Greece & Negative Interest Rates Could Be The End Of QE (Part 2)

As I described in Part 1 and what I can’t emphasize enough is that we are witnessing that the extreme low interest rates are sustaining companies that otherwise would have gone out of business whose production is adding to the oversupply in the market. The low interest rates fuel deflation and price destruction in almost every sector with all its devastating consequences for the commodity markets, the oil sector, the cotton industry, the retail industry, the banking sector and the bond, equity and real estate markets. Low and negative interest rates are the nail in the coffin of the economies and the monetary system as we know it. They are increasing the leverage and the debt levels in the economy and destroying any value that is left in the system. There has been no risk representation in the interest rates though that is rapidly changing in the last couple of weeks in my point of view.

As I described in Part 1 and what I can’t emphasize enough is that we are witnessing that the extreme low interest rates are sustaining companies that otherwise would have gone out of business whose production is adding to the oversupply in the market. The low interest rates fuel deflation and price destruction in almost every sector with all its devastating consequences for the commodity markets, the oil sector, the cotton industry, the retail industry, the banking sector and the bond, equity and real estate markets. Low and negative interest rates are the nail in the coffin of the economies and the monetary system as we know it. They are increasing the leverage and the debt levels in the economy and destroying any value that is left in the system. There has been no risk representation in the interest rates though that is rapidly changing in the last couple of weeks in my point of view.

Huge moves show us the nervousness and volatility and risks in these markets because of the extreme valuations. The flash crash in the bond markets and other events are illustrative.

On April 29 the 10-year Bund sold off hard after data showed that for the first time in three years, lending by Euro-area banks to companies and households rose. Growth in euro-area M3 money supply, which policy makers see as a gauge of the underlying strength in economic activity, averaged an annual 4.1% in the first quarter, the fastest pace since 2009, according to ECB data published. The annualized inflation rate in Germany quickened to 0.3% in April from 0.1% last month, according to European Union-harmonized data published by the Federal Statistics Office in Wiesbaden on April 29. That’s not good for the flight to safety trade and despite Mario Draghi’s assurances that PSPP will be implemented in full come hell or high lending, the market still fears an QE taper triggered by a Euro area recovery and so the rout was on with yields on the 10y bund jumping on April 29 some 12 bps, to their “highest” level since March 18, from 0.17% to 0.29%, a 70% increase. Since then the bund yield has been steadily climbing to 0.59% on May 6th. And in accordance we saw the Euro strengthening to $1.134.

I personally don’t believe we are out of the woods in Germany, Europe or anywhere else. These huge moves show us more the nervousness and volatility and risks in these markets because of the extreme valuations. Extreme valuations leave very little room for error.

We had the ‘flash crash’ on US bond markets last October, October 15, 2014, Treasury securities moved 40 basis points, statistically 7 to 8 standard deviations – an unprecedented move – an event that is supposed to happen only once in every 3 billion years or so. We had the collapse of the Swiss currency floor in January showing currency moves of 30%+. The euro surged more than 4% against the buck, its biggest jump in a single day in 15 years, according to Deutsche Bank, when Federal Reserve expressed that it was in no hurry to raise interest rates. And for a few minutes on Wednesday March 18, the lack of dollar buyers caused a short-term freeze in electronic trading platforms. The volatility and the size of the swings are of a magnitude we have never seen before.

Bund yields rose from 0.05 (April 17) to 0.59 (high on May 6) +1,080%! A correction or a major trend change? See the parallel between the current moves in in the bund yields and those in the GJB yields over the period 2002-2005

German government bonds remained pinned close to levels last seen more than two months ago, signaling that while the recent selloff may not mark a major turnaround, it has become more than just a passing blip. The yield on the 10-year Bund edged higher to 0.59% on May 6, a 1,080% rise since April 17. On April 17, the 10-year Bund yield hit an all-time low of 0.05%, spurring predictions of zero or even negative yields on the benchmark for European credit markets. Bond prices fall as yields rise.

Last week though, investors abruptly distanced themselves from some of the most popular trades so far this year, fearful that the rally in stocks and the dollar, as well as European government bonds, had become dangerously overdone. Especially after comments form Bill Gross, "German 10 year Bunds are the short of a lifetime”, and Jeffrey Gundlach who considered a 100X- leveraged bet against 2-year German bunds. “The bond market meltdown goes on,” Société Générale strategist Kit Juckes wrote in a note Tuesday May 5. He agreed with others, however, that while the selloff has now moved into its second week, it still looks “far more like a correction than a major trend change.”

I disagree I believe there is major illiquidity creeping into the bond markets, which always get accentuated in selloffs. Next to that the chart of the 10y GJB over the period 2002-2005 might also be indicative of more than just a correction. Zerohedge had an article on May 4 drawing a parallel between the current moves in in the bund yields and those in the GJB yields over the period 2002-2005 (see chart below). A sovereign issuer, Japan, with an extremely low yielding bond suddenly saw its bond market collapse when Greenspan cut US rates less than expected following pressure of the White House to give a more rosier picture of the US economy, heard before? Within hours, Greenspan's comments triggered the biggest massacre on the bond market since the Long-Term Capital Management collapse in autumn 1998. This time Yellen might be “forced” to increase interest rates to keep the idea high that the economy is improving! Next to that she also said "I would highlight that equity market valuations at this point generally are quite high. There are potential dangers there."

Let me also quote Steve Wynn here about the situation in the US and Macao (China). “If you were to ask me, since we’re making forward-looking statements, what will the second quarter look like in Las Vegas? Weak. Do you hear me? Weak. So I’m trying to lower expectations here. This notion of a big recovery is a complete dream. I don’t think Las Vegas is experiencing a great recovery. I think it’s still very patchy and I think that that’s probably our non-casino revenue in the first quarter was flat. I’d be thrilled if it was flat in the second quarter.” Meanwhile, the situation in Macau continues to deteriorate at a rather remarkable pace, as gaming revenue fell 39% last month, the eleventh consecutive monthly decline which looks good only in comparison to March’s 39.4% decline and February’s 49% drop with the depression of the VIP market continuing. Next to some policy changes what does this say about the Chinese economy?

At 5bps on April 17 10Y Bund yields were the short of a lifetime (Bill Gross) and it looks like yields could go higher (see below), after some consolidation, which should boost the Euro explaining the weakness we have been recently witnessing in the US dollar. Also see the correlation between the movements in the bund yields and the treasury yields (see $TNX chart)! Are we breaking out in the 10y treasury yields? The critical technical level is 2.27%-2.32%

Chart: Bloomberg

Many investors were overweight duration in anticipation of the “shortage” of bonds as a result of the ECB’s QE. Though when everybody started taking profits it has been leading to significant yield changes.

Many European investors especially asset managers and hedge funds, were tactically overweight duration. Duration it’s the weighted average of the payments an investor will receive over time, discounted to present value. For individual investors, duration is primarily used as a measure of a bond fund’s sensitivity to prevailing interest rates. A portfolio with a duration that is above its benchmark can be expected to outperform the benchmark if rates are falling, and underperform if rates are rising. These overweights persisted for some time, ahead of the well-anticipated sovereign QE program on March 6. Some observers have argued many times that markets are prone to episodic volatility, as dealers have limited capacity to warehouse risk. The recent moves fit this thesis.

Several consensus exposures in European rates were centered around the expectation that QE would result in a scarcity of bonds leading to a price squeeze. Subsequently this was followed by profit taking as we are witnessing. The magnitude of the recent moves suggests that exposures were quite large, see chart below.

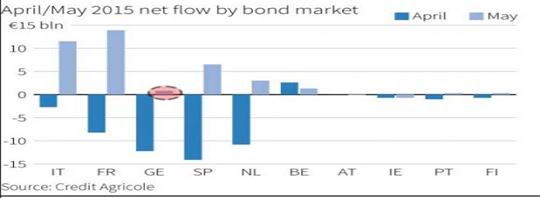

Bund weakness driven by net flows, the balance of the redemption and issuance of bonds? The net flows are turning in May from sharply negative to modestly positive

The sell-off in Europe almost certainly was exacerbated because it occurred on the day of the FOMC meeting. Speaking of positioning, perhaps the biggest drive of the Bund weakness as we have entered May is that German net flows turn from sharply negative to modestly positive, suggesting the technical pressure would be far less hence ……….

However, in June and later the flows flip again, and German net flows once again become strongly negative.

Still, the most notable thing over the past couple of days is the sheer velocity and pace of the selloff, proving once again just how illiquid the market is, and that when one of the most concentrated positions begins unwinding, the market may very well simply go bid less. Or just shut down entirely.

On April 29 large volumes were going through in futures with stop losses being triggered and few dealers willing or able to take the other side, similar to the treasury flash crash of Oct. 15. And of course illiquidity gets accentuated in a falling market and not in a rising market. Who wants to give a bid/offer spread when you don’t know how much further the market could fall? That problem doesn’t exists on the way up.

As Commerzbank's Christoph Rieger, head of fixed-rate strategy, explained following the huge percentage moves in the bund yields on April 29, “A cascade of small events is creating a large splash in a structurally ever-thinner market. Amongst factors behind selloff he cites: (1) bond supply and (2) rate locking; (3) higher German inflation and euro-area M3; (4) bearish risks from the FOMC statement. Large volumes are going through in futures with stop losses being triggered and few dealers willing or able to take the other side, similar to the US treasury flash crash of Oct. 15. Markets will have to get used to erratic swings, with banks being forced to curtail balance-sheet capacities and central bank interventions undermining trading liquidity.”

As mentioned before the more we go to extreme situations the more vulnerable these situations become because they are so far from the median and artificially invoked. And at these low interest rates small movements represent huge percentage moves hence huge volatility (although not really seen reflected in the VIX). When you have fed funds rates of between 0-0.25% increases of 0.125% or 0.25% represent moves of 50% and 100% measured from the base interest rates. That is different in a situation where interest rates are 4% and the interest rates rise by 0.125% or 0.25% which then represent increases of only 0.03% and 0.06% respectively which are relatively minor and thus don’t have such a major impact as when the interest rates are ultra low. We have to look at things in context in order to determine the impact and cannot say it is only a small increase. No, it is not a small increase in context to the existing level. Next to that low interest rates lead to high leverage in order to have an impact on earnings. I just have to refer to Grunlach who suggested to leverage up the German two-year bunds 100 times, resulting in a 20% return. The other point I would like to make is that when one uses high leverage the equity is by definition small and therefore erratic and strong movements in the underlying bonds can very easily and quickly wipe out the equity with all its ripple effects.

Is risk finally being discounted in the interest rates?

Next to that you have to ask yourself the question how long do you think you can borrow money 10y money and getting paid by the lender? That is a destructive operation, getting paid when you borrow money that inevitably will lead to destruction of your economy especially when investors finally realize that all economies are linked to each other through their currencies. And we are witnessing the very effects of that absurdity with reality/risk finally being reflected in the interest rates. And with higher rates on the horizon and these extreme percentage moves, that algorithms even can’t deal with, there is in my opinion no place to hide except for buying gold and silver and surely not contemporary art and apartments as Blackrock’s CEO suggests.

We have arrived at the peak when Blackrock’s CEO Laurence Fink says, “gold has lost its luster and the two greatest stories of wealth are contemporary art and apartments in Manhattan, Vancouver and London”

Blackrock’s CEO Laurence Fink’s remark at a Credit Suisse conference in Singapore that "Gold has lost its luster and there's other mechanisms in which you can store wealth that are inflation-adjusted." and that "The two greatest stores of wealth internationally today is contemporary art … and I don't mean that as a joke, I mean that as a serious asset class," said Fink. "And two, the other store of wealth today is apartments in Manhattan, apartments in Vancouver, in London" is a misperception of some magnitude. Last year broke the record for most homes over $100 million sold worldwide, according to a new report by Christie’s International Real Estate. This number is expected to keep on climbing in 2015 though if you look at it from a different angle it basically tells you the story about the devaluation of money.

Apartments have normally a mortgages attached to them and thus have a fixed nominal debt attached to them, which always drags prices down when there are adverse economic circumstances. So when the markets will implode do you think that apartments don’t decrease in value? And don’t you think that people will get a different perception if a piece of canvas with a few colors, like a Rothko, is really worth between $10m-$150m in a world, I am not talking about a region, that is going into depression. Gold and silver are nobody’s liability. There is no debt attached to the physical gold and silver, it is unencumbered and its pricing is uniform and worldwide. That is not the same for apartments and contemporary art, their price is what as we say in Dutch “wat de gek er voor geeft” or what the nutter is willing to pay for it. Because compared to real living costs for a normal household the prices for these trophy goods are insane and completely of the rocker, out of touch with reality!!!

What would you rather have $10m in physical gold or silver or ……?

Anyway I ask you? What would you rather have $10m worth of gold, an apartment of that value in NY or a Picasso when the @#$%& hits the fan? I still think that there are very few people who understand that when this bubble of bubbles implodes, besides the fact that very few people think that it will be something we have never witnessed before, the least thing people will be interested in is living in NY (just extrapolate the rudeness and the everybody for themselves attitude) and having contemporary art on their walls.

Illiquidity? ECB President Mario Draghi said three weeks ago that he saw no "scarcity" problem in the bond markets from central bank buying. Then why buying bonds with negative yields?

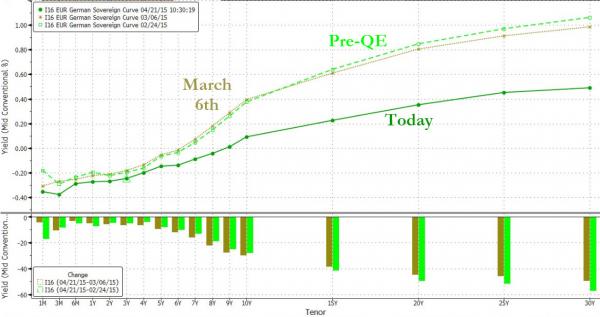

Anyway going back to Bill Gross statement: "German 10 year Bunds are the short of a lifetime”. The following chart of April 21 (Today on the chart) showed how much the interest rates had already fallen since March 6 following the start of the ECB QE. Though in the last couple of days the 10y bund yield has reversed strongly and is now trading at 0.59%, which is above the level from when the ECB started with its QE on March 6!! Is QE working? No! And since there already is a scarcity in the bond markets I don’t see how the ECB can possibly push down interest yields to the low levels we have seen.

The reason for the initial lowering of the interest rates was that Europe simply does not have enough unencumbered collateral for the ECB monetize, there are more buyers than sellers, hence why the rates were being forced downwards so strongly. NCBs (National Central Banks) are responsible for 80% of purchases under QE, with the ECB directly buying the remaining 20% in the roughly €7trn euro zone government bond market. Mid April ECB President Mario Draghi said he saw no "scarcity" problem in bond markets. Well with the ECB, the Fed, the PBOC and the BOJ buying ask people in the industry if there is a shortage in quality government paper and if there are price disruptions. Supply in bonds was getting scarce and the market reacted and investors took profits hence why the bunds are trading around a yield of 0.60%. Another result of the purchases of the central banks has been that everybody has been pushed up the high yield risk ladder!

In the 1990s’ anyone who bought a bond yielding over 12% was referred to as “a yield hog.” Back then, anything over 12% had a high probability of default. Back then 12% was 600 basis points (6%) over the 10-yr Treasury bond. Currently, some junk bonds with triple-C ratings are yielding under 6%. This is less than 400 basis points (4%) over the 10-yr bond. Think about it: because the Fed has taken short rates to zero, investors are chasing bonds with 5% yields that have at least a 50/50 chance of defaulting. This is despite the fact that energy junk bonds recently have delivered $100’s of millions of losses to junk bond investors. And investors will go on buying high yield till the @#$%& hits the fan. Carl Icahn who has some right of speaking has been warning people against the extreme valuation in HY.

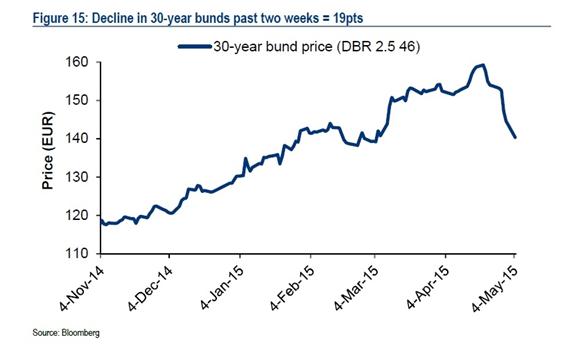

According to an article in Bloomberg Hans Mikkelsen, credit strategist at Bank of America Merrill Lynch, crunches the numbers on the outsize moves in bunds and comes up with some ugly math for investors:.... 30-year bund yields have now increased 53bps over the past two weeks. For the typical high yield bond with a duration of 4.4, a 53bps increase in yield would imply roughly a 2.3% decline in bond price – or the equivalent of about a third of a year’s worth of yield. However, at their peak two weeks ago 30-year bunds had duration of 23.7. Hence 30-year bund prices have declined approximately 12% over the last two weeks, or roughly 25 years worth of yield!

The yield on the 30-year bund has already surged from an April low of 0.465% to 1.186% in the sell-off. Yields on 30-year U.S. Treasuries have risen to a near five-month high, prompting some high-profile investors to call the end of the historic bull market in bonds.

If ECB bond-buying is not pressuring yields lower then how can they hope to contain real Grexit contagion? QE is over! Algos can’t cope with extreme movements we could look at a similar situation as with LTCM.

Having called for the end of the great Bund rally (and so far nailed it in dramatic fashion), Janus' Bill Gross sees more exuberance coming to an end soon and Greece inability to strike a deal with the Troika, ECB, EC and IMF, might be the lynchpin for the markets to really correct with all its consequences in the derivatives market. Blackrock is trying to blow new live in the CDS (Credit Default Swap) market which has shrunk from $1.58trn in late 2008 to $686bn today due to increased regulation, read capital requirements. Despite a good start, since early March when the ECB began its bond-buying bonanza, things have not been going the way Mario Draghi had hoped. While inflation data inflected modestly higher, European bond yields (and peripheral bond spreads) have increased and widened notably. Whether this is "sell the news" trading, Gross-Gundlach-driven unwinds, or Greek "serious disappointment" contagion (Greek 10Y bond yields are up over 200bps from the announcement in January of ECB QE) is unclear but what is clear is that if ECB bond-buying is not pressuring yields lower then how can they hope to contain real Grexit contagion? QE is over! It is the things we don’t know that will bring down the markets. Algos can’t cope with extreme movements, they can theoretically but not in practice, what jumps to mind is the situation with LTCM.

As LTCM's capital base grew, the managers felt pressed to invest that capital and had run out of good bond-arbitrage bets. This led LTCM to undertake more aggressive trading strategies. Although these trading strategies were market neutral, i.e. they were not dependent on overall interest rates or stock prices going up (or down), they were not convergence trades as such. By 1998, LTCM had extremely large positions in areas such as merger arbitrage (betting whether mergers would be completed or not) and S&P 500 options (net short long-term S&P volatility). LTCM had become a major supplier of S&P 500 vega, which had been in demand by companies seeking to essentially insure equities against future declines. Because these differences in value were minute—especially for the convergence trades—the fund needed to take highly leveraged positions to make a significant profit. At the beginning of 1998, the firm had equity of $4.72 billion and had borrowed over $124.5 billion with assets of around $129 billion, for a debt to equity ratio of over 25 to 1. It had off balance sheet derivative positions with a notional value of approximately $1.25 trillion, most of which were in interest rate derivatives such as interest rate swaps. The fund also invested in other derivatives such as equity options. Does this sound kind of familiar with respect to leverage and adverse market conditions?

Are European bunds anticipating the Grexit, is the indifference of the markets finally over?

European bunds moved sharply lower on Wednesday, as nagging concerns that Greece won’t be able to strike a genuine pact with its Eurozone lenders before a large debt payment is due next week intensified. Greece’s latest debt-negotiation drama, led by its anti austerity government, has placed the Hellenic Republic squarely back in the spotlight. Greek jitters: Athens is facing a €750 million ($832 million) debt repayment to the IMF next week, but there are fears it will run out of cash unless it reaches a deal with creditors to unlock the next tranche of bailout money. Progress is being made, but it remains unclear whether a deal will be struck in time for the Eurozone finance ministers’ meeting on Monday. Meanwhile, head of the Eurogroup Working Group Thomas Wieser told CNBC Greece and its creditors won’t come to a comprehensive agreement by next week as was previously expected though he said there will be a deal. I doubt that. And if there is a deal what kind of “deal” is that?

The negotiations have been going on since Greece and its lenders agreed on a bailout extension in February, and the two sides are struggling to agree on which reform measures the country must undertake to receive the next portion of aid. One of the creditors, the IMF, fears Greece’s debt burden is becoming unsustainable again, and it has warned it may withhold bailout money unless the Eurozone agrees to debt relief, the Financial Times reported Monday. Eurozone officials have categorically ruled out a write-down on Greece’s debt. Christian Schulz, senior economist at Berenberg, said in a note that debt relief could carry “moral hazard” as it would “reward Greece for reckless economic behavior at the expense of its Eurozone partners.” Next to that it would motivate Spain, Portugal and other countries to follow the same course. “Without structural reforms, and particularly without reversing previous structural reforms, Athens will not be able to pay back its debt,” he said. The yield on 10-year Greek government bonds climbed 47 basis points to 11.194%.

When will Greece run out of money? The question has been vexing European capitals and the markets for months, as the standoff between the new government in Athens and its Eurozone creditors remains unresolved.

So far, Greece has managed to both service its external debt and pay for wages and pensions.

But the worst kept secret in the country is that for thousands of people, businesses and institutions relying on government pay cheques, in every practical sense, Greece is already out of money. Greece has not received any loans from the Eurozone or the IMF since August 2014. There is €7.2bn (£5.3bn;$8bn) left in the country's bailout program, but creditors refuse to release the money before their demands for further reforms, spending cuts and tax increases are satisfied by Athens. The Greek government, led since January by the leftist Syriza party of Prime Minister Alexis Tsipras, is refusing to "violate its anti-austerity mandate". Euclid Tsakalotos has replaced Finance Minister Yanis Varoufakis as lead negotiator with the Eurozone.

Greece is in default, it is scraping its coffers, pensioners get barely paid, and the economy is coming to a halt.

Without loans from official creditors or access to the international bond markets, Greece has so far covered its financing needs by resorting to extraordinary and controversial measures. These have included the forced transfer of the cash reserves of public sector entities such as regional governments and pension funds to the central government's coffers. Greece is scraping its coffers, there is no money left, which puts Greece in an even more precarious and dependent position.

Pensioners were alarmed to discover last week that they could not make their usual withdrawals from ATMs on the day their accounts were supposedly credited. The money became available with several hours' delay. The government attributed the delay to a "technical problem". But reports in the Greek press and the Financial Times gave a less benign explanation: government pension funds had struggled until the last minute to find enough cash to cover pension claims. For several categories of employees working for the wider public sector, the feeling of finding zero balance on your payroll account is all too familiar.

The government faces major repayments to its creditors in the coming weeks. "We are now running one month behind on our salaries. Until only recently we were two months behind, and no-one would tell us if and when we would get our next pay cheque," an office employee at a cultural institution funded by the state budget told the BBC. The cash crunch is felt even by public institutions as sensitive as hospitals. A junior doctor told the BBC that although wages were paid regularly to medical staff, the government was more than four months behind on payments for on-call time. "Last week we got paid on-call time for the month of December," she said. Hospital suppliers that provide healthcare units with everything from bandages to dialysis machines warned last week that they may be forced to stop supplying hospitals. "In the past four months we are experiencing an undeclared suspension of payments," their associations said in a recent statement. Greece's de facto domestic default extends to most sectors, from academic book publishers to military contractors. "Payments are long overdue. Before, there was at least a regular flow of payments from the education ministry. Now, we are told to wait," a publishing house executive told the BBC. And the chief executive of an army food contractor said his company had not received any money for products it had delivered to Greece's armed forces some time ago. "Everyone in my sector used to fight hard to do business with the state: it was profitable and safe. Now, the government is the worst customer." Even industrial conglomerates are feeling the pain caused by liquidity shortages, increasing borrowing costs and frozen credit lines. Firms are postponing much-needed investment and are pleading for a resolution, says Theodore Fessas, chairman of the Hellenic Federation of Enterprises (SEV), which represents companies from most branches and sectors of the Greek economy. "Uncertainty is the greatest problem today. It is now threatening even the healthiest businesses, those that managed, despite the crisis, to pay wages and taxes on time, and fulfill all their obligations."

Greece’s short-term payment obligations

The cabinet in Athens last week failed to approve new reforms and tax increases that it needs to convince Eurozone finance ministers to unlock loans at their next scheduled meeting on 11 May.

Greece's urgent payment demands are as follows:

- 12 May: more than €750m for a repayment to the IMF

- June: more than €2.6bn including €1bn to IMF

- July-August: more than €8.7bn, including €7bn to European Central Bank in bond redemptions

Analysts warn that this kind of money will be impossible to raise without new bailout loans. And if the troika would give Greece new bailout loans it is basically throwing good money after bad money whilst the debt load increases further. For their part, Eurozone officials believe time is pressing Greece, not Europe, and have openly admitted they have plans in place to avoid contagion if Greece defaults or exits from the euro. I doubt that the Eurozone officials have a clue how far reaching the effects of the Greek fall out will be. These people are civil servants, policy makers not problem solvers.

Greece doesn’t want to cut pensions, well at least for the moment, a major hindrance to a deal

Euro-area finance chiefs are urging Greece to bow to their terms for releasing aid within days to avert a potential cash crunch with payments to the IMF due on May 12. European officials are concerned that Greece may struggle to meet its obligations this month unless Tsipras drops his opposition to cutting pensions and making it easier to fire workers.

Greece's debt mountain is now expected to balloon to more than 180% of GDP, compared to the initial projection of 170%. The economy managed to grow for the first time in seven years in 2014, but any positive developments have been wiped out by ongoing political uncertainty over its future in the Eurozone, warned Brussels. Tax revenues have collapsed since the start of the year, while ordinary Greeks have pulled out more than €28bn from the country's banking system since November 2014.

The IMF is suggesting a debt write off by the European partners but doesn’t want to make any concessions itself

Hinting at a potential rupture between Greece's creditor powers, the International Monetary Fund was reported to have told Eurozone finance ministers they could cut Greece loose if no breakthrough was agreed soon. The IMF has suggested the country will need some form of debt-write off if it is ever to get its finances back on a stable footing - a concession, which has been continually ruled out by the Eurozone. The Fund also predicts that Greece will run a primary budget deficit of 1.5% this year, far undershooting the ambitious 1.2%-1.5% surplus target demanded by its bailout conditions.

Pierre Moscovici, the Eurozone’s economist chief dismissed fears of a "Grexit", insisting that the single currency remained "irreversible". "Once you have one country leave, you ask who is next?" said Mr. Moscovici. Greece paid €200m on Wednesday May 6 to the IMF. Although relatively small, the €200m repayment has run the government's coffers dry. As mentioned Athens has already fallen into arrears with its suppliers and struggled to makes its monthly pensions bill last week. Greece is with its back against the wall.

The IMF won’t compromise on labor deregulation and pension reforms, while the European Commission is insisting on fiscal targets being met

Euro-region finance ministers are next scheduled to meet on Monday May 11, with Germany’s Wolfgang Schaeuble saying earlier he’s “skeptical” that an agreement can be reached by then. Greece’s new line of argument focuses on what it says are divisions among the international creditors. The IMF won’t compromise on labor deregulation and pension reforms, while the European Commission is insisting on fiscal targets being met, said the government official, who spoke on condition of anonymity because the talks are confidential. The commission is also refusing to consider a debt write-down, he said. Anyway it sounds all very difficult and more that we have come to the end of the road. It is time to take precautions to preserve your capital.

The only asset class that is at multi year lows and is one of the few safe havens left: gold and silver.

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold (as happened under FDR in 1934). If everyone decided, for example, to convert all their bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.” – Alan Greenspan, “Gold and Economic Freedom” 1966. And this $%#&%#* who created the onset of the greatest value destruction of the modern American history was Fed president! And then they, Greenspan and Bernanke, become advisors at Paulson or Citadel or Pimco. You just have to wonder how incestuous and ethical these people really are! They sow the seeds for total financial destruction and then harvest at these hedge funds that are too close for comfort to the Fed. Anyway do I need to say more what will keep its value in distressed times?

© Gijsbert Groenewegen May 7, 2015

Courtesy of www.groenewegenreport.com