The Great Inflation Of The 1970s May Well Return In 2013-2016

In the 1970s the U.S. stock market was a mess. It lost 40% in an 18-month period. By the close of the decade few people wanted anything to do with stocks. Economic growth was weak, which resulted in rising unemployment that eventually reached double-digits. The easy-money policies of the U.S. Central Bank, which were designed to generate full employment by the early 1970s, also caused record high inflation.

Interest Rate Casualties

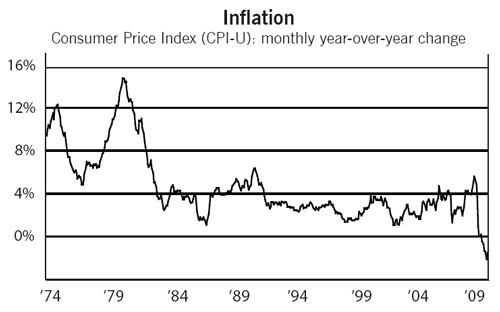

This is the gruesome story of the great inflation of the 1970s, which began in late 1972 -- and didn't end until the early 1980s. In his book, "Stocks for the Long Run: A Guide for Long Term Growth" (1994), Professor Jeremy Siegel, called it "the greatest failure of American macroeconomic policy in the postwar period." Here is a chart showing the Consumer Price Index (ie INFLATION) from 1974-2009. Of particular note is how much the CPI soared in the late 1970s.

From 1977-1980 Treasury Bonds plummeted -38% from (100 to 62) – as interest rates sky-rocked +58% (from 7.6% to over 13.0%). During this same period the US Dollar declined -21% (from 107 to 85). Interest-sensitive industries (such as housing and cars) were devastated by the soaring interest rates. Sadly, many people were priced out of new cars and homes by the skyrocketing interest rates.

FAST FORWARD to 2013

Today’s interest rates are at all-time record lows. They cannot conceivably go lower. The “Official Unemployment Rate” remains stubbornly high At 7.7%. However, some economists state the Real Unemployment Rate is most probably over 20% (resembling the Great Depression when Unemployment soared to 25%).

The Total National Debt today fast approaches $17 TRILLION…and is said it may balloon to $25 TRILLION by 2016.

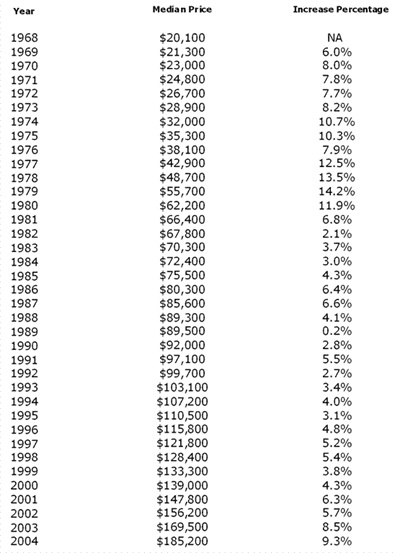

Furthermore, US Real Estate is again creating a BUBBLE. It is imperative to understand that US Real Estate values have sky-rocketed more than 220% in the past 4 years. This is unprecedented in real estate history. The exaggerated explosion in US Real Estate is entirely due to QE...driven by interest rates that are at all-time low levels. OBVIOUSLY US Real Estate has become another BUBBLE during the past four years. In the 36 year period from 1968 to 2004 US Real Estate values experienced only a 6.4% average annual increase in home values. See the following table.

Source: National Association of Realtors

HOWEVER, Since 2009 the Real Estate BUBBLE boosts a Compound Annual Growth Rate (CAGR) of 35.4% vs the 36-year period (1968-2004) of only 6.4%/year. Think about it: In the past 4 years U.S. Real Estate values have increased nearly 6 TIMES FASTER PER YEAR than the historic average.

If that ain’t a BUBBLE, then what the hell is?!

FORECAST TO 2016

- Count on President Obama and US Fed pumping up the money supply via QE

- Bank on interest rates rising and correspondingly T-Bonds losing value

- U.S Real Estate may have already peaked…and may fall again to 2008 lows

- Better believe the value of the US greenback will eventually fall

- Brace for a substantial sell-off in US stocks

- Unemployment to remain stubbornly high

- Prepare for the on-coming tidal wave of global inflation generated by competitive currency devaluations

- In view of all the above, count on the value of gold and silver rising yearly to new all-time highs through the end of 2014

On the geo-political front there is high probability Israel will bomb Atomic Generating Installations in IRAN, which will cause global turmoil as crude oil soars to its 2008 record high of $150/bbl. See chart:

The monetary policies heretofore crafted and implemented by the US Fed are clearly inflationary. Since Obama became President, the price of Unleaded Gasoline has soared 113%. This equates to a Compound Annual Growth Rate (CAGR) of 22% per year. In the event the US Fed continues its inflationary policies (ie QE), gasoline prices in the U.S. will reach $6.96 by the time President Obama leaves office.

Gasoline Price

Gasoline Price 1979-2012

http://www.randomuseless.info/gasprice/gasprice.html

* * * * * * * * *

I.M. Vronsky

GOLD-EAGLE