (in US$) run parallel to increases in Gold’s value

- China’s dire need to diversity its overtly dangerous FOREX risk

- In recent years precious few people have invested in gold

- US Federal Debt vs the price of gold

- Internet Communication to easily transmit gold’s message – instantly and worldwide

- US Dollar is on course to lose its global reserve currency status

Universal acceptance of gold as a timeless currency and store of value

The history of gold begins in remote antiquity. But without hard archaeological evidence to pinpoint the time and place of man's first happy encounter with the yellow metal, we can only conjecture about those persons, who at various places and at different times first came upon native gold. Experts of fossil study have observed that bits of natural gold were found in Spanish caves used by the Paleolithic Man about 40,000 B.C. Consequently, it is not surprising that historical sources cannot agree on the precise date that gold was first used. One states that gold's recorded discovery occurred circa 6000 B.C. Another mentions that the pharaohs and temple priests used the relic metal for adornment in ancient Egypt circa 3000 B.C. However, it is curious to note that the early Egyptian's medium of exchange was not gold but barley. The first use of gold as money in 700 B.C. is claimed by the citizens of the Kingdom of Lydia (western Turkey). Surely, you remember the kingdom of the famous fortune seeking King Croesus - circa 550 B.C.

Gold’s value runs parallel with growth in the monetary base and to money supply

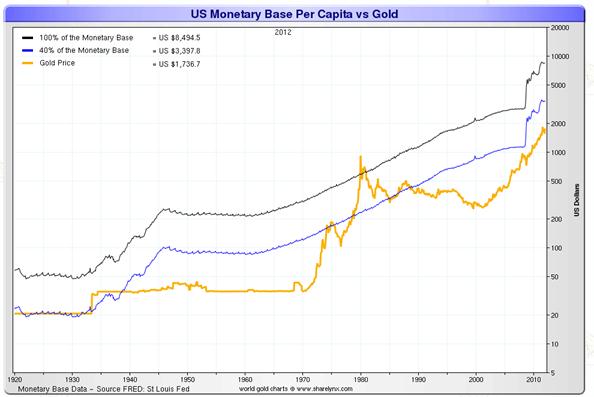

The following charts clearly indicate that on-balance (i.e. over the long run) the Monetary Base and Money Supply are primary drivers of the gold price. The next chart shows the US monetary base to gold price ratio, from 1930 till 2012.

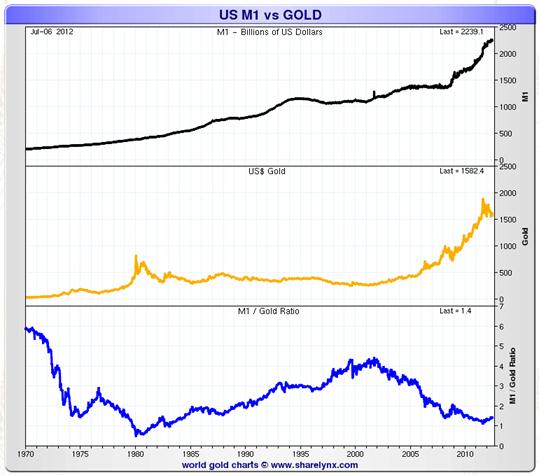

The US M1 money supply to gold price ratio, from 1970 till 2012

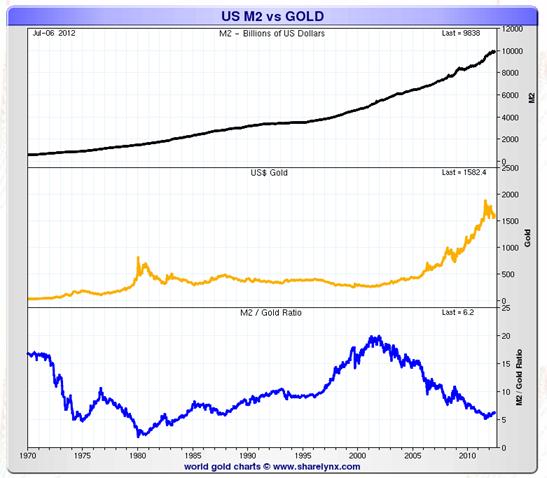

The US M2 money supply to gold price ratio, from 1970 till 2012

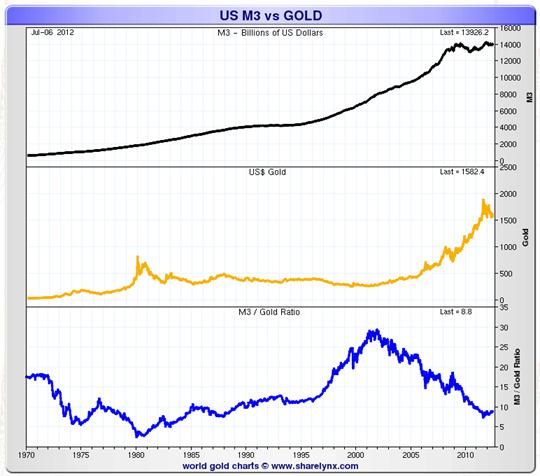

The US M3 money supply to gold price ratio, from 1970 till 2012

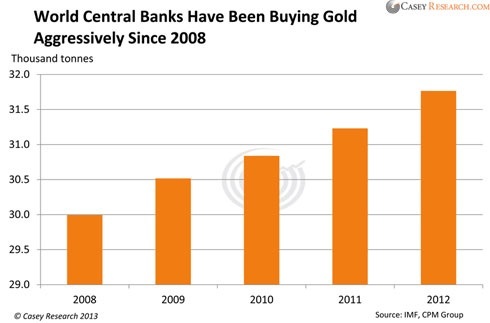

Many major Central Banks are accumulating gold reserves

Indeed foreign central banks, particularly in the developing world, have been buying gold to diversify their reserve assets away from the dollar and euro. It is reported more than 500 tonnes of gold were snapped up by Central Banks last year alone. And this does NOT take into account China’s gold purchases – as it is not public knowledge. Some market pundits in Asia suggest China is buying gold hand over fist at today’s discounted prices. ..which is characteristic of that country’s fugal nature.

The big reason to buy gold now, proponents argue, is that it should hold its value better than fiat currencies that aren't backed by hard assets, such as the dollar or Japanese yen. The Federal Reserve along with central banks in Europe and Japan have issued so much debt — and pumped so much cash into their economies — that they'll eventually have to inflate their way out of debt by devaluing their currencies, according to this line of thinking.

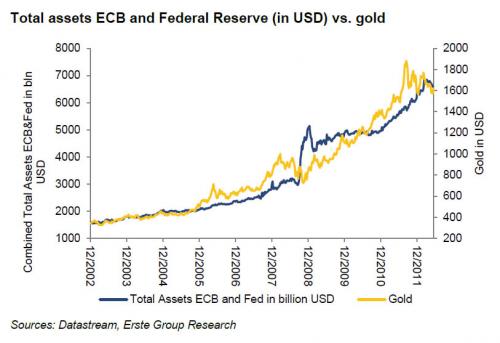

Total Assets ECB and Federal Reserve (in US$) vs Gold Price

Another primary driver of the gold price is the ever increasing total assets of the ECB and the Federal Reserve (as the chart below clearly demonstrates). It is indeed astounding how the increases in total bank assets have fuelled the price of gold in parallel fashion.

China’s dire need to diversity its overt FOREX risk away from the U.S. dollar

When it comes to foreign exchange reserves, China’s total was $3.8 trillion U.S. dollars in 2013…a sharp increase from the mid-90s as you can see in the chart below. There are several challenges facing the Asian nation’s monetary system too; the multi-currency system which includes the renminbi and the dollar is no easy task to manage.

But how are China’s foreign exchange reserves and monetary troubles a driver for gold demand?

To substantially reduce China’s dangerous FOREX risk, it must buy thousands of tonnes of gold to shore up its thin Total Foreign Reserves. To be sure the Sino nation indeed has the money to accomplish this daunting task. All the Peoples Bank of China need do is to sell-off much of its $1.3 trillion hoard of US Treasuries. Incidentally, China is today the largest holder of US government debt paper.

In recent years precious few have invested in gold

In 1968 nearly 5% of total global financial assets was invested in gold. And today (2014) gold investments accounts for only one percent of total global financial assets. Most prudent financial advisors recommend that everyone should have between 5-10% of their total portfolio in gold and/or silver with a view to diversify all forms of risk.

The above chart shows the value of gold as percent of total global investment assets. Still under 1%. Back in 1968, before anyone even knew what an investment bubble was, gold represented just under 5% of global financial assets. Now, historically it has been an accepted tenet of portfolio management that gold should represent 5-10% of any investment portfolio, if just for the reason that it has a negative market beta. That chart shows that, at best and on average, gold is less than 1% of investment portfolios, institutional and individual. How the hell can this possibly be the statistical profile of an asset that is in a bubble stage? This chart attests there is an absolute tsunami-sized flood of capital that still has yet to flow into the sector before we can even begin to whisper the "B" word. Currently, it is estimated that gold as a percent of global financial assets is still only about ONE PERCENT (1%)…which is only one-fifth of what it was in 1968 (5%). This equates to a virtual army of investors who most probably and eventually march into the shiny yellow when it again resumes its secular bull trend.

US Federal Debt vs the price of gold

Gross Federal Debt: That’s the gross amount of debt outstanding issued by the US Treasury. “Debt held by the public” and “debt held by federal government accounts”.

Today’s Federal Debt is about $17,952,841,077,000…and counting…and is estimated to rise to $21 TRILLION by the time President Obama leaves office. Needless to say the ascending US Federal Debt will fuel gold and silver to new record all-time record highs. Correspondingly, precious metal mining company shares will fly into orbit hundreds of percent higher than today’s values.

The chart below is testament that since 1962, the US Federal Debt has (on-balance) also fuelled the price of gold higher.

Internet Communication to easily transmit gold’s message – instantly and worldwide

Once the price of gold has put in a definitive bottom, the news will be communicated instantly and worldwide via Internet publications and emails . Consequently, gold price will quickly soar as international investors stampede into gold. Moreover, gold and silver equities will rise parabolically…as they are much more severely depressed than gold itself.

US Dollar is on course to lose its global reserve currency status

It is no secret major world powers are maneuvering to replace the US greenback as the world’s primary Total Reserve Currency. Specifically, the actions of China and Russia (and others) working in concert to replace the US$. In this event there will be a mass exodus from Uncle Sam’s currency…resulting in a precipitous decline of the US Dollar Index. Consequently, this will lead to a massive resurgence in the value of gold and silver…and resurgence in prices of precious metal mining company stocks. In fact the prices of mining stocks will inevitably and eventually go ballistic…because their current values are the lowest relative to gold since 2001. (See chart below)

Although there are short-term Technical aspects that gold must deal with, FUNDAMENTALS will ultimately prevail. To be sure the greatest weakness of FUNDAMENTALS is the almost total absence of timing…and in the market speculations, as everyone knows, timing is ESSENTIAL to maximizing profits.

As the legendary sage seer of the 1929 Stock Market Crash observed:

“Gold has worked down from Alexander’s time... When something holds good for two thousand years, I do not believe it can be so because of prejudice or mistaken theory.”

- Bernard Baruch, a 1929 and aftermath winner

********

Related Readings:

Close To The Bottom But Not There Yet

GOLD: Will Bulls Or Bears Prevail?

China Goes For The Gold As Beijing Gold Demand Goes Parabolic

Why Chinese Citizens Invest In Gold

Keep Your Powder Dry…There May Be A Great Opportunity Coming In Gold

Fed Ends QE? Greenspan Says Gold “Measurably Higher” In 5 Years

********